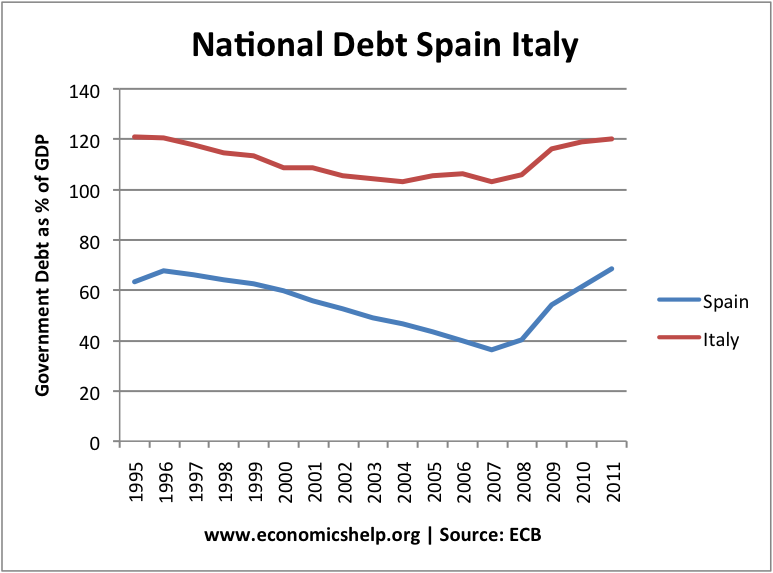

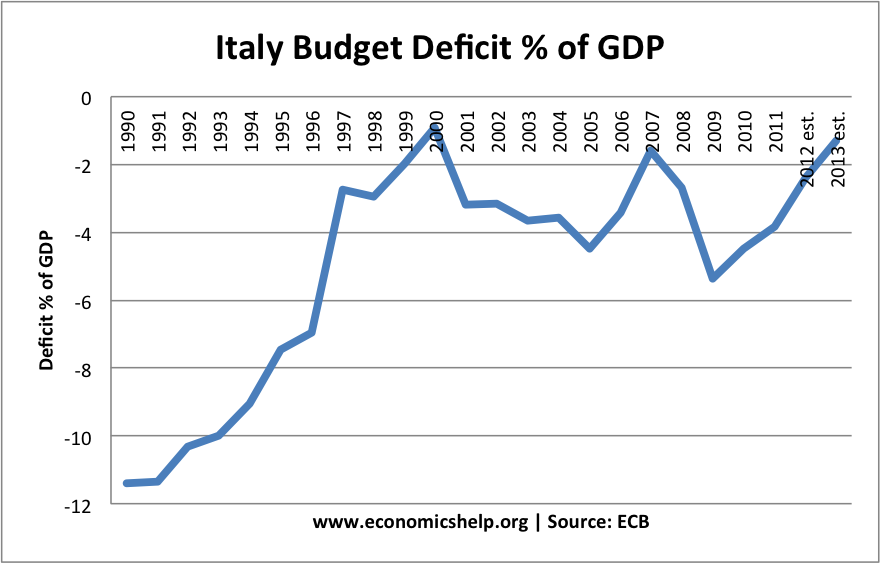

In the past 20 years, the Italian economy has stagnated compared to its main international competitors. Using different measures, such as labour productivity and relative GDP growth – Italy has fallen significantly behind. Despite low budget deficits (and primary surpluses) Italy is facing high bond yields and crippling interest payments. These high bond yields are in response to both the high levels of debt – but also the continued economic weakness.

Italian Productivity

Italian productivity relative to the UK. In the 1990s and 2000s, Italian output per workers has fallen behind it’s main competitors. It’s a similar story if we compare Italian productivity to France or Germany.