In recent years, there has been a growing trend toward using electronic payments rather than physical cash. This trend to a cashless society is likely to be accelerated by the Coronavirus which gives an impetus to avoiding unnecessary physical transactions. There are several advantages of a cashless society, such as a lower risk of violent crime, lower transaction costs and fewer issues of tax evasion. However, there are also concerns that a move to a cashless society could cause privacy issues and problems for those on low-incomes and with bad credit histories.

Advantages of a cashless society

Reduced risk of crime. Cash tills have often been the source of violent crime. It puts employers of banks and shops at risk from hold-ups. If cash is removed from business premises, this risk is substantially lowered. It also means a small business does not have to worry about employing security guards. Currently, a shop may need to employ a specialist guard to carry cash in a secure format. If cash is replaced, this is a potential cost saving for the business and the consumer.

Less tax evasion. A significant problem for governments is the issue of tax evasion. Self-employed workers such as builders can seek to be paid in cash and therefore declare less income than they actually earnt. This leads to a loss of income tax revenue for the government. It is estimated that the UK government lost £8bn in tax revenue due to ‘cash in hand payments’ (if this tax gap was closed it would be equivalent to 2% on the basic rate of income tax) A cashless society would make it easier for government to prevent tax evasion.

Harder for organised crime. Organised crime rely on cash transactions as it enables them to avoid government security. If shops stopped accepting cash, it would be a problem for criminals as they would either have to declare cash (BTW: Al Capone was sent to jail for tax evasion) or find some other outlet. A cashless society would make crime less profitable.

Hygiene and virus transmission. Since the spread of COVID-19, many shops have either banned cash payments or strongly encouraged e-payment. It is suggested that the virus can live on paper money and coins for up to two days and is a source of possible virus transmission. Paying by card reduces the risk of transmission through this method. I would not have thought of this point before 2020, but it could be relevant for quite a few years.

Quicker transactions. Paying for an item with cash taxes time and makes the queue longer. For time-sensitive business, this is a major issue. For example, if everyone paid for a bus ticket with cash and required the driver to count change, the journey time would increase and there would be more traffic congestion. Everybody on the bus would waste time. This becomes a major financial cost, and it is no surprise that many travel companies are refusing to accept cash payments. There is a similar issue for other business like coffee takeaways where speed is important – when people pay cash, the transaction becomes slower.

Reduces spare change. A consumer rarely has exact change, and so you end up with small coins which are difficult to spend. In the US, the situation is worse because the price you see advertised doesn’t include sales tax. The final price will always be an odd number like $4.84 for a coffee. The 16 cents change then often ends up in drawers and is a welfare loss. The time cost of spending pennies is higher than the financial value.

Lower transaction costs for business. In some respects, business who accept only cards will have lower transaction costs. There is less labour time in counting cash and sending money to the bank. It also avoids any inaccuracy related to counting or dealing with potentially forged notes. (e.g. many shops don’t accept large denominations).

Costs of cash infrastructure

At the moment, the UK cash infrastructure costs around £5 billion a year to run (PDF). It is paid for mostly by commercial banks (who pass costs on to consumers).

Problems of a cashless society

Difficult for those without bank account. In 2015, the Financial Inclusion Commission estimated nearly two million adults do not have a bank account in the UK. In the US in 2017, it is 14.7 million adults (6.5%) (2017) If shops only accept cashless payments, it is difficult for those without bank cards to pay. Many low-income households rely heavily on cash and can be left behind if some and services are not available via cash. Some people with very poor credit history may be prevented from getting a bank card. The great thing about cash is that it doesn’t discriminate on things like credit history. A report into a cashless society found 17% of adults or 8 million would struggle in a cashless society. (Access to cash – PDF)

Privacy. China is leading the way with a move towards a cashless society. In 2020, over 50% of consumers have made a transaction with mobile payment. The government is now pioneering a government digital currency. The motive is for the government to be able to access all data on households, pressure groups, business and organisations. It gives the government tremendous power over its citizens and raises fears of techno-dystopia. A political dictatorship with the ability to monitor any economic activity will have more powers to clamp down on dissent. Even in the west, some households may dislike the way firms can track spending patterns and send targetted marketing. The privacy issues of electronic money are a major concern to civil liberties.

Cash helps ration spending. People with a tendency to get into debt may purposefully decide to cut up their cards and restrict themselves to cash payments. The reason is that with a card, it is easier to spend money without feeling you are overspending. Psychologically, there is little barrier to buying on plastic. But, when you pay in cash, you have a greater emotional attachment to money and it makes you more conscious of what you are spending. Having to part with cash can help prevent impulsive purchases. In one study, 16% of households say they use cash because it is easier to manage their household budget when using cash.

Business costs. Although cashless payments have advantages (e.g. no need to take money to the bank), firms also become reliant on credit card and bank companies, who charge a commission for processing accounts. For some cards, it may account for 2% of the transaction, and with some credit card companies even more. This means business are losing out to card companies who will have increased market power in the absence of cash.

Freedom to choose. There is a big difference between an increased use of electronic payments to making it compulsory. If shops refuse cash, it is in effect a form of discrimination against those without bank accounts. Individuals may also have reasons to want to pay cash.

Hard to revert. Sweden made plans to shift to a cashless society but found that some groups were getting left behind – as a result, they agreed to ‘put the brakes on’. One important thing is that when cash infrastructure has disappeared, it is very hard to put it back.

The emotional value of money. As a kid – getting a five-pound note from my uncle for my birthday gave great joy. Getting five pounds into your bank account doesn’t have the same value. There is a certain psychological value in giving cash to charity rather than just a bank transfer, you feel more connected to the gift of giving.

Potential technological failures. There is always the risk that a digital economy is dependent on technology. If there was a power outage or internet breakdown, the economy would be brought to a halt. Cash is much more adaptable in difficult times.

Conclusion and personal note

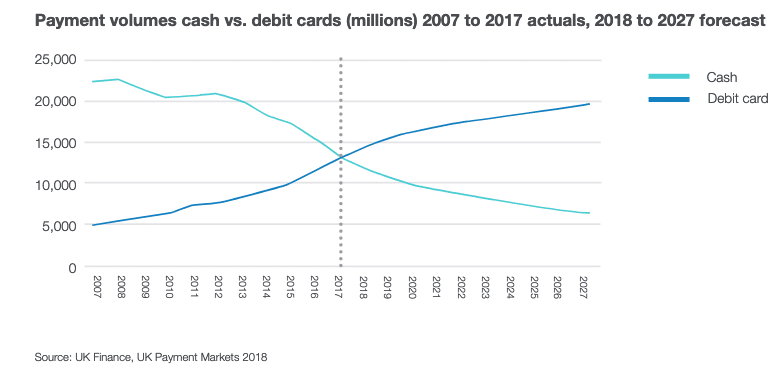

This is an interesting question because I quite like dealing with cash and money. I often end up with cash because I organise not for profit running races. I then enjoy having £300 in cash which I then spend in town. Whilst I like spending cash, since COVID-19, I haven’t spent any cash at all – only card. I feel 2020 is a tipping point COVID-19 is only going to accelerate the trend towards a cashless society.

The more I think about it, the more it makes sense to use a card for buying coffee to help speed up the process and get shorter queues. However, whatever the merits of bank cards and e-payments, I feel there is a strong argument to legislate to protect the role of cash and see it as an important utility for the financially marginalised. Access to cash and the ability to pay in cash should be maintained.

Related posts

Despite the so-called advantages of a cashless society, we have more to give up with allowing our privacy to get even further damaged. It would definitely discriminate against the poorer members of our society. It would even make it easier to target our buying habits than it is now. I think we have societies moving too quickly towards control now, so to accelerate this is a very bad idea. I will personally resist this trend in any way I can.

yard sales, flea markets, paying neighborhood to mow your lawn etc. are much easier with cash

Doscriminating the poor is one of the main reason we should not have a cashless society but it also allows so much more control to be impossed on us. I take money from my account every week and dont buy in shops that dont allow cash. We can only speak with our feet. We are controlled and watched so much now but cashless societies make this happen so that we have no privacy at all left. We will all be minions.

How does tipping work with card only payment?

I do not agree with a cashless society at all. It is a way to save money and not overspend. What does going cashless have to do with people without a bank account? Nothing. It is government over reach that gives them the power to close banks and then you have nothing.

This article was very helpful! I’m researching for a mock-debate for my class. I think that going digital only give the governments of the world more power than they need. We should be able to mind our own business, and trade and buy as we please.