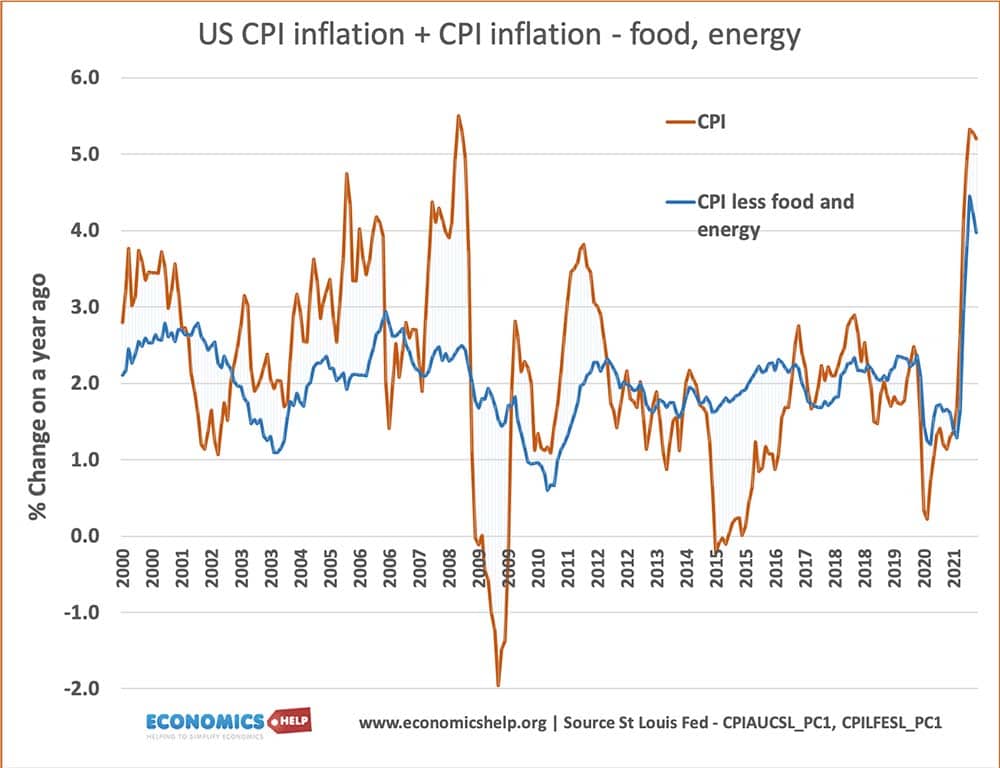

The difference between CPI and PCE seemed relatively insignificant. However, a big issue is the difference between CPI and Core CPI.

- CPI is the consumer price index. A measure of the cost of living for the typical person.

- Core CPI is the CPI – energy and food prices.

Energy and food prices are removed because they have tendency to be highly volatile.

This graph of Core CPI and CPI in the US shows how volatile CPI can be.

- CPI inflation less food and energy is much more stable than the headline CPI rate.

Policy Implications of Core CPI

This clearly has policy implications. If we look only at CPI, monetary authorities may be inclined to change interest rates more frequently. For example, in 2008, we had a rise in energy prices causing cost push inflation of 5%, a few months later we were in deep recession. In other words, CPI can give a misleading impression of underlying inflationary pressures. If you tighten monetary policy because of temporary food and energy inflation, you create the potential for slowing down economy. Similarly when there is a slump in energy and food prices, there is a danger monetary policy can become too lax, creating future underlying inflation.

It is true that consumers have to face rising food prices and rising energy prices. I don’t suggest indexing linking pensions to Core CPI. This could give pensioners an increase in benefits less than their cost of living.

However, it is important for the Bank of England and monetary authorities. It explains why the Bank of England hasn’t been increasing interest rates in response to inflation above target.

There is a danger temporary cost-push inflation could lead to higher inflation expectations. But, this is not convincing.

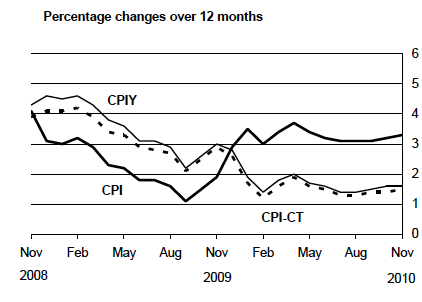

CPI – Taxes

Source: [2. Focus on Consumer price index. Office National Statistics ]

The CPIY is the same as the CPI except that it excludes price changes which are directly due to changes in indirect taxation (such as the increase in air passenger duty, which came into effect from 1 November 2010).

The CPI-CT is the same as the CPI except that tax rates are kept constant at the rates they were in the base period

Clearly it is also important to strip away tax changes to get an understanding of the underlying ‘core’ inflation. Tax increases tend to be a one off so will not affect the price level next year (unless the chancellor raises the VAT by 2.5% every year)

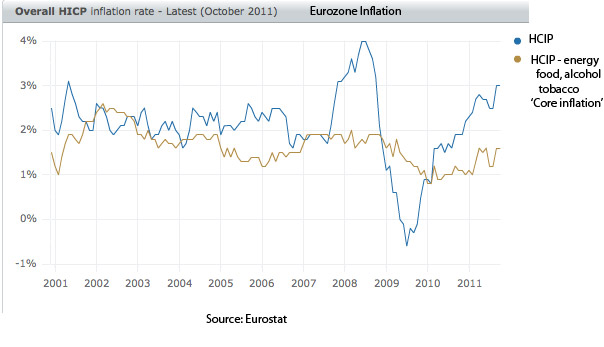

EU Core Inflation

EU Core Inflation

Related

- CPI, RPI and RPIX

- Food Inflation

- Inflation at National Statistics

use the increase of the amount of money ppl paid to get the same servicer/goods to gauge inflation. Tax, duty or whatever, ppl are paying more to get the same thing.

what a joke splitting theses terms. it costs the consumer more period and wgo can live without food and energy? Analyze the volatility!!