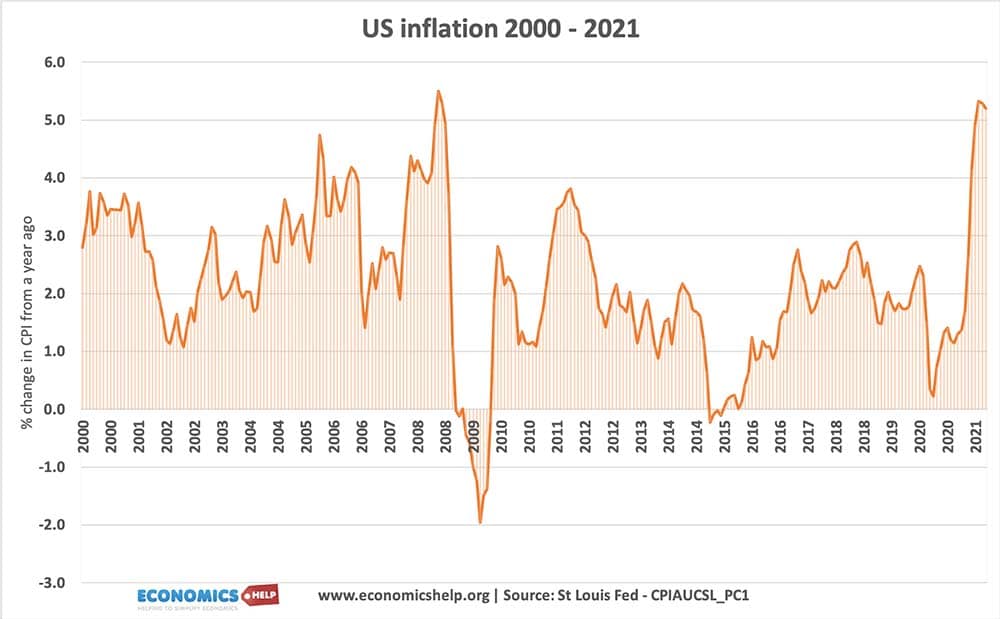

In the past two decades, we have had a remarkable period of low inflation. Inflation has been so low, some economists have suggested a new paradigm – the end of inflation as a primary economic concern.

Since 2009, any predictions of imminent inflation have proved to be wide of the mark.

There have been warnings of imminent inflation in the past – some commentators have argued a policy of zero interest rates and quantitative easing is a recipe for inflation and devaluation of the dollar. In normal circumstances, these warnings may have proved true, but we have not been living in normal times, the response to quantitative easing has not been a surge in investment and spending but higher savings by corporations and wealth individuals. The monetary base has increased, but velocity of circulation (frequency of money use) has remained stubbornly low.

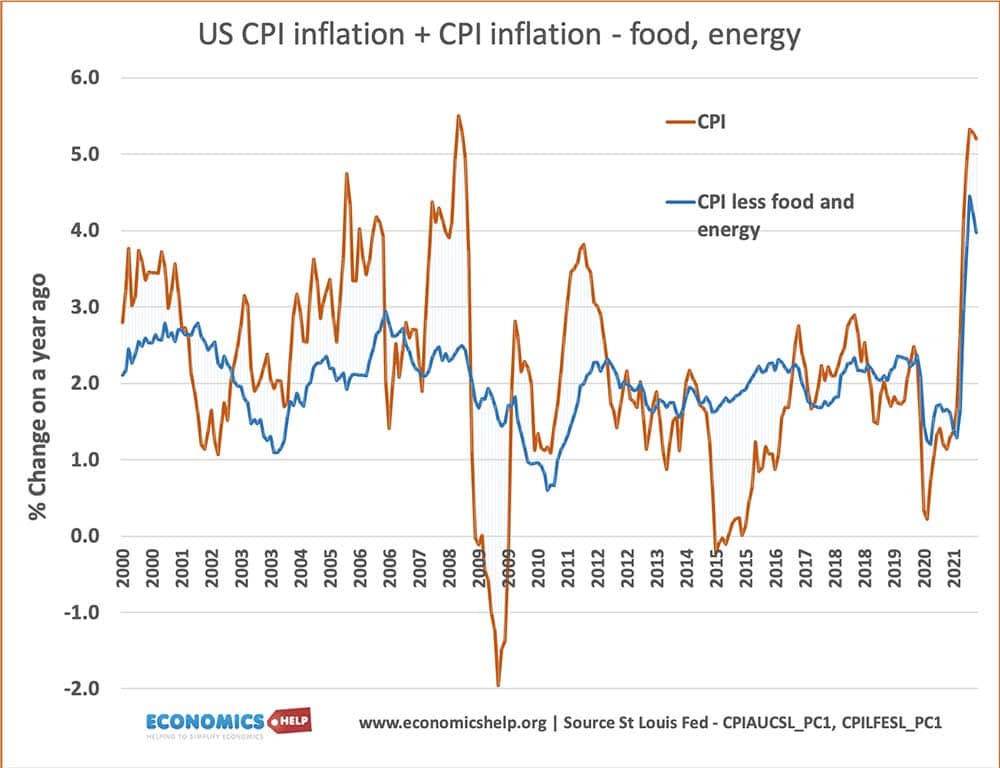

There have been temporary spikes in inflation due to cost-push pressures (e.g. oil in 2008). But these spikes have proved temporary and inflation has soon fallen.

Video summary

Why inflation has been so low for so long?

- Technological improvements which have caused lower prices for many manufactured goods

Strong competitive global pressures which have kept the price of commodities low. - Weak economic growth since the financial crisis.

- Failure of quantitative easing to cause strong economic growth. The increase in the money supply has not led to higher economic activity but has often been absorbed by increased saving – especially by corporations and the wealthy.

- Weak wage growth. A key determinant of a sustained inflation is wage growth. If wage growth is low, then this invariably keeps core inflation low. This is because firms are not seeing a rise in costs and workers are not seeing a rise in income.

Prospects for future inflation

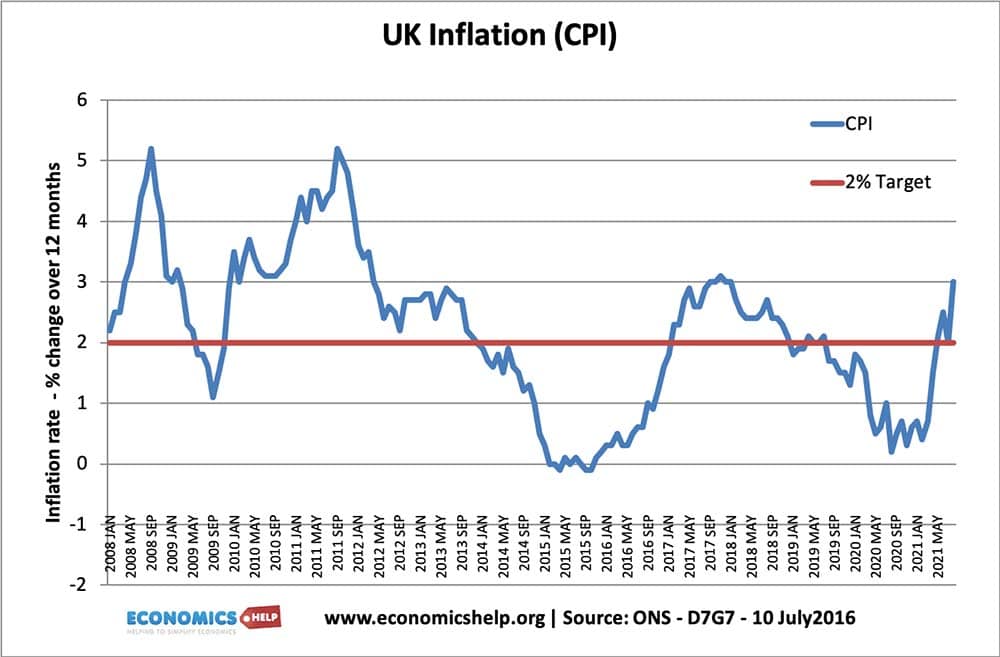

We have seen a rise in inflation across the globe. This is due to rising energy costs and rising commodity prices. These are set to continue to rise, with the recent increase in wholesale gas prices.

Alone, this would not cause a rise in core inflation (e.g. 2008 oil price rise led to no increase in cost-push inflation. However, cost-push inflation can be a factor in leading to a more sustained rise in inflation. In the 1970s, the rise in oil prices was a factor behind the sustained inflation of the 1970s. If workers feel energy prices will keep rising, they will start to demand higher wages.

Loose monetary policy. Monetary policy has been so loose for so long, we have grown accustomed to low interest rates not causing inflation. However, if firms see strong economic recovery, they may start to be more willing to spend and invest their large cash piles.

Wage growth. In the UK, we have seen strong wage growth in 2021. This is due to a combination of factors, such as Brexit, Covid and labour shortages in many areas. This is a strong indicator of future inflation. If this kind of wage growth is maintained, it will start to feed through into long-term inflationary pressures. In the UK at least, there is no quick fix to labour shortages.

Shipping costs. Covid has led to a shortage of shipping containers, which has pushed up the price of international transport. Again, on its own this would be a temporary cause of inflation, which could be soon reversed. But, combined with other inflationary pressures may cause inflation to be more embedded.

Environmental factors. Extreme weather events are disrupting some supply chains and putting up prices of certain commodities. Combined with efforts to move away from fossil fuels, there is the prospect of higher taxes.

Reasons not to be so concerned

We are still a long way from the 1970s. Inflationary expectations are still relatively low, wage growth has not become embedded in the economy. The upward pressure on inflation can still largely be attributed to temporary factors – food, energy and also Covid related supply chain issues. Covid related bottlenecks which have caused a rise in core inflation may dissipate in 2022.

However, more than any other time since 2008, there are reasons to see that the era of super low inflation and zero interest rates may finally be coming to end. If supply-side disruptions remain and labour markets continue to have shortages, this temporary inflation could become more permanent and sustained. It is of great significance because so many individuals, firms and governments have become used to zero interest rates. It will be a big shock if interest rates were to start to rise.

Related

These Economic reports are very useful. It gives real context to what is happening to the economy and what could happen in the future. Thank you

Great job

Martin West