Economic growth means an increase in national income/national output. If we have a slower rate of economic growth – living standards will increase at a slower rate.

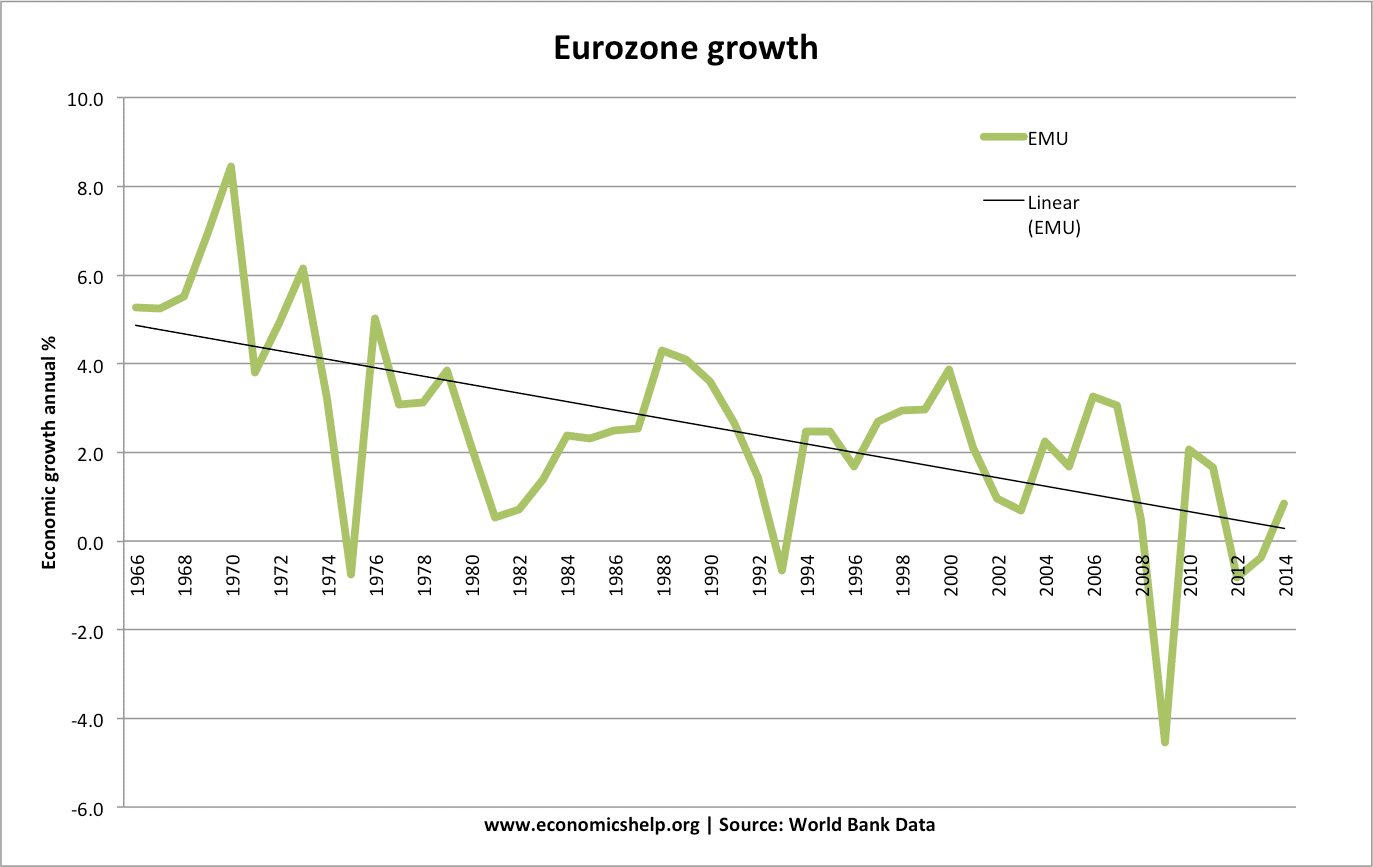

For example, in the post-war period, western economies grew at 2.5% to 4.% per year. However, since the early 2000s, growth rates have slowed down. This process of slower economic growth is sometimes known as ‘secular stagnation.’

The effects of slower economic growth could include:

- Slower increase in living standards – inequality maybecome more noticeable to those on lower incomes.

- Less tax revenue than expected to spend on public services.

- Increased government borrowing – e.g. if demand for medical care and old-age pensions is growing faster than the low rate of economic growth.

- Possible unemployment if growth is insufficient to create new jobs displaced by technology

- Lower inflation rates

- Less strain on environmental resources than expected.

The effect of slower economic growth also depends on what causes slower growth. Slower growth could be two main factors

- Lower productivity growth (supply-side factors)

- Weak aggregate demand (demand-side factors)

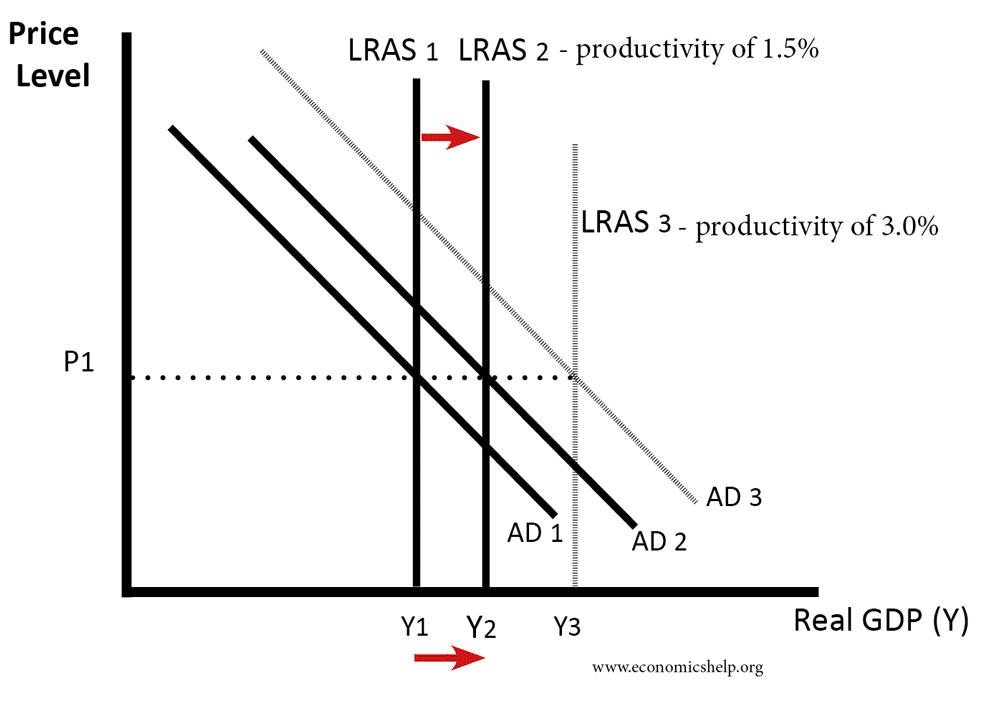

Diagram showing slower economic growth

Slower economic growth due to low productivity growth.

Suppose the economy used to have productivity growth of 3%. Then real GDP increases from Y1 to Y3, and therefore, we get strong economic growth.

However, if productivity only increases by 1.5% a year, then the economy expands only from Y1 to Y2.

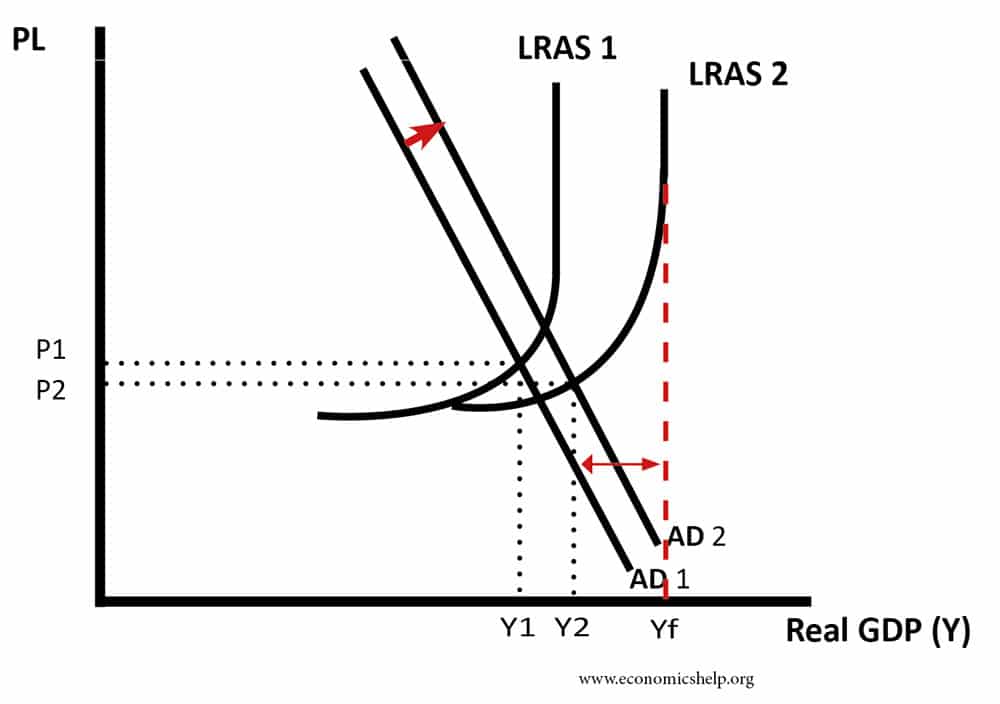

Slower economic growth due to weak aggregate demand

The other main cause of low economic growth is weak aggregate demand. If demand-side factors are weak, then the economy is more likely to experience a negative output gap – real GDP is less than potential GDP.

In this case, there is a small increase in AD but productive capacity increases at a faster rate. This leads to a negative output gap (Y2 is less than Yf)

If slower growth is due to weak aggregate demand (e.g. due to low confidence, high-interest rates, falling house prices) then the low growth rate will give similar effects to a recession. We will tend to see:

A rise in unemployment If productivity is growing at 3% a year, then new technology will enable firms to produce more output with fewer workers. When new technology is increasing labour productivity, it becomes more important for economic growth to create new jobs lost by productivity gains. For example, China has been growing at over 7% a year – due to rapid growth in productivity and improvements in efficiency. The fear is that if Chinese growth slows down below 6% – the economy may start to see rising unemployment as workers made redundant from inefficient state-owned enterprises struggle to gain new employment.

An alternative to rising unemployment is a rise in ‘disguised unemployment‘ This is when workers gain fewer hours than they would like. Rather than full-time work, they only get part-time work. Since 2010, UK unemployment has fallen, but the low rate of economic growth has contributed to more part-time and insecure work.

Effect on living standards. When growth rates are high, it is easier to ensure everybody is becoming better off. Even if there is a rise in inequality, high rates of growth will tend to reduce absolute low income and increase real incomes for everyone. However, if economic growth is very low – it is more likely some may see stagnating incomes or even falling incomes. This has been a feature of growth post-2008 – a stagnation of real incomes, especially for those in low-skilled and flexible job contracts. This decline in real incomes creates dissatisfaction.

Pressure on public services and government borrowing

When the government set spending and tax plans, they budget for an expected rate of growth of say 2.5% or 3%. This enables them to promise real increases in public spending. However, if growth is lower than expected, tax revenues will be disappointing and the government will have to increase borrowing. For example, the 2017 US tax cut was not financed by cutting spending. The government hoped that cutting taxes would lead to higher rates of economic growth. So far growth rates have been lower than predicted – causing a rise in government borrowing – even though the economy is not in a recession.

Benefits of lower rates of economic growth

- Environment. With lower rates of economic growth and lower rate of increasing national output, it will be easier to meet targets for reducing carbon emissions. If growth is very rapid, there is more pressure to produce quick and cheap energy, which may require burning fossil fuels. Lower rates of economic growth give more chance to shift to renewable energy. Lower rates of growth will also slow down the rate of consuming non-renewable resources which may be beneficial for the very long-run.

- Lower inflation. With lower growth rates, there is less inflationary pressures. This means the Central Bank can keep interest rates lower, which is good for borrowers, mortgage holders and the government selling bonds. Low inflation creates the stability which may encourage more investment.

Related