A summary for understanding exchange rates. Factors that affect exchange rates and the impact of exchange rates on the economy.

Terminology

- Depreciation/devaluation – fall in value of exchange rate – exchange rate becomes weaker (see also: definition of devaluation and depreciation)

- Appreciation – increase in the value of exchange rate – exchange rate becomes stronger.

Example of Pound Sterling depreciating against the Dollar

- £1 used to equal $2.

- Now £1 is only equal to $1.75

Video on Exchange rates

What is the effect of a depreciation in the value of the Pound?

- Buying goods from America becomes more expensive.

- If a meal cost $10, it used to require £5 (10/2) for a British tourist.

- But, now after the depreciation, the $10 meal will cost £5.71 (10/1.75)

- The depreciation in the pound may discourage British tourists to travel to the US.

- It makes US imports into the UK more expensive, so it may reduce UK imports

- UK exports will become relatively more competitive. It is cheaper for Americans to buy UK goods, so the quantity of exports should increase.

- UK inflation will increase. Imported goods are more expensive (cost push inflation). Also, British goods are more attractive causing a rise in demand (demand pull inflation)

Summary of depreciation

- A depreciation in exchange rate makes exports more competitive and imports more expensive

- A depreciation helps UK exporters and improves UK growth prospects, but causes higher prices and inflation.

Effects of appreciation

The effects of an appreciation in Sterling will lead to the opposite.

- A higher value of sterling makes US imports cheaper for British consumers, but, UK exports become more expensive.

- An appreciation in the exchange rate will tend to reduce aggregate demand (assuming demand is relatively elastic) Because exports will fall and imports increase.

- An appreciation is likely to worsen the current account (assuming Marshall Lerner condition and demand is relatively elastic)

An appreciation is likely to reduce inflation because:

- Import prices are lower

- Fall in aggregate demand

- Firms have more incentives to cut costs.

Is it good or bad to have a devaluation in the exchange rate?

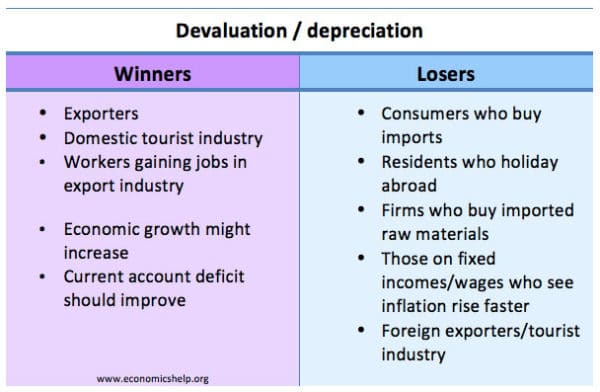

A falling exchange rate can be beneficial if the economy is uncompetitive and stuck in a recession. A devaluation helps to increased demand for exports and create jobs. In a recession, inflation is unlikely to be a problem. However, in a boom, a devaluation could lead to inflation. Also, a devaluation does reduce living standards as imports become more expensive.

An appreciation in the exchange rate is beneficial if it is caused by the economy becoming more productive and competitive. However, if there is an appreciation due to speculation, then it could be harmful as exporters will not be able to compete. E.g. The Swiss intervened to prevent the Swiss France becoming too strong in recent Euro crisis.

See more detail on the effect of exchange rates on business

Factors influencing exchange rates

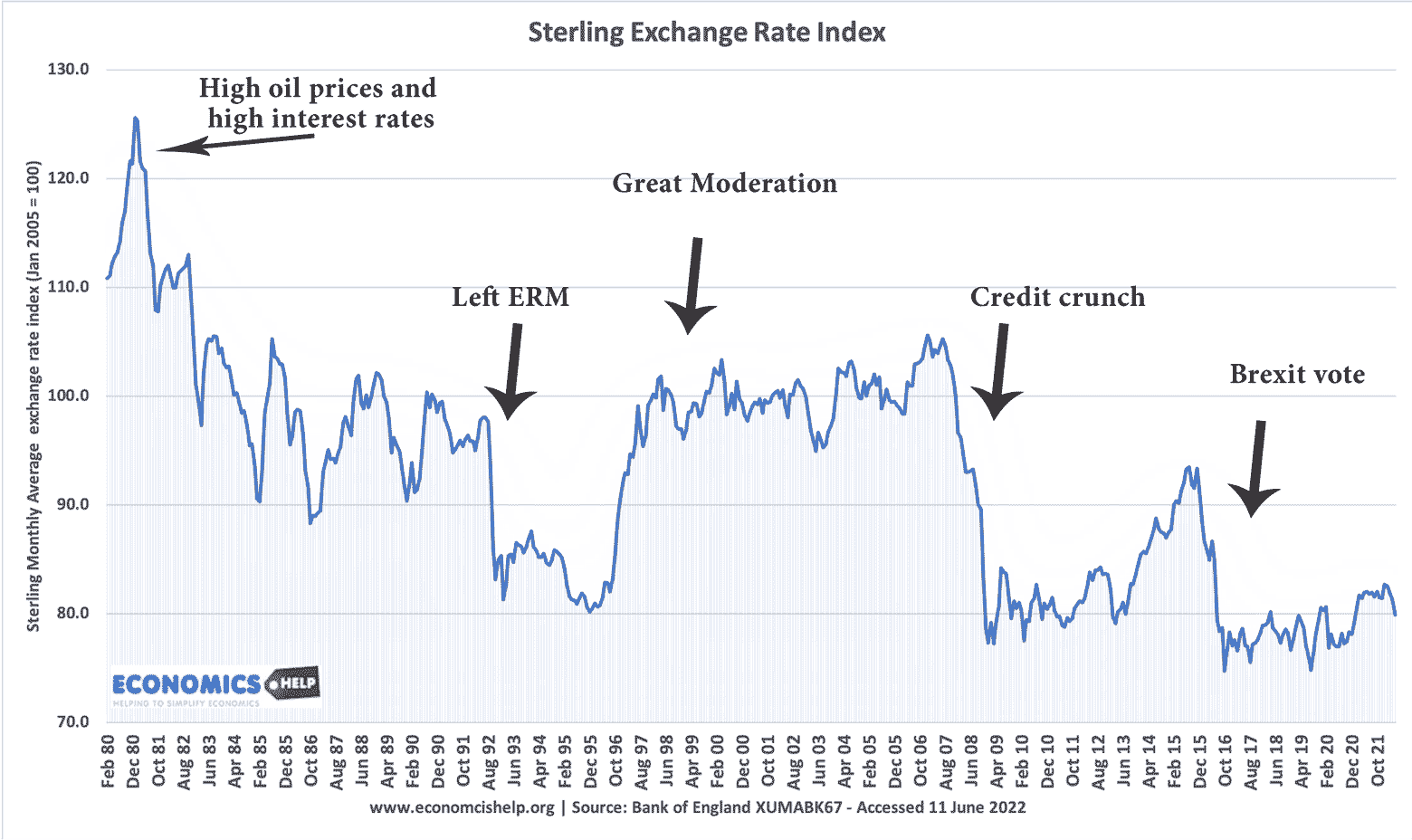

In 2007-08, there was a substantial fall in the value of the £, due to the financial crisis and cut in UK interest rates.

An exchange rate is determined by the supply and demand for the currency. If there was greater demand for Pound Sterling, it would cause the value to increase. Example: An appreciation in the exchange rate could occur if the UK has:

- Higher interest rates. Higher interest rates make it more attractive to save in the UK, therefore more investors will switch to British banks. Therefore the value of the pound will increase.

- Lower inflation. If British goods become more competitive, there will be greater demand causing the value to increase.

- Current account surplus. A current account surplus means the value of exports (of goods and services) is greater than imports. This demand for UK goods tends to cause a stronger exchange rate.

See also: Factors influencing exchange rates

Floating Exchange Rates

A floating exchange rate occurs when the government doesn’t intervene but allows the value of the currency to be determined by market forces.

Fixed Exchange Rate

This occurs when the government intervenes to try and keep the value of the currency at a certain level against other currencies. For example, in 1990, the UK joined the Exchange Rate Mechanism where the value of the Pound was supposed to keep within a certain target band against D-Mark.

The UK was later forced out of the ERM – see: Exchange Rate Mechanism Crisis

Currency Manipulation

Some countries are not part of an official exchange rate mechanism, but they may still to try influence their currency. For example, China has sought to keep the value of their currency undervalued by buying US assets. The motive for keeping exchange rate undervalued is that exports become more competitive leading to higher growth. Some argue this intervention is a form of ‘unfair competition’ and it can be termed currency manipulation

Single Currency

The Euro is a bold attempt to replace individual currencies with a single currency. The idea is to eliminate exchange rate fluctuations. However, the Euro has run into several problems. In particular, uncompetitive countries are no longer able to devalue to restore competitiveness. See: Problems of Euro

Related

How to overcome from challenges trade with European union ?

very detailed explanation about trading rate