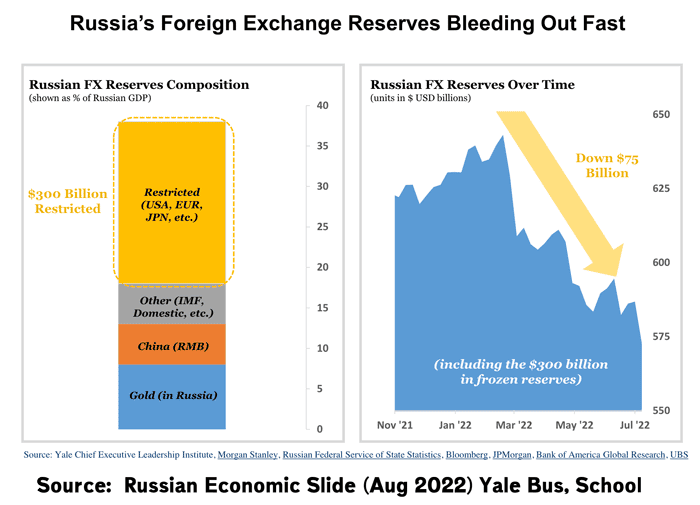

In February 2022, western economies imposed sanctions on Russia in response to the invasion of Ukraine. These sanctions were wide-ranging including banning exports of many goods to Russia, freezing Russian foreign reserves and recently the EU has proposed banning Russian oil exports.

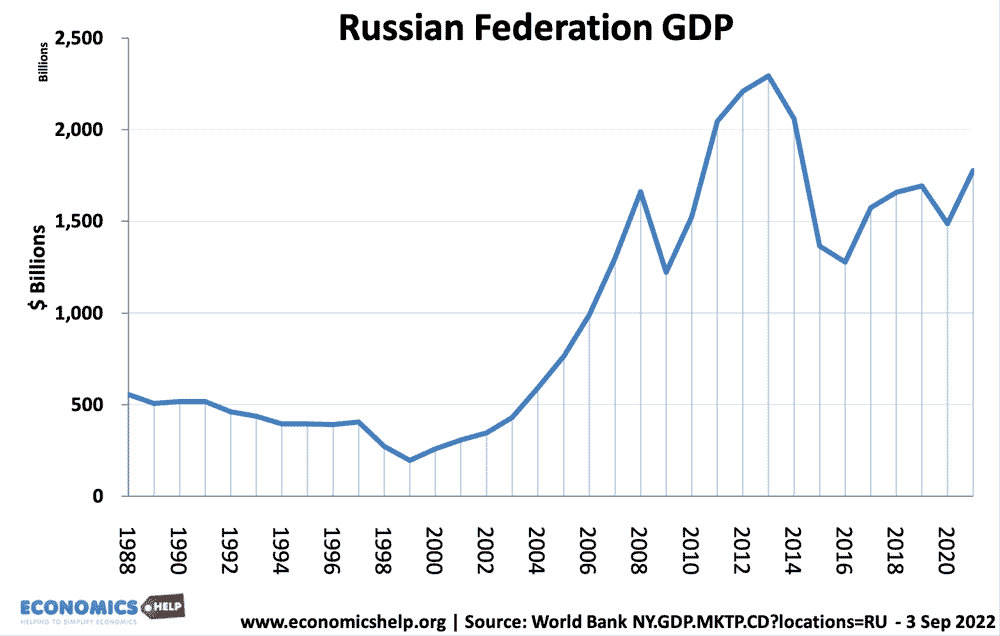

In response, Russia has retaliated by cutting off gas supplies to Europe causing a sharp rise in prices. The Russian economy has seen a sharp drop in GDP and many industries have struggled without access to their usual supply chains. However, outperforming the most pessimistic forecasts, the Russian economy has avoided any imminent collapse with an economy buoyed by continued high oil prices. Europe on the other hand is also struggling with unusually high inflation, a cost of living crisis and a risk of an imminent recession. Yet, in the long-term, Europe is confident they can ride out the storm, but Russia’s increasing isolation, risks the economy suffering longer term irreparable damage.

In July 2022, the IMF forecast Russia’s economy will decline 6% in 2022 (less steep than the original forecast of – 8.5% in April). For 2023, the Russian economy is expected to decline 3.5%. The slightly better than expected performance is due to strong oil revenues.

“Russia’s economy is estimated to have contracted during the second quarter by less than previously projected, with crude oil and non-energy exports holding up better than expected,” (Euroactiv)

The OECD are more pessimistic, (Sep) survey suggests Russian growth will fall 4.5% in 2023.

However, Bloomberg recently reported that an internal report suggests that despite optimistic propaganda Russian officials are concerned that the Russian economy could take years to bounce back from the impact of sanctions. In the worst case stress scenario, Russian GDP will fall to 11.9% lower than the 2021 level and not recover for over a decade.

Impact of last sanctions

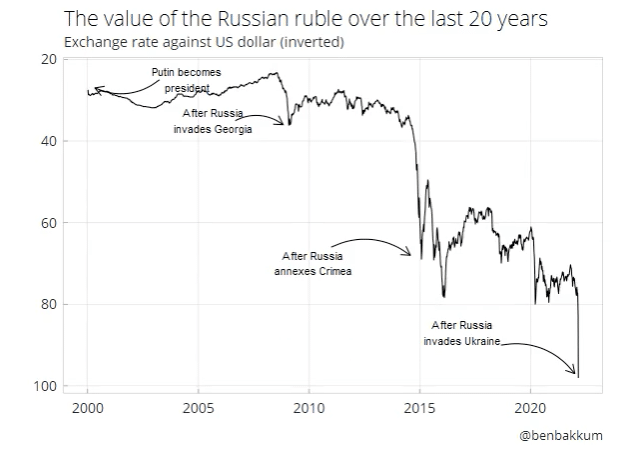

Measured in terms of US$, the Russian economy has still not recovered from the impact of the relatively mild sanctions of 2014, which caused a sharp fall in the value of the Ruble, which has not recovered.

How have sanctions affected the Russian economy?

Transport blockade. Russia faces a near blockade in terms of transport to Europe and flights around the world (except for a few remaining allies). For example, even former Soviet country Kazakhstan has started to crack down on a loophole which allowed Russian and Belorussian lorry drivers to bring goods from the EU. (Euractiv)

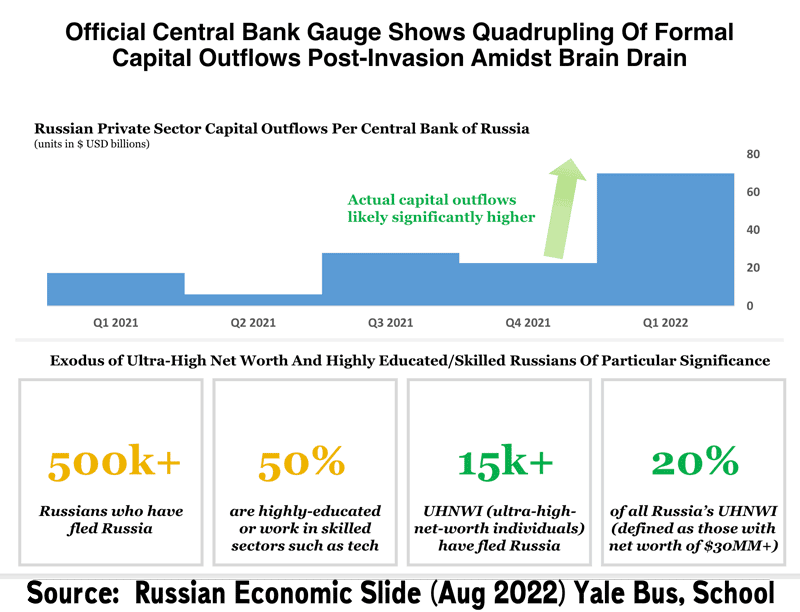

Brain drain. The Russian internal report estimated that as many as 200,000 IT specialists may leave the country by 2025, reducing human capital, a key part of potential Russian growth.

A study by Yale university in August estimated half a million Russians had already left, many of which were highly educated and high net worth.

More problems

The partial mobilisation of Russian men in September has only encouraged more Russian to leave Russia. An estimated 360,000 Russians have left to various neighbouring countries as there is deep unease at the prospect of conscription. The loss of young adults will be particularly felt by a Russian economy already experiencing a demographic shock, with an ageing population and a falling birth rate (1.50 Russian birth rate).

Diminished access to western technologies. Sanctions on exports to Russia have been quite effective, leaving the Russian industry short of key components, such as microchips and ball-bearings. This damages long-term growth, and whilst firms can to some extent source alternatives or make do with simpler products, it will lead to lower growth potential in the long-term. It was hoped that Chinese exports would replace western exports, but in some technology, China is not ready. There is also evidence that Chinese firms themselves are reluctant to export to Russia for fear of western sanctions.

A good example, of the importance of western technology, is that it is critical in building liquefied natural gas plants. If Russia is to pivot from exporting to Europe by pipeline to LNG exports, it needs this western technology, and without it there will be significant delays.

War stimulus?

It is worth mentioning that when the US had entered wars, such as Second World War, Korea, Vietnam, it caused a surge in demand and production leading to high economic growth? Is there any chance the Russian economy could benefit from this? Ilya Matveev a Russian political scientists says this is unlikely to happen for a few reasons. Russian manufacturing is weak due to capital and political investment in fossil fuels. Russian industry suffers from widespread corruption, which sees investment funds and profits diverted. Lack of key components that can’t be imported means industry is struggling to produce. The loss of basic manpower as Russians leave the economy is hampering productivity.

Playing with fire

Russian retaliation to EU and US sanctions has been to cut off gas flows to Europe. A full cut-off to Europe, Russia’s main export market would cost $6.6 a year in lost tax revenues, which can’t easily be compensated by growth elsewhere.

Capital outflows

Global growth

The war has hit global growth. In 2021, growth was 6% but now is expected to be only 2.25%, rather than the 3% predicted before the war.

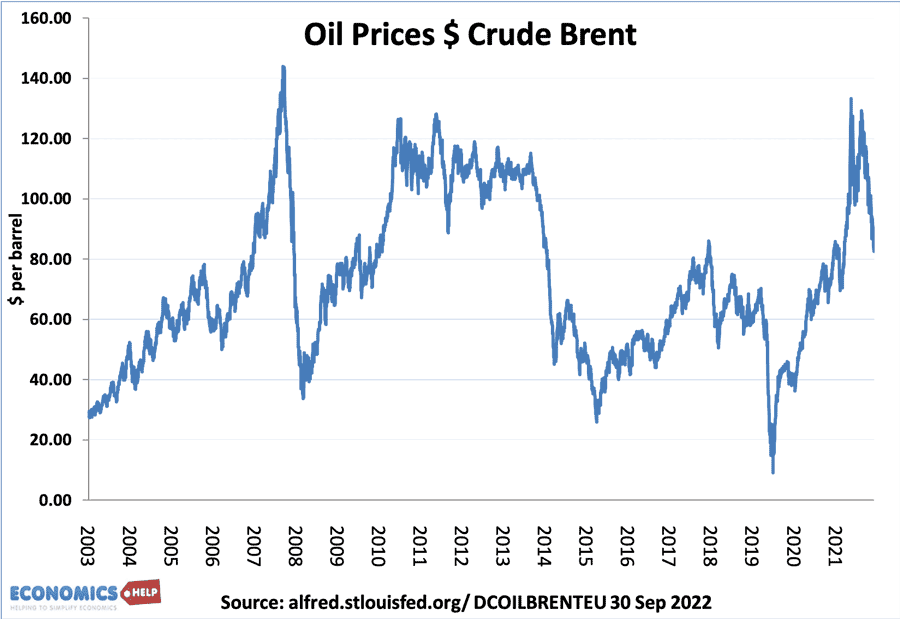

This shows a fall in business and consumer confidence. The problem for Russia is that if the world does slow down or a few major economies go into recession, the price of oil could fall precipitously. For example, look at oil prices.

In 2008, oil prices reached a peak of $145, then in a great financial crisis plummeted to under $40. Such a reoccurrence would severely damage Russian GDP and Tax revenues (almost 50% of Russian tax revenues come from energy sector)

Problems facing Russia

An OECD report from Sept 2023 suggested Germany is likely to go into recession in 2023, despite their expensive efforts to cap the price of gas. Germany is likely to go into recession because of the size of its industry and relative dependence on gas imports.

Germany is preparing to borrow $200bn to cap the price of gas and the EU is proposing an EU wide price cap. However, the concern is that a price cap may backfire, causing supplies to go elsewhere in the world. Also, a price cap may prevent demand from rising and therefore lead to shortages. Such a shortage would be very damaging for EU economy and could break up EU wide unity.

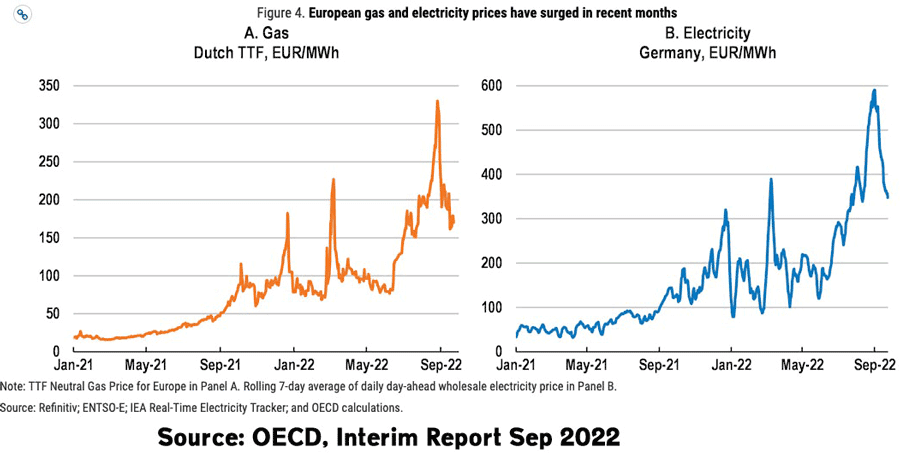

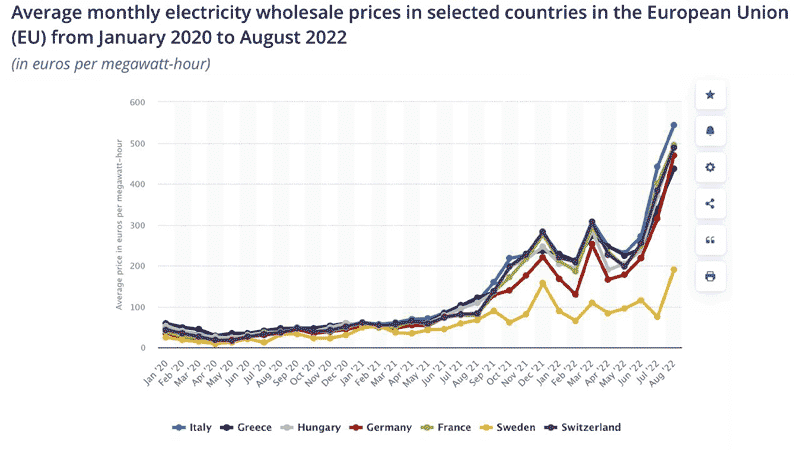

Gas and electricity prices

European gas and electricity prices surged in the early summer months to a record level. However, since the tide of the war started to shift against Russia in summer, prices have fallen down. However, whilst that is welcome news for European consumers, they are still 600% above levels seen in early 2021. Wholesale energy prices

It is hard to underestimate how significant these prices are.

For example, Italy is spending 13% of its GDP on energy compare to 5% in 2019/21. Germany has risen from 3.8% to 9.2%. UK more than doubled 3.7% to 8.0%. Also, long-term weather forecasts for this winter are predicting a cold winter, which will push up gas demand.

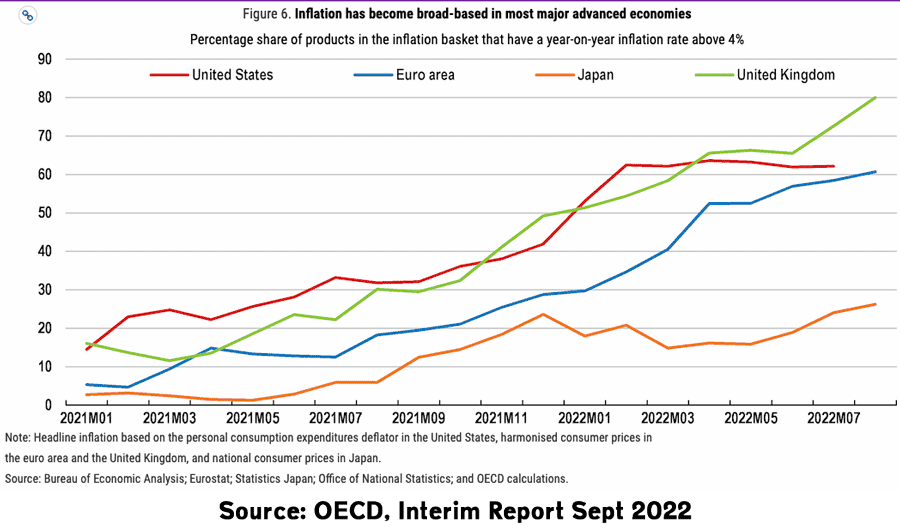

However, it is not just energy prices that are rising. Higher price rises are becoming entrenched in a range of goods. This is because energy affects many aspects of the economy. For example, more expensive gas increases the cost of making fertiliser which increases food prices. But also inflation itself is becoming entrenched with firms pushing up prices where they can.

Impact of gas shortages

The OECD model that a temporary period of enforced reductions in business gas usage in early 2023, would cause a 3% decline in potential output in all EU economies, pushing many countries into full-year recession in 2023.

Oil sanctions

Currently, the EU imports 2 million barrels per day of Russian crude and refined oil exports. However, later in the year once EU sanctions on seaborne oil supplies and maritime insurance from Russia take effect, that will lead to a fall in global supply, equal to 2% of global supply.

OECD “Paying the Price of War” Sept 2022

Pres. Putin is a very convenient scapegoat for the decades of failure by the Brit govmnt to develop an energy contingency plan. The fact that UK has minimal gas storage compared with the EU is a major factor. The EU have enough gas stored to last the winter – the UK does not, so the public are threatened with elec cuts and told to use less. The UK public are not told most of our elec is generated from gas and our lack of gas security is the govmnt fault – not Russias. UK gas/oil is not our own; it’s sold on the international market, so if we make more it will not help our domestic prices that are at the whim of the markets and these markets are not at the whim of Pres. Putin, but are controlled by greedy rich men seeking to strip us to the bone while they get fatter profits. There is all so much more to this than blaming it on Russia – though the conflict triggered the response from the greedy rich men and the USA, which is always seeking profit; esp from war as history shows. The western sanctions will do nothing to Russia – they already have BRICS and will increase relationships with them and others while the west diminishes into dust. From the start of this it was obvious the west shot itself when it imposed these useless sanctions.