A look at the impact of strong (overvalued) currency

Readers Question: Why would a strong currency be bad for a country? If we consider a country like an individual, having a strong currency means the country can accumulate more assets and resources for its people, thereby increasing the value of its country. As for the reasoning that it decreases competitiveness, if for example, it reduces tourism like in Switzerland, that just means that actual demand has reduced. This will naturally cause people to diversify into some other business, overall, leading to much-improved productivity and diversity.

It is true that a strong currency can have various advantages.

- The price of imports falls. Therefore, living standards can increase as consumers and firms can benefit from lower prices of imported goods. Some firms who rely on imported raw materials will see a fall in costs. Consumers who buy expensive imports will see improved living standards and greater purchasing power.

- Incentives to cut costs. A strong currency makes exports less competitive. This creates an incentive for exporters to:

- look for efficiency savings / increase productivity.

- Diversify into less price sensitive exports. This is often exports with greater value added. This can lead to long-term benefits for the economy and is arguably better than always trying to compete through relying on the weak currency which may encourage fewer incentives to be efficient.

- Can help reduce inflationary pressures. An appreciation in the currency can help prevent domestic inflation and prevent the economy overheating. This is because imports are cheaper, and we get relatively lower aggregate demand.

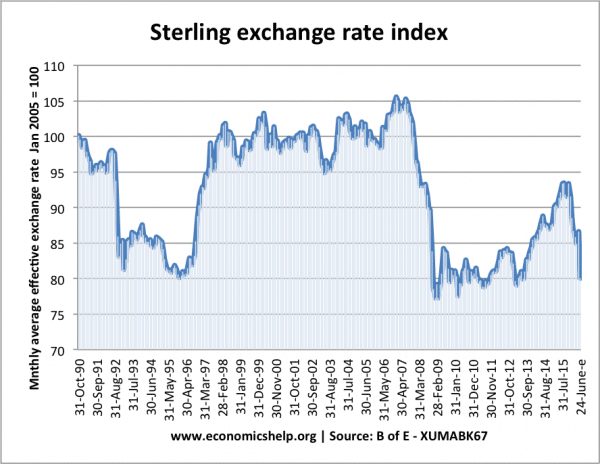

In many circumstances, a strong currency is beneficial for an economy. An appreciation in currency usually reflects the fact the economy is becoming more competitive and productive. For example, in the post-war period, Japan and Germany both experienced a sustained appreciation in their currency. This was compatible with rising productivity, low unemployment and high economic growth. By contrast, in this period, the UK experienced a sustained depreciation in the value of Sterling, This was a reflection of the fact the UK was losing relative competitiveness.

When a strong currency becomes a problem

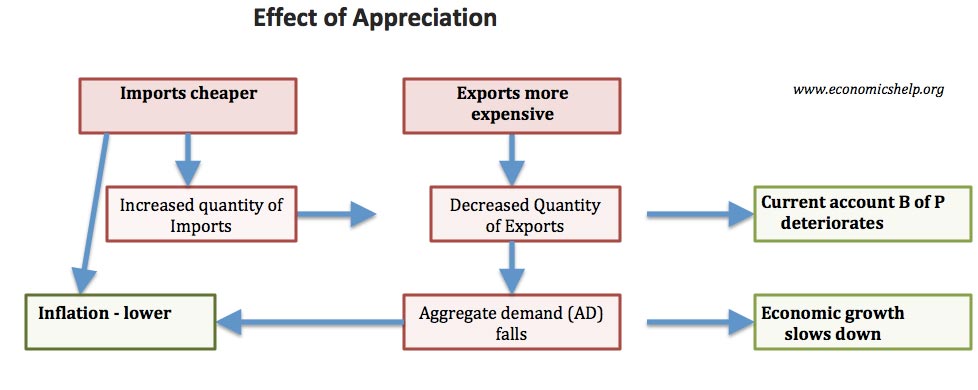

If a currency appreciates, then it can lead to a fall in domestic demand. Exports are less competitive, imports are cheaper. For an economy which is already growing slowly, a strong currency will worsen this economic slowdown.

A strong currency can also cause a deterioration in the current account

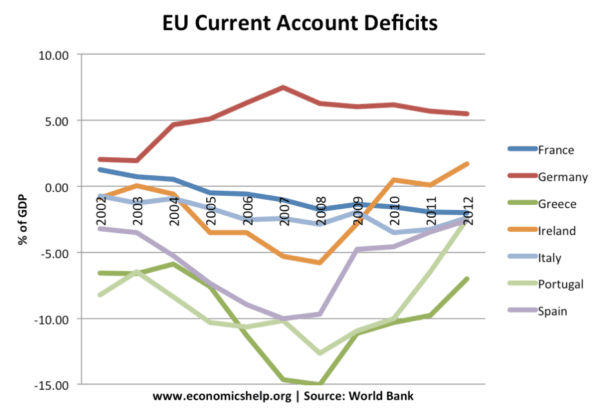

From 2002 to 2012, some members of the Euro found that they became very uncompetitive in the Euro. The currency was too strong for the relative price of their exports. Because they couldn’t allow the currency to depreciate, it led to a serious deterioration in their current account. With Portugal, Spain and Greece all experiencing record levels of a current account deficit.

It depends on why a currency is strong

- If it is strong because of strong economic fundamentals (e.g. rising productivity, strong growth) the economy will be able to absorb the relative loss in competitiveness from a strong currency.

- If a currency appreciates because of speculation (e.g. markets deciding one country like Switzerland has the best chance of strong currency). Then the currency may become much stronger than economic fundamentals suggest. Therefore, the currency becomes overvalued compared to relative purchasing power. In the case of Switzerland, the currencies strength was being driven by investors seeking a safe haven from worries over US and EU economies. The appreciation of the exchange rate was creating a fundamental over-valuation of Swiss exports. This was leading to a fall in domestic demand. The currency appreciation was so fast, it wasn’t possible for a successful diversification. I believe Switzerland did the right thing in limiting the appreciation. If they had allowed foreign currency traders to continue to pile into the Swiss Franc, the value of the Franc would have become divorced from economic fundamentals, and they would have seen a recession.

It depends on when a currency is strong

- If you have an economic boom (high growth, inflation) an appreciation can be beneficial. The appreciation in the currency leads to a reduction in inflationary pressure, but high growth is maintained.

- If you have a recession, a strong currency can make the recession deeper. In a recession, a strong currency will lead to a further fall in domestic demand. This is particularly a problem for a country in the Eurozone. For example, the value of the Euro is far too high for a country like Greece. Greece is fundamentally uncompetitive; this is reflected in a current account deficit of over 10% of GDP. But, in the Euro, Greece can’t pursue expansionary fiscal or monetary policy. Therefore, the strong currency contributes to a fall in economic growth and deflation.

Example – Strong Currency in 1992

In 1992, the UK exchange rate was over-valued. The Pound was kept in the ERM by increasing interest rates and reducing domestic demand. This led to the recession of 1991/92.

When the Pound left the ERM, interest rates fell and the economy recovered. See more at: ERM crisis 1992

Thank you for the nice economics education. Very appreciated and nicely

done. You might want to tidy up a couple of typos however. ( one is Franc vs France).

IMHO the question and answer format is one of the best for learning

Best wishes with your work, Cyborg, USA.

thanks Cyborg. I updated 2 typos too. !

Thanks for this.

I’m trying to figure-out why, in the US, i keep hearing that with a stronger currency, inflation WILL increase.

Also, i have read that the US has been “printing money” for many years now(maybe since ’71, when the gov left gold backed money), and that this will absolutely be paid back with bigtime inflation. BUT, the inflation sensitive longterm US treasury bonds are at a whopping 20% increase in some funds i see online.

i’m trying to figure that out.

Can you help?

arto