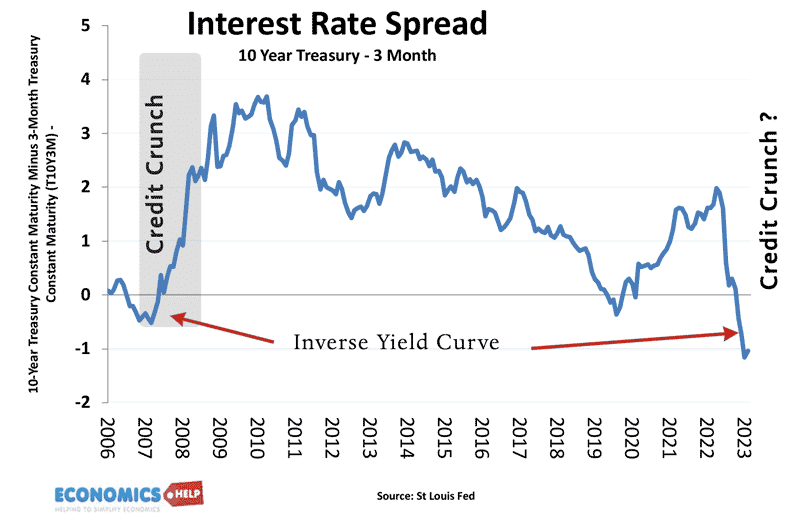

Are we heading for another Credit Crunch?

In 2008, the world global banking system went into meltdown after the bankruptcy of Lehman Brothers. It stemmed from a toxic combination of falling house prices, rising interest rates and sub-prime mortgage debt. To relive the 2008 Credit Crunch – see this article on Credit Crunch Explained (which was one of my earlier articles as …