On Friday 23 September Kwasi Kwarteng the new chancellor introduced a set of tax cuts and energy price guarantees in a measure the treasury described as a ‘fiscal event.’ Yet even as he was reading out his series of unprecedented tax cuts (as share of GDP, 2nd biggest on record), markets took fright, causing the Pound to plummet and gilt yields to rise.

It was the biggest sell-off of government bonds for decades, breaking 15 years of quiet markets. Just a few days later the Bank of England was forced to intervene using Quantitative Easing to buy government bonds and prevent a rout on the market. Normally sober analysts like the IMF issued rare criticism of G7 governments

“Given elevated inflation pressures in many countries, including the UK, we do not recommend large and untargeted fiscal packages at this juncture.”

Former US Treasury secretary Lawrence Summers declared the budget as “utterly irresponsible” and that “The U.K. is behaving a bit like an emerging market turning itself into a submerging market.” Some City traders were even less prosaic arguing the Conservative party had turned itself into a “Doomsday Cult” oblivious to reality and pursuing “fantasy economics.’

How do things unravel so quickly, so badly? How to explain what is going on?

UK weakness

- Firstly, the UK economy has been doing relatively badly since the great financial crisis. Growth and productivity have been low. Lower than many of our competitors and well below post-war trend rate.

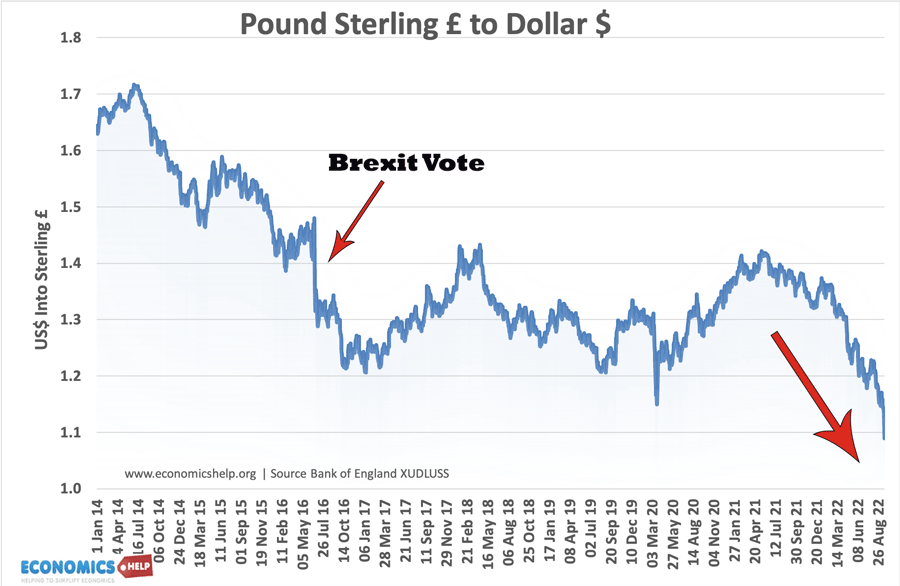

- The Pound has been in steady decline for many years. But since June 2021, had already fallen by around 20% against the dollar and 6% against the Euro.

- Debt has increased since 2007 due to low growth, Covid and is expected to grow because of demographic trends pushing.

- Inflation. Rising energy prices have pushed up inflation to levels not seen since the early 1990s. Also, it is in danger of becoming more embedded in the economy, despite nominal wages falling behind inflation.

- Current account deficit. The UK has seen an increase in current account deficit (despite Pound’s depreciation) and this winter it is expected to worsen as the cost of gas and oil imports rises.

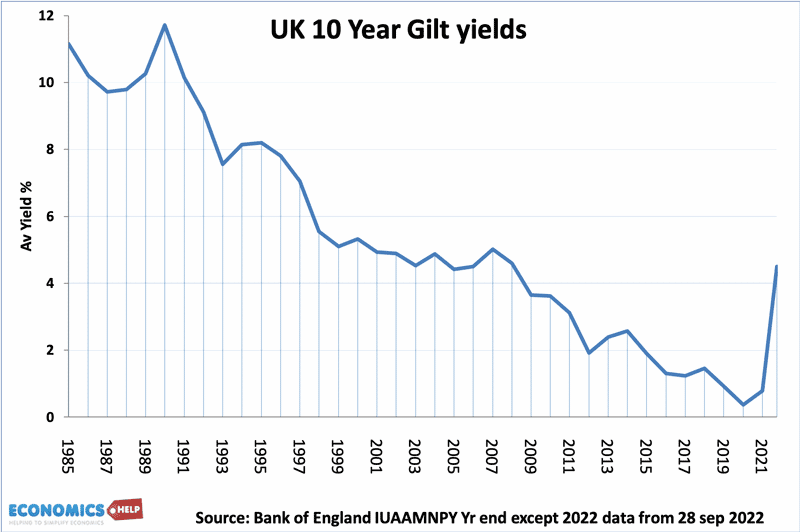

Nevertheless, despite this long-term trends, the bond market has been very quiet. Bond yields were around 2%, still very low by historical standards. Bond issues by the government have been heavily over-subscribed showing strong demand for UK bonds. The Bank of England had even begun quantitative tightening – selling off the bonds it bought in the last recession.

What explains the market reaction?

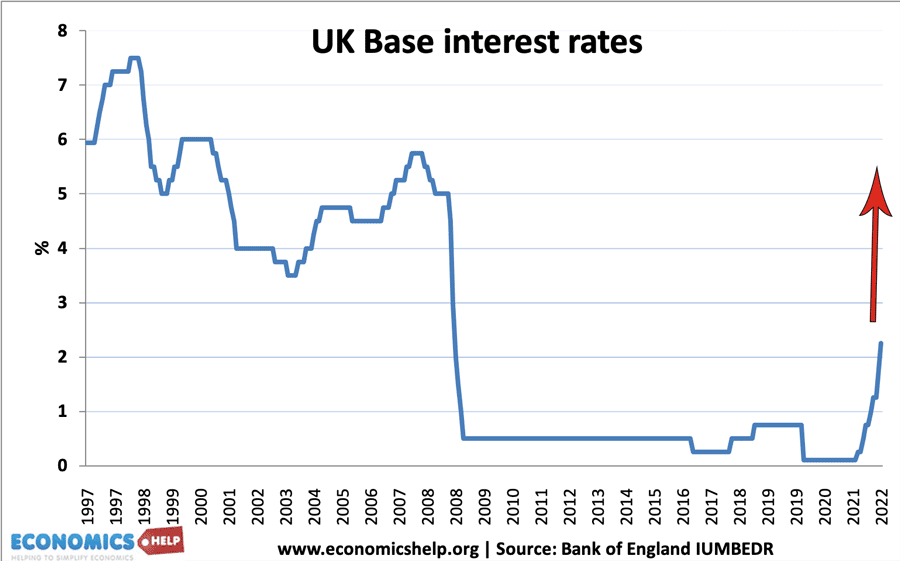

The budget worsened inflation. Providing a massive fiscal boost of tax cuts, increases inflationary pressures – at a time when inflation is already a problem. Higher inflation causes the Pound to depreciate more (UK goods are less attractive). Also, higher inflation reduces the value of real bonds so investors need higher interest rates to compensate.

The budget put upward pressure on interest rates. The market reaction to the budget is that the Bank of England will need to increase interest rates

- To keep inflation closer to its target of 2%

- To prop up the falling Pound. (Higher rates make it more attractive to save in UK)

The unexpected cut in top rate of income tax. A curious feature of the market reaction was that most of the budget was announced in advance. But, Kwasi Kwarteng surprised markets with the abolition of the top rate of income tax of 45% on high earners. On its own, these tax cuts only lose the government around £2.5bn. But, it was symbolic that this government is ideological and willing to pursue unpopular measures and not caring about costing tax cuts. City traders are exactly the kind of people who will benefit from tax cuts and ending limits on banker’s bonuses. So why the adverse reaction?

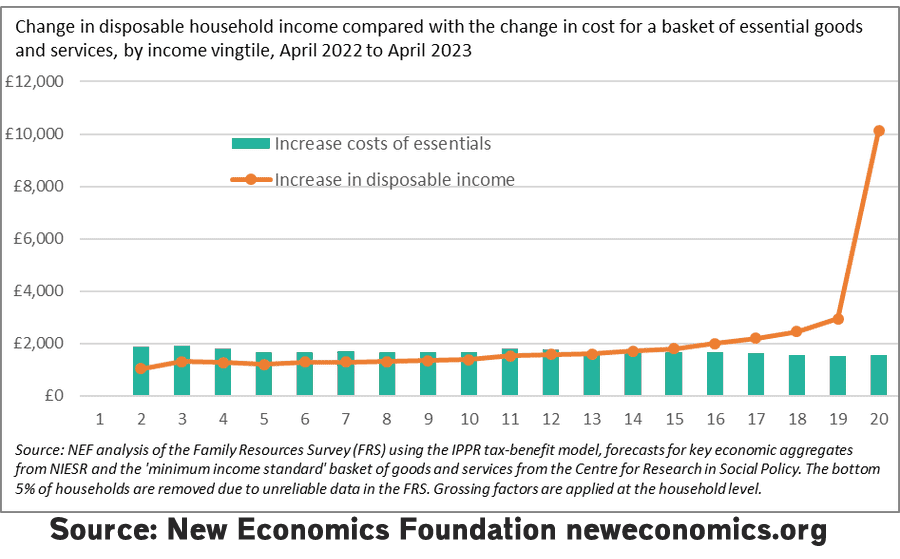

They see the budget as politically unsustainable. Why cut taxes for high earners when low-income and middle-income households are worse off – despite the energy price guarantee?

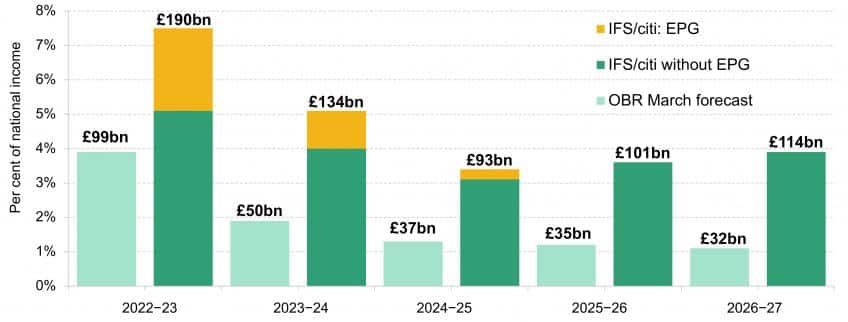

The budget doubled government borrowing with no plan to reduce it

The budget will increase annual government borrowing from around £99bn to £190bn. But, the government did not let the OBR give any assessments of a sustainable path to reducing the deficit and national debt.

Fantasy economics

One city insider argued that the rise in UK gilt yields was due to a ‘moron premium’ not very economic language. But, the point is the government’s plan for paying back debt through a miraculous increase in growth rates was based on wishful thinking, ideology and not any economic reality. The theory you can boost economic growth through tax cuts and deregulation has a certain political appeal. Exponents have included the great Milton Friedman. But, in reality, there is no shortcut to improving growth. (see limits of trickle-down economics). City traders probably like tax cuts, but if they have to put their money where the mouth is, they know these tax cuts are not going to improve the UK’s long-term growth prospects. So we have this big increase in debt, but no real hope that economic growth rates will improve to pay it off.

The arrogance of Chancellor and PM

It is not often personality plays such a key role in economics. But, with regard to market reaction, what people say does matter. Both Truss and Kwateng come with a proud reputation of doing unpopular things and not ‘listening to experts.’ The first action of Kwasi Kwarteng was to sack, the well-respected independent civil servant Sir Tom Scholar, who Kwarteng claimed was too wedded to ‘Treasury orthodoxy – i.e. having a credible plan to reduce debt. After the market rout on Friday, Kwarteng announced the next day, he would have more unfunded tax cuts in March. It is said on Friday night when asked about the falling Pound, he is alleged to have said “I don’t care, it will come back.” Whether he said it or not is irrelevant. After a week of crisis, both PM and chancellor appeared reluctant to come out and defend their decisions preferring to blame ‘over-reaction’ from the markets. The problem is markets do weigh very carefully the words, sentiment and actions of the chancellor and PM. And they don’t like, don’t trust their ability to pursue a sensible correction in policy which would reassure markets.

When Liz Truss went on local radio interviews on Thursday her answers offered little comfort to markets. It seems they slowly realising they need to change and have started to meet with the OBR, presumably to find spending cuts.

Bank of England intervention

The Bank of England has announced a £65bn intervention to buy long-term bonds. It was motivated by concerns pension funds were being wiped out by the rapid fall in bond prices. Ironically, Truss had wanted the Bank of England to end QE and pursue the tighter monetary policy. This is actually a return to QE though for the specific purpose of financial stability rather than monetary stimulus. Having a buyer of last resort is a very powerful way to calm markets and it will government more breathing time. However, this policy has its limits creating more money to buy bonds will not help Sterling, especially at a time of high inflation.

Are there mitigating factors?

Very few have been willing to come out and defend the actions of the government. Rather humorously, some have tried to claim the market reaction was a sudden concern about the inevitable arrival of a Labour government in 2 years’ time.

US monetary policy. A stronger case is that the UK government’s position has been made worse by strength of dollar and rise in US interest rates. However, the crisis is entirely of the UK’s making. The Pound also fell against the Euro, even though the Eurozone has the same issues with strong Pound.

Implications of UK crisis

Higher interest rates. Markets have forecast interest rates to rise from 2% to 6%. This will significantly increase the cost of mortgage repayments and could cause a crash in house prices.

Majority of households are still worse off after budget. Tax cuts targetted at high earners, who are better off. But, many on low and middle incomes will still face a cost of living crisis.

Spending cuts. To appease markets and restore fiscal credibility, the government are expressing a preference for spending cuts rather than reversing tax cuts. Spending cuts would be very damaging given many departments are already threadbare and the NHS facing long waiting lists. Really, the long-term constraints to the UK economy come from education and health care (rise in long-term sick). This will worsen long-term growth.

Permanently higher bond yields. In recent years, the UK government has been able to borrow at exceptionally low interest rates. If the UK now faces higher debt yields because of the perceived risk premium, it will increase debt interest payments and create an opportunity cost of lower spending.

Weak Pound. The crisis has only intensified the pressures on Sterling and it could easily push the Pound below parity of £1 to $1. This will increase future inflationary pressures and reduce living standards for UK households.

Recession imminent. Despite the fiscal boost, it has been poorly targeted on high-income earners, who are more likely to save it. Overall, the fiscal boost is likely to be offset by higher interest rates, rising energy prices (still going up 25% despite the expensive price cap), falling house prices, low confidence and falling real wages. A recession would only give the government worse trade-off with more limited room for manoeuvre.

Further reading

very well done thank you

There is no such thing as trickle down economics (Thomas Sowell). It is a straw man created by opponents of sensible tax and supply side economics. Ireland would not be successful without its low taxes.

THANKYOU !!!

ITS MEANS A LOT FOR ME .GOT A LOT TO LEARN .