Definition

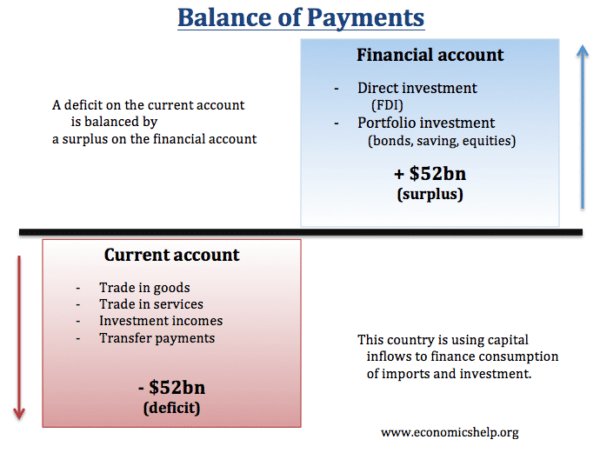

The Balance of Payments shows a countries transactions with the rest of the world. It notes inflows and outflows of money and categorises them into different sections. The two sections of the Balance of Payments are:

- Current Account. – Trade in goods/services/investment incomes/transfers)

- Financial (Capital) account. – Foreign direct investment, capital flows, portfolio investment

Balance of payments equilibrium

In a floating exchange rate, the current account will mirror the financial account.

If there is a deficit on importing goods – there will be a surplus on the financial account.

Further reading – equilibrium in balance of payments

Current Account Balance of Payments

The current account measures:

- Net export-imports for goods (trade balance) – used to be called trade in visibles.

- Net export-imports of services – used to be trade in invisibles. Examples including paying for insurance, tourism.

- Investment incomes. For example, a UK firm that invested in Japan, if profit comes back to the UK, this counts as a credit on current account

- Transfers. For example, if the UK send money to the EU, this is a debit on the current account

The current account comprises the trade balance (which is trade in goods) and also includes the balance for trade in services.

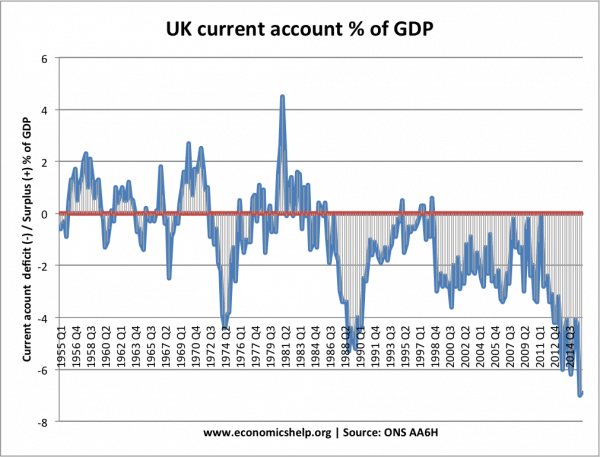

When people refer to a balance of payments deficit they usually mean a current account deficit

Further reading – Current account balance of payments

Financial Account (Capital) Balance of Payments

The financial account measures inflows of capital both short term and long term. this includes

- Foreign direct investment

- Purchase of securities by investors

Further reading – financial/capital account

Definition of Balancing Item

This is an item used when preparing accounts to cover up imbalances between two figures which should balance. Often when preparing accounts there are slight discrepancies between payments and annual income. The balancing item is used to offset the difference without having to alter the initial calculations. There is a balancing item in the Balance of Payments accounts

Balance of Payments Crisis

This occurs when the current account deficit cannot be maintained. It means there will be a fall in foreign exchange reserves as the country can no longer attract sufficient capital flows to finance the current account deficit.

The solution to a balance of payments crisis is usually to devalue the currency and slow down consumer spending on imports, usually by causing a recession.

Russia experienced a balance of payments crisis in 1998, leading to devaluation of Rouble.

Related