Biflation is a term used to describe a period where some prices are rising and some prices are falling. It can appear we have both inflation and deflation at the same time.

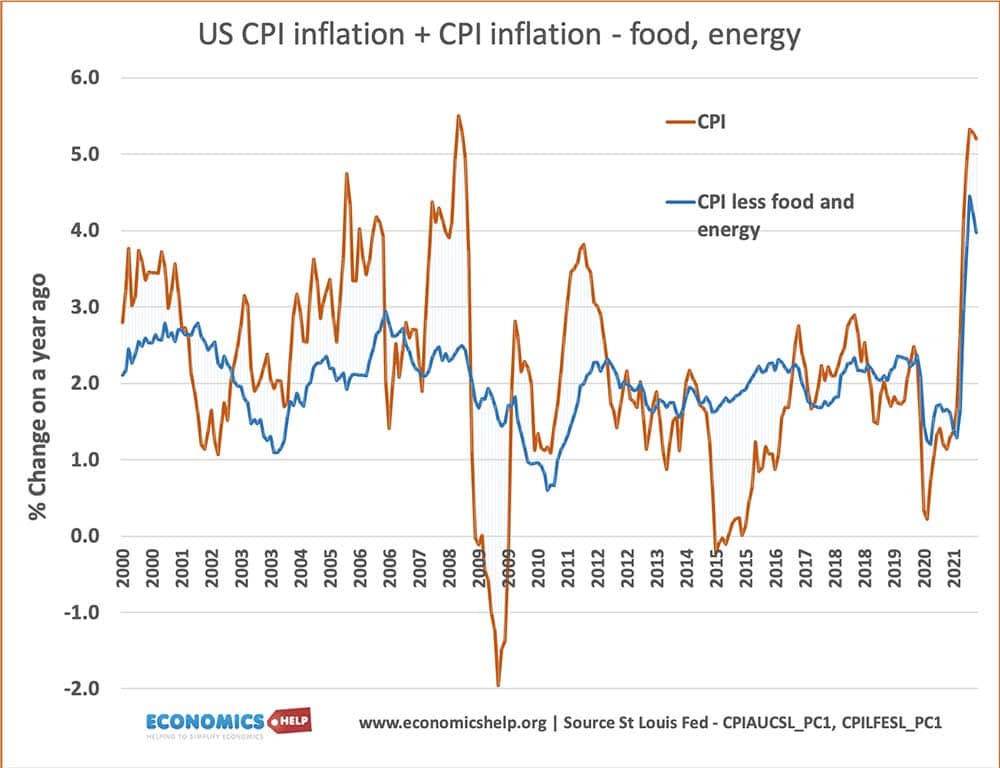

- CPI = Headline inflation rate

- CPI less food and energy = underlying or core inflation.

In the above example, the headline rate is more volatile than the core inflation rate.

Biflation and commodity prices

Biflation usually involves an increase in commodity prices (e.g. oil and wheat), but a fall in asset prices and a fall in price of non-essential goods.

In 2008, we saw a rapid rise in oil prices, whilst house prices were falling.

Why do we get biflation?

Recession In a depressed economy, demand for essential commodities (like food) will remain relatively high. Therefore, the price of these goods can increase. However, if there is a fall in economic growth and rise in unemployment, there will be a substantial fall in demand for expensive assets such as houses. Therefore, it can be possible for house prices to fall, whilst demand for basic commodities continues to rise.

Global pressures. This contrast between different sectors can be exacerbated by international factors. In 2008, commodity prices rose because in the developing world (emerging economies like China) growth has been strong and therefore commodities have been in high demand pushing up prices. However, in 2008-09 the West experienced a financial crisis and deep recession. This financial crisis has led to a shortage of liquidity and falling asset prices. Also the lower growth led to higher unemployment and deflationary pressures, putting downward pressure on prices in the west. Yet, although there was deflationary pressure, the west experienced higher commodity prices because of strong demand in other parts of the world. This explains the paradox. Energy, oil and food prices rose substantially above the inflation rate, whilst other prices fell..

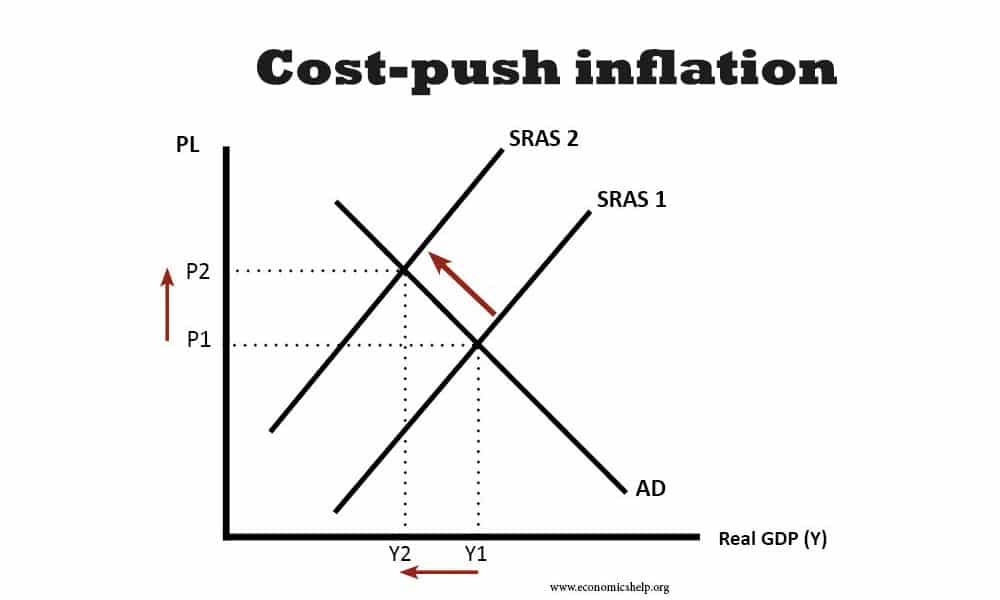

Cost-push inflation. If we get cost-push inflation, then we can get higher prices, but also lower growth.

The price of some goods like oil and wheat have been rising due to shortages and supply constraints. This causes short-run aggregate supply (SRAS) to shift to the left. This causes inflation, but also lower real GDP. Households will see their disposable income squeezed and so they will spend less. This reduces demand-pull inflationary pressures and could cause some prices to fall. Therefore, whilst oil and food increase in prices, the price of many other goods have been falling, indicating deflationary pressure.

Biflation in 2022?

2022 has seen further rises in commodity prices due to Covid bottlenecks and the Ukraine conflict causing higher price of oil and natural gas. This has led to a rise in cost-push inflation, however, there is little sign of any falls in prices in other goods.

What is The Real Inflationary Pressure?

When you have rising commodity prices and falling prices of other goods, it can be difficult to work out whether inflation or deflation is the real problem.

However, there are a few things to examine.

- Level of spare capacity. If economic growth is well below the trend rate of growth, there is a negative output gap. This will keep underlying inflation low.

- Wage Growth. If inflationary pressures are strong, workers will be able to demand higher wages. These higher wages will cause inflation to be strengthened and cemented.

- Inflation expectations. Do people expect inflation to remain high?

In the current climate, the evidence suggests that inflation remains just a short term issue. There is still a negative output gap, high unemployment. Wage growth is very low and inflation expectations haven’t changed. It suggests that the high CPI is due to commodity inflation and therefore just a short term factor.

Stagflation

Biflation is a similar concept to stagflation. Stagflation refers to falling GDP / stagnant economy, but inflation at the same time. If you have inflation and very low growth. The inflation will be caused by temporary cost-push factors (e.g. higher oil prices) and not the usual demand pull inflation.

Related