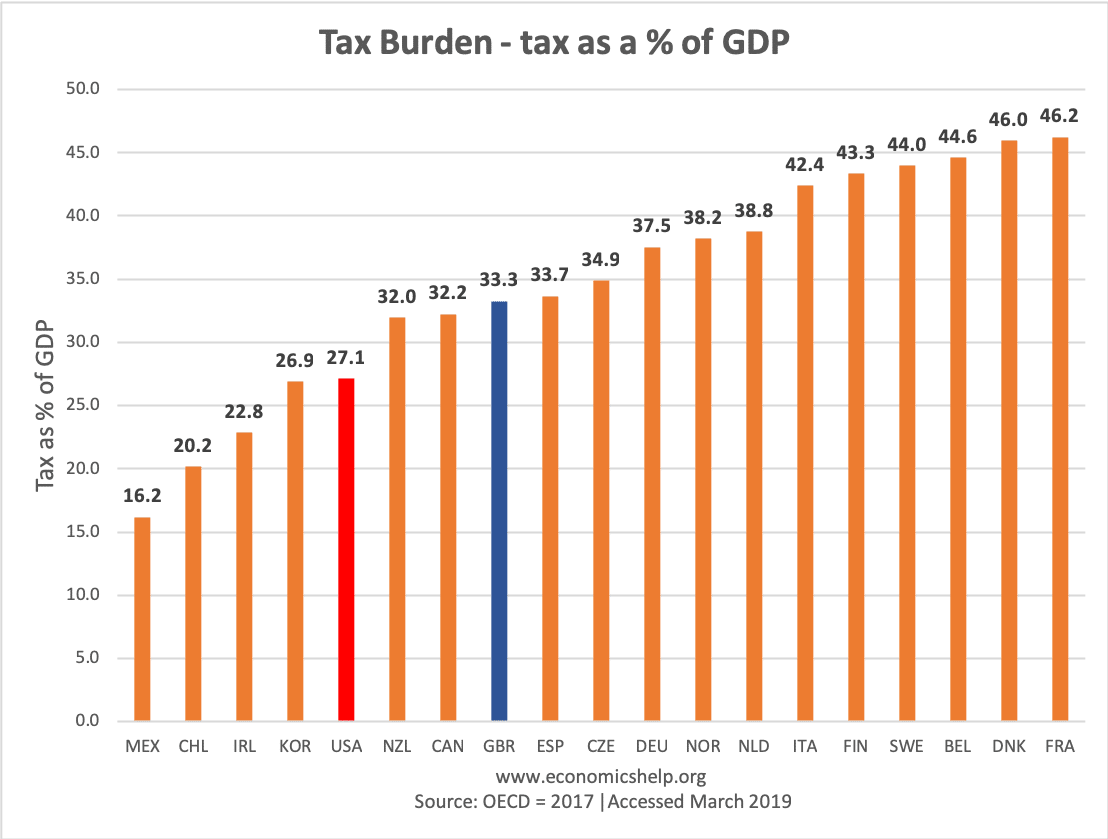

Tax Burden as % of GDP

The tax burden refers to the share of GDP that is collected in different forms of tax within an economy. For example, in an economy with a size of £1,000bn – if the government collects tax of £300bn, then the tax burden will be 30%. The tax burden gives a strong guide to the extent …