The principal-agent problem is a situation where an agent is expected to act in the best interest of a principal. But, the agent has different incentives to the principal, leading to a conflict of interests.

A principal delegates an action to another individual (agent), but there are two issues. Firstly, the principal does not have full information about how the agent will behave. Secondly, the interests of the principal diverge from that of the agent, meaning that the outcome is less desirable than the principal expects.

Shareholder and manager

For example, a shareholder (principal) wants to maximise profits for his firm. He hires a manager (agent) to run the business. However, due to agency costs, the shareholder cannot fully know how hard the agent is working and to what extent the manager is fulfilling the contract. Also, in this situation, the manager does not share the same interest in maximising profits as the owner.

Market failure

The principal-agent problem can lead to market failure because the agent pursues his own self-interest rather than that of the principal and the business may be run in an inefficient way. In extreme cases, the mutually beneficial action may not happen because the principal lacks information.

The Principal-agent problem can also cause adverse selection – poor choices based on asymmetric information. This is where the agent has private information before a contract is written. For example, a lazy worker gets a job because the employer doesn’t know he is lazy.

Requirements of principal-agent problem

- Multiple actors who have a different set of objectives (e.g. shareholders vs workers.

- Asymmetric information (the agent having more information than principle.) The shareholder can see some stats like profit, but only the manager knows exactly how hard he worked or didn’t.

Examples of Principal-Agent Problem

Shareholders and managers of a company. Shareholders will wish to maximise a firm’s profits to increase their dividends. However, the manager and workers, who are responsible for day to day running of the firm, may fail to pursue profit maximisation. Instead, they concentrate on enjoying work and getting on with workers.

Landlord and tenant. The landlord owns house and rents out to tenants. He asks tenants to take care of the property and minimise electricity bills. But, tenants may open windows rather than turn down the heating.

Sub-contracting your essay. Suppose a lazy student paid a random stranger on the internet to write a dissertation. Apart from being cheating which could lead the student to be expelled, it is also an example of a principal-agent problem. The lazy student pays $500 for the essay, but the person writing the essay in anonymity has not the same motivation and may not care about the quality. They will gain $500 whatever happens to the grade.

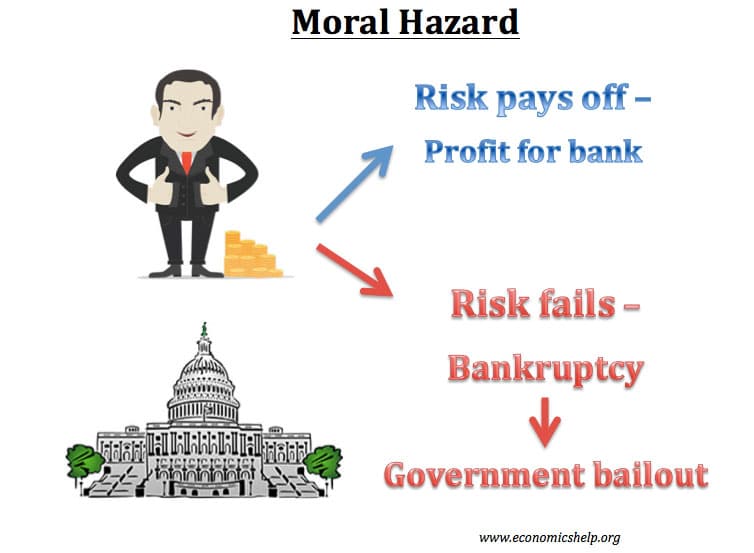

Principal-Agent Problem and Moral Hazard

The principal-agent problem can also lead to an individual taking an excessive risk because the ultimate cost is borne by someone else. This is an example of moral hazard.

For example, an investment banker may gain a bonus for making high profits. This encourages the banker to take risky investments. If he fails and loses $700m, the losses are absorbed by the bank (or taxpayer) – not by the individual banker. This has led to major banking collapses, such as rogue trader Nick Leeson and Barings Bank (1995).

Costs of Principal-Agent Problem

Agency costs. Due to information asymmetries, principals may be unaware of how much a contract has been fulfilled. Principals may be reluctant to enter into a contract at all for the fear that they will not know what is going on. For example, a landlord may be reluctant to lend if he fears that a tenant may mistreat his property and be unable to know how it is cared for. If a mutually beneficial transaction doesn’t occur at all, this would be a significant welfare loss.

“We define an agency relationship as a contract under which one or more persons (the principal(s)) engage another person (the agent) to perform some service on their behalf which involves delegating some decision making authority to the agent. If both parties to the relationship are utility maximisers, there is good reason to believe that the agent will not always act in the best interests of the principal.”

Theory of the Firm: Managerial Behavior, Agency Costs and Ownership Structure Jensen and Meckling (1976)

Inefficiency. Principal-agent problem enables agents to produce sub-optimal work. For example, managers may be profit-satisfiers – leading to higher costs and less profit.

Cost of monitoring/incentives. To try and overcome the principal-agent problem, the principal will have to spend money on monitoring and providing incentives for workers.

“However, it is generally impossible for the principal or the agent at zero cost to ensure that the agent will make optimal decisions from the principal’s viewpoint.”

Jensen and Meckling (1976)

Overcoming Performance Related Pay

Tipping. Waiters who rely on tips for pay will have their interests more aligned with owners (principals). This can be an effective way to remove the principle-agent problem. However, due to social conventions, it is difficult to move away from tipping in all but the limited industries of restaurants and cafes

Performance Related Pay. A simple solution to give agents an incentive to work hard. However, it depends on how Performance Related Pay is implemented. Without sufficient flexibility, it can create tension in the workplace and reduce co-operation. Also, some jobs are suitable for objective evaluation, e.g. fruit pickers have an easily quantifiable output. But, other jobs, such as teaching and managers require more subjective evaluation.

Different workplace environment. Workers are motivated by a variety of factors other than pay. Some of the main motivations are not pay, but pride in work and a sense of achievement. A management structure which encourages independence and workers taking responsibility for work can be more effective than crude pay bonuses.

Related