Readers question: what are the advantages and disadvantages of devaluation?

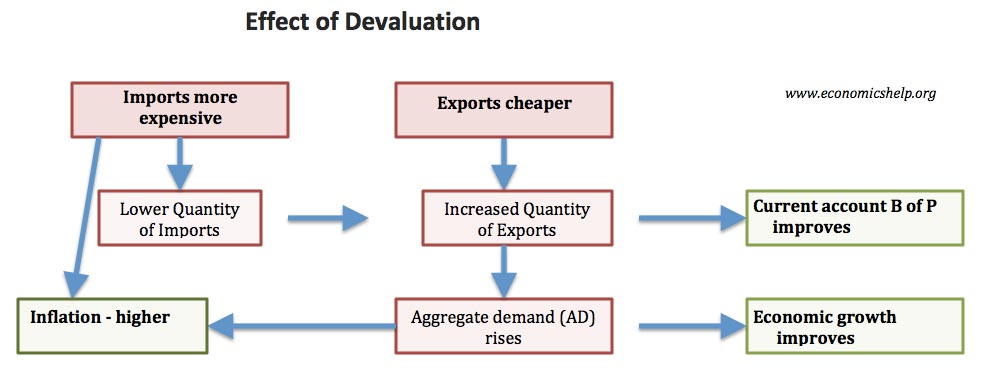

Devaluation is the decision to reduce the value of a currency in a fixed exchange rate. A devaluation means that the value of the currency falls. Domestic residents will find imports and foreign travel more expensive. However domestic exports will benefit from their exports becoming cheaper.

Advantages of devaluation

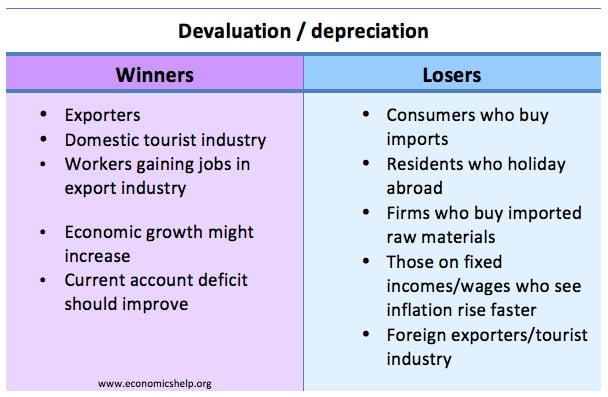

- Exports become cheaper and more competitive to foreign buyers. Therefore, this provides a boost for domestic demand and could lead to job creation in the export sector.

- A higher level of exports should lead to an improvement in the current account deficit. This is important if the country has a large current account deficit due to a lack of competitiveness.

- Higher exports and aggregate demand (AD) can lead to higher rates of economic growth.

- Devaluation is a less damaging way to restore competitiveness than ‘internal devaluation‘. Internal devaluation relies on deflationary policies to reduce prices by reducing aggregate demand. Devaluation can restore competitiveness without reducing aggregate demand.

- With a decision to devalue the currency, the Central Bank can cut interest rates as it no longer needs to ‘prop up’ the currency with high interest rates.

Disadvantages of devaluation

1. Inflation. Devaluation is likely to cause inflation because:

- Imports will be more expensive (any imported good or raw material will increase in price)

- Aggregate Demand (AD) increases – causing demand-pull inflation.

- Firms/exporters have less incentive to cut costs because they can rely on the devaluation to improve competitiveness. The concern is in the long-term devaluation may lead to lower productivity because of the decline in incentives.

2. Reduces the purchasing power of citizens abroad. e.g. it is more expensive to go on holiday abroad.

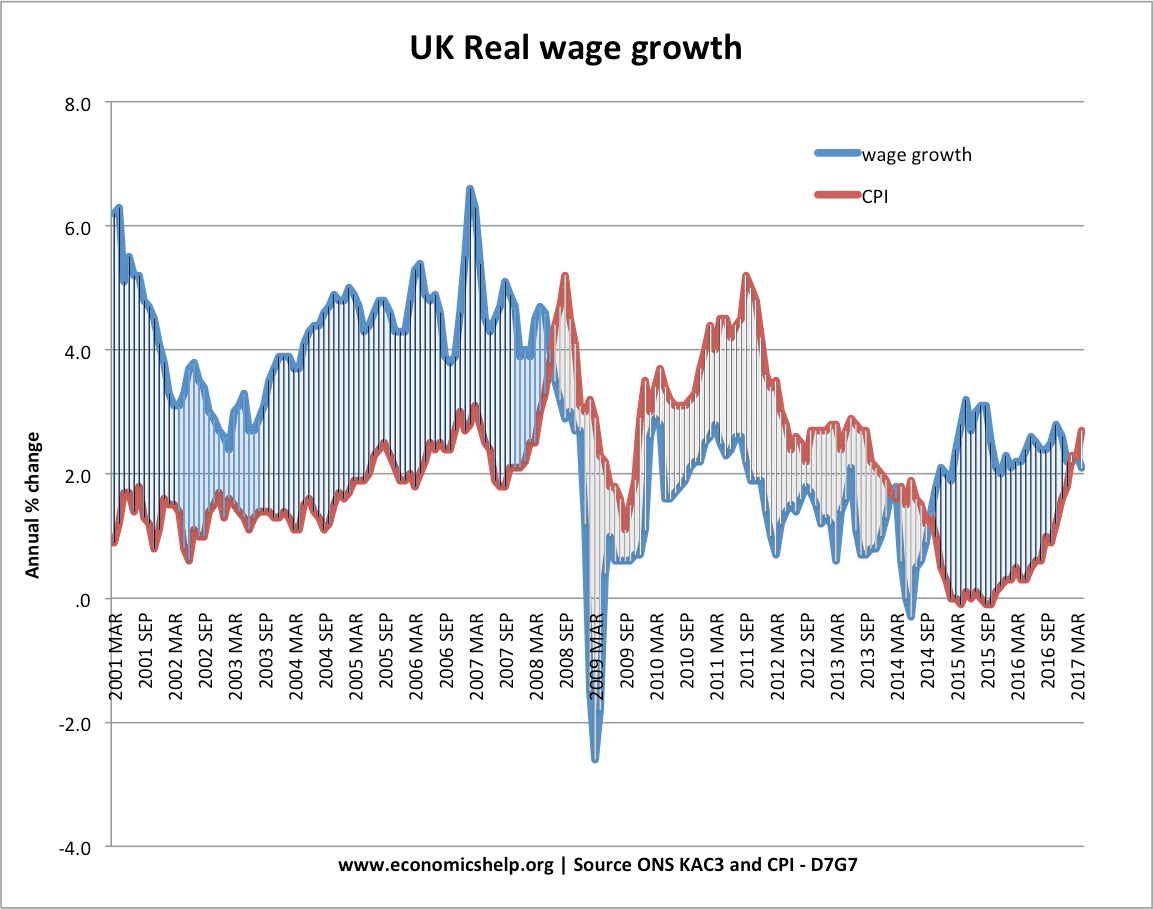

3. Reduced real wages. In a period of low wage growth, a devaluation which causes rising import prices will make many consumers feel worse off. This was an issue in the UK during the period 2007-2018.

4. A large and rapid devaluation may scare off international investors. It makes investors less willing to hold government debt because the devaluation is effectively reducing the real value of their holdings. In some cases, rapid devaluation can trigger capital flight.

5. If consumers have debts, e.g. mortgages in foreign currency – after a devaluation, they will see a sharp rise in the cost of their debt repayments. This occurred in Hungary when many had taken out a mortgage in foreign currency and after the devaluation it became very expensive to pay off Euro denominated mortgages.

Evaluation of impact of devaluation

- It depends on the state of the business cycle – In a recession a devaluation can help boost growth without causing inflation. In a boom, a devaluation is more likely to cause inflation.

- The elasticity of demand. A devaluation may take a while to improve current account because demand is inelastic in the short term. However, if demand is price elastic, then it will cause a relatively bigger increase in demand for exports. (See: J-Curve effect)

- If the country has lost competitiveness in a fixed exchange rate, a devaluation could be beneficial in solving that decline in competitiveness.

- Exports and imports increasingly invoiced in dominant currencies such as Euro and Dollar. This means that a fall in the value of Sterling has less impact on UK competitiveness because UK exports may be involved in Euros anyway. See paper on “Dominant Currency Paradigm” August 7, 2017 (Casas, Gopinath)

- Type of economy. A developing economy which relies on import of raw materials may experience serious costs from a devaluation which makes basic goods and food more expensive.

Case studies of devaluation

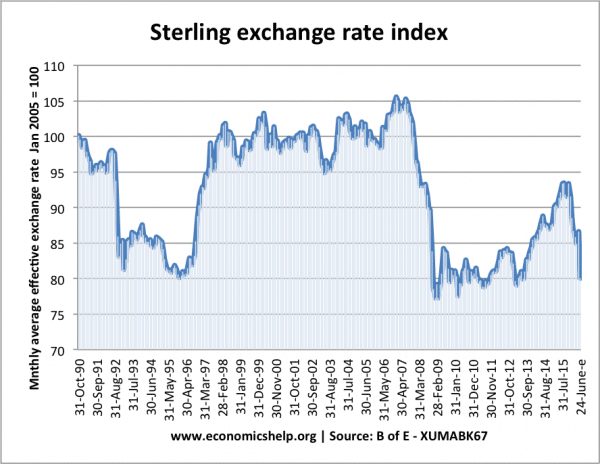

UK leaving ERM in 1992

In 1992, the UK was in recession. Trying to keep the Pound in the ERM, the government increased interest rates to 15%. When the government left the ERM, the Pound devalued 20%, but more importantly, it allowed interest rates to be cut, and the economy recovered. This is widely considered to be a beneficial devaluation. An important note is that the Pound was overvalued in early 1992.

See: also: UK in the ERM 1992

2. UK – 25% fall in value of Sterling in 2008/09

The pound fell considerably after the financial crisis of 2008/09, the depreciation in the Pound made UK goods more competitive. It also caused some cost-push inflation. The benefits of this depreciation were muted because of weak export demand in the global recession. The depreciation in the Pound also caused imported inflation, which during a time of low wage growth, reduced household living standards.

Between 2007 and 2018, UK prices rose 30%, compared to 17% in the Eurozone.

With low wage growth, imported inflation has led to periods of falling real wages.

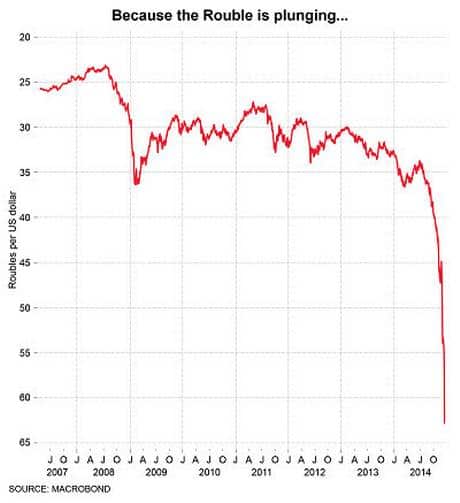

3. Russian economic crisis – 2014

The Rouble plunged during the economic crisis. This was due to the fall in the price of oil and balance of payments problems. The scale of this devaluation was not helpful – causing a rise in inflation and a decline in living standards. The problem was not so much the devaluation as the fact the economy was reliant on oil exports – so when oil prices fell there was a significant fall in demand for the Rouble.

See: Fall in value of the Rouble – an example of the impact of the devaluation in the value of the Rouble on the Russian economy.

Winner and losers from devaluation

One way to think about the advantages and disadvantages of a devaluation is to think who gains and who loses.

Long-term effects vs short-term effects

A long-term devaluation tends to reflect an underperforming economy.

In the post-war period, the UK has experienced a decline in the value of the Pounds against its main competitors

- 1948, £1 = $4 and 13.4DM

- 2018, £1= $1.3 and 2.2DM

This shows the Pound has fallen, but in this period, UK living standards have increased at a slower rate than the main G7 economies (apart from Canada) Generally, in the long-term the weak pound is caused by a weak economy (relatively high inflation)

Note: See explanation on the technical difference between devaluation and depreciation.

See also:

to what extent does devaluation policies achieve its objectives in LDCs