Why have countries in the Eurozone faced greater difficulties in promoting economic recovery?

How does a country with its own currency find greater flexibility in overcoming a recession?

1. Impact of Currency and Bond Yields

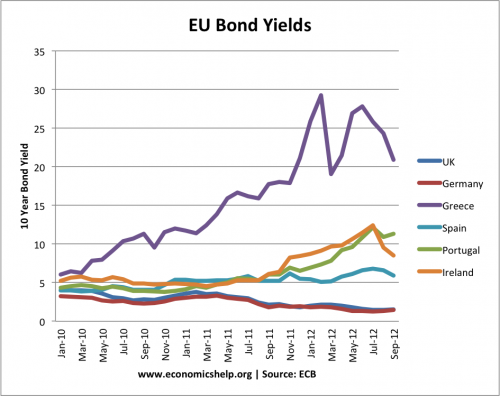

A striking feature of recent years is that countries in the Eurozone have been significantly more susceptible to rising bond yields. By comparison, the UK and US who have their own currency, have seen falling bond yields, despite high budget deficits.

Firstly, if you have your own currency, your Central Bank has the ability to print money and buy government bonds if necessary. Therefore bond markets know that a country like the UK is unlikely to have a liquidity crisis. I.e. if not enough people buy bonds on one occasion, the Central Bank can step in and buy the necessary bonds. This creates certainty and removes fears over a temporary liquidity crisis. (it doesn’t solve a solvency issue but, apart from Greece, most Eurozone economies are not insolvent)

However, countries in the Eurozone don’t have this luxury. There is no Central Bank willing to step in and buy bonds (at least not without very protected wrangles and uncertainty)

Therefore, countries like Ireland, Italy and Spain have found it more difficult to attract investors, because of worries over liquidity fears – and these fears have become self-fulfilling. For example, because investors fear liquidity shortages, buyers have avoided Spanish bonds. This pushed up bonds, scaring away more investors. This has created adverse confidence in buying Eurozone bonds.

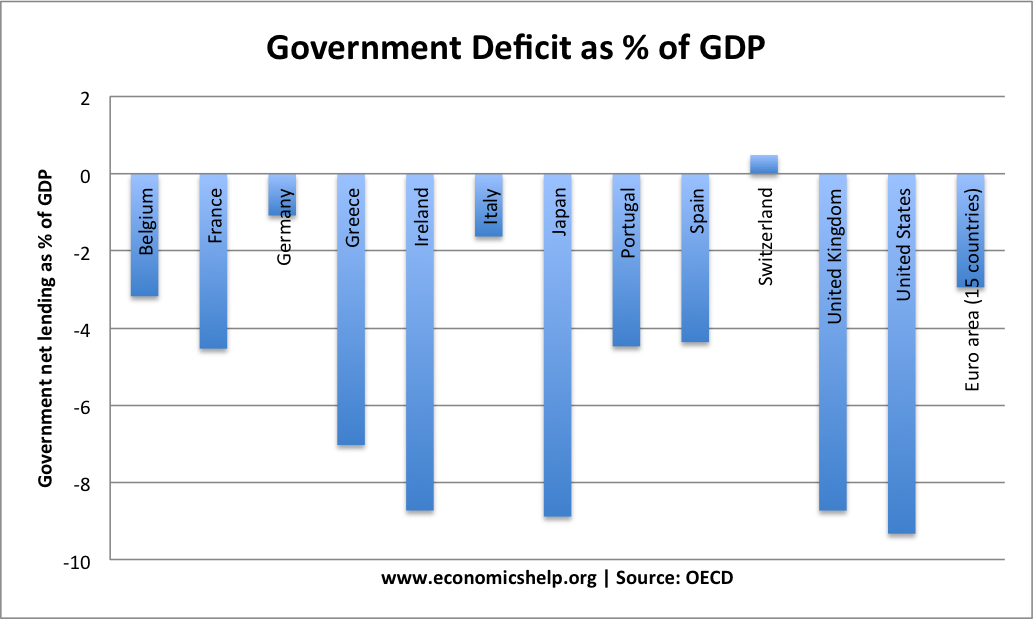

Budget deficits 2012.

UK, US and Japan have three of the highest deficits, but with their own currency have very low bond yields.

If you compare levels of Spanish debt and UK debt, the UK has much higher debt, but much lower bond yields. (See: link between debt and bond yields)

Deflationary fiscal policy

As a consequence of higher bond yields, Eurozone economies have been ‘forced’ ‘pushed’ ‘encouraged’ to pursue deflationary fiscal policy (cutting spending to reduced deficits). Yet, given they are in a deep recession with falling private sector spending, these spending cuts have made the recession even worse. Given their level of unemployment, they need expansionary fiscal policy. But, being in the Eurozone, has encouraged them to pursue austerity measures. This has been exacerbated by the mistaken belief that spending cuts would ‘restore confidence’ see: Confidence fairy explained.

Furthermore, this negative economic growth has also been a factor in pushing up bond yields. Falling GDP increases the debt to GDP ratio. Without economic growth, it becomes much harder to reduce spiralling debt levels.

Impact of Devaluation

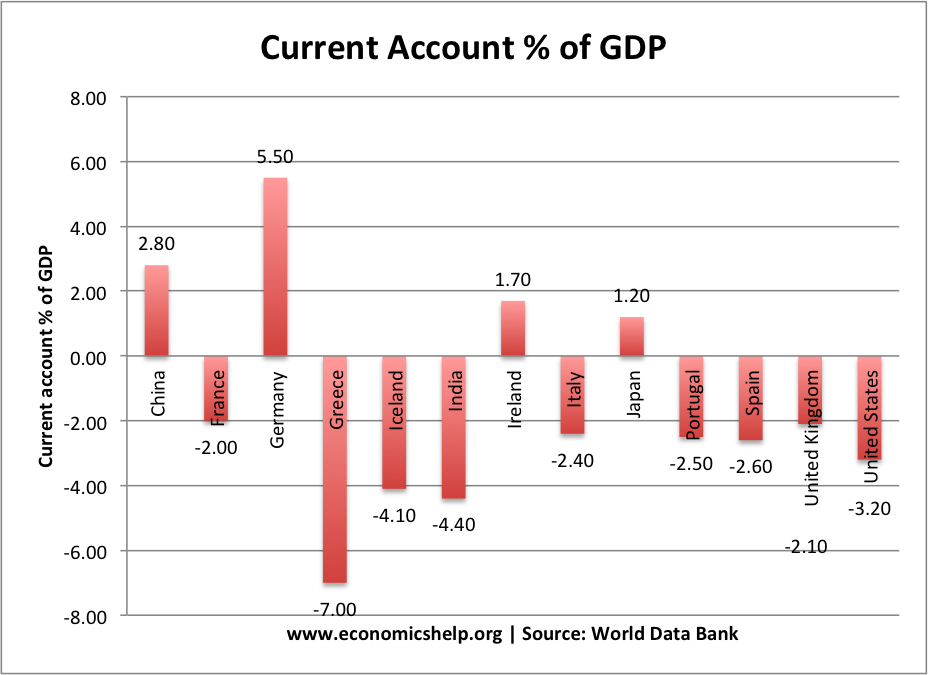

A second feature of having your own currency is that you can devalue (depreciate) if you are uncompetitive. In 2008/09, the Pound depreciated in response to the deterioration in the economic climate. This depreciation helps give a boost to domestic demand. (exports more competitive, imports more expensive). An overvalued currency limits export growth.

Countries in the Eurozone, such as Portugal, Greece and Spain have experienced large current account deficits – suggesting their currency is overvalued. Yet, they can’t benefit from the same temporary boost from a devaluation. They have had to pursue internal devaluation – which is much slower in restoring competitiveness.

Some debate the extent to which southern European exchange rates are overvalued. Some also question how much boost to aggregate demand there would be from a depreciation. But, countries which have devalued have benefited from stronger growth.

To summarise countries with their own currency and independent monetary policy can:

- Devalue if necessary to restore lost competitiveness providing a boost to domestic demand through higher exports.

- Their central bank can reassure markets over liquidity shortages. This leads to lower bond yields and less pressure to pursue undesirable austerity measures in a recession.

- They can pursue a more independent monetary policy. Increasing money supply and targeting higher nominal inflation, if necessary. Expansionary monetary policy also makes it easier to pursue expansionary fiscal policy.

Evidence

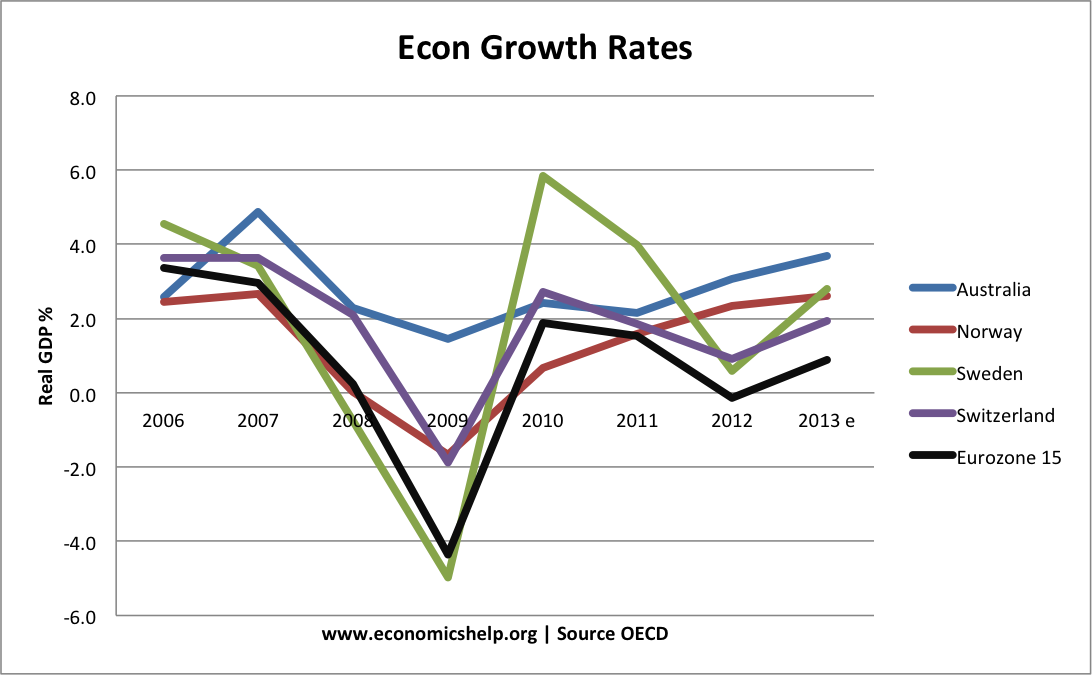

The worst performing economies in 2012 have been those countries in southern Europe, who are members of the Euro, but struggling with an overvalued exchange rate and rising bond yields.

www.economicshelp.org | Source: OECD Quarterly national accounts

Related

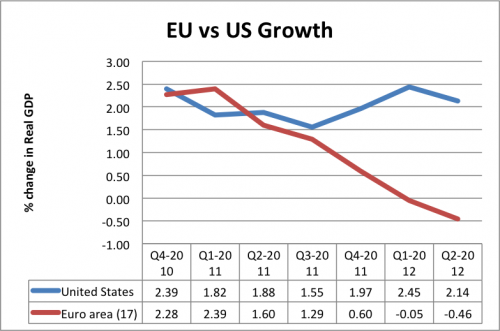

By comparison to the EU, the US has recovered relatively well.

Related

- Problems of the Euro – another way of looking at this issue is just seeing all the problems of the Euro.