In the late nineteenth century, firms with great monopoly power were the US railroads and oil companies. These days we have a new set of monopolies, companies like Google, Amazon. For example, Amazon has over 30% of the online retail of books and DVDs. Also, a firm with a monopoly selling power like Amazon can often create monopsony buying power. If you are an author, there are only a limited number of firms who will take your e-book and sell it for you. Given the little choice of firms to retail your product, puts authors and publishers in a weak position, meaning Amazon can dictate the amount they pay to authors – especially small independent authors.

Amazon market share of books in US

If you want to sell e-books, Amazon is a dominant firm. In 2012 in the US, Amazon has 27% of the market share for selling book units (traditional and e-books). (book publisher).

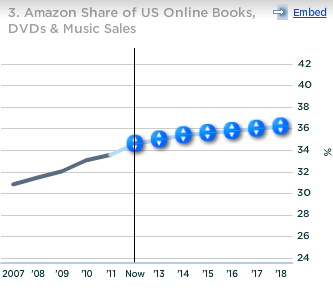

Share of online books, DVDs & music

For online sales, Amazon’s position is greater. With online sales, rising to 36% of the market.

Market Share of e-Book sales

For sales of e-books, Amazon’s share of the market is 60% in 2012 – (down from 90% in 2007). (link) Apple has 10%, and Barnes & Nobel 25%.