Summary – Periods of high inflation usually lead to lower returns on the stock market because higher inflation is likely to lead to higher interest rates, lower economic growth and lower dividends.

Impact of high inflation on share prices

If the inflation rate increases, this will make investors wary for a few reasons.

- Firstly, if the inflation rate increases, the Central Bank is likely to consider raising interest rates. Higher interest rates will increase the cost of borrowing and lead to lower investment. Also with higher inflation and higher interest rates, many firms will face higher costs of production (e.g. debt repayments), leading to lower profitability. All this will lead to lower than expected economic growth and therefore lower share dividends – reducing demand for shares.

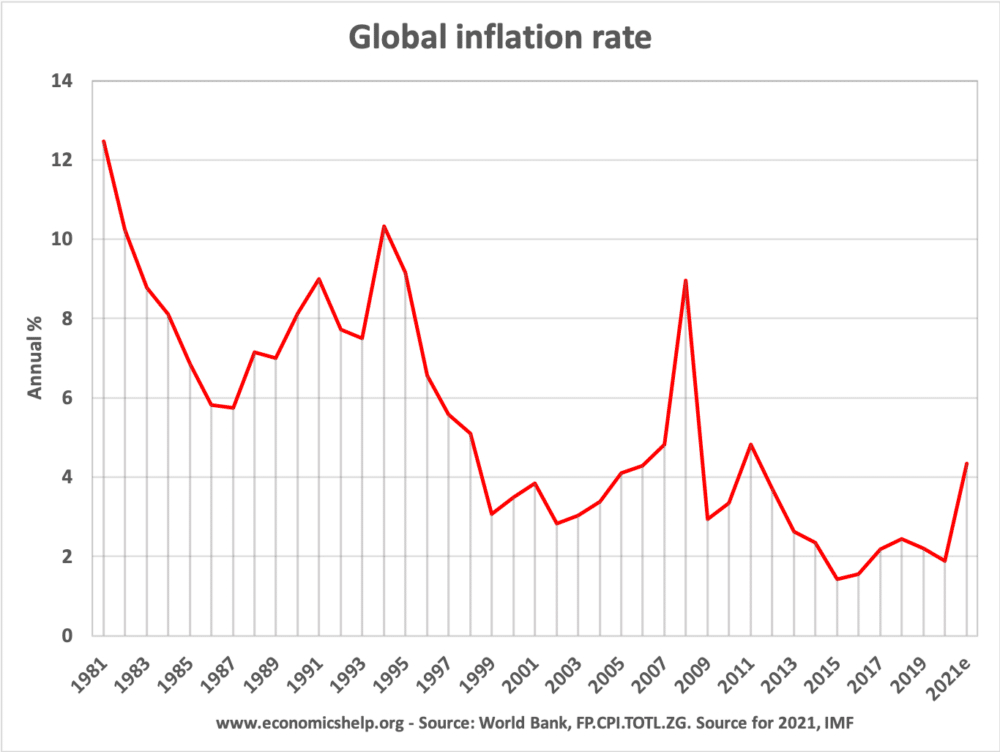

- Secondly, periods of high inflation (especially if unexpected) will cause greater uncertainty, and discourage firms from making risky investment decisions. This uncertainty can lead to lower economic growth and lower profitability for firms, making shares relatively less attractive. In periods of uncertainty, investors may pull out of shares and put a higher percentage of their portfolio in ‘safer’ options, such as index-linked government bonds or physical assets that hold their value, such as real estate and gold. A good example is the high inflation of the 1970s, led to poor returns on shares. During the high inflation period of 1969 to 1982, the real (adjusted for inflation) return on shares fell 11.6%, according to DataTrek Research (MW).

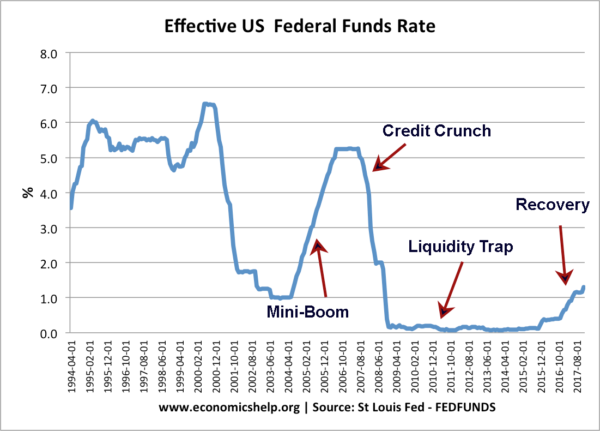

- Bonds vs shares. Many investors are looking for the best yield on their investments. If interest rates rise, bonds become more attractive compared to shares. In the period 2009-20, interest rates were at a record low (close to 0%). Therefore, investors were reluctant to buy government bonds and save money in bank accounts because the interest rate and therefore return was close to zero. This period of zero interest rates made shares much more attractive because at least with shares there is the possibility of getting good dividends that offer more than 0%. If interest rates rise sharply over the next few years, then investors will be encouraged to switch back from shares to bonds because bonds will now give higher returns.

The period of low interest rates from 2009 to 2022 co-incideded with the Dow Jones rising from 7,700 (March 2009) to 36,000 Jan 2022) Of course, many other factors affect share prices. But, low interest rates did cause greater liquidity and willingness to buy shares.

Evaluation

Growth shares. Companies that are in the growth phase – those expected to make higher profits in the future will be more negatively affected by inflation. This is because any forecast future profit will be diluted by the effect of inflation in reducing the value of money. If there is high inflation, it is better to get income now, rather than in the future. If inflation is 2%, future profits in 10 years’ time will have a low discount rate. But, with inflation of 10%+, future profit will have a greater discount rate. Examples of growth shares include Amazon (2000-2015) – making low profit but gaining market share.

High yielding shares. On the other hand, shares which focus on being low growth and high yield (e.g. electricity utilities) can also be vulnerable to higher interest rates because if interest rates increase, investors may move out of this kind of shares into government bonds and saving accounts which now offer comparable better returns.

Depends on the type of inflation. If there is a gradual rise in inflation because of strong economic growth (demand-pull inflation) then firms are likely to be making more profit and the negative impact of inflation may be outweighed by the higher growth and confidence. However, if inflation is of the cost-push type it is likely to more costly causing a degree of stagflation.

Hyperinflation. In the period of hyperinflation in 1920s Germany, the stock market was actually quite a good investment. Investors who were able to buy shares in companies with physical assets were able to maintain their real value of investment, whilst those who held money in the bank saw the value of their savings wiped out by inflation. The reason is that in hyperinflation, companies selling physical goods like food, steel and coal were able to maintain some profitability as they could increase prices at the same rate as inflation. Although it was a very difficult time for business, some were able to cope with inflation and so share prices kept rising in line with inflation.

Further reading