Should the government leave house prices to market forces, or actively intervene to prevent a house price crash?

Arguments for intervention

Falling House Prices Could cause a recession

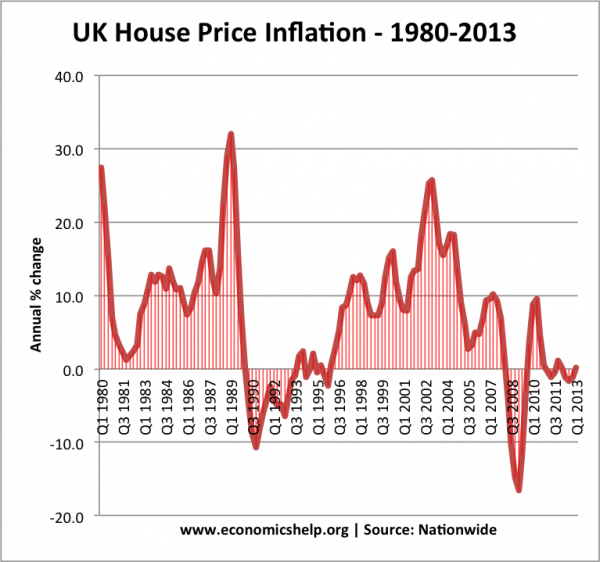

If house prices fall, it will cause significant problems for the UK economy. There will be a fall in consumer wealth, and declining house prices can lead to negative equity. (house prices are less than what people bought them for). Therefore, some people will have their home repossessed and will also owe money on their old mortgages. The effects of a fall in consumer wealth will be to reduce confidence and consumer spending; equity withdrawal will slow down sharply – this has been a significant contributor to increasing AD in the UK). Therefore, falling house prices will cause a fall in AD and is likely to cause a recession. This occurred in 1991 and 1992 when falling house prices caused a recession

Reduce House Price Volatility

To prevent a house price crash, in the future, the government needs to reduce house price volatility and speculation. For example, the government could try these policies

- Encourage Fixed Rate Mortgages – Fixed-rate mortgages (for 2,5, and ten years) make mortgages less sensitive to interest rate changes.

However, in practice, this is difficult to do. Also, it may take a long time to change consumer’s preferences from variable mortgages. - Higher Stamp Duty. Increased taxes on buying a house will discourage speculative buying – this is a major cause of house price volatility. However, it increases taxes on all homeowners and not just speculators.

- Increase supply in Property Hotspots. Rising house prices have been caused by a shortage of supply. Increased supply means that a small rise in demand will have less impact on prices. Therefore, this reduces volatility. However, it is difficult to increase supply due to a shortage of land and planning permission. It would take a long time to overcome the housing shortage.

Arguments against Intervention

Macroeconomic objectives of inflation and growth

There are only so many things that the government can seek to control. The main target of monetary policy is low inflation. If the government start targetting house prices, then it may conflict with these other objectives. e.g. trying to stop rising house prices could lead to higher interest rates and economic downturn.

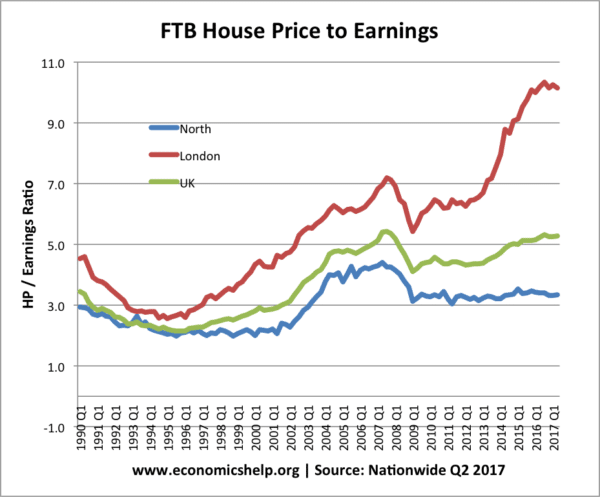

Benefits of allowing house price correction

If house prices are overvalued, for example, they have risen much faster than average earnings and renting. Then there are benefits to allowing house prices to fall. At the moment, many first time buyers are priced out of the market; this has led to a shortage of key public sector workers in areas like London. Falling house prices can have economic benefits, for at least some section of the workforce. A fall in house prices could also discourage future house price speculation (although the early 90s was soon forgotten). If the government try to intervene against market forces, it may only delay the inevitable fall.

4. House Prices fall doesn’t necessarily cause a recession

It is possible that house prices could fall without causing a recession. For example, if the MPC cut interest rates in response to falling house prices, this may maintain reasonable levels of consumer spending. It is worth remembering, a fall in wealth does not automatically cause a fall in consumer spending; Consumer spending is primarily dependent upon income.

To prevent a future house price crash, there are clear benefits for the government to try and reduce house price volatility. This means they need to prevent rapid house price rises and house rapid house price falls. The best way to try and reduce volatility would be to try and tackle the fundamental shortage of supply. It is the inelastic supply which makes house prices volatile and increases the likelihood of falling house prices.

If house prices do start to fall or stagnate there may be certain economic benefits. However, there is a strong argument that the government should try to minimise house price falls. A sharp fall (crash) in house prices is likely to adversely affect AD and economic growth. However, if the correction in the housing market is gradual, then serious macroeconomic problems can be avoided.

To answer the question.

1. Ye, there is a good argument for governments to reduce boom and busts in UK housing markets.

2. If the government fail to reduce house prices speculation and house prices are overvalued, then it may be necessary to allow house prices to fall. However, there are benefits of making the correction gradual rather than immediate.

3. Although there are benefits of intervention, it is worth remembering it is not easy for the government to actively dictate house prices. Especially, since monetary policy is undertaken by the MPC; also their target is inflation, not house prices.

Related