A trade war involves the imposition of tariffs between trading partners. This will almost certainly cause a fall in economic welfare for all the countries who experience higher tariffs and a fall in trade. However, this fall in economic welfare is not the same as a recession (a fall in GDP).

In some circumstances, a trade war can be the external shock which leads to a fall in aggregate demand and recession, but the link is not guaranteed.

In the past, (notably them1930s) recessions have led to a trade war. This is due to countries responding to falling demand by trying to protect domestic industries. This protectionism has been blamed for exacerbating the existing recession. See Great Depression.

Costs of a trade war

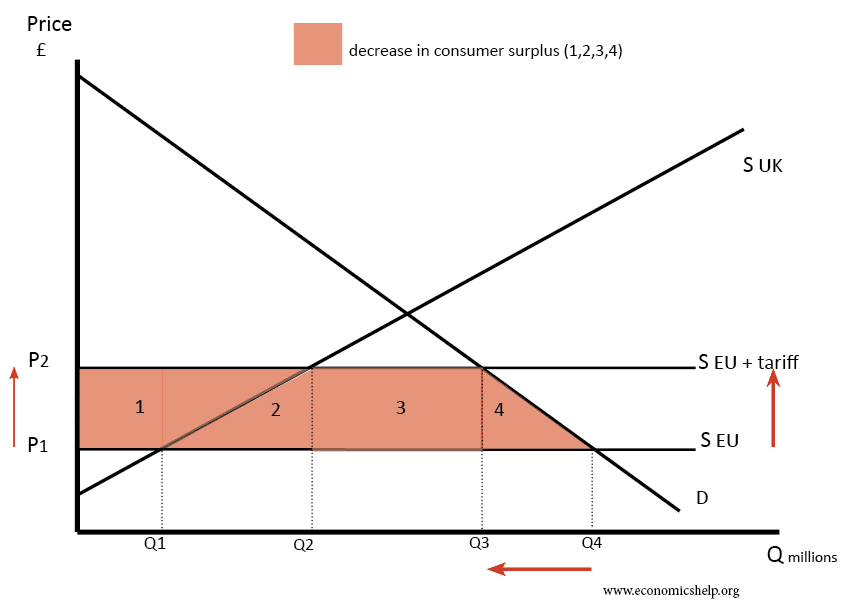

Higher tariffs will lead to a fall in imports and a shift to domestic production. However, if tariffs are reciprocal, a country will also see a fall in exports. To put in context.

- The US imposed tariffs on the import of steel. In the US, this will lead to a shift in demand. US consumers will buy fewer imports but shift demand for US producers.

- However, US consumers will face higher prices. As a result, there will be lower consumer demand for other products. This effect is less visible, but there will be lower growth in domestic sales.

- Furthermore, US firms producing goods will face higher costs and as a result, will see a fall in demand.

- Also, as a result of US tariffs, other countries retaliate, with the EU placing tariffs on goods like Harley Davies motorbikes. Therefore, some US exporters will see a fall in demand.

A trade war causes a shift in demand within the economy. There are winners and losers. There is an expected net welfare loss, but on its own, the fall in aggregate demand is relatively small.

Paul Krugman gives a hypothetical cost of a trade war.

Now, the U.S. currently spends 15 percent of GDP on imports. Suppose we end up with a trade-war tariff of 40 percent, and (as I’ve been suggesting) a 70 percent decline in trade. Then the welfare loss is 20% * 0.7*15, or 2.1% of GDP. (Thinking about a trade war)

Furthermore, if there is a fall in aggregate demand, then, in theory, there can be a loosening of monetary policy to offset the fall in demand. With trade war gaining more traction, the Fed are likely to raise interest rates at a slower pace.

However, there are still reasons to be concerned that a trade war can cause a recession.

Effects of a trade war

Confidence effects. With business uncertain how trade war will escalate, investment will be curtailed and this can lead to an actual fall in demand.

According to Robert Shiller a trade war could cause a recession. “It’s exactly those ‘wait and see’ attitudes that cause a recession,” (Trade war will trigger recession)

Negative multiplier effects. From the initial fall in investment, we can see knock on effects, with lower employment levels and workers spending less causing further falls in aggregate demand.

Disruption effects. The model of welfare loss assumes that business can make a seamless transition from imports to more costly domestic production, but in practice, shifting output is time-consuming. This is particularly true in modern economies with inter-connected supply chains. There is no such thing as US car producer or EU car producers, supply chains are deeply interconnected and set up to benefit from economies of scale. US Tariffs on steel impact US car producers who import raw materials.

Alex Tabarrok makes a similar point in ‘Effects of a trade war in a supply chain world.‘ June 25, 2018

Could a trade war be the Tipping point for pushing economy into recession?

A big question is whether the economy is vulnerable to small demand side shock. Although the net effect on aggregate demand is insufficient to cause a recession on its own. If it combines with other factors, then it will cause a recession.

For example, there are concerns in 2018, the Chinese economy is facing the prospect of a slowdown. There has been a crackdown on ‘shadow banking’ which has led to less investment. The trade war also caused a depreciation in the Yuan. Now a small depreciation can make Chinese exports more competitive and this should help. But, if demand is inelastic, there will be little benefit. But more problematically, a rapid depreciation raises the price of imported raw materials and starts to affect confidence.

German economy. The German economy is more reliant on exports than say UK or US and this makes German economy more vulnerable to a trade war. The problem is that the retail side of the German economy is doing poorly in 2018. German retail sales declined by 2.1 per cent month-on-month in May 2018. If exports also start to slide due to a trade war, the economy is vulnerable to a general slow down.

US economy. The US economy is doing relatively well, with low unemployment and buoyant growth. But, like many economies, real wage growth has been low and interest rates have failed to return to normal levels. With rising oil prices, the economy has potential vulnerabilities.

Related