The effective exchange rate measures the value of a currency against a basket of other currencies. This exchange rate index is usually trade-weighted to take into account the relative importance of other currencies.

When looking at the effective Sterling exchange rate we compare the value of Sterling against our main trading partners – The Euro, the Dollar, the Yen e.t.c and give a weighting depending on how much we trade with that currency, e.g. Eurozone 60%. A weighting will be given to different trading countries depending on how significant they are.

An appreciation in the Sterling effective exchange rate means that on average the UK currency is increasing in value against our main trading partners.

See also: Real exchange rates

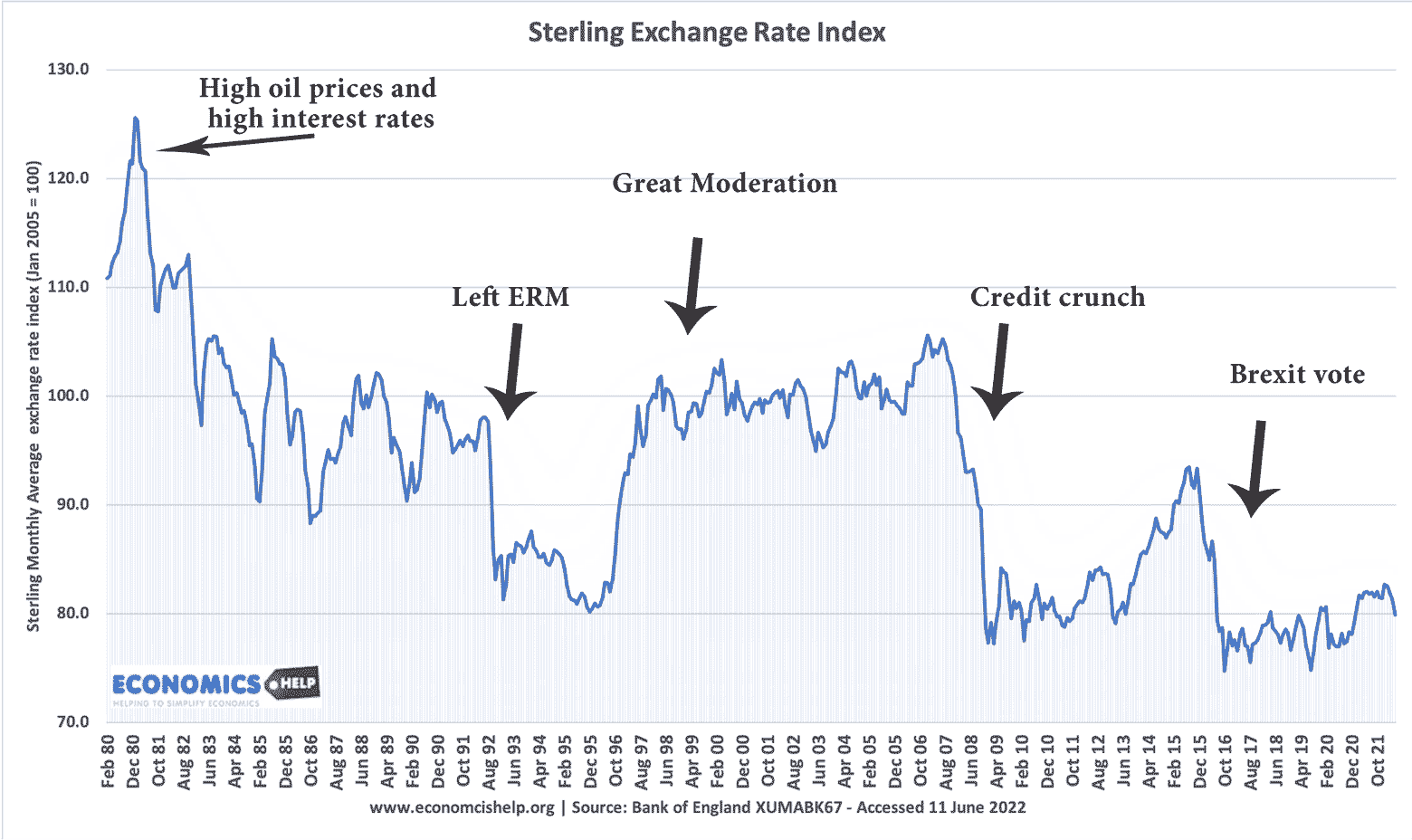

Sterling exchange rate index

This is the Sterling exchange rate index since 1980. Some interesting points on the graph:

- 1980 – sharp appreciation in Pound due to high-interest rates and increased oil production in the North Sea.

- 1980-1984 – sharp depreciation in Pound Sterling due to deep recession of 1980/81 and subsequent cut in interest rates.

- 1992 – Devaluation of Pound as UK leaves the ERM – the UK unable to maintain a high value of the currency because high-interest rates were causing a deep recession.

- 2008 – Sharp depreciation in the Pound because the UK economy was hit hard by the financial crisis and recession. Interest rates cut to 0.5%

- 2013-2015 – Increase in the value of the Pound as the UK economy recovery compares favourably to the rest of the Eurozone – making it likely interest rates will rise sooner in the UK than Eurozone.

- 2016 Brexit vote changed the complexion of the UK economy. With the UK leaving single market and EU customs union, UK exports have struggled and the UK is attracting less foreign investment because it is outside the single market.

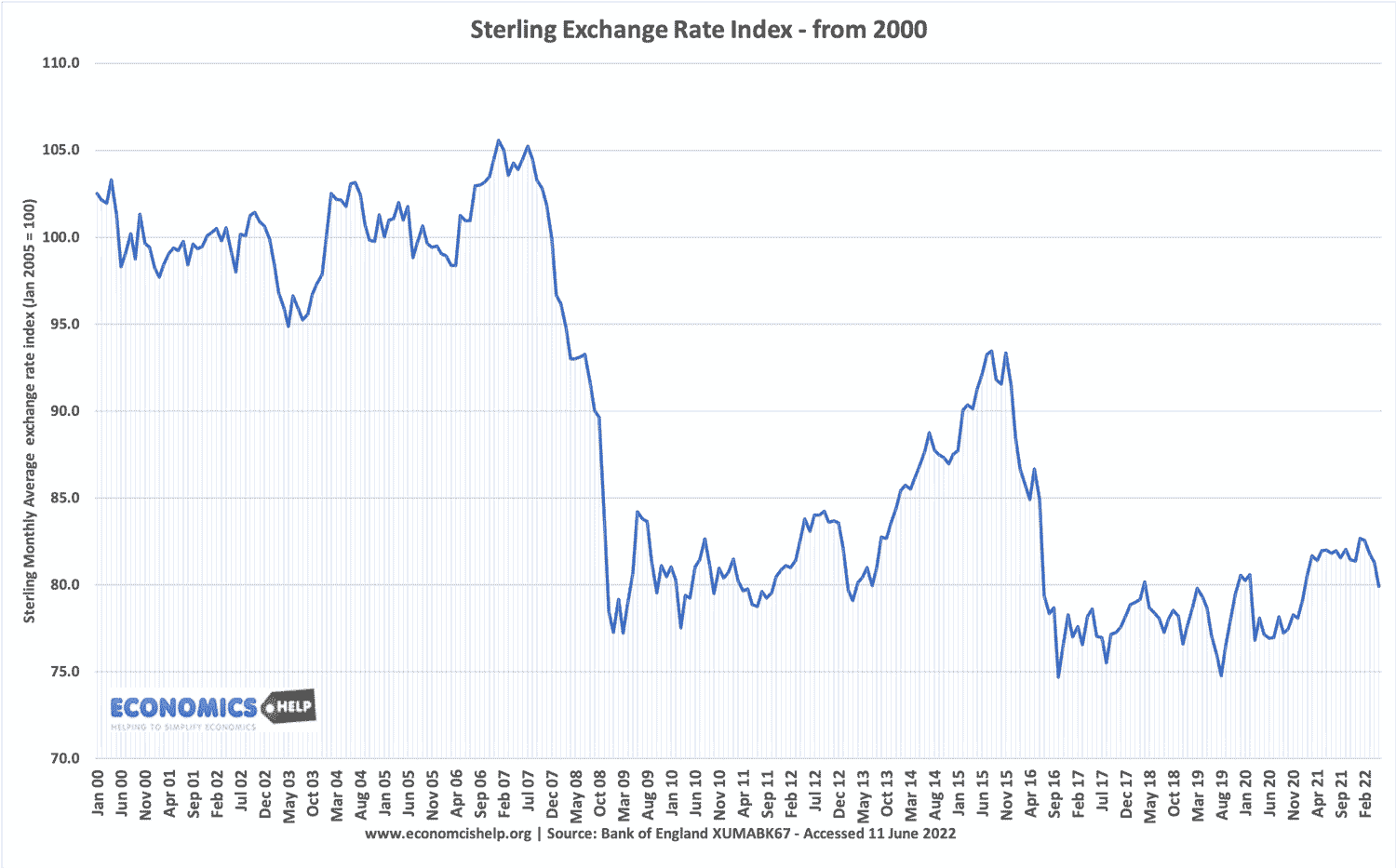

Sterling index since 2000

Recent Sterling changes in more detail.

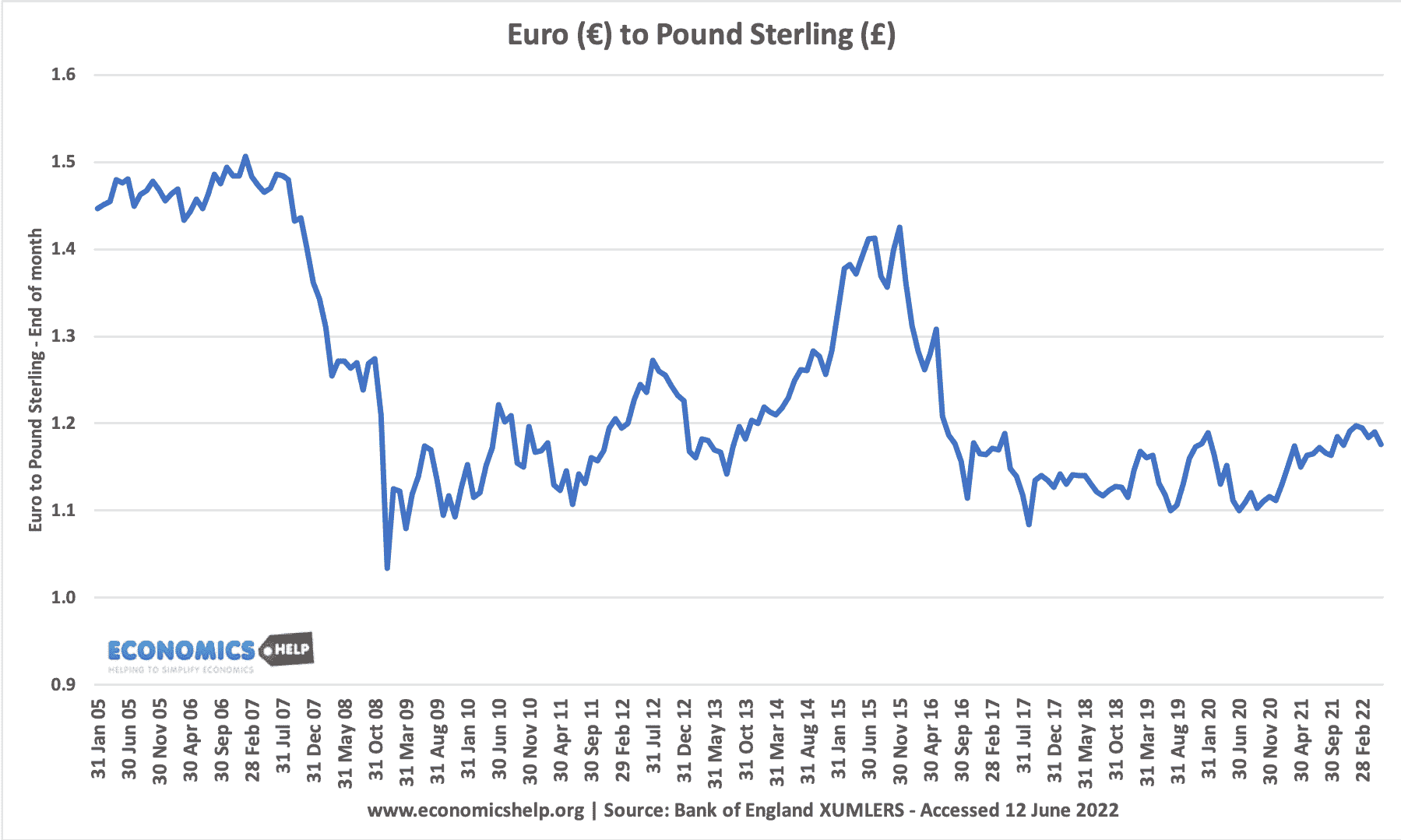

Euro exchange rate index

- Approx 230% decline in value of Pound to Euro since the financial crisis and Eurocrisis of 2009-12. Since Brexit vote in 2016, the UK Pound has continued to be weak against the Euro.

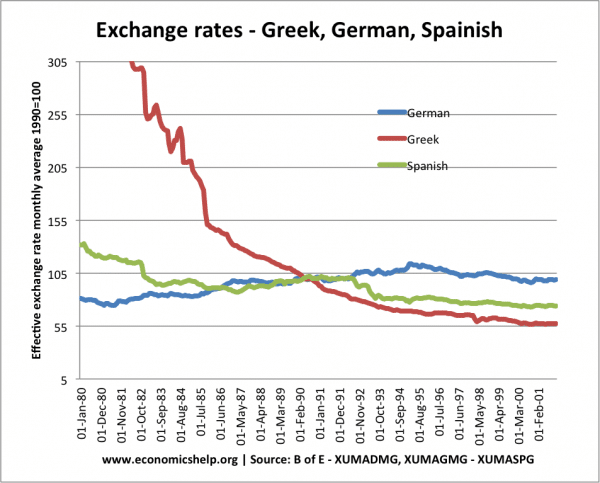

Euro exchange rates before Euro

A look at three European exchange rates before the creation of the Euro.

- Spanish and Greek currency underwent large depreciations in this period.

- The German currency appreciated considerably. (though reunification in the 1990s caused some depreciation)

- This large divergence in exchange rates foreshadows the significant exchange rate imbalances in the Eurozone. Problems of Euro.

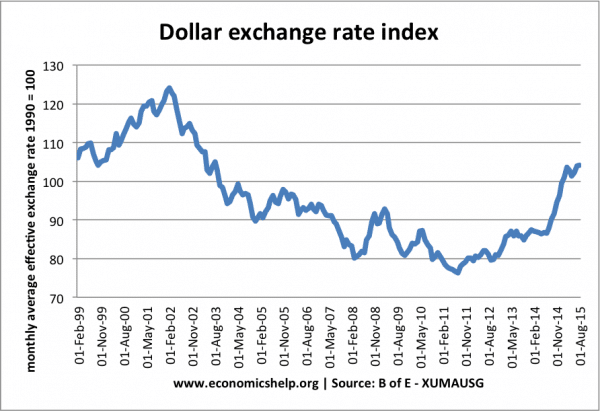

Dollar exchange rate index

- The long and persistent depreciation in the dollar 2001-2011 (approx 35%) has been reversed since 2012, as the US economy shows signs of economic recovery and probability that interest rates will rise at some point in the future.

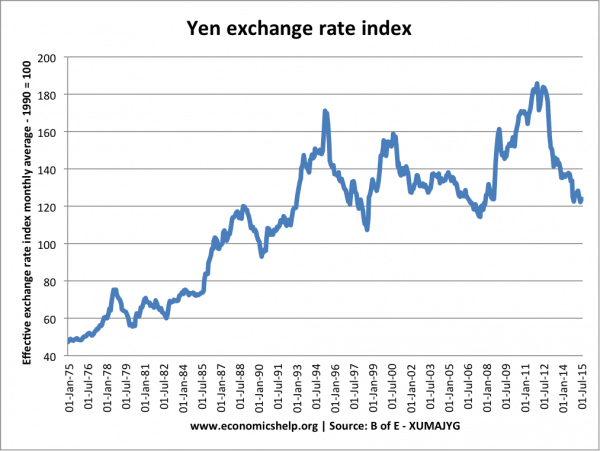

Japanese Yen

- The remarkable appreciation in the value of the Yen from mid-1970s to mid-1990s reflects the superior Japanese long-term competitiveness. By increasing productivity and becoming more competitive (relative lower inflation, relatively higher productivity), the Yen has increased in value.

- Period of stagflation in 1990s and 2000s, put an end to the appreciation.

- Rise in 2008-10 due to Japan being less affected by financial crisis. Japanese interest rates were already close to zero, so with other economies also having low-interest rates, there was less demand for saving abroad.

- Since 2011, Japanese Yen reversed gains – falling approx. 30%. This was partly due to Abenomics – looser monetary policy and expansion fiscal policy with an aim to increase inflation and economic growth

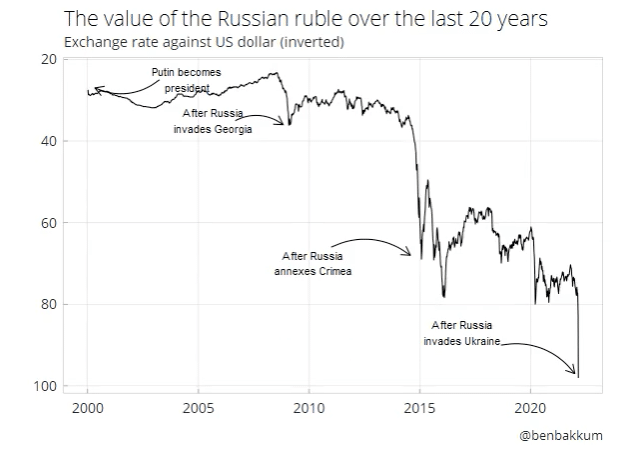

Russian Ruble

This shows the importance of the value of geopolitical events on a currency. After Russian invasion and annexations of other countries, the Ruble has fallen in value in response to economic sanctions and greater unwillingness to invest in Russia.

Related

Stats

- Latest Sterling exchange rates at Bank of England

Thanks for the layman’s overview..

Surely about time for an update.. with continued deflation since Nov last year ? An indication of whether matters will improve after the referendum would also be interesting.

HI THERE,

I AM CURRENTLY STUDYING ABOUT THE EXCHANGE RATES, FIXED AND FLOATING AND ALOT OF YOUR NOTES HAVE EXPLAINED BETTER THAN OTHERS.

ELL COULD NOT FIND THE EFFECTS OF THESE EXCHANGE RATES INDIVIDUALLY ON BUSINESSES AND INDIVIDUALS.

IF YOU MAY PLEASE HELP ME UNDERSTAND HOW EACH ON THEM HAVE DIFFERENT EFFECTS ON US AND ON BUSINESSES.

THANKING YOU,

Thanks for sharing the infographics and all the info. Great work, indeed. Keep up the good work!