Financialisation is a term used to describe the increased role of the financial sector in a modern economy.

Source: NYT 2013

Financialisation also refers to particular trends in the financial sector of the economy.

This includes:

- Increased use of financial intermediaries

- Increased use of futures markets. For example future contracts for bonds, shares, currencies and interest rates)

- An increased importance placed on the financial sector. For the concept of‘shareholder value’ as the primary motivation of companies. This can lead companies to become focused on maximising dividends to please shareholders. This can lead to downward pressure on wages, and a short-termism rather than long-term investment.

- Financialisation can also refer to how profit is made increasingly through financial channels rather than through trade and commodity production.

Problems of financialisation

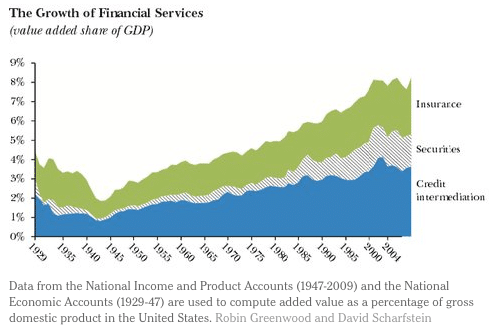

- Increased wealth inequality. In 1978 commercial banks held $1.2 trillion (53% of US GDP) by 2007, commercial banks held $11.8 trillion – 84% of GDP. Wages in the finance sector have risen faster than the non-finance sector.

- Focusing on finance can be at a detriment to investment in real goods and industry.

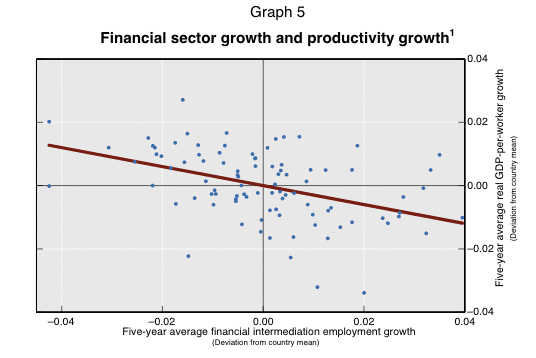

Research by Stephen G Cecchetti and Enisse Kharroubi (2012) suggest after a certain point of economic development – faster growth in finance is bad for aggregate real growth. “One interpretation of this finding is that financial booms are inherently bad for trend growth.” (BIS – working paper 381)

- It has caused wealth to be created through rising asset prices rather than through innovation and increased production. The consequence is that encourages rent seeking – where income and wealth is sought from success in the finance industry. It diverts time and effort away from seeking profit from producing goods and services.

- Short-termism. A focus on returns from finance rather than long-term investment and wider social factors.

- High wages in the finance sector, attract skilled graduates, especially with maths and science degrees – taking these graduates away from jobs in the real economy which are more productive.

- Increased complexity of financial instruments can make even banks struggle to understand what they have. E.g. Collateralised debt obligations actually contained bad mortgage loans, but banks and investors often didn’t realise what they were buying.

- Increased financialisation has encouraged speculation over future asset prices. But, it doesn’t add to the real value of the economy.

- Financial markets can become infected with irrational exuberance. For example, in the lead up to credit crisis 2000-2007, house prices rose above long-term averages, mortgage loans exploded, but the prevailing market sentiment was that ‘this time was different.’

- Financialisation has been accelerated by the process of leverage. In the period 1930s to 1980, bank lending was mainly based on deposits. This kind of banking was safe, if unspectacular. However, with financial deregulation, banks were increasingly creative in borrowing money on money markets, to increase their scope for lending profitable mortgages/credit cards. This enabled banks to increase their profit margin, but they became over-extended, their liquidity was reliant on the ability to borrow money on short-term money markets. In the credit crisis, the liquidity dried up, banks weren’t able to ‘roll-over’ their long-term loans with short-term borrowing and so faced a liquidity (credit) crunch.

- Financialisation increased interdependence between different local markets. A credit crisis in the US, will soon spread and affect other finance markets too.

- Misaligned exchange rates. Financial speculation in certain assets can lead to an appreciation in a currency due to demand for financial assets. However, this can make the export sector less competitive – leading to more resources moving into the finance sector and away from a manufacturing base. The problem is that if there is a correction in the exchange rate and exchange rate falls, it takes time to recreate a more diverse economy based on exports. (This idea has a relationship with the Resource Curse)

Advantages of finance sector

- Growth in service sector reflects increased productivity in manufacturing and agriculture. With greater mechanisation and improved technology, it is inevitable that the service sector increases in importance and the primary/manufacturing sector decline.

- Future contracts for currencies can help insulate exporters from swings in the exchange rate. For example, a rapid appreciation could make exporters unprofitable. A futures contracts can smooth over this unexpected appreciation. This encourages investment by exporting firms.

- Financial sector plays a crucial role in providing loans to business which enable economic expansion.

- Lower transaction costs. Firms and individuals can look around for best loan which suits their needs.

- Financial markets can help individuals to evaluate different types of risk and costs of investmetn.

- Raising investment directly.

- High wages important source of income tax. “The UK’s financial services sector contributed £71.4bn in tax last year, according to a report on behalf of the City of London” (BBC)

- When the finance sector works, it can help distribution of capital and risk across the economy

- Allows foreign flows of capital – Inward investment creates jobs and helps a developing economy to catch up.

- A strong, well functioning banking sector can play an important role in promoting economic prosperity. Firms need banks and financial markets to finance investment. However, it depends how the banking sector is created. Do banks take a short term view or long term view? Is the bank lending sustainable? Are banks taking too much risk by borrowing on money markets to make temporarily more profitable loans?

Related