- Negative externalities occur when the consumption or production of a good causes a harmful effect to a third party.

Examples of negative externalities

- Loud music. If you play loud music at night, your neighbour may not be able to sleep.

- Pollution. If you produce chemicals and cause pollution as a side effect, then local fishermen will not be able to catch fish. This loss of income will be the negative externality.

- Congestion. If you drive a car, it creates air pollution and contributes to congestion. These are both external costs imposed on other people who live in the city.

- Building a new road. If you build a new road, the external cost is the loss of a beautiful landscape which people can no longer enjoy.

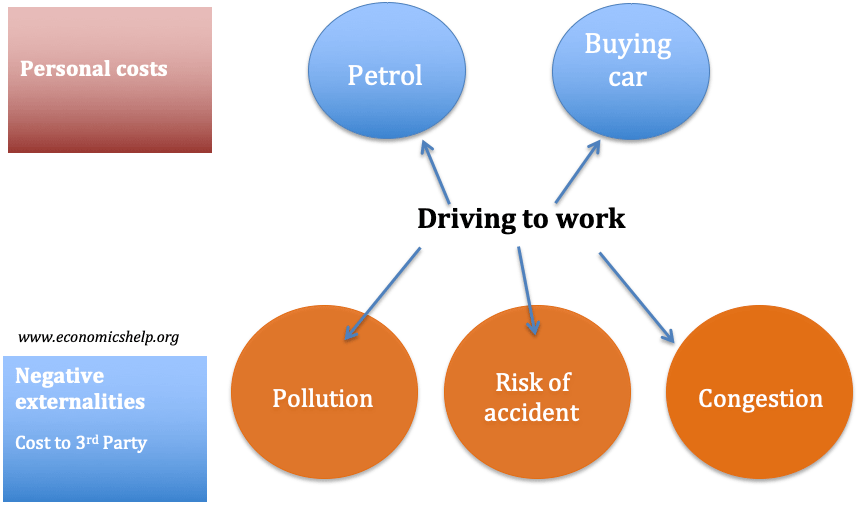

The externalities of driving a car to work

- The personal cost of driving are buying car, petrol, your time

- The negative externalities are – pollution to other people, possible accident to other other people, and time other people sit in traffic jams

Social cost

- Social cost is the total cost to society; it includes both private and external costs.

- With a negative externality the Social Cost > Private Cost

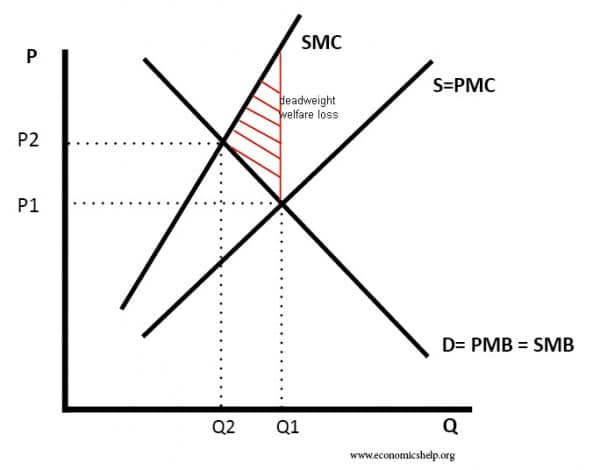

Negative production externality

- When producing a good causes a harmful effect to a third party. Therefore the social cost is greater than the private cost.

Examples of negative production externalities

- Burning coal for energy creates pollution.

- Producing conventional vegetables with pesticides causes carcinogens to get into the environment.

- Producing beef in South America involves cutting down Amazon rainforest, which has an impact on global climate and local environment

- Because of the external costs the social marginal cost is greater than the private marginal cost.

- In a free market, producers ignore the external costs to others. Therefore output will be at Q1 (where Demand = Supply).

- This is socially inefficient because at Q1 – SMC> SMB

- Social efficiency occurs at Q2 where Social marginal cost = Social marginal benefit

The red triangle is the area of deadweight welfare loss. It indicates the area of overconsumption (where SMC is greater than PMC)

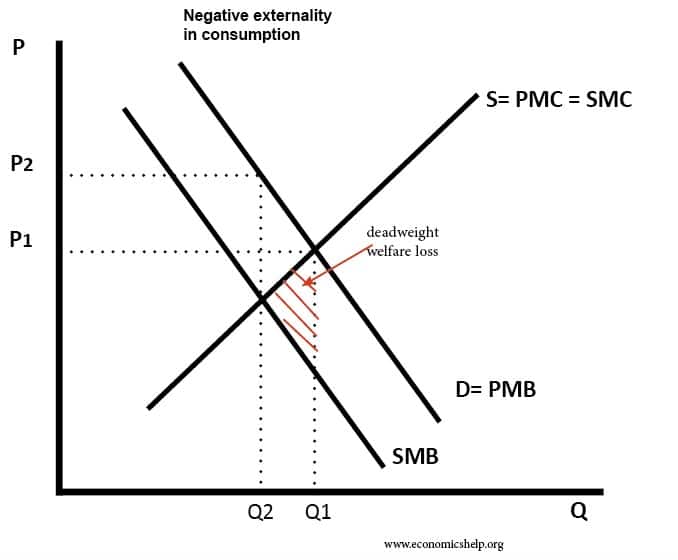

Negative externality of consumption

This occurs when consuming a good causes a harmful effect to a third party. In this case, the social benefit is less than the private benefit.

Examples of negative externalities of consumption

- Consuming alcohol leads to an increase in drunkenness, increased risk of car accidents and social disorder.

- Consuming loud music late at night keeps your neighbours awake.

- Consuming cigarettes causes passive smoking to others in the vacinity.

Diagram of negative externality in consumption

- In a free market, we get Q1 output. But at this output, the social marginal cost is greater than the social marginal benefit.

- The red triangle is the area of dead-weight welfare loss.

- Social efficiency occurs at a lower output (Q2) – where social marginal benefit = social marginal cost.

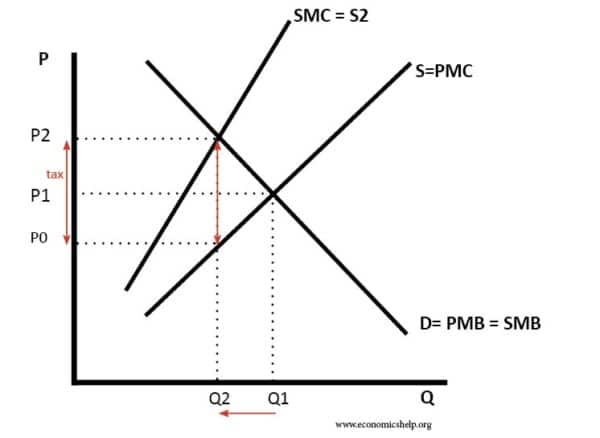

Implications of negative externalities

If goods or services have negative externalities, then we will get market failure. This is because individuals fail to take into account the costs to other people.

To achieve a more socially efficient outcome, the government could try to tax the good with negative externalities. This means that consumers pay close to the full social cost.

See: Tax on negative externalities

Economists on negative externalities

Arthur Pigou 1920 introduced the concept of externalities in The Economics of Welfare. Pigou used the example of alcohol having external costs, such as creating more demand for police and health care.

In 1975 William Baumol and W. Oates provided a comprehensive review of the literature on externalities in Theory of Environmental Policy. In particular, they applied economic concepts of externalities to the emerging issue of environmental costs. For example, in 1975, they mentioned some of the environmental costs which were considered to be pressing.

a. Disposal of toxic wastes,

b. Sulfur dioxide, particulates, and other contaminants of the atmosphere,

c. Various degradable and nondegradable wastes that pollute the world’s waterways,

d. Pesticides, which, through various routes, become imbedded in food products,

e. Deterioration of neighborhoods into slums,

f. Congestion along urban highways, g. High noise levels in metropolitan areas

Related

Last updated: 10th July 2019, Tejvan Pettinger, www.economicshelp.org, Oxford, UK