One thing I really struggle to understand at the moment is why any country would want to join the Euro.

The experience of the past few years is that membership of the Euro can devastate your economy. Given a chance, half of the members of the Euro would wish they had never joined. Greece, Spain, Italy, Portugal, Ireland would all be better off outside the Euro. But, leaving is even more difficult. Membership of the Euro is like a trap which dooms your economy to inflexible exchange rates and can create a very strong deflationary tendency. The result is mass unemployment, political instability, and a feeling of being squeezed and ordered around by EU (German) officials. I fail to see how an Economic system which creates recession and unemployment can help in any way improve European unity. It is the deflationary impact of the Euro that is threatening to create splits within Europe.

The problem is that many feel that ‘This Time it can be different’. They think that as long as they reduce their budget deficits and don’t be as wasteful as the Greeks everything will be fine. But, the problems of the Euro have always been much more than just excess government borrowing. If it was about Government borrowing – how did Spain end up in so much difficulty when it only had low government borrowing (government debt 30% of GDP OECD) on the eve of the crisis?

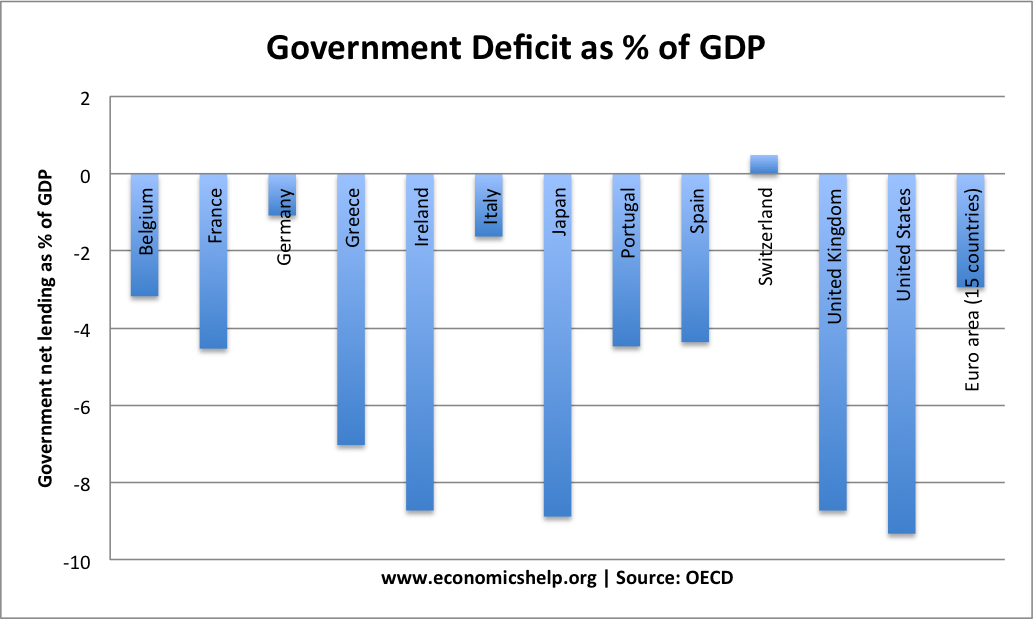

Budget Deficits 2012

Source: OECD Budget deficit 2012. Spot the Countries at risk of default.

Highest budget deficits – UK, US and Japan have high budget deficits – but their bond yields have fallen to record levels.

Problems New Countries Will Face in the Euro

It is possible that new countries may meet the criteria (Maastricht criteria) for joining the Euro

- Low government deficit

- Low government total debt

- Low inflation, close to Euro average

- Low interest rates, close to ECB rates

However, at some time, they are likely to experience some kind of divergence from the Eurozone core.

1. Decline in competitiveness. Countries have a tendency to have different productivity and growth rates. See: EU Competitiveness. There could easily be some kind of supply shock that makes their exports more expensive. But, in the Euro, they will not be able to devalue. Because they can’t devalue or pursue an independent monetary policy, they have to rely on internal devaluation. This means wage restraint, spending cuts and low economic growth as firms seek to regain competitiveness through lower prices. Internal devaluation may eventually work – but why experience another four years of high unemployment? If you look at countries who have the ability to devalue, it tends to be quicker and a less painful process of readjustment.

2. Rising Bond Yields. Countries in the Euro have been much more susceptible to rising bond yields. Rising bond yields:

- Increase the cost of debt interest, leaving less to repay the actual debt.

- Increases pressure for austerity measures at the wrong time (i.e. spending cuts in a recession)

3. Asymmetric Shock. A country could easily experience an asymmetric shock. Arguably, the UK was hit hardest by the global credit crunch because of our reliance on the financial sector. This made the UK recession deeper than the rest of Europe, but at least we had an independent monetary policy (e.g. quantitative easing) and devaluation to lessen the impact of the recession. Countries wanting to join the Euro could easily experience an asymmetric shock in the future. But, if the Eurozone is growing strongly, will the ECB cut interest rates to help a country like Estonia or Serbia suffering from an asymmetric shock. If the ECB won’t cut interest rates in the middle of a recession, they aren’t going to cut interest rates when Europe is growing strongly.

There are benefits of joining the Euro. – such as lower transaction costs and greater price transparency. But, these benefits are really very minor compared to the awkward situation a single currency can leave you in. Also, once you’ve joined, it’s very difficult to even contemplate leaving.

See: more problems of joining the Euro

Could Not the Eurozone be Reformed?

If there was a real common Eurozone bond, If there was perfect labour and capital mobility between Eastern Europe and the heartland of Europe, the Euro would work better. But, I can’t see either occurring. A common Euro bond would help reduce the tendency for bond yields to rise, but even then an inflexible exchange rate and monetary policy offers potential for a prolonged recession and deflationary pressures.

The Euro was always a project pushed ahead by Euro elites, who summarily dismissed any potential problems. The sad thing is despite the experience of the past few years, some Euro elites still want to join a sinking ship.

Countries Wanting to Join the Euro

Poland, Romania, Estonia, Latvia, Baltic countries like Serbia, (see: EU Enlargement at BBC)

Related