Reader’s Question: The Central bank is raising interest rates (I understand why). At the same time, the government is being called to reduce taxes. These appear contradictory policies to me? What am I missing?

In summary

You are right they tend to have opposite impacts on consumer spending and economic growth.

- Higher interest rates tend to reduce economic growth (and therefore reduce inflationary pressures)

- Lower taxes tend to increase economic growth (and potentially increase inflationary pressures.)

The logic is that interest rates need to go up to reduce inflation (because inflation is well above the inflation target) and there is risk high inflation could become entrenched. By reducing inflation, ultimately, the cost of living will fall in the future. But, whilst the cost of living remains high, lower taxes will give some support to households in increasing their real income during present time.

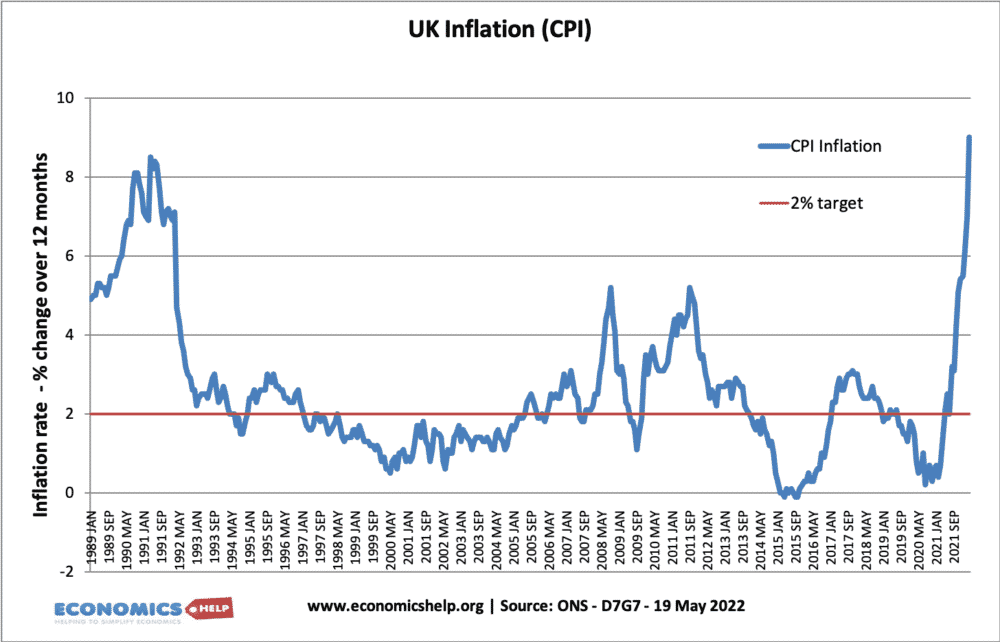

The UK economy is experiencing a rapid rise in inflation, causing higher living costs, especially for those on low incomes. At the same time, the economy is flatlining, with lower rates of economic growth and falls in real wages. With inflation higher than nominal income growth, there is pressure to maintain people’s standard of living. There are two basic ways to improve the standard of living

- Reduce inflation – reduce the cost of living.

- Increase income – through higher wages/benefits and/or lower taxes

- High-interest rates are seeking to reduce inflation

- Lower taxes seek to increase real disposable income.

Impact of higher interest rates on living standards

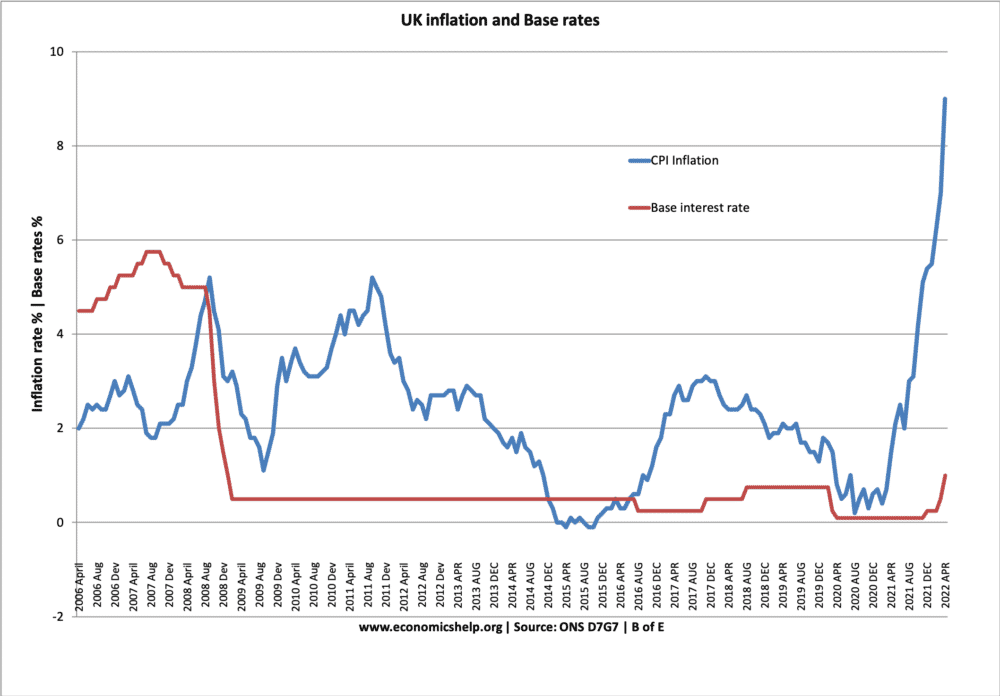

- Higher interest rates are the central policy for bringing down the rate of inflation. Higher rates work by increasing the cost of borrowing and reducing the incentive to spend and invest (see more at: The effect of higher interest rates). Over time, higher interest rates will reduce the rate of growth and reduce inflationary pressures in the economy.

- If higher interest rates do bring inflation down, then this will help tackle the ‘cost of living crisis.’

- Higher interest rates will also do something to protect the real value of savers. With UK inflation at 9% and interest rates at 1%, this is a record level of negative interest rates. Your money is devaluing at 9%, but the interest rate is only 1%.

Evaluation of higher interest rates on living standards

- However, at the same time, higher interest rates could push the economy into recession, which will cause a different cost of living crisis – one from rising unemployment and lower wage income.

- Also, higher interest rates increase the cost of borrowing. Homeowners with variable mortgage payments will see an increase in their monthly mortgage repayments and those consumers with loans and credit card debt will see higher debt interest payments. So it is important to bear in mind higher interest rates themselves will increase the cost of living – in particular for borrowers.

- The current inflation we see is cost-push inflation (caused by rising food, energy and import prices) This inflation is not directly linked to the state of the UK economic growth. The Bank of England can increase interest rates to reduce economic growth, but this doesn’t necessarily tackle oil and gas prices. If there is a shortage of gas, the price will continue to rise – even if the UK economy goes into an economic slowdown. This is not to say higher interest rates will not have an effect – they will. But, to get inflation back down to 2 or 3% would require very high rates and a deep recession. To some extent, we have to live with higher cost-push inflation – at least in the short term.

Impact of tax cuts on living standards

- Tax cuts (or benefit increases) will directly increase household disposable income by allowing them to keep a higher share of their wage. It is in effect an increase in real income. The main drawback is higher government borrowing.

- In fact, lower taxes not only increase disposable income but also help promote economic growth. With lower taxes, consumers are more willing to spend and this higher spending will increase economic growth. (and potential inflationary pressures) However, given that there is a cost of living crisis and falling real incomes, the lower taxes are unlikely to cause much inflationary pressure.

- In one sense the combination of higher interest rates and lower taxes are working in opposite ways in terms of growth and inflation.

- Higher interest rates slow down economic growth and slow down inflationary pressures. Lower taxes promote economic growth and increase inflationary pressures.

Unequal nature of cost of living crisis

One important thing is that the cost of living crisis is being most felt by the poorest 10% income decile. They are facing a higher inflation rate 10.9% – because a higher share of their income goes on energy and food. At the same time, benefits have been increases less than wages, so their fall in real income is much greater than higher income declies. Tax cuts will do little to help the poorest 10% because they typically don’t pay income tax. Therefore, a better solution would be to increase universal credit and targeted benefits to the poor.

You forgot the bit about global capital markets selling off GILTS and causing the biggest crash in GBP:USD fax rate in history. Rendering the BoE impotent. And reducing the UK to a third world emerging market basket case. Please add that in.

Raise interest or VAT?Inflation in and of itself is not a problem IF wages and prices and savings all increase at the same rate. So we need to be sure that the medicine of raising interest rates is not doing more harm than good… it probably is doing just that because higher rates reduces investment which reduces productivity growth the only sustainable way to improve people’s standard of living. Far better to reduce aggregate demand by targeted increases of VAT which will exclude the essentials of living, energy and food so protect the poorest.

Slightly confused. I get the principle of reducing spending power = likely reduction in demand, therefore inflation. But, why is there so much focus on interest rates being the ‘only’ tool? The key beneficiaries of increased IR are the financial institutions, so my blunt observation is to wonder why we don’t use tax increases as the control? The tax system would take the heat off the lower decile, currently most affected and (genius) the government gets the dosh. Which could either reduce deficits or be used for public works. How about pothole free safely marked roads?