Readers Question: Why do the costs of living keep going up and our wages do not match it?

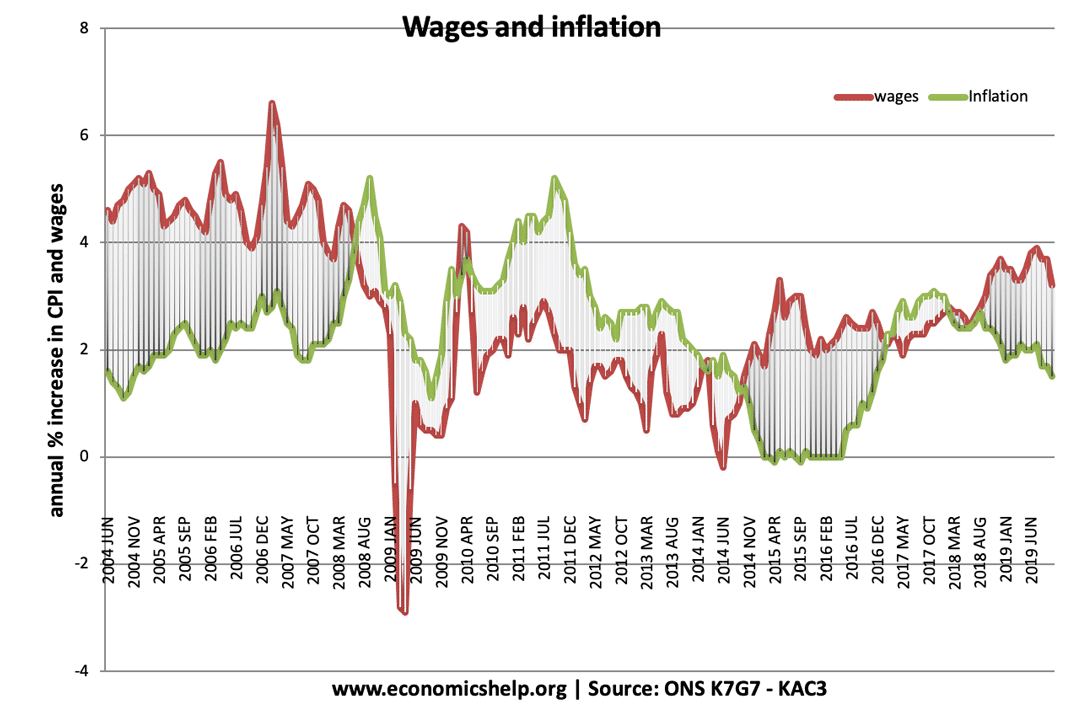

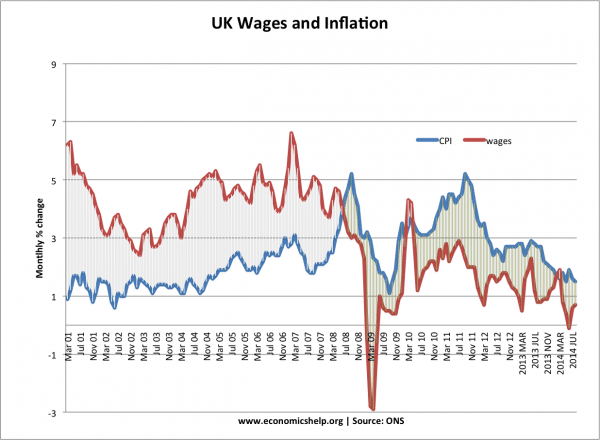

In recent years, many people have seen the cost of living rising faster than wages. This has led to a fall in real wages – wages increased less than inflation. This effectively means a fall in the number of money consumers have to spend on goods and services, leading to a decline in living standards.

- The cost of living measures the price of goods and services that we typically buy. This rise in the cost of living is measured by the inflation rate.

- If the inflation rate is higher than our nominal wage growth, then we see a decline in real wages. We are financially worse off.

This is not always the case. In the twentieth century, there was an unprecedented rise in living standards with the average wage of workers significantly increasing – enabling workers to be better off.

Ways to become worse off

- Inflation higher than wage growth – falling real wages

- Falling wages – and constant prices – leading to falling real wages

- Higher taxes, leading to less disposable income – disposable income measures after tax income. Your real wage may increase by 2%, but if income taxes rise 3%, your disposable income will be less.

- Higher living costs leading to less discretionary income. If you have to spend more on essential items, such as heating, insurance and travel costs, debt repayments – then the amount of money left over after spending on essentials falls. We say this is a fall in discretionary income (though people may use term disposable income). Again, you will feel worse off because there is less money left over to spend.

- Lower benefits. Many low-income people rely on government benefits, such as unemployment insurance, housing benefit or income support. If benefits fall behind inflation, this will create a fall in real income. This will be quite noticeable because people on low income are already stretched and have limited disposable income.

Falling real wages are quite rare in Western Europe since 1945. Typically we have seen positive economic growth and rising real incomes. People are definitely better off than 50 years ago. The graph below shows that since 2008, the rise in living standards has temporarily ended and become negative.

UK real wages

It is a similar situation in many other developed economies, such as US and Europe.

Reasons for falling real wages

Negative economic growth. If there is a recession – which means a fall in real GDP – then average incomes are likely to fall. Firms will be cutting wages and / or cutting jobs, therefore there will be a decline in living standards.

However, we can also see falling real wages during economic growth. An interesting feature of this recovery is that despite economic growth (rising real GDP), real incomes are still falling. How can real incomes fall, when there is positive economic growth?