Under certain circumstances, the government might want to intervene in the foreign exchange markets to influence the level of the exchange rate.

Methods to Influence the Exchange Rate

- Reserves and Borrowing. If the value of an exchange rate is falling and the government wants to maintain its original value it can use its foreign exchange reserves – e.g. selling its dollars reserves and purchase pounds. This purchase of Pound sterling should increase its value.

- Borrow The government can also borrow foreign currency from abroad to be able to buy sterling.

- Changing interest rates (In UK this is now done by the MPC) higher interest rates will cause hot money flows and increase demand for sterling. Higher interest rates make it relatively more attractive to save in the UK. If investors wish to save in the UK, then there will be more demand for Pound Sterling and the exchange rate will appreciate.

- However, higher interest rates do have the effect of depressing demand in the economy. The government may be reluctant to depress demand – just to increase the value of the currency.

- Reduce Inflation

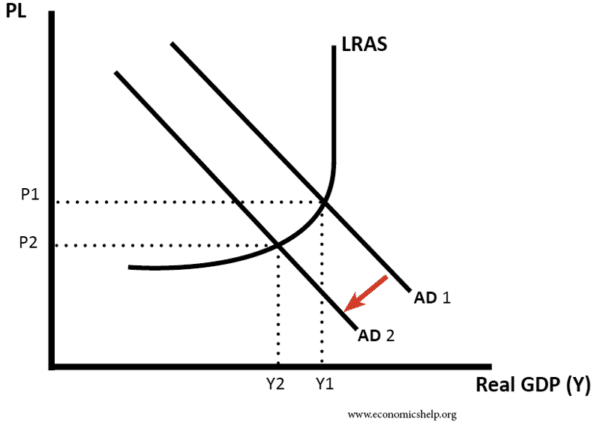

- Through either tight fiscal or Monetary policy, the government can reduce Aggregate Demand and hence inflation can be reduced.

- By decreasing, AD consumers will spend less and purchase fewer imports and so will supply fewer pounds. This will increase the value of the ER

- The lower inflation rate will also help because British goods will become more competitive. Thus, over time, the demand for Sterling will rise.

However, this policy has an obvious side effect because lower AD will cause lower growth and higher unemployment

- Supply-side measure to increase the competitiveness of the economy. This will take a long time to have an effect. But, if successful, the UK exports will become more competitive, increasing demand for Sterling.

- Join fixed exchange rate. One method to influence the exchange rate is join a fixed or semi-fixed exchange rate. The idea is that if the government are committed to a particular target, it may encourage speculators to expect currency to stay within this range.

- However, in practice, investors may feel government exchange rate targets are never guaranteed and are actually an opportunity to speculate against the government.

The UK forced out of Exchange Rate Mechanism

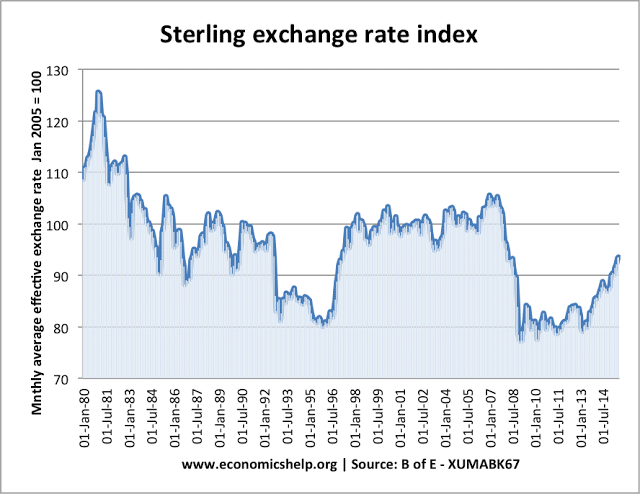

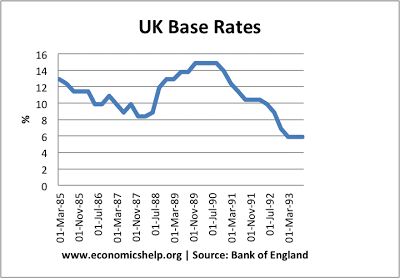

Note: Governments often fail in their attempt to influence the exchange rate. In 1990-92 the Pound Sterling was in the ERM but struggled to keep its value against the DM. The Pound Sterling kept falling to its lower limit in the exchange rate mechanism.

In response, the government raised interest rates to 15% and bought Pound Sterling on the foreign currency reserves. However, this was insufficient to stop the £ falling. Eventually, the govt had to give in to market pressures and exit the ERM.

The govt intervention failed because the market felt the governments intervention was not sustainable. Interest rates of 15% were disastrous for an economy already in recession. Therefore, high interest rates were insufficient as the markets correctly bet interest rates would have to fall and the government devalue.

After fighting the inevitable, the government eventually was forced to leave the ERM in October 1992. This enabled a fall in interest rates and an economic recovery.

See – Exchange rate mechanism crisis 1992

Chinese intervention in Chinese Currency

In the past few decades, the Chinese have often followed a policy of keeping the Chinese currency (Renminbi) undervalued.

China runs a current account surplus (due to strong export sector). With these foreign currency reserves, they have bought foreign assets, e.g. US Treasury bonds. This leads to increase in foreign currency reserves. But, more importantly, by buying US assets (and supplying Chinese Renminbi, the Chinese government is effectively reducing the value of the Renminbi.

The motivations for selling Chinese currency to buy US assets is that by keeping the currency undervalued, Chinese exports remain very competitive. This increases economic growth and provides jobs for the many workers leaving low-paid agricultural work.

At various times, US commentators have criticised this policy for being a case of ‘currency manipulation‘ The argument is that by keeping the Chinese currency undervalued, the dollar is overvalued causing a loss of US jobs.

Related