Laissez-faire economics is defined as a situation with minimal government intervention. Under laissez-faire, governments and regulators ‘leave alone’ private firms to allow them to make decisions about production and output.

In particular, laissez-faire involves zero / minimal government intervention on issues such as regulation, taxes and tariffs.

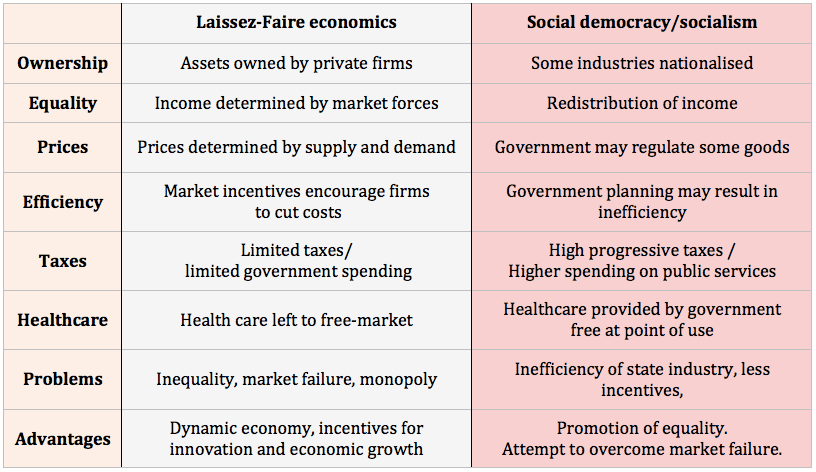

Comparison between Laissez-Faire economics and social democracy

Origin of Laissez-faire

Laissez-faire is a French term and is said to have originated in the Eighteenth Century. French industrialists were asked about the optimal policy for the French government to help business and the term ‘laissez-faire’ was used in response – translating as – ‘leave us alone / Let do and pass). The phrase is traditionally attributed to the French businessman Legendre. Responding to a Mercantilist minister Colbert.

(‘Que faut-il faire pour vous aider?’ asked Colbert. ‘Nous laisser faire’ answered Legendre).

What can we do to aid you? asked Colbert Let us do (what we want to do) (Laissez-faire)

Laissez-faire stood in contrast to the Mercantilist theory of trade which advocated accumulation of gold and placing tariffs on imports.

Laissez-faire was also a reaction against the perceived incompetence and bureaucracy of Eighteenth and Nineteenth Century states.

Philosophically, laissez-faire corresponded to emerging political doctrines about the rights of men and freedom from state interference. It also shared similarities to Darwinism – the survival of the fittest is an idea used to justify allowing unprofitable firms to go out of business for the ‘greater good’

Laissez-faire and classical economics

The principle of laissez-faire and minimal government intervention was important in the development of classical economics and became a founding teaching principle of economics. Adam Smith seemed to give more intellectual credence to laissez-faire economics when his writings (Wealth of Nations) showed how if individuals pursue their own self-interest in can end up being for the public good. This seemed to be justification for minimal government intervention and leaving economies to the invisible hand of the market.

Laissez-faire economics usually advocated some government intervention – even if just restricted to the protection of private property and maintaining the rule of law.

Benefits of Laissez-faire economics

- It avoids the distortion of tariffs and welfare loss. Free trade is an important principle of maximising economic welfare and enabling countries to mutually profit from trade.

- It avoids the inefficiency and possible corruption of heavy government intervention in markets where bureaucrats have limited information.

- Creates market incentives. The main principle of laissez-faire economics is that entrepreneurs, workers and firms have an incentive to work hard and create goods that consumers want. Inefficient firms will tend to go out of business, creating a dynamic of creative destruction and increased efficiency.

Criticisms of Laissez-faire economics

- Can lead to inequality of wealth and income. Wealth and opportunity tend to get inherited, and those with limited opportunities, struggle to compete against established interests. Far from creating an equal playing field, laissez-faire enables powerful vested interests to dominate wealth and income.

- Monopoly power. Adam Smith raised the problem of monopolies, which can arise under an economic system of laissez-faire. Monopolies can charge higher prices, restrict supply, and those firms with monopsony power can pay lower wages to workers.

- Adam Smith was also critical of some aspects of capitalism. He noted that in capitalism, landlords could gain a passive income from mere ownership of property. This could make them lazy and indolent.

- Public goods and positive externalities. The principle of laissez-faire economics might work for markets without externalities. But, goods with negative externalities, (e.g pollution) will be over-consumed, and goods with positive externalities (e.g. education) will tend to be under-consumed. Public goods may not be provided at all.

- Keynes wrote an important tract “The End of Laissez-faire” (1926) in which he advocated a mixed economy, making use of capitalism, but also examining the role of government intervention on a case by case basis.

“The world is not so governed from above that private and social interest always coincide. It is not so managed here below that in practice they coincide. It is not a correct deduction from the principles of economics that enlightened self-interest always operates in the public interest. Nor is it true that self-interest generally is enlightened; more often individuals acting separately to promote their own ends are too ignorant or too weak to attain even these.”

(Keynes on Laissez-faire, 1926)

Influence of laissez-faire

Although most economies have converged towards some kind of mixed economy, the principle of laissez-faire economics still influences aspects of economics.

- Motivation for privatisation and selling off state assets, e.g. UK’s extensive process of privatisation

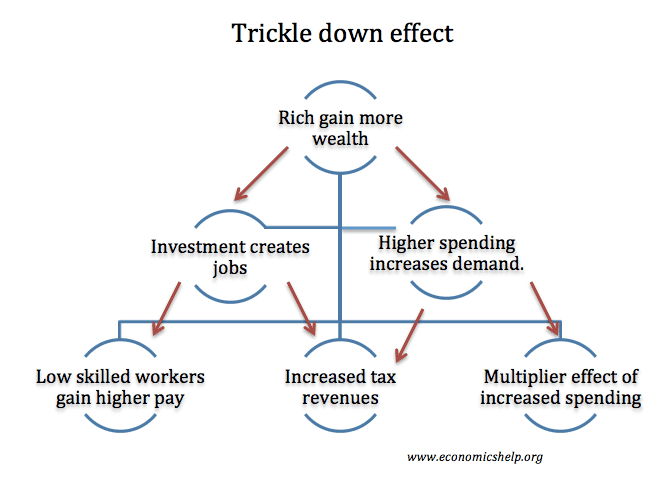

- Trickle down economics. Popularised in the US under Reagan, the idea that allowing private business to make money is in everyone’s interest as if business become successful, this will ‘trickle down’ to other people.

- Arguments for tax cuts and removal of regulations, such as labour market regulations.

Related

Excellent, thorough, scholarly discourse on ‘laisser-faire’

economics. In my humble view, it is felt some forms of

state control should be applied as government is quite

responsible for the equitable administration and well-being of a country. Competing elements are fto be duly

encouraged to allow a free market reducing monopolies.