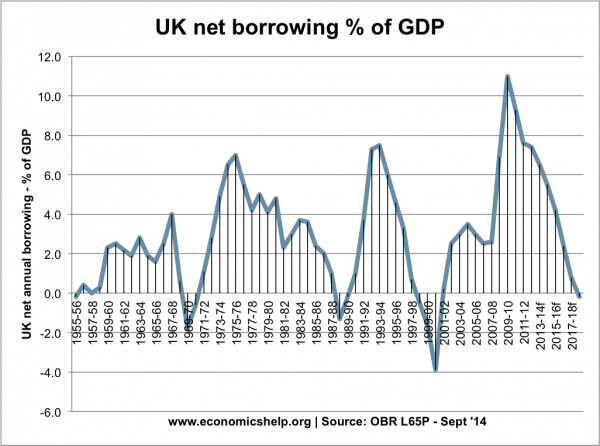

Readers Question: Surely when we have near full employment as we have now the Government should be producing a surplus (as in the late 1990s) and reducing the national debt. Not to do so means that we have a structural problem in the UK?

Not necessarily.

A structural deficit problem implies that even allowing for cyclical fluctuations in the economy, current government spending is being financed by borrowing. A structural deficit problem implies that borrowing is becoming increasingly unsustainable or expensive.

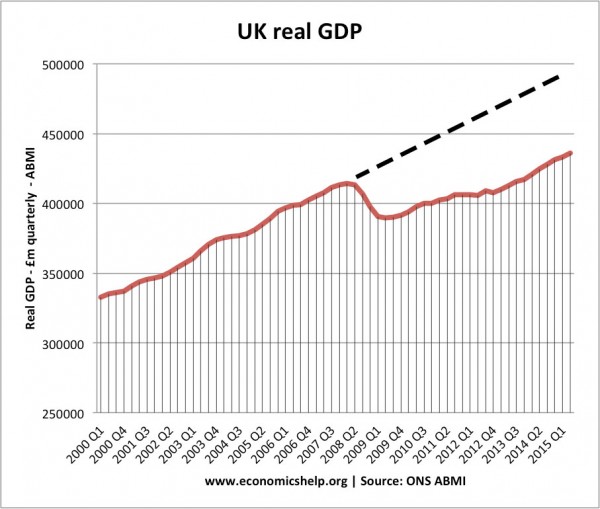

Firstly, although unemployment is low and close to traditional methods of full employment, output is well below the past trend rate of growth – indicating spare capacity.

In recent years, economic growth in the UK has been well below trend rate, so arguably the economy is still below full capacity.

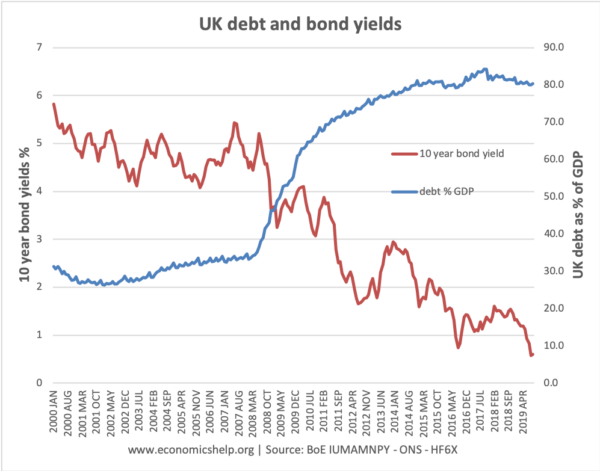

Interest rates close to zero

The current situation is also unusual in that interest rates – the cost of borrowing – is close to 0%. We have not seen anything like this – this century. It means that the Central Bank can’t use monetary policy to boost demand, so fiscal policy (government borrowing) becomes more important.

Low interest rates also mean there is a strong demand to buy government bonds and people are willing to borrow even if the interest payment is very low. This means the cost of servicing the national debt is quite low and not a structural problem.

You don’t need a budget surplus to reduce debt to GDP

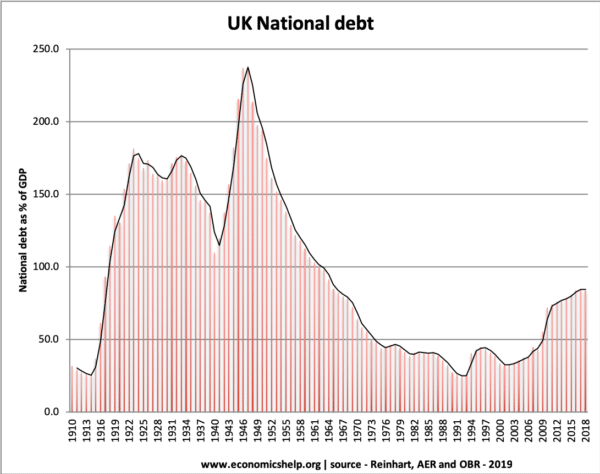

The most useful measure of national debt is – debt as a % of GDP. If the economy grows faster than the level of debt, then you can reduce the debt to GDP ratio even with a relatively modest budget deficit.

The UK’s debt was over 200% of GDP in the early 1950s, but debt fell sharply in the post-war period because of high economic growth – not because of budget surpluses.

The other thing is that if growth is weak, and the government try to pursue a budget surplus, this can be deflationary and lead to lower economic growth – which makes it harder to reduce debt to GDP. This is why some economists say it is possible austerity can be self-defeating in terms of debt reduction.

Structural deficit problem

What would indicate a structural deficit/debt problem?

- A rise in interest payments as a % of GDP. This means a greater burden of tax revenues would be going to paying debt interest payments.

- The reluctance of markets to buy government debt causing rising bond yields.

- High inflation could make the issue more serious. When inflation is low (like now), the government can always rely on the Central Bank to print money and maintain liquidity. But, with high inflation, you can’t print money without causing more inflation.

- Long-term budgetary pressures – e.g. rising spending commitments on pensions, health care. An ageing population can make a structural deficit problem more likely.

Readers Question: One more question: if the B of E buys Government debt, where does it get the ‘money’ from to do this? I assume it is Government that issues gilts not the BoE

In recent years, the Bank of England has been buying government debt by literally creating money electronically. So the Central Bank is just increasing the money supply to buy bonds. (In more normal circumstances this would cause inflation, but it hasn’t because of the unusually low growth/liquidity trap we are currently in)

Related

A complex answer – but surely there is a ‘double whammy’ affect: debt goes up but not GDP ie poor productivity. I would still argue that with near full employment the debt should be being paid off (which it is not as we have a deficit) even if GDP stays the same (ie no improvement in productivity).

If we continue to have a payments deficit when we have ‘full’employment when will we be able to pay off debt?!

It may be argued that we do not have to pay off debt but when (not if, but when) interest rates go up money will be going on interest payments not on public spending. I don’t see this as sound economic management.