Pollution Permits

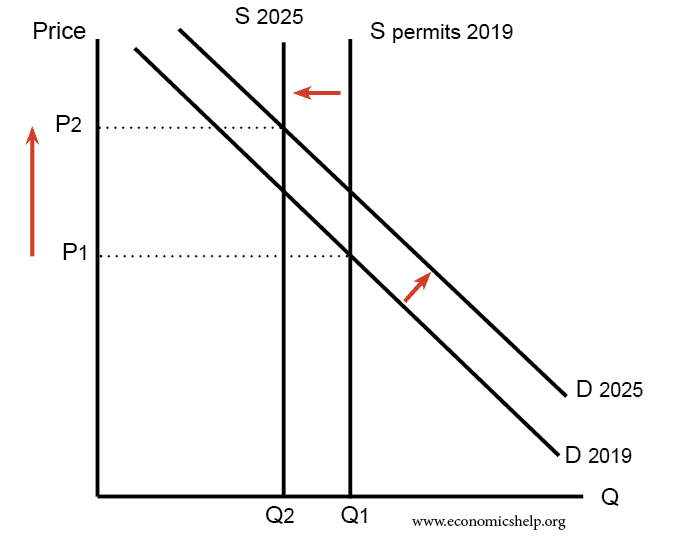

Pollution permits involve giving firms a legal right to pollute a certain amount e.g. 100 units of Carbon Dioxide per year. If the firm produces less pollution it can sell its pollution permits to other firms. However, if it produces more pollution it has to buy permits from other firms or the government. This creates …