Readers Question: I only have $10,000 in my bank. With this virus situation, what is going to happen to the value of my money? Serious question. Do I try to exchange my money to another foreign country currency? Help, please. I am 68 years old, no pension and no job. George

Firstly, I would not worry. Savings in a bank are safe for a few reasons.

- The crisis will cause lower inflation (possibly deflation) and the value of money could increase.

- Savings are guaranteed by the Central Bank (Federal Reserve, Bank of England)

- There is no particular reason for the dollar to devalue against other currencies.

There are three possible causes for concern about savings in a bank

- Inflation – Higher prices lead to a fall in the value of money because the cost of living increases. (With high inflation your $10,000 would buy fewer goods.)

- Devaluation of US dollar against other currencies (rapid devaluation would make imports expensive and cost of living higher)

- A financial crisis which causes banks to go bankrupt and savers to lose money.

Currency rates

Firstly, I assume you are a US citizen. There is definitely no need to exchange dollars for another currency. A devaluation in the dollar might occur if the crisis hit the US and nowhere else, but this Coronavirus crisis will affect all countries, so I don’t think there is a need to swap for another currency.

Although all countries will be affected by the coronavirus, the economic impact may be greater in some countries. For example, the UK is particularly reliant on trade and financial services. These industries may be more affected than say agriculture and the manufacture of basic necessities. Yesterday on the exchange rates there were large swings in currency with the dollar appreciating and the Pound Sterling falling. In this case”

- Americans might see cheaper imports

- British might see more expensive imports.

Despite the crisis in the US, the US dollar is appreciating. This is because investors feel it is a relatively safe haven compared to the alternatives.

The most badly affected countries might be developing countries who export oil or who rely on tourism. The price of oil is falling so fast, it is going to significantly reduce foreign incomes for countries like Iran, Russia and Venezuela.

Possible inflation?

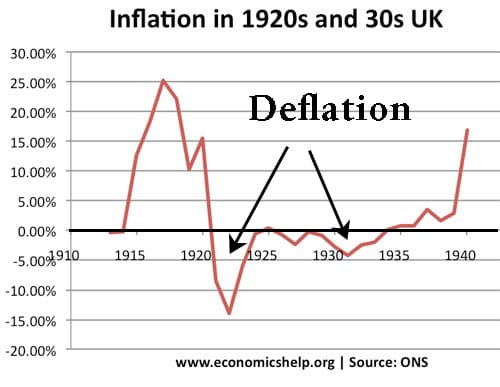

The most obvious effect of the Corona recession will be a fall in inflation. Oil prices are falling, demand is falling, output is falling. All these factors will put downward pressure on prices, firms will try to offer lower prices to entice consumers to buy. As inflation falls, we may end up with deflation (falling prices). With deflation, savings will increase in value; you will be able to get more goods for your money.

What if Central Banks print money?

The only possibility of inflation is if Central Banks responded to the crisis by printing a lot of money. For example, to pay a universal basic income, the Central Bank could create additional money. In usual circumstances, printing money would cause inflation. This is because with more money circulating, households have more money to buy the same number of goods and this causes the price to rise. (see money supply and inflation)

The complication is that these are not usual circumstances – we have an unprecedented drop in income, output and spending. The Central Bank can create money without causing inflation (like 2009 and 2010). My fear is not that the Central Bank will cause runaway inflation, but that they are too timid to deal with the severity of the crisis and print too little.

There are many things to worry about at the moment, but inflation is definitely not one of them.

Financial crisis and runs on the bank

In the Great Depression, it is true that many US banks went bankrupt. Losses on Wall Street and then firms going bankrupt meant that banks saw loan delinquency and the banks lost money. As banks lost money, it caused a run on the bank. Savers went to try and get their savings out. This caused big queues and then there was a collapse in confidence – no one wanted to save with banks and many savers did lose money because banks went out of business.

However, now things are very different because the Central Bank (Federal Reserve) acts as lender of last resort. If there was a surge in demand for consumers wanting to withdraw money from the bank, the Central Bank would step in and provide liquidity (money). No matter how many people wanted to withdraw money from a big commercial bank like Bank of America, the US Federal Reserve would supply the Bank of America with all the money it needs. This will ensure people remain confident in the banking system and there is no need to rush to the bank to withdraw.

(I wish I could have 100% confidence the European Central Bank will act as lender of last resort for Eurozone economies like Italy, but this is another issue.)

Conclusion

In summary, there is no need to worry about your $10,000 savings – it’s probably much better having cash in the bank, than other forms of assets like shares. Also, no matter how bad the crisis is, it will come to an end, and the economy will (hopefully) bounce back.