Since 1980, China has experienced an economic miracle with over three decades of economic growth averaging over 10% a year. This growth has enabled millions of people to be lifted out of absolute poverty and for China to become one of the most dominant economies in the world.

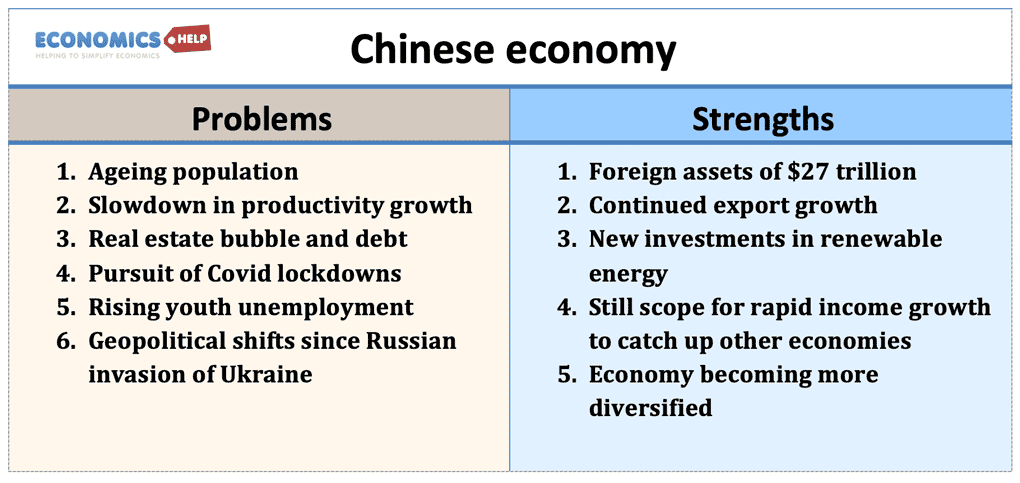

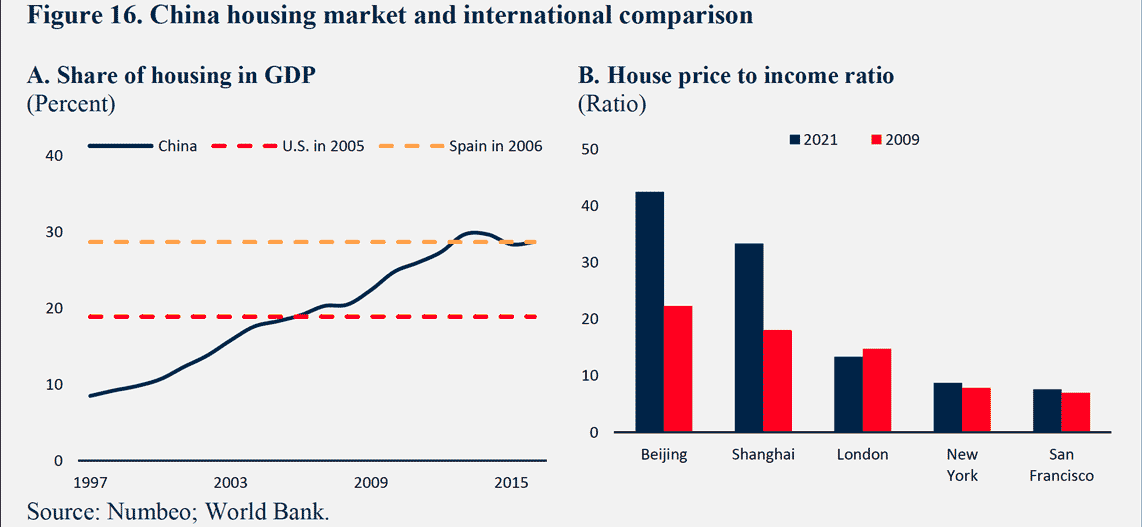

However, as we move into the 2020s, the Chinese economy is undergoing a significant transition as an ageing population and slow down in productivity growth means the past rates of growth will not be able to be maintained. Also, there are real concerns about the over-leveraged real estate market in China, with house price to income ratios in major cities amongst the highest in the world. Furthermore, China has struggled to cope with Covid, as its zero-Covid policy has led to punishing lockdowns which have hampered growth and deterred investment.

Yet, despite the challenges faced by demographics, Covid and debt, China maintains an impressive strength in its major export industries, which continue to perform strongly. Its trade position has enabled an accumulation of $3.15 trillion of foreign currency reserves (SCMP) and net foreign assets of $27 trillion (World Bank).

Problems facing the Chinese economy

Covid

In the short term, China’s zero-covid approach is causing a slowdown in economic growth (the economy only grew 0.4% in Q2 2022) It has also had a knock-on effect on reducing tourism and reducing business confidence. It was hoped a zero-covid approach (Or dynamic zero) as the Chinese government called it, would enable a return to normalcy. But, the new Omicron variants are making this almost impossible to achieve. The result is lockdowns and stringent checks which are hampering the economy and reducing confidence. It is a factor behind the slowdown in growth with the government’s target of 5% in 2022, looking unachievable.

Geo-political shift

The Russian invasion of Ukraine in February 2022, was shocking for many in the West. In response, the West imposed severe sanctions on Russia and is now desperately trying to escape from its reliance on Russian oil and gas. China’s reluctance to condemn Russia and continued economic support has led to many western companies re-evaluating their attitude to China. It shows how a sudden military action (such as China wishing to retake Taiwan) could lead to western companies amidst sanctions because of their exposure to China. Therefore, many companies will be wishing, in the long-term, to diversify their supply chains and not rely too heavily on China.

Demographic shift

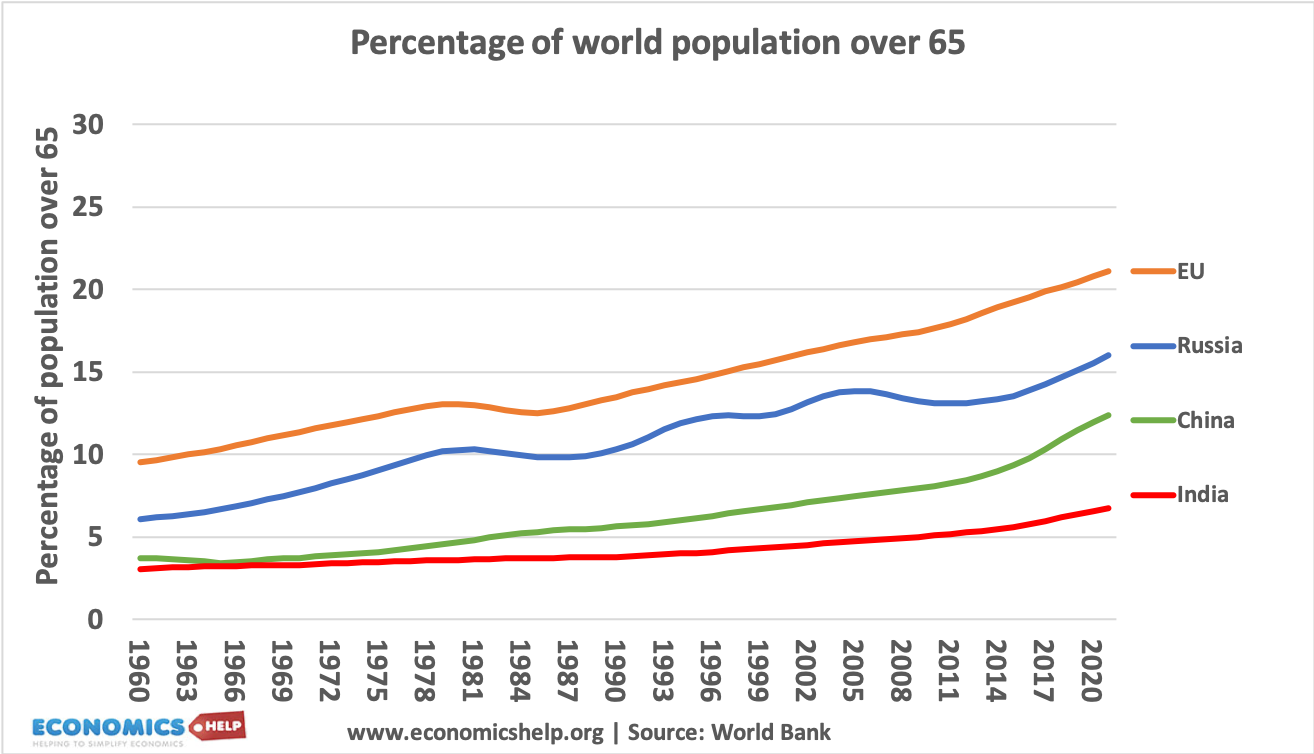

China’s one-child policy is leading to a very marked change in its population. Even since the policy was abandoned in 2016, China still has the lowest fertility rate in the world (1.15 children per woman) Due to selective one-child families, in China, men outnumber women 120 to 100. (BBC) The percentage of the population over 65 is forecast to rise considerably, leading to a skewed population with more old people than young people. In 2019, there were 254 million people aged 60 and over. By 2040, this is estimated to be 402 million people (28% of the total population, WHO)

China’s working-age population peaked in 2014 and is projected to shrink to less than one-third of that peak by 2100. This means that while there are currently 100 working-age people available to support every 20 elderly people, by 2100, 100 working-age Chinese will have to support as many as 120 elderly Chinese. (China’s population)

This demographic shift will change the nature of the economy, with increased demand for health care services and pensions and a smaller working-age population to meet it. Currently, China’s health care system is not geared up toward a rapidly ageing population which will increase demand.

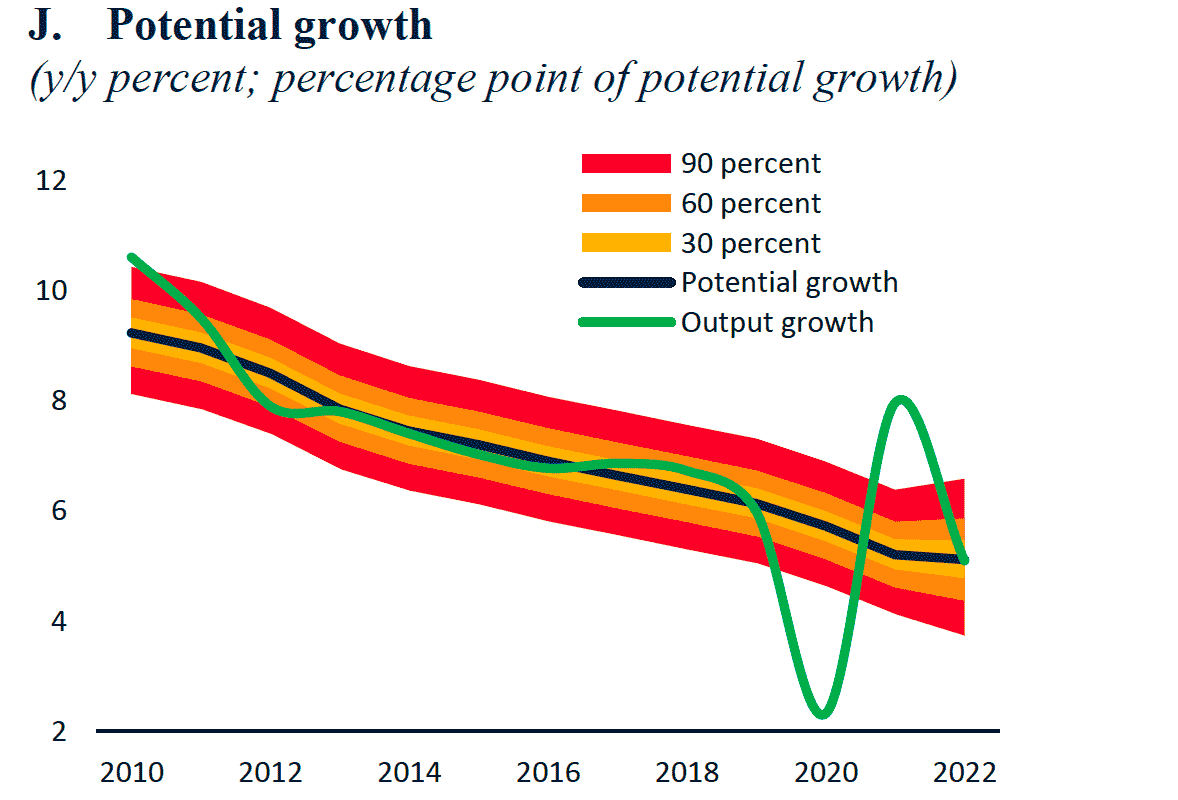

Slowdown in potential growth

China’s breakneck growth has been based on elastic supply of cheap labour working in manufacturing, but these gains are becoming exhausted. Combined with lower productivity growth and an ageing population, China’s growth potential is forecast to fall.

For an idea of how the Chinese economy may be affected by this rapidly ageing population, it is useful to look at the case of its near neighbour Japan, which began its process of ageing three decades earlier. A rise in the dependency ratio has led to secular stagnation – low growth rates, rising debt and deflationary pressures. Already, China’s slowing growth rate is causing some problems with rising youth unemployment. Recently, unemployment, among urban residents aged 16 to 24 rose to 18.4% (May 2022)

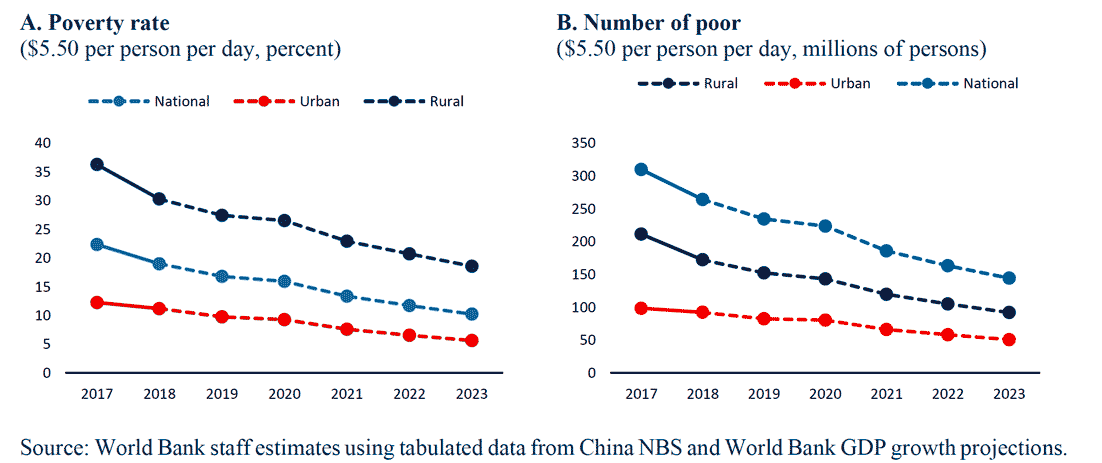

However, we should not overdo the constraints on Chinese growth. It is natural that as the economy develops, the double-digit growth cannot be maintained, but with per capita income still at one-fifth of those in advanced economies, there is plenty of scope for rising real incomes. Also, there are promising signs of diversification of economic growth – away from just relying on manufacturing export industries, towards domestic consumption and services. Also, China continues to reduce its poverty rate through its strong growth, even if regional inequality remains a significant problem.

Real estate bubble?

China’s rapid growth has seen a boom in the real estate market, with investors becoming highly leveraged to keep up with investment in new housing. Demand for housing in urban areas has been very strong, as speculators seek to cash in on rising prices. But, this has led to unsustainably high prices and the state of the Chinese housing market is reminiscent of the US and Spain’s before their housing crash in 2006.

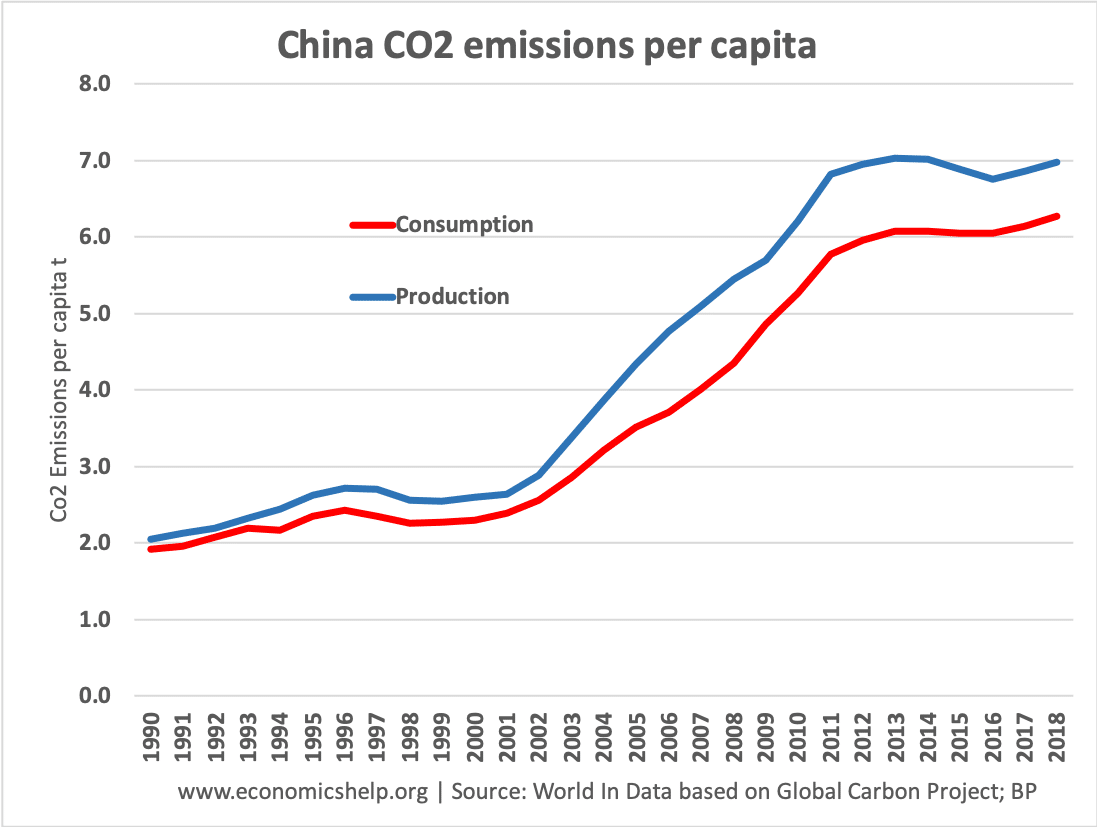

Shortage of power

As a net importer of oil, China is affected by rising commodity prices and oil. Though buying Russian oil at a discounted price has given it a temporary competitive advantage over the US and Europe. In response to increased demand for energy, China has embarked on an ambitious programme of off-shore wind and solar energy generation. Projects that dwarf anything in the western world. It is also a belated effort to deal with rising carbon emissions as China has become one of the world’s biggest emitters.

China itself will not be immune from issues around global warming and is already suffering from effects on agriculture, forestry and water resources. Some of the most densely populated cities, such as Guangzhou and Shanghai are built on the ocean’s edge and would be affected by rising sea levels.

Further reading