“Readers Question – A microeconomics question. In you labour market section you discuss a monopsonist.You say that “in order to employ one extra worker the firm has to increase the wages of all workers”- why? You give a coal mine as a possible example of a monopsonist, do you really think that a coal mine owner hired an extra worker(the marginal cost) and then increased the “wages of all workers”? Can you clarify this.

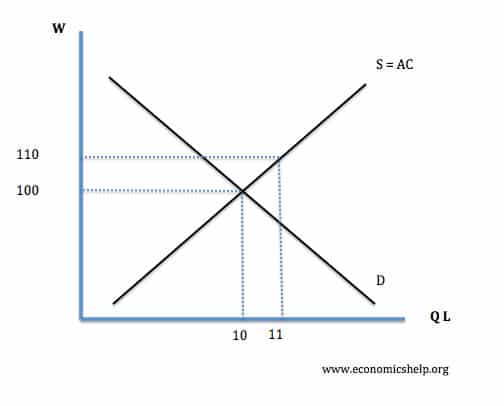

Just think of an upwardly sloping supply curve of labour.

- If the firm offers a wage of £100, it can employ 10 workers.

- To employ 11 workers, it would have to increase the wage rate to £110.

Therefore, according to this supply curve, if the firm needs to employ 11 workers the firm has to pay every worker £110. Therefore the marginal cost of employing an 11th worker is £210 (11*110 = £1,210 – 10*100). The marginal cost of the 11th worker is greater than the average cost

Theory and in practice

1. Wage discrimination. One exception would be if a monopsonist could wage discriminate – i.e. pay £110 to the extra worker, but continue to pay £100 to the existing mine workers. In reality this could be possible. For example, the firm could introduce a special post or job title which pays £110, whilst the existing workers get stuck on £100. If the monopsony can get away with this, then it will not have to pay every worker £110.

2. Elastic supply. Also, another possibility is that the supply curve is very elastic, therefore there may be infinite (or at least a very large) supply of labour at £100. For example, in a period of high unemployment, there are probably many workers willing to supply there labour at £100. Many coal mine owners may find, even at low wages, a large pool of unemployed workers willing to take a job at £100.

However, the theory of an upward sloping supply curve suggests that the marginal cost of employing an extra worker will increase faster than average cost.

Readers Question: My confusion gets worse as on the same page you say that one of the problems with a monopsonist is it can “lead to lower wages for workers”. Doesn’t this contradict your above point about a monopsonists increasing all workers’ wages as it employs one extra worker?

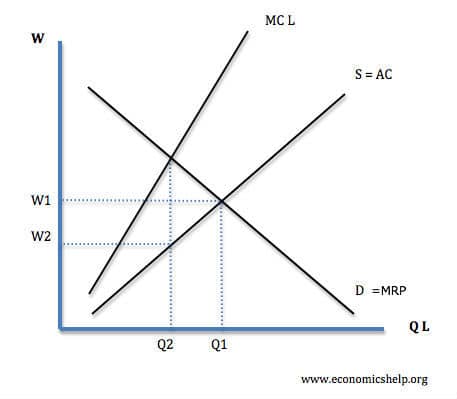

The key thing is that a monopsonist is reluctant to hire extra workers, precisely because it would have to increase wages of all workers (high marginal cost). Because of this prospect the monopsonist prefers to employ less workers and pay lower wages. To profit maximise, it avoids the extra marginal cost of paying all workers more.

This diagram shows a theoretical monopsony. It’s profit maximising decision is to employ only Q2 workers at a wage of W2. (where MRP = MC). This is a lower wage and lower quantity of workers than in a perfectly competitive market.