In 1974, the National Institute for Economic & Social Research made a report about the UK economy, concluding:

“It is not often that a government finds itself confronted with a possibility of a simultaneous failure to achieve all four main policy objectives: adequate economic growth, full employment, a satisfactory balance of payments, and reasonable, stable prices.”

Two years later, the UK economy was in further difficulties, a run on the Pound, a large trade deficit, rising budget deficit and the UK rather embarrassingly was forced to go to the IMF for a loan. The IMF gave the UK the then-largest-ever loan of £3.5bn, but required deep cuts in public spending and higher interest rates to bring inflation under control. (See: IMF Loan of 1976)

Nearly 45 years later, we see some similarities, but also differences.

Wage inflation

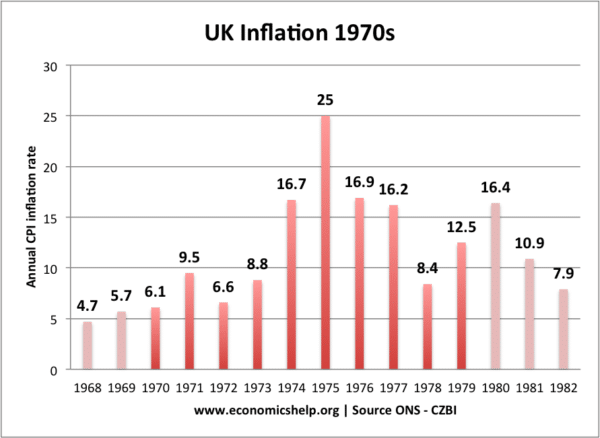

In the 1970s, there was a supply-side shock with OPEC cutting oil supply causing the oil price to triple. This led to inflation of double-digit. However, in the 1970s, this initial burst of inflation led to rising nominal wages as workers successfully maintained real wage increases. This combination of rising costs and wages, pushed up inflation into double digits, reaching a peak of 24.2% in 1975.

In 2022, nominal wages are being squeezed as workers see falling real wages. There is little prospect of strong growth in real wages, as the government look to find spending cuts by keeping a lid on public sector pay.

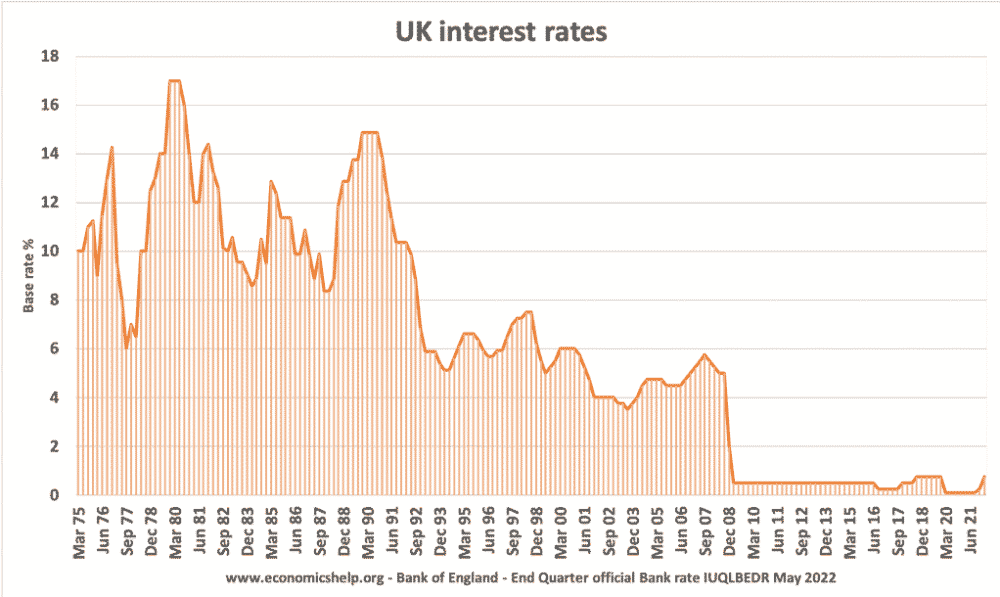

Higher interest rates. In response to the IMF bailout, the UK increased interest rates to an eye-watering 14.5% in an effort to reduce inflation.

What will happen to interest rates in UK?

Interest rates were forecast to rise this summer, due to high inflation and the weak Pound. Also, the fact the US is tightening interest rates strengthens the dollar and puts pressure on other countries to also increase interest rates, so as not to lose too much value of the currency.

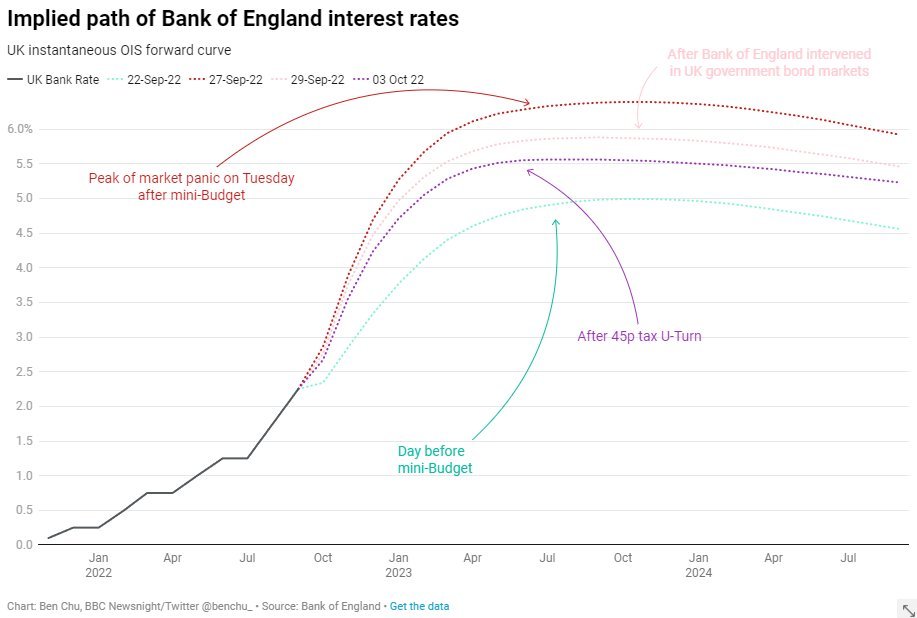

The mini-budget did cause an increase in the expected rise in interest rates as markets reacted to the inflationary impact and decline in public finances.

You can see that before the mini-budget, interest rates were forecast to rise to 4.0% in Jan 2023. The budget caused markets to price in interest rates of 6%. Since the 45p tax U-turn, Bank of England intervention and talk of strict spending limits, expected interest rates have fallen back to 5.5$ – still above the pre-budget level.

This is the cost of unfunded tax costs – higher mortgage payments and higher loan fees for business

Source: Sky News

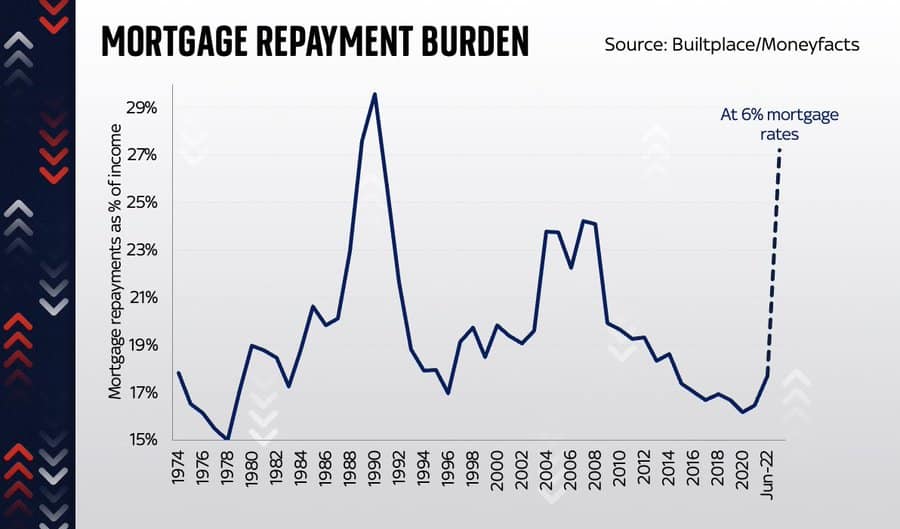

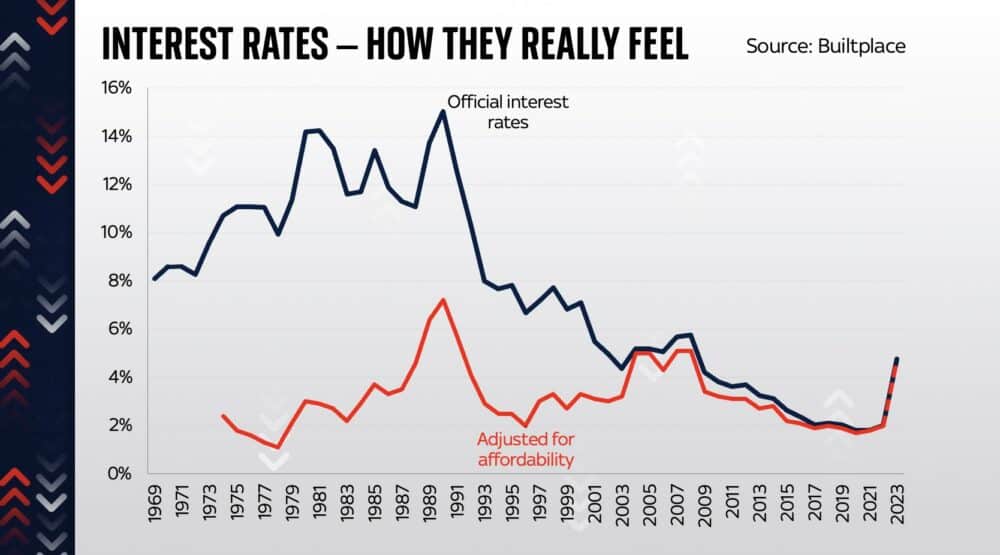

If interest rates do rise to 6%, we can see how mortgage payments as a % of income will rise to levels not since the housing price crash of the early 1990s. It is noticeable that in 1992, interest rates peaked at 15%, but now in 22, even a mortgage rate of 6% would cause big decline in affordability. The reason is house prices are so much higher and so average mortgages are much higher.

This is a similar graph showing interest rates adjusted for affordability.

An old student recently got in contact saying he was taking out a large mortgage and the new offer was either 2 years fixed at 5.5% or 5 years fixed at 5.5% which is better? Economic predictions over 6 months are notoriously difficult. But, it may be in the long-term, we return to the period of low-interest rates we have seen during the post-financial crash. I will explain in a later post. However, a fall in interest rates for two years hence will not be much comfort for those struggling with the cost of living now.

Bank of England intervention

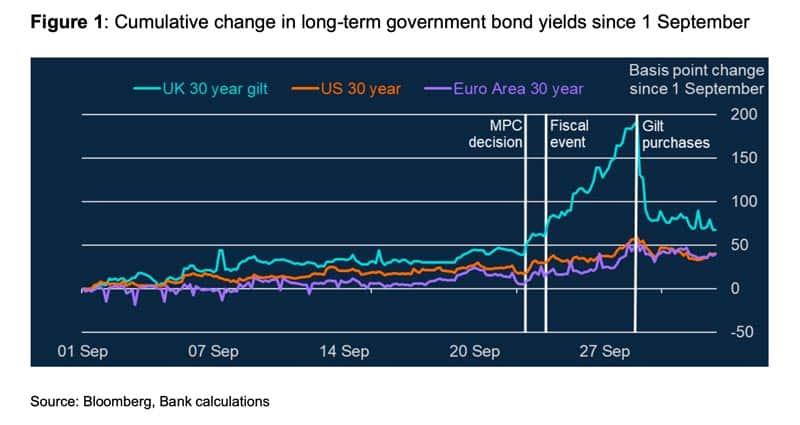

To calm bond markets and prevent a meltdown in pension funds, the Bank of England stepped in to pursue a new form of quantitative easing where the goal is simply to stabilise bond markets and prevent rapid fall in bond prices. Their intervention has been quite effective, reversing some of the rising bond yields.

The Bank of England made it very clear – who they blamed for the rise in gilt yields, pointedly contrasting rising UK yields with US and Euro area. It also shows how gilt purchases bought yields back down

As a result of this Bank policy, I heard a few jokes to the effect of – how come the chancellor lost £65bn on their first day in office – but he’s still in a job?

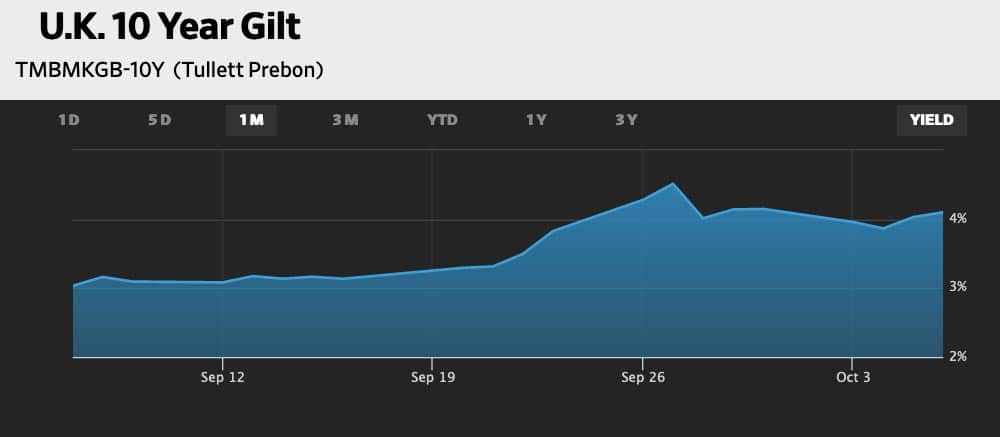

He certainly had a bad day at the office, but he didn’t lose £65bn for two reasons. Firstly, QE means the Central Bank creates money electronically. In other words, there is no opportunity cost of lower spending or higher taxes. Secondly, once the Bank of England started buying bonds (at low prices), bond prices rose and the Bank is technically sitting on a profit. The Bank could sell these bonds and make more money (in theory, though bond prices would also likely fall if they sold in a sudden). Whilst this intervention was successful, it is time limited. The government can’t rely on continued intervention. Creating money at this stage with inflation of 10% does create the risk of inflation. Before the crisis, the Bank was actually reversing QE and selling bonds. It will want to return to QT when it can. Therefore, although bond yields have recovered somewhat. However, as the Bank stopped buying bonds yesterday, bond yields have gone back up.

Source: WSJ

Yields rose when Bank stopped buying today.

Inflation

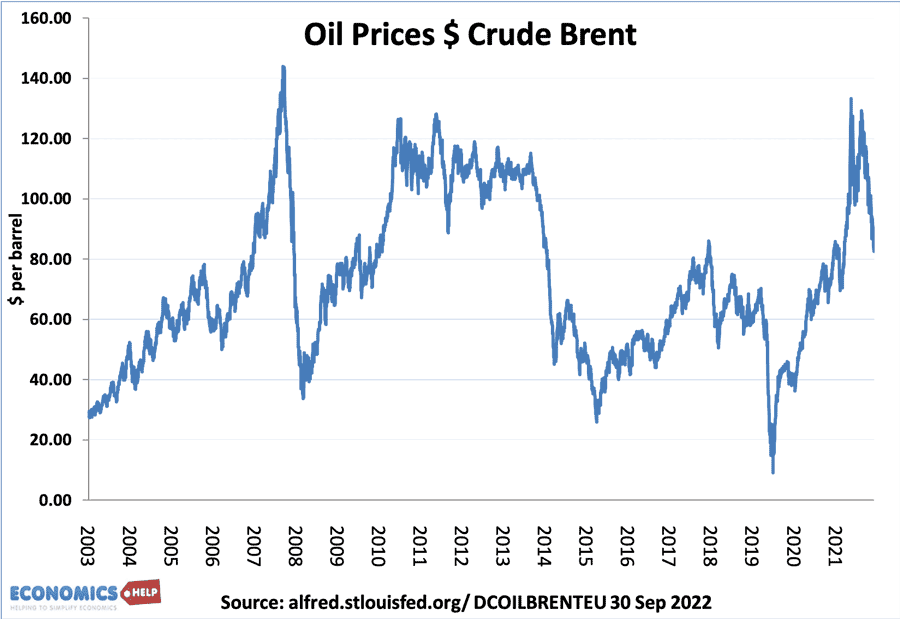

Recently I made a post about the Russian economy, predicting that a global recession could cause a sharp fall in oil prices as it did in 2008 when oil prices slumped from $140 to $40.

However, shortly after that OPEC+ (which includes Saudi Arabia and Russia) surprised many people by planning to cut output by 2 million barrels a day. Their reasoning is they don’t like recent falls in price (though others suspect geo-politics). This cut in oil supplies will reverse recent price falls and put upward pressure on inflation. It will also be a boon for the struggling Russian economy.

Global recession

The World Bank has warned that simultaneous rate tightening across the world is increasing the risk of a 2023 recession.

Analysts say that there are early warning signs of a global recession in indicators such as a strong fall in German exports in July and worse sentiment among German exporters since Covid times (Reuters) Even in the US leading indicators like rents and house prices are suggesting future problems. Analysts argue CPI and wage growth is more of a lagging indicator and as a result the Fed may be tightening too much. Perhaps wanting to avoid a 1970s experience (though there is little evidence of 1970s-style wage inflation.)

How does a global recession affect UK households? Well, if the world goes into recession, it will definitely drag the UK further into recession, leading to unemployment and more downward pressure on living standards. Despite Brexit, we are more reliant on trade than many economies. Also, the negative effect of a global recession would feed through into lower investment and lower economic growth.

Impact of tax changes

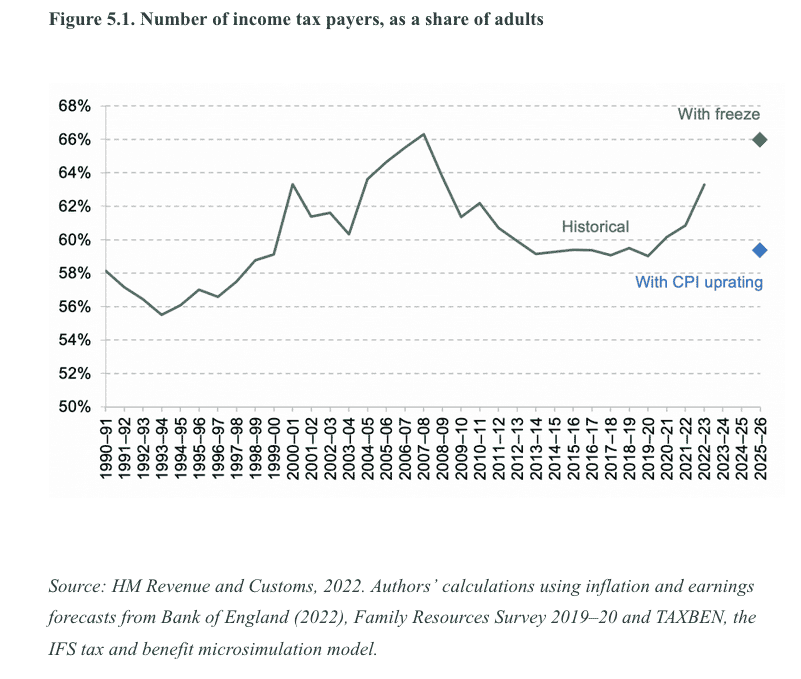

Whilst there has been much coverage of the £43bn unfunded tax cuts. Another aspect of recent tax changes will actually raise revenue by stealth. This is the decision to freeze income tax thresholds – rather than rise in line with inflation. This matters because when inflation is high, more people will find themselves – paying tax and also moving into higher tax brackets. It is sometimes called bracket creep.

This paper from IFS shows how more adults will start paying income tax as more slip into the lower threshold for income tax.

“Freezes to personal tax parameters alone will reduce households’ income by £1,250 on average by 2025–26. Adding in freezes to benefits and gradual policy roll-outs brings that figure to £1,450, or 3.3% of income, and means a £41 billion boost to the exchequer.

In other words, on average for every £1 households gain from high-profile cuts to rates of income tax and National Insurance, they lose £2 from the freezes and policy roll-outs.”

How come taxes will be going up despite high-profile tax cuts?

It reflects the poor performance of the UK economy. Declining labour participation, rising long-term sickness, Low growth, stagnant real incomes, but increased pressure on government spending (health care, pensions). This is why you can understand why a government would want the higher growth rates which characterised the post-war period – you can meet public spending without having to squeeze in tax increases. Whether the government’s tax cuts will do anything to boost economic growth, is highly debatable. (see effect of tax cuts)

More in depth reading