A summary for understanding exchange rates. Factors that affect exchange rates and the impact of exchange rates on the economy.

Terminology

- Depreciation/devaluation – fall in value of exchange rate – exchange rate becomes weaker (see also: definition of devaluation and depreciation)

- Appreciation – increase in the value of exchange rate – exchange rate becomes stronger.

Example of Pound Sterling depreciating against the Dollar

- £1 used to equal $2.

- Now £1 is only equal to $1.75

Video on Exchange rates

What is the effect of a depreciation in the value of the Pound?

- Buying goods from America becomes more expensive.

- If a meal cost $10, it used to require £5 (10/2) for a British tourist.

- But, now after the depreciation, the $10 meal will cost £5.71 (10/1.75)

- The depreciation in the pound may discourage British tourists to travel to the US.

- It makes US imports into the UK more expensive, so it may reduce UK imports

- UK exports will become relatively more competitive. It is cheaper for Americans to buy UK goods, so the quantity of exports should increase.

- UK inflation will increase. Imported goods are more expensive (cost push inflation). Also, British goods are more attractive causing a rise in demand (demand pull inflation)

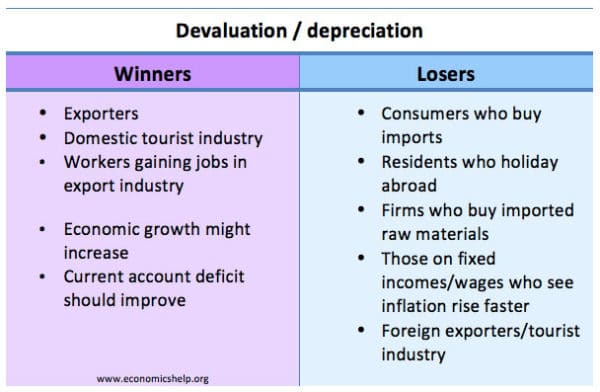

Summary of depreciation

- A depreciation in exchange rate makes exports more competitive and imports more expensive

- A depreciation helps UK exporters and improves UK growth prospects, but causes higher prices and inflation.

Effects of appreciation

The effects of an appreciation in Sterling will lead to the opposite.

- A higher value of sterling makes US imports cheaper for British consumers, but, UK exports become more expensive.

- An appreciation in the exchange rate will tend to reduce aggregate demand (assuming demand is relatively elastic) Because exports will fall and imports increase.

- An appreciation is likely to worsen the current account (assuming Marshall Lerner condition and demand is relatively elastic)

An appreciation is likely to reduce inflation because:

- Import prices are lower

- Fall in aggregate demand

- Firms have more incentives to cut costs.

Is it good or bad to have a devaluation in the exchange rate?

A falling exchange rate can be beneficial if the economy is uncompetitive and stuck in a recession. A devaluation helps to increased demand for exports and create jobs. In a recession, inflation is unlikely to be a problem. However, in a boom, a devaluation could lead to inflation. Also, a devaluation does reduce living standards as imports become more expensive.

An appreciation in the exchange rate is beneficial if it is caused by the economy becoming more productive and competitive. However, if there is an appreciation due to speculation, then it could be harmful as exporters will not be able to compete. E.g. The Swiss intervened to prevent the Swiss France becoming too strong in recent Euro crisis.

See more detail on the effect of exchange rates on business

Factors influencing exchange rates

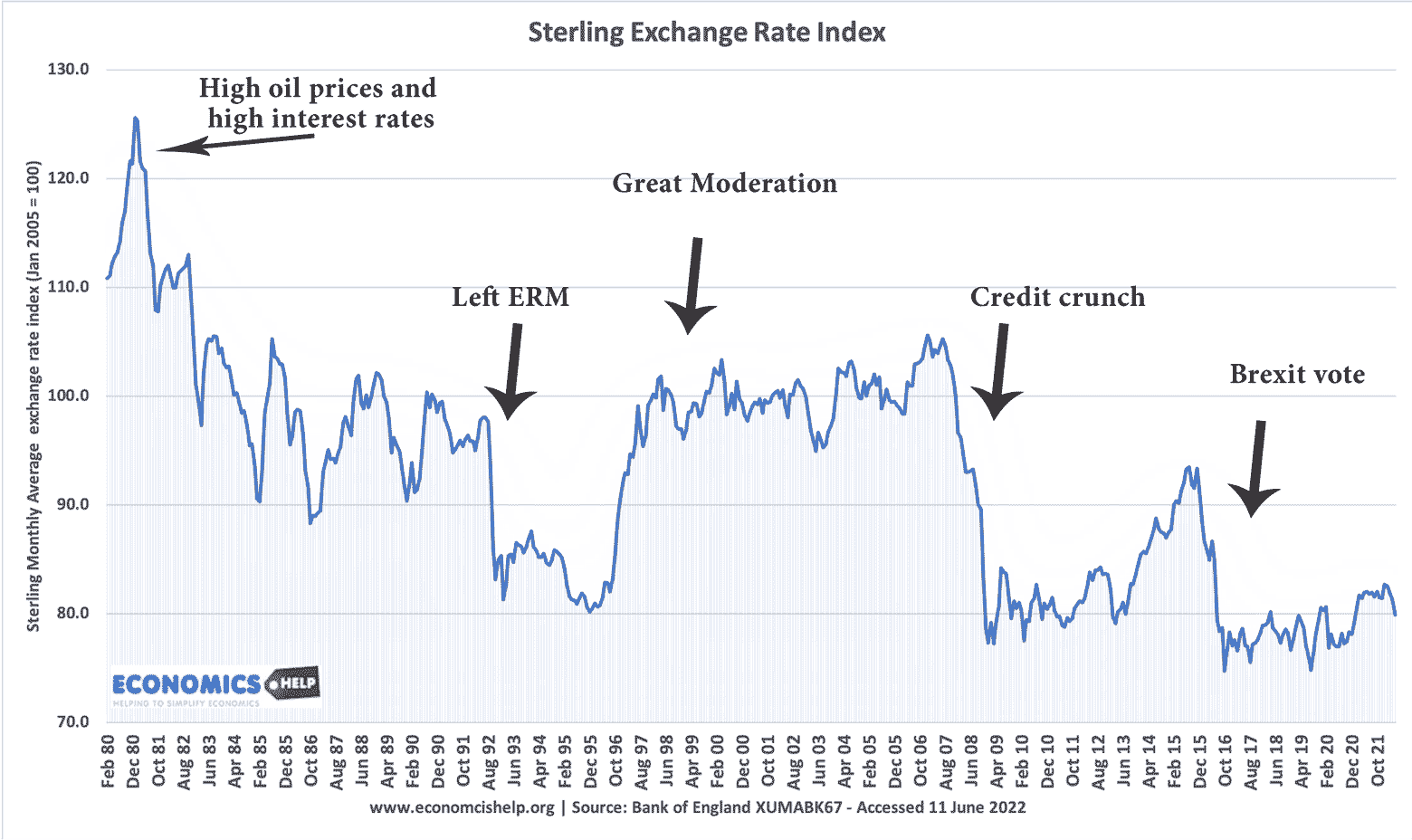

In 2007-08, there was a substantial fall in the value of the £, due to the financial crisis and cut in UK interest rates.

An exchange rate is determined by the supply and demand for the currency. If there was greater demand for Pound Sterling, it would cause the value to increase. Example: An appreciation in the exchange rate could occur if the UK has:

- Higher interest rates. Higher interest rates make it more attractive to save in the UK, therefore more investors will switch to British banks. Therefore the value of the pound will increase.

- Lower inflation. If British goods become more competitive, there will be greater demand causing the value to increase.

- Current account surplus. A current account surplus means the value of exports (of goods and services) is greater than imports. This demand for UK goods tends to cause a stronger exchange rate.

See also: Factors influencing exchange rates

Floating Exchange Rates

A floating exchange rate occurs when the government doesn’t intervene but allows the value of the currency to be determined by market forces.

Fixed Exchange Rate

This occurs when the government intervenes to try and keep the value of the currency at a certain level against other currencies. For example, in 1990, the UK joined the Exchange Rate Mechanism where the value of the Pound was supposed to keep within a certain target band against D-Mark.

The UK was later forced out of the ERM – see: Exchange Rate Mechanism Crisis

Currency Manipulation

Some countries are not part of an official exchange rate mechanism, but they may still to try influence their currency. For example, China has sought to keep the value of their currency undervalued by buying US assets. The motive for keeping exchange rate undervalued is that exports become more competitive leading to higher growth. Some argue this intervention is a form of ‘unfair competition’ and it can be termed currency manipulation

Single Currency

The Euro is a bold attempt to replace individual currencies with a single currency. The idea is to eliminate exchange rate fluctuations. However, the Euro has run into several problems. In particular, uncompetitive countries are no longer able to devalue to restore competitiveness. See: Problems of Euro

Related

Please help. I can not get my brain wrapped around this. I read a higher currency exchange rate is best but I don’t know what “higher” means. Does that mean the Euro is closer to the USD or? I will be getting some Euros before we go to Ireland in May for pitstops, taxis, etc. Thank you.

Hello, I’m not an expert maybe I can help. I have a little understanding of it. I just looked and the current exchange rate is in technical terms 1 US Doller per 0.81 Euros. I mean it goes both ways that’s why it can be confusing. If you had only 1 euro and exhanged it for American currency you would get more than 1 american dollar. Probably around $1.15. I assume you’re exchanging US dollars for Euros; in that case, if you wanted to exchange say $100 usd you would get 81 euros. I don’t know what prices are like there but keep this in mind.

Say the exchange rate goes up before your trip faster than the price of the meals at the local restaurant in Ireland, if you exchanged your dollars at a higher exchange rate, your money would probably go further.

If I’m way off somebody correct me but I’m okay at math.

What will happen if the end/dollar exchange rate is above the equilibrium exchange rate? Will it have a shortage of dollar and exchange rate will fall or rise?

Hello, I am working on the project “the impacts of exchange rate on the economic growth of Ghana.” I don’t know how to go about it, any help?

if even i get a sample work i believe it will be of a great help.

That is really interesting that if British goods become more competitive then the value will increase. That sounds like something that we could also use in America as well. The whole world should learn about their exchange rates to help bring a better value to their economy.

Hey, what does ‘surplus’ mean, please can u reply by email?

Hi everyone! Please I need definitions of food inflation by IMF,FAO and world bank please

I am still stuck. Am I thinking if the pound is strong and I wanted US Australian /New Zealand dollars. Does this mean I get more New Zealand dollars for my pound than I would if the pound was weak

Yes. That is correct. When the Pound is strong, you will effectively be able to buy more goods in US, NZ and AU.

sir Iam Rudrappa K M karnataka India

What are the benifits of trade between India and European Union ?