Definition – A maximum price occurs when a government sets a legal limit on the price of a good or service – with the aim of reducing prices below the market equilibrium price. For example, the government may set a maximum price of bread of £1 – or a maximum price of a weekly rent of £150.

- If the maximum price is set above the equilibrium price then it will have no effect.

- If the maximum price is set below the equilibrium price, it will cause a shortage – demand will be greater than supply.

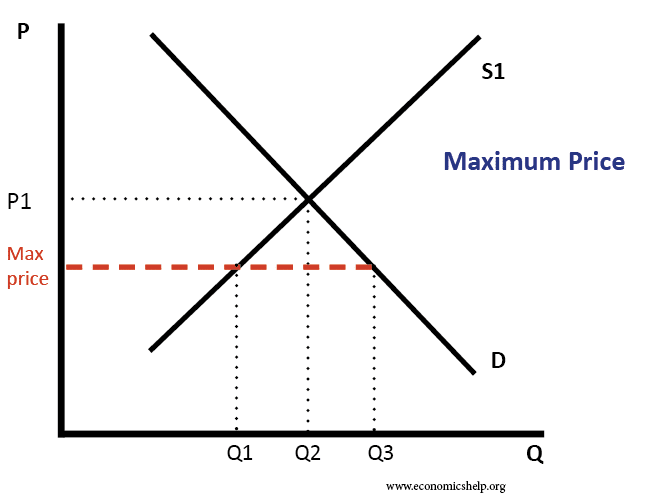

Diagram of maximum price

In this diagram, the max price causes excess demand of Q2-Q1.

Reasons for maximum prices

Maximum prices involve the government making a normative judgement that the market-clearing price is too high, and needs to be reduced. The government may impose a maximum price for a variety of reasons.

- The good is essential for daily living – without a maximum price, some people may be unable to afford the good. By reducing the price, it can help reduce relative poverty.

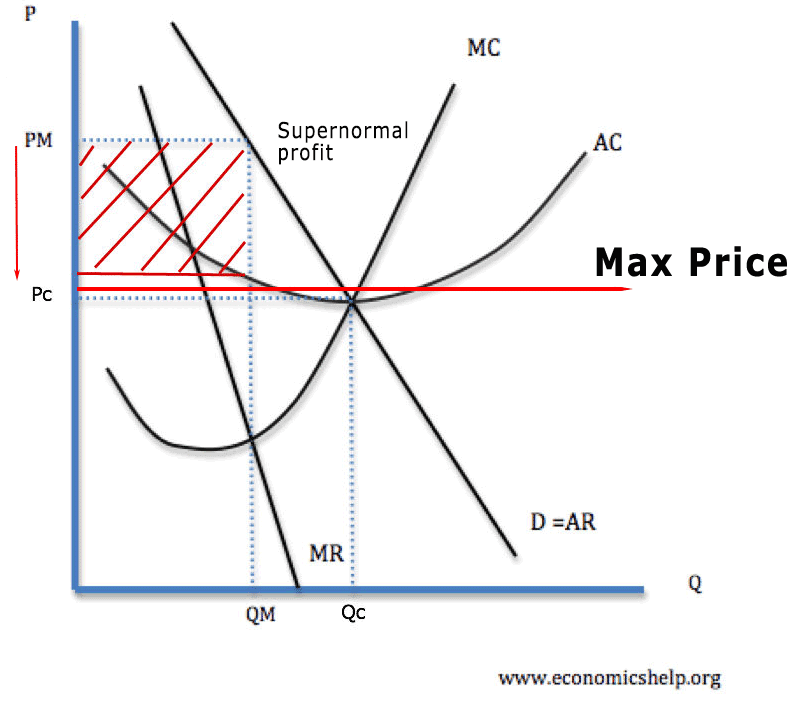

- Monopoly exploitation. If firms have monopoly power, they can charge high prices to consumers – higher than the marginal cost of production and higher than in a competitive market. A maximum price can be a way of reducing ‘monopoly prices’ and also increase allocative efficiency.

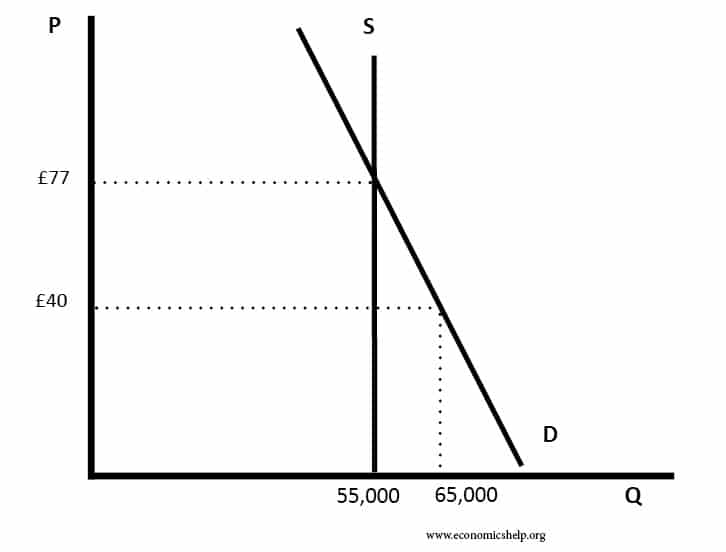

- Inelastic supply. If supply is very inelastic, then a maximum price will not reduce the supply of the good, therefore, there will be no fall in the quantity supplied.

In this example, there is a maximum price, but because supply and demand are both price inelastic, there is only a small shortage of rented accommodation. Supply for rented accommodation can be quite price inelastic in the real world because landlords don’t have many alternatives to renting property.

- Resource allocation. If rents were very high, it may cause investors to concentrate on building new houses and ignoring other aspects of the economy. However, an excess of house-building could contribute to a bubble in home-building – which leaves the market vulnerable to a correction in prices. For example, housing bubbles in Ireland and Florida pre-2007 credit crisis. A maximum price limits the resources flowing to houses and enables a more balanced economy.

Examples of maximum prices

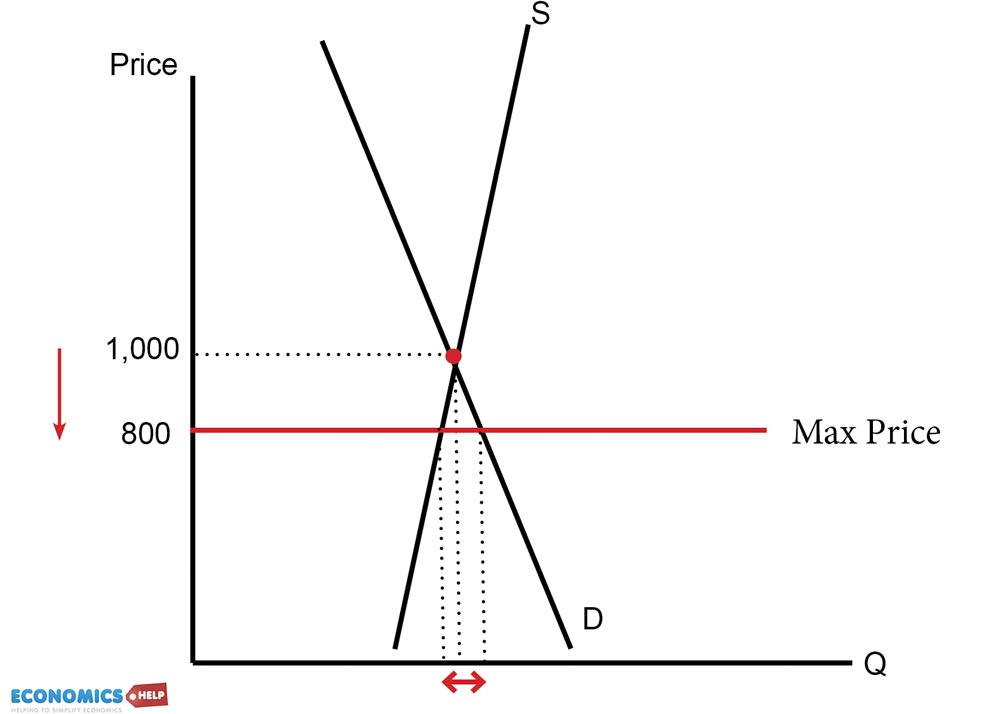

- Maximum prices for train tickets. With monopoly power, train companies could increase the peak tickets, but governments may impose a maximum price (or maximum price increase on firms) to keep tickets affordable – even if it leads to over-crowding.

- Maximum price for rent. Governments have tried different types of rent control – keeping the cost of renting below a certain level.

- Maximum price for food. In some developing economies, there are maximum prices for certain foodstuffs to keep them affordable.

- Ticket prices. Football clubs keep prices well below the market-clearing equilibrium. This kind of maximum price is voluntarily chosen and not set by the government – but for important occasions, the government could decide to set maximum price.

The club may keep a maximum price of £40 – even though this leads to 10,000 supporters wanting tickets at that price.

Problems of maximum prices

- Shortage. A maximum price distorts the market and leads to disequilibrium. The demand is greater than supply meaning many consumers will be unable to get the product at all. Cheap rents are no good if it leaves many people homeless.

- Encourages the black market. Because of the shortage, it creates the incentive to develop a ‘black market’ where people illegally trade the good. People could buy the good at the low maximum price and then resell to those customers who were unable to buy. This is potentially quite lucrative as some of those customers who missed out may be willing to pay a very high price.

- Queues. One consequence of a maximum price is that people will end up queuing to try and get the good before it sells out. This will encourage people to spend longer and longer in queues before it runs out. This time spent queuing represents a significant cost in terms of time.

- The market will become less profitable for firms. In the long-term, this may lead to less investment and also decrease supply in the long-term. For example, rent controls may be a way to deal with the short-term problem of expensive housing. But, reducing rents will discourage some landlords from letting out property. It may also discourage people from building houses.

Evaluation of Maximum prices

The most effective way to implement maximum prices would be to also try and deal with the supply. If housing is too expensive, a long-term solution is to build more affordable housing – and not just rely on maximum prices.

Maximum prices may be most useful in the case of a monopoly who is both restricting supply and inflating prices. An alternative may be to reduce the power of monopolies; though, in some industries, this is not possible – so maximum prices will be the most effective.

Related

Thumbs up 👍, incredible

Very good economics site

thank you…such easy to remember and understand notes…

Very good site with good information

awesome very helpful

Thank you so much

Can’t the maximum price on monopoly diagram be drawn with the usual monopoly diagram.(I mean using Mc curves and MR curves )

Direct and clear pages. Thanks

Amazing! 👌 on point

Goog cause its way of bringing humanity.. All kinds of people are valued

very vivid

thanks

Your website has indeed been of great help in my studies. Having gone through all the notes provided here, I am now able to set a clear distinction between a whole lot of things that did not make sense before. I am very much thankful………..

straight to the point ,concept well explained

GOOD POST BUT ADD MORE EXAMPLES

Please include real-life examples also.