In recent years, the level of pension spending in the UK has increased significantly in both real terms and as a share of GDP. Demographic trends suggest there will be a continued increase in the old age dependency ratio, and further rises in pension spending, at a time, when budget constraints limit spending in other government departments.

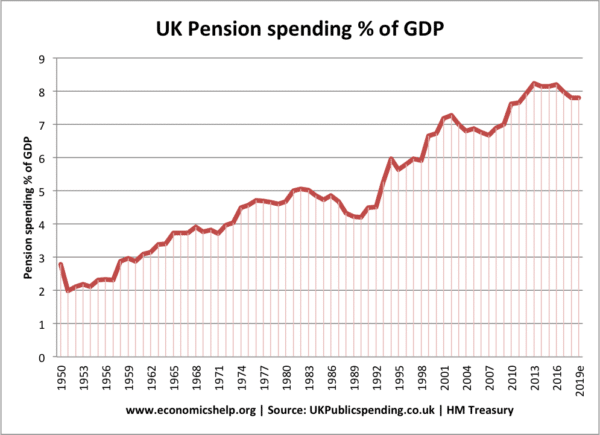

In the post-war period we have seen a rise in pension spending as a % of GDP from 2% in 1950 to over 8% in 2017.

Forecasts from the ONS suggest that – even with increased retirement ages – this spending will rise to £491bn (9.4% of GDP) by 2062/63.

In many respects, a rising share of spending on pensions is an indicator of rising living standards and in particular – higher life expectancy. Now people are able to enjoy a longer retirement than in previous decades. We may not have Keynes’ predicted 15 hour week, but many who retire at 65 can expect a further 21 years of life, with access to full state pension.

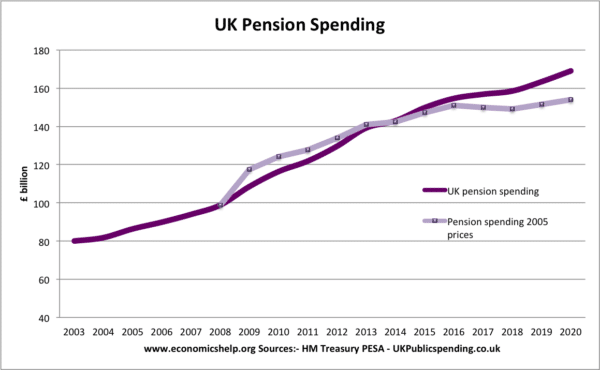

Nominal and real pension spending

In 2003, pension spending accounted for £80 billion. By 2020, that is forecast to rise to £169bn.

Even adjusted for inflation, there has been a 45% increase in real pension spending between 2008 and 2020. A large increase given, it has been a period of austerity for other government departments.

Problems of rising burden of pension spending

- In addition to rising pension spending, there are additional costs associated with rising life expectancy, such as social care, housing benefit, disability living allowance and health care spending.

- Crowds out spending on other public services, such as health, education and capital investment.

- Concerns over contribution to national debt. A higher pension burden may require government spending cuts elsewhere. Governments borrowing to pay pension commitments is a different kind of borrowing to borrowing in recession or borrowing to fund capital investment.

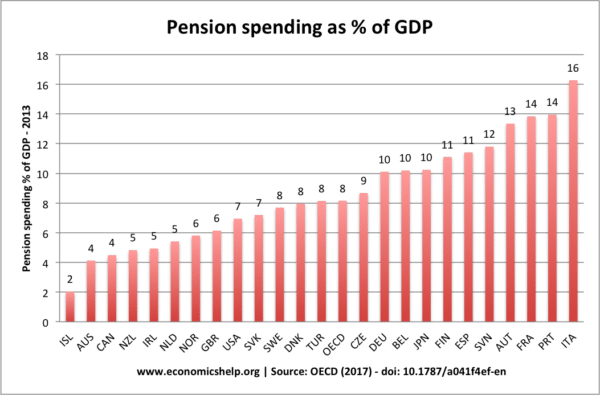

Global Pension spending as % of GDP

Source: OECD (2017) Pension Spending

Pension spending as % of GDP around the world.

Iceland lowest spending 2% of GDP. Italy 16% of GDP. UK in middle at around 6.9%.

External links

- Pension spending at UK public spending

- Public spending at ONS

- HM Treasury PESA (released 21 July annually

Related posts

Could a Universal basic Income, replace Personal Tax allowances, State pensions and unemployment benefit as automatic stabilisers in the UK economy?