Definition: Money is an object used as a medium of exchange between two parties. It can have intrinsic value like gold or it can be a universally accepted instrument such as notes and coins printed by a Central Bank.

Early money

These gold coins are an example of money with an intrinsic value. Made out of gold, its value is widely accepted because gold has value in nearly all countries.

Fiat money

Fiat money is money that does not have any intrinsic value but gains its value from being recognised as legal tender by the government (or other central authority)

For example, banknotes do not have any intrinsic value being made out of paper. But, if people have confidence in the banking system, they are willing to accept this fiat money because they know that other people will accept it as payment.

For example, on a British banknote there is a sentence which says I promise to pay the bearer on demand the sum of five pounds. This reflects the beginning of banknotes where the Bank of England issued notes in lieu of gold. People believed the promise the notes could be converted to gold and the currency became widely accepted.

Functions of Money

- Medium of Exchange (can be widely accepted for payment of debt/goods)

- Unit of Account (a measure of the relative worth of goods/debt)

- Store of value (inflation means cash tends to reduce value over a period of time)

- Standard of deferred payment (money is used to pay back debt. Closely related to unit of account.

Alternatives to money

One alternative to money is a barter economy – where people swap eggs for vegetables. Anthropologists argue the evidence for economies based on barter is relatively rare.

Gift economy. In many early societies, there was a culture of doing favours and giving gifts to other people in the community. Social and cultural ties were strong so people would help out others in the community knowing that they would get favours in return.

Money supply

The money supply measures the total amount of money in the economy at a particular time. It includes actual notes and coins and also any deposits which can be quickly converted into cash.

Types of Money

- Narrow Money = cash, notes and coins. This is what springs to mind when people think of money.

- Broad Money = notes and coins + bank + building society deposits. This is often known as paper money because it exists in accounts but banks don’t actually keep the total value of bank deposits as cash (they keep a very small %)

Money supply and inflation

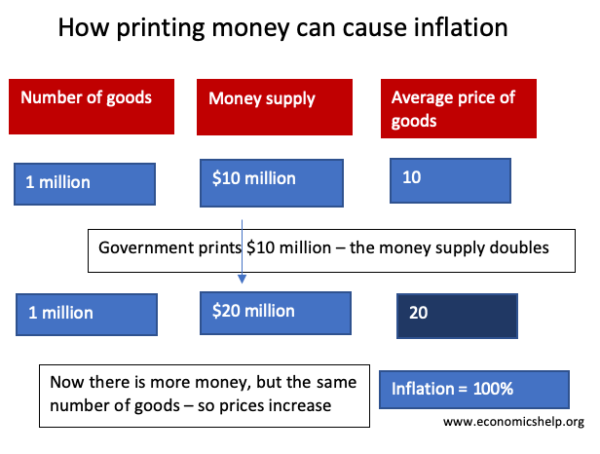

If the supply of money increases faster than the amount of goods and services, then the value of money will tend to decrease. If more money is in circulation, but the same amount of goods, firms will respond by putting up prices.

Printing more money doesn’t change the real value of output in the economy. It will just cause price to go up.

Example of how printing money can cause inflation

See: Link between Money Supply and inflation

The demand for money

The demand for money refers to how much assets individuals wish to hold in the form of money (as opposed to illiquid physical assets.) It is sometimes referred to as liquidity preference. The demand for money is related to income, interest rates and whether people prefer to hold cash(money) or illiquid assets like money. Demand for money

Banks and increasing the supply of money

The money multiplier effect reflects how an increase in deposit at backs may lead to a bigger increase in the money supply.

See: Banks and the supply of money

Is bitcoin money?

Bitcoin is an electronic cryptocurrency where users are willing to accept bitcoin like money. The difference with regular money is that it does not have the backing of a central government or central bank. The value of bitcoin depends on market forces and the willingness to accept payment.

Bitcoin can be used as money in some circumstances but many shops do not accept it. So it is limited in its acceptance.

The ascent of money

I think that Niall Ferguson’s book and series – The Ascent of Money makes a good read and also helps to explain some of the mystifying aspects of money.

More Money Links