Readers Question: Why does the government borrow?

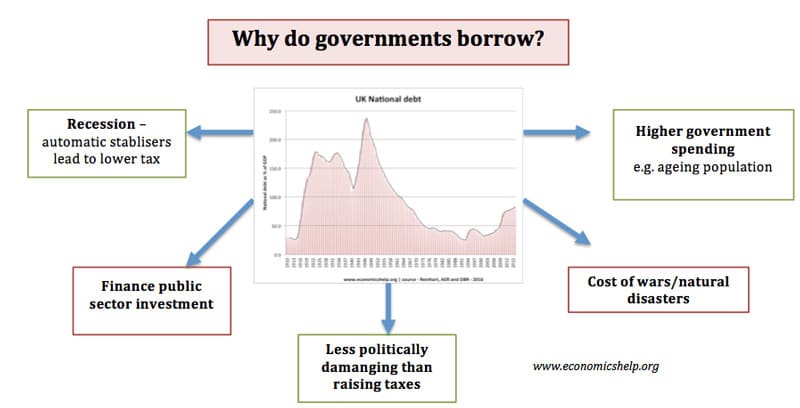

Essentially, the government borrows so that it can enable higher spending without having to increase taxes.

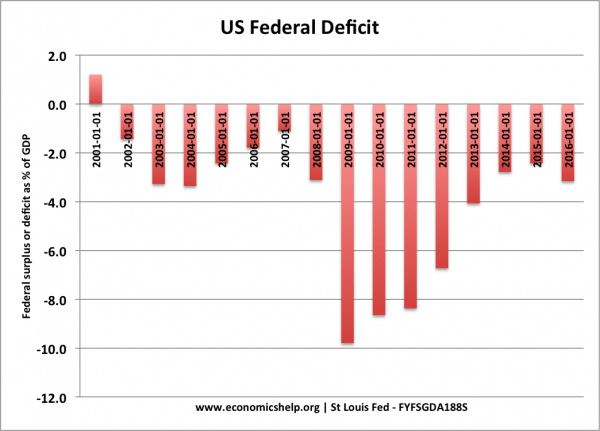

- The annual amount the government borrows is known as the budget deficit.

- The total amount the government has borrowed is known as the national debt or public sector debt.

There are many different reasons for government borrowing.

- Tax revenues are less than predicted. borrowing means the government can meet a temporary shortfall by borrowing, rather than having to immediately cut back on spending. Like an overdraft facility, government borrowing gives the government more flexibility and means they can maintain wages and spending commitments without having to keep cutting spending.

- Automatic fiscal stabilisers. In a recession, government tax revenues fall (e.g. people earn less so pay less income tax). Also, the government have to spend more on unemployment benefits. Therefore, in an economic downturn, borrowing rises. To eliminate borrowing in a recession would make the recession worse and increase inequality. If the government couldn’t borrow in a recession, the unemployed may not get any benefits and have no income. Also, higher taxes and lower spending would reduce domestic demand and make the recession even worse. (automatic fiscal stabilisers)

- Investment. The government may invest in public sector investment. For example, building schools, hospitals, better roads. This investment can give a return on the investment which helps to boost productive capacity and increase economic growth. In this case, the government is acting like a firm who takes out a loan to finance investment.

- Spending commitments. The government is committed to providing certain benefits, such as pensions and health care spending. With an ageing population, this puts upward pressure on government spending to rise; therefore, governments may start to run a structural deficit. See – rising cost of pension spending

- Political. The biggest tendency to borrow comes from political pressures. Voters generally like to hear the promise of lower taxes and increasing spending. A manifesto to tackle a budget deficit (higher taxes and lower spending) is unlikely to be popular. Voters often are supportive of the general idea of reducing government debt, but when it comes to actual policies like lower benefits, higher pension age, increased VAT rate, then it is likely to hit some particular pressure group with a vested interest in maintaining low tax and spending. For a government to increase borrowing is generally less politically damaging than increasing taxes. (though ironically, I feel austerity can be politically popular at all the wrong times)

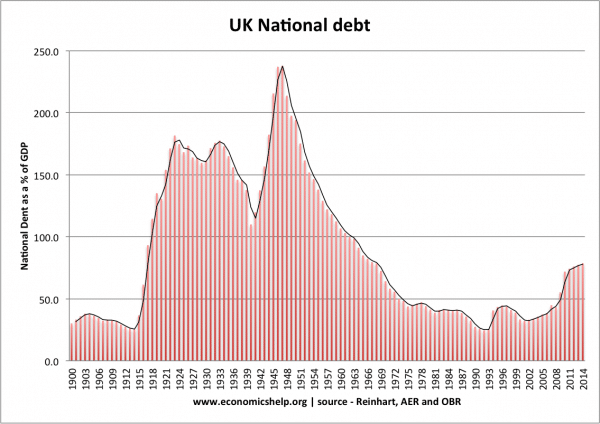

- War. During a war, government spending is stretched leading to higher borrowing. The highest rates of borrowing occurred during the two world wars. Also, during wars, it may be easier to sell bonds as you can play the patriotic card to encourage people to finance government borrowing.

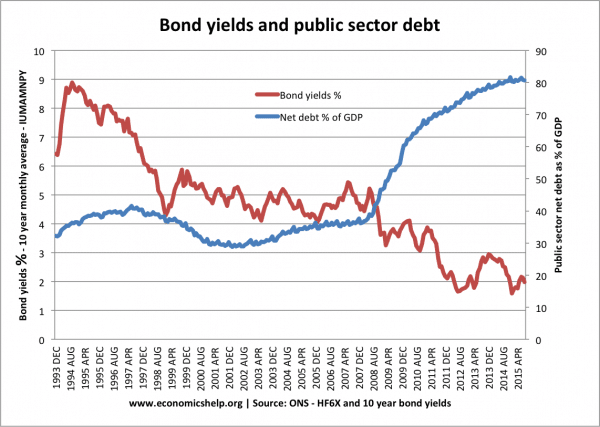

- It’s cheap. Governments like the UK can usually borrow at very low-interest rates, especially during an economic downturn. This is because people have confidence government bonds are secure and so are willing to lend at low-interest rates. When borrowing costs are low, it can be more desirable to borrow than raise taxes.

- Economic growth tends to reduce the real debt burden. In the early 1950s, UK public sector debt was over 200% of GDP. However, over next few decades, economic growth helped to reduce the burden of debt. Assuming constant economic growth of 3% a year, the government can borrow more but maintain the same % of tax revenue on interest payments. See: Debt as % of GDP You could think of a mortgage. People take out a 30-year mortgage to buy a house. Over time, economic growth and inflation, tend to reduce the real burden of mortgage payments.

Keynesian perspective on why governments borrow

Keynes advocated higher government borrowing in a recession. Keynes noted in recession, firms cut back investment and households cut back spending. This causes a rise in private sector saving and a rise in unused resources. In this circumstance, government borrowing will not cause crowding out, but inject money into the circular flow and ‘kickstart’ economic activity. Government borrowing will enable economic recovery and an improvement in tax revenues.

Monetarist/free market perspective on why governments borrow

Monetarists are more critical of government borrowing arguing that government borrowing is often due to political pressures. As Milton Friedman stated “There is nothing so permanent as a temporary government programme” Friedman argued government borrowing arises due to vested political interests which keep governments committed to raising spending on programmes like social security, farm subsidies and healthcare.

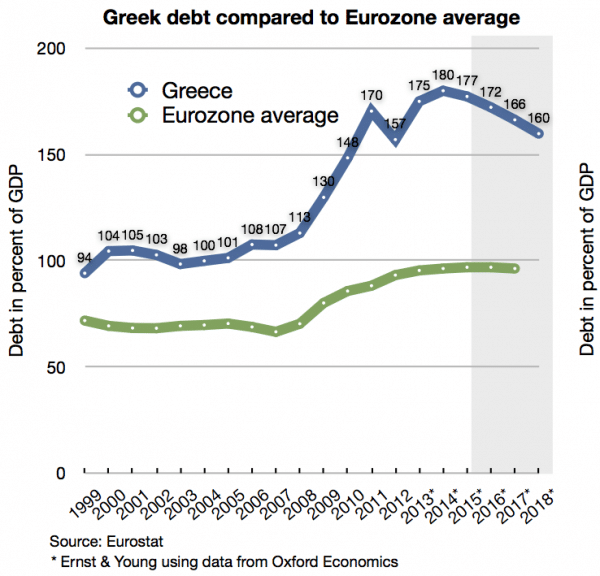

Why has Borrowing increased in Europe?

All European economies have seen a sharp rise in government borrowing since the start of the credit crunch / economic crisis in 2007/08. This is primarily because, with lower economic growth, governments see a sharp fall in tax revenues. Also, they see an increase in automatic stabilizers such as higher welfare benefits. Some countries like Spain and Ireland saw a sharper fall in tax revenues because they collected significant tax revenues from stamp duty and taxes on property. The property collapse led to a particularly sharp fall in tax revenues from this source.

Apart from Greece, and Italy, government debt in the EU was relatively low pre-2007. See graph at EU debt crisis explained.

Can An Economy Function Without Borrowing?

Some economies like Saudi Arabia, Qatar, find it so easy to gain tax revenues from oil, that they don’t need to resort to borrowing. There is no reason economies have to borrow. But, it is not really a priority to have zero government debt.

Can An Economy Function without Borrowing in a Recession?

Attempts to reduce government borrowing in a recession, almost inevitably make the recession worse. In 1931, Treasury official put pressure on the government to reduce government borrowing (through higher taxes and lower unemployment benefits). This further reduces aggregate demand and makes the recession worse. By reducing spending and output, it ironically makes it more difficult to balance a budget.

Is Borrowing Good or Bad?

It depends what a government is borrowing for. It depends where in the economic cycle is borrowing. It depends on the cost of servicing borrowing. Do markets fear the government will default?

Related

Why does the government borrow when it could get the Bank of England to create the money?

Why is it a good idea for banks to be allowed to create money when loans are taken out instead of allowing the government to create money?

Presumably one answer is that the government can’t be trusted to devalue the currency, but what other reasons are there?

In 2009, the government did partly finance borrowing by Bank of England’s Quantitative easing. In normal circumstance, the Bank of England could print money to financed the debt, but this would cause inflation and discourage investors from buying government bonds in the future.

Economic growth tends to reduce the real debt burden. In the early 1950s, UK public sector debt was over 200% of GDP. However, over next few decades, economic growth helped to reduce the burden of debt. Assuming constant economic growth of 3% a year, the government can borrow more but maintain the same % of tax revenue on interest payments. See: Debt as % of GDP You could think of a mortgage. People take out a 30-year mortgage to buy a house. Over time, economic growth and inflation, tend to reduce the real burden of mortgage payments.

Since printing of more money leads to inflation… yet for some countries budgets(developing countries) always hv a deficit budget and revenues are always less than expenditures… the government is likely to switch to borrowing to cover the deficit

I challenge you to prove that “printing more money leads to inflation….” You can’t do it.

This is what happens when you print more money because of national debt. Germany 1922

By fall 1922, Germany found itself unable to make reparations payments.[16] The mark was by now practically worthless, making it impossible for Germany to buy foreign exchange or gold using paper marks. Instead, reparations were to be paid in goods such as coal. In January 1923, French and Belgian troops occupied the industrial region of Germany in the Ruhr valley to ensure reparations payments. Inflation was exacerbated when workers in the Ruhr went on a general strike and the German government printed more money to continue paying for their passive resistance.[17] By November 1923, the US dollar was worth 4,210,500,000,000 German marks.[18

printing more money leads to inflation because more of it will sacculate in the economy,,, reducing its value resulting to inflation since people hold huge amount of money without value.

Didnot the govt also borrow for balancing current account deficit?

What about borrowing for unfavourable balance of trade? Is this inclusive

Why economically strained countries experience difficulties in borrowing outside money needed for economic recovery?

why do governments borrow money from foreign countries when they can through the central bank print more money to fund thier projects

What is the cause?, Developing Countries have a higher interest payment on Money Borrowed as compared to Developed Countries.