After a decade of secular stagnation in the west and ultra-low interest rates – from an economic perspective, the Turkish economy is ‘interesting’ in the sense that it gives a very different set of economic circumstances. An economic boom with parallels and similarities to the 1997-98 Asian Crisis.

Since 2000, the Turkish economy has grown rapidly, helped by foreign direct investment which is attracted by new markets and an economy which is growing faster than the more sclerotic West.

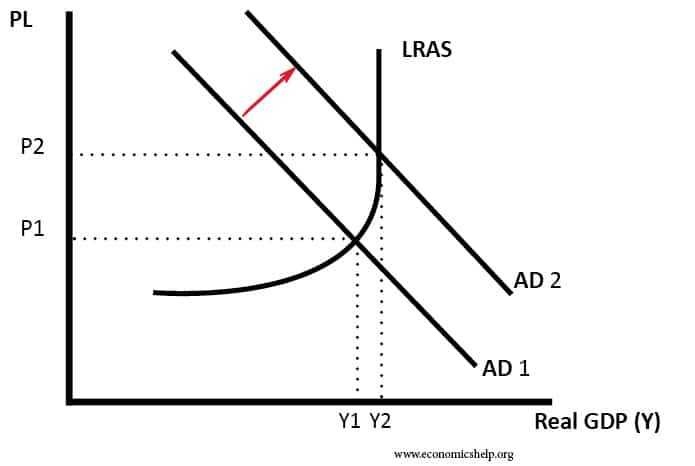

However, rapid economic growth fuelled by low-interest rates invariably has an opportunity cost. If the economy grows too quickly, supply struggles to keep up with demand, and we see rising inflation, a current account deficit and supply constraints.

- Turkish current account deficit was 5.9% in 2017.

- Despite strong growth, Turkish unemployment is still hovering around 10% (2018)

- Economic growth of 7.4% in 2017

High inflation has also put downward pressure on the Turkish currency. If inflation in Turkey is higher than elsewhere, there will be less demand for holding Lira and more demand for holding currencies which have low inflation.

Response to overheating economy

A good A-level student will be able to suggest some basic policies for dealing with an over-heating economy. With double-digit inflation and a falling currency, the traditional response is to raise interest rates. This increases the cost of borrowing and discourages investment/spending. This year, the Turkish Central Bank has increased interest rates to 17.5%, while inflation has increased to 15.9% (June 2018). However, this increase in interest rates has not proved sufficient to restore confidence in the Lira.

Lack of confidence in monetary policy

The response of the Turkish Central Bank has been complicated by the actions of the powerful president Erdogan. He has frequently stated that he dislikes high-interest rates and has put pressure on the Central Bank to keep interest rates lower than they might feel appropriate. Erdogan’s dislike of high-interest rates is due to several factors.

- The moral issue of Islamic banking not charging interest on loans

- Erdogan has claimed high interest rates make “the rich richer and the poor poorer”.

- The economy is reliant on debt-financed investment.

- The government has offered loan guarantees to big business taking out investment. These companies have been strong political supporters of Erdogan.

- High-interest rates risk derailing the strong economic growth which is important for maintaining Erdogan’s popularity. (Interestingly President Trump has also declared himself a ‘low-interest rate guy’)

Erdogan’s power and interference in monetary policy means foreign investors don’t have confidence in Turkey reducing their inflation rate. As a result, the Turkish Lira has fallen as overseas investors look to reduce exposure to the Turkish economy.

The Turkish Lira has fallen 45% against the dollar in the past 12 months.

- This falling exchange rate causes further problems.

- It will cause imported inflation and further upward pressure on inflation.

- The fall in the exchange rate increases the burden of debt denominated in foreign currency like the Euro and dollar. For Turkish business who took out debt in dollar/euros, the real value of debt is increasing and could lead to increased risk of default

To strengthen the Lira, Turkey may need to not only increase interest rates but also reassure markets that the Central Bank has the independence to pursue a low inflationary policy.

For UK tourists dismayed by the weakness of the Pound, at least Turkey is becoming cheaper has a tourist destination.

US sanctions and tariffs

Into this mix, the US and President Trump have been throwing more difficulties into the economic mix. In response to the detention of a US pastor, the US has responded by imposing sanctions on its old ally. The sanctions on their own will only have a very limited effect, but for the US to even consider sanctions on an important NATO ally will further reduce confidence in foreign investment when investors are already looking for reasons to move out.

What happens next?

The problem with having so much foreign debt, is that Turkey remains vulnerable to both higher interest rates and a falling currency. However, whilst the economy overheats, it is impossible to maintain both low interest rates and a strong currency. There are ominous signs that the rapid rate of economic growth could slow down.

Related

the next option is; people sell out their currencies they have to change against lira ,so people must save lira than currencies this will increase the value of lira for short period of time .

“There are omnius signs that the rapid rate of economic growth could slow down.”

I think omnius is a typo.

Yes, thanks Kathy

Thanks for this post! Are you suggesting that the A-level student should recommend raising interest rates in Turkey? Your subsequent paragraphs suggest that this may not be so useful, as does one of your previous posts on the inefficiency of austerity measures (https://www.economicshelp.org/blog/5268/economics/is-austerity-self-defeating/).