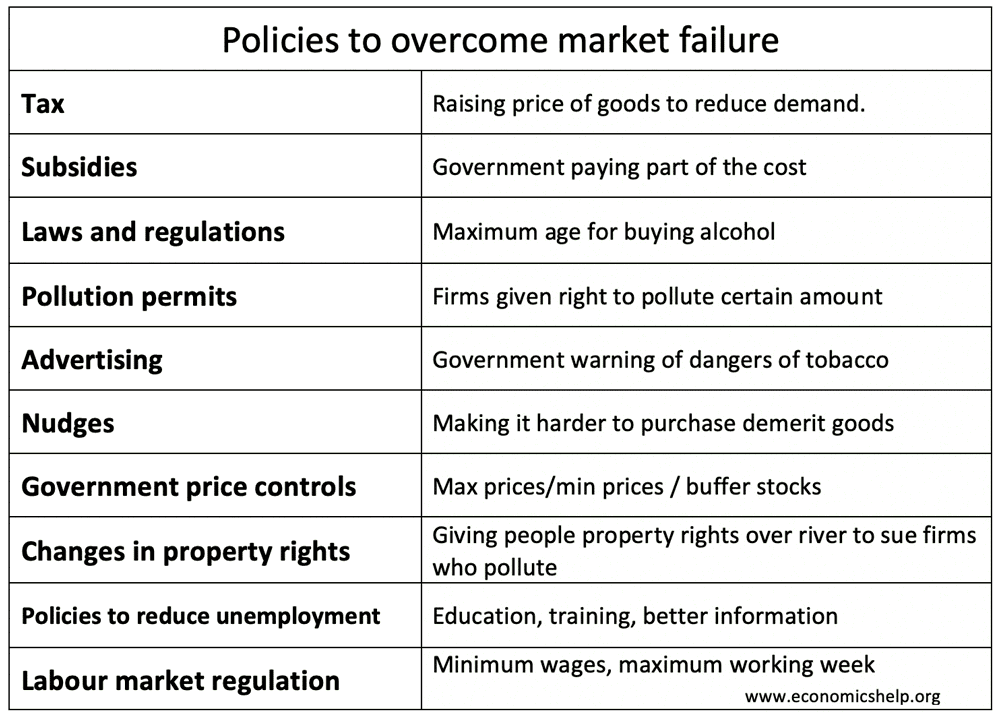

Policies to overcome market failure

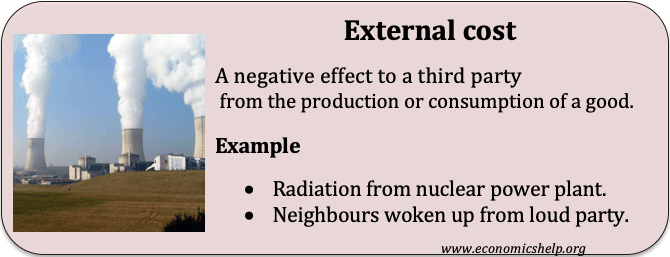

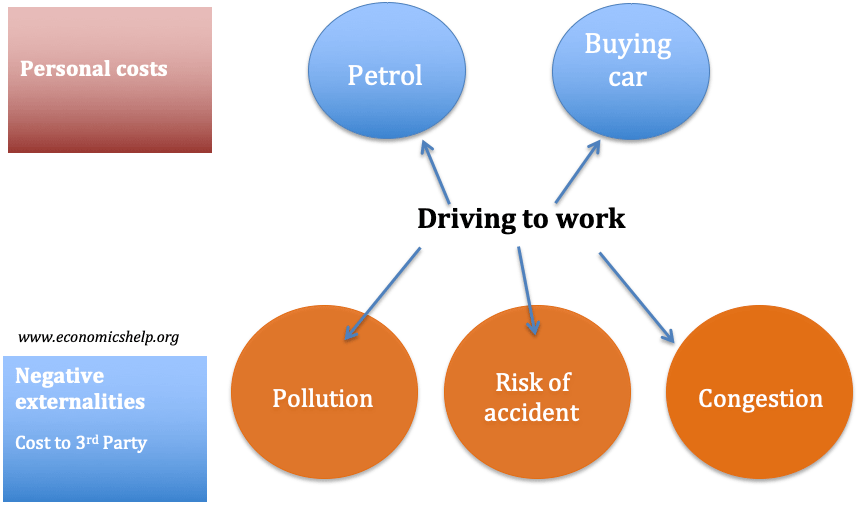

To overcome market failure, the government can use various policies. For example, to reduce consumption of demerit goods, they can increase taxes. Policies to overcome market failure Taxes on negative externalities Subsidies on positive externalities Laws and Regulations Electronic Road Pricing – a specific tax related to congestion Pollution Permits – giving firms the ability to …