Readers Question: how to revise for a possible exam question like: discuss the likely effectiveness of ‘expansionary fiscal and monetary policies as means of closing the output gap’

Firstly write down the question on a blank piece of paper. Then try and revise in three parts.

Part One – Knowledge define terms

- Expansionary fiscal policy – an attempt by the government to increase AD, through increasing government spending and cutting tax, (leading to bigger budget deficit)

- Expansionary monetary policy – When the Central Bank cuts interest rates or increases money supply, through a policy like quantitative easing.

- Output gap. This is the difference between potential output and actual output. A negative output gap means that current real GDP is less than potential and therefore there is spare capacity / unemployment.

Part Two – Explain effect of fiscal and monetary policy on output gap

Expansionary monetary policy could involve cutting interest rates. If the Bank of England cut interest rates, this should stimulate aggregate demand. Firstly, lower interest rates reduce the cost of borrowing and therefore encourage consumers to spend on credit. Lower borrowing costs will also encourage firms to invest because it is cheaper to finance investment. Secondly lower interest rates will reduce the amount householders have to spend on mortgage interest payments and therefore they will have more disposable income; this should increase consumer spending. Overall, with higher C and I, we should see an increase in AD.

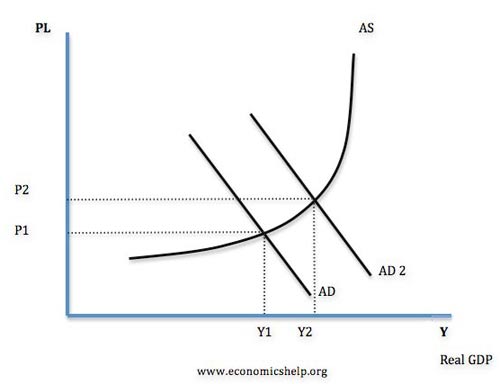

This increase in AD should lead to higher real GDP and reduce the output gap. At Y1, there is a significant negative output gap, Y1 is less than potential AS. Therefore, increasing AD does reduce the output gap.

Expansionary fiscal policy

The government could decide to borrow from the private sector and use this to spend on capital investment, such as building new roads and railways. This increase in government spending will increase AD and have a similar effect in increasing GDP. Alternatively, the government could cut the rate of VAT, this lower tax will give consumers greater spending power and should hopefully increase consumption; this should also increase AD, leading to great real GDP and reduce the output gap. There may also be a multiplier effect with the initial investment causing a bigger final increase in real GDP.

Part Three evaluation

For evaluation we need to discuss

- Will these policies actually be successful?

- What could determine with monetary and fiscal policy actually close the output gap?

- What might different economists say?

Evaluation for macroeconomics could involve several factors, such as:

- Other factors affecting AD

- Time lags

- It depends on the state of the economy

- It depends on side effects of policies implemented.

Using these evaluation points for this question

- Other factors affecting AD. If the Bank of England cut interest rates, we might expect to see higher C and higher AD. However, in the real world, there might be a fall in exports, due to a European recession. Therefore, despite a small rise in domestic consumption because we get a fall in exports, overall AD doesn’t increase. Therefore, in this circumstance, lower interest rates may fail to reduce the output gap.

- Time Lags. If the Central Bank cut base rates, it might take considerable time to actually affect firms and households. If the Central Bank cut base rates, commercial banks may not pass this base rate cut onto consumers because they are short of liquidity. Homeowners with a fixed rate mortgage will also not see any difference. Their mortgage payments will be unaffected until they remortgage in 2-3 years. Therefore, cutting interest rates may take quite a long time to boost AD. Therefore, in the short term we may see no reduction in the output gap.

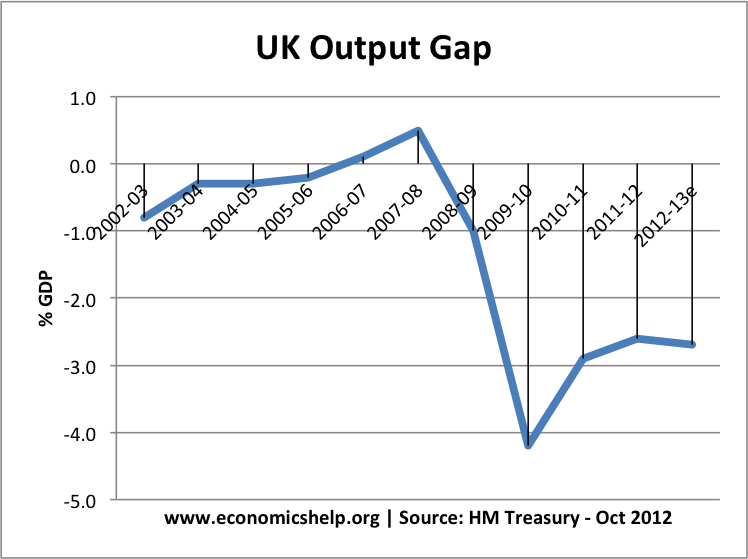

- It depends on the state of the economy. If confidence is low then tax cuts or interest rate cuts may not affect demand. For example, a cut in VAT may give consumers more disposable income, but if they are pessimistic about the future, they may just save the extra money and not spend. In 2008, the interest rate cut was largely ineffective because banks were short of money and so didn’t want to lend. Therefore, even though official interest rates fell – we didn’t see an increase in lending and investment. The base rate cut failed to reduce the output gap.

- It depends on side effects of policies implemented. A side effect of expansionary fiscal policy will be an increase in government borrowing. It is possible that higher government borrowing may cause problems, such as rising bond yields and these higher bond yields make investors reluctant to lend to the government. In the case of several European countries in the Euro, bond yields did rise in 2010 /11 and they felt they couldn’t pursue expansionary fiscal policy to reduce the output gap.

Conclusion

In theory, expansionary fiscal and monetary policy should be able to reduce the output gap. if combined together, we would expect to see higher consumption and higher investment, leading to increased AD. However, the effectiveness of fiscal and monetary policy does depend on several factors. For example, from 2008, traditional monetary policy was ineffective in closing the output gap. Banks didn’t pass on lower interest rates. Due to large losses, banks were reluctant to lend and firms couldn’t borrow, even though base rates were low. However, if policymakers had been more determined to close the output gap then they maybe we would have greater success. If monetary policy is insufficient, then using expansionary fiscal policy would have injected more spending into the economy and the higher aggregate demand. With a large output gap, savings rise and so there is usually strong demand to buy government bonds. In the case of the UK, we could borrow at low long term interest rates and use these inactive resources and stimulate economic activity.

The revision is to test whether

1. You know the terms

2. You know how to explain and draw correct diagrams

3. You know a few potential evaluation points

4. Practise brining all these together, making sure you answer the question.

Related

- More exam tips for approaching questions at Exam / Study tips