The UK voted to leave the EU in May 2016. It formally left the EU on 31 January 2020. The transition period ended on 31 January 2021. At this time, UK trade with the EU is subject to new paperwork, customs checks and import duties. The impact of Brexit has been made uncertain due to the economic shock of Covid and rising energy prices. However, early indications are that Brexit is causing a significant supply shock to UK trade, investment and economic growth.

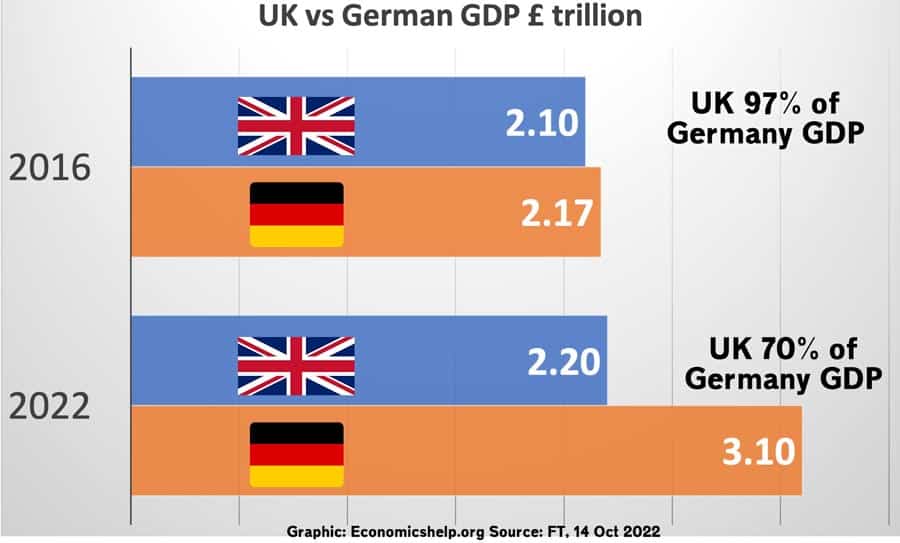

For example, relative to other countries, UK economy is falling behind. As Mark Carney recently pointed out in FT interview.

Jan 1 2016

- UK GDP was £2.10 trn or 97% of German £2.2 trn.

2022

- UK GDP £2.17 trn or 70% of German £3.10 trn.

(Note on this stat. Mark Carney got this figure by comparing GDP in $US. Therefore, the relative decline is mainly to do with relative decline in value of Pound Sterling against the dollar. A better guide to compare growth rates would be to compare GDP in PPP. On this metric, the difference is small)

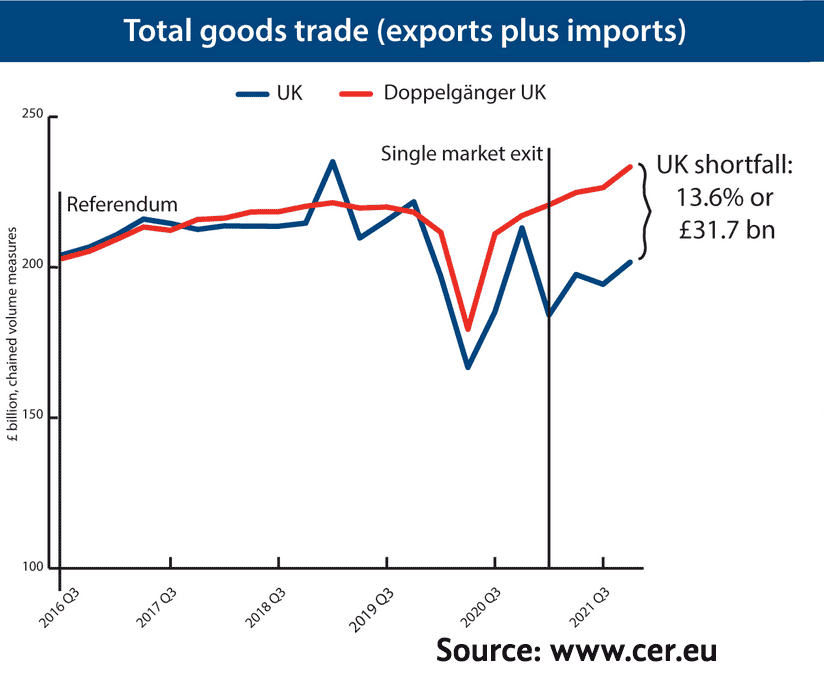

Loss of Trade Goods

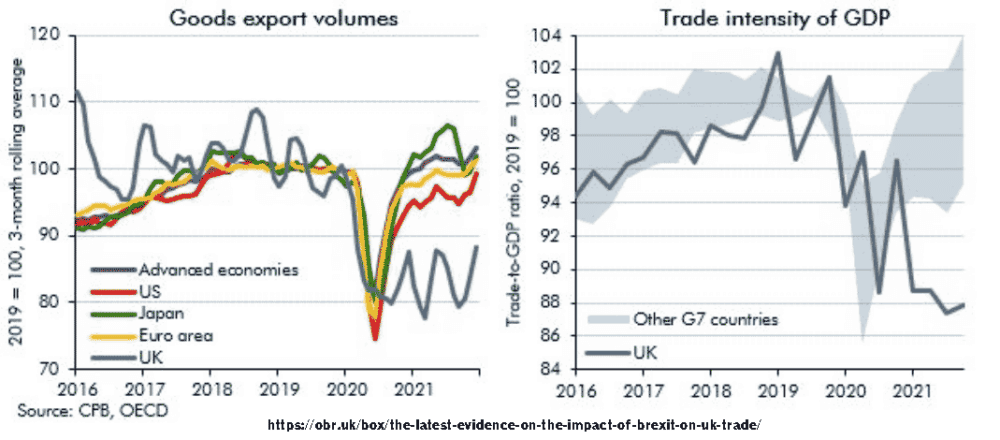

This is matched by the OBR’s own research, which shows how compared to other countries, UK trade has fallen behind.

Although the pandemic hit all countries, UK export volumes were particularly affected. The latest statistics from this summer (August 2022) show some recovery with exports to the EU rising 6.2% in three months to Aug 2022. Though imports fell 0.5% in the same time period.

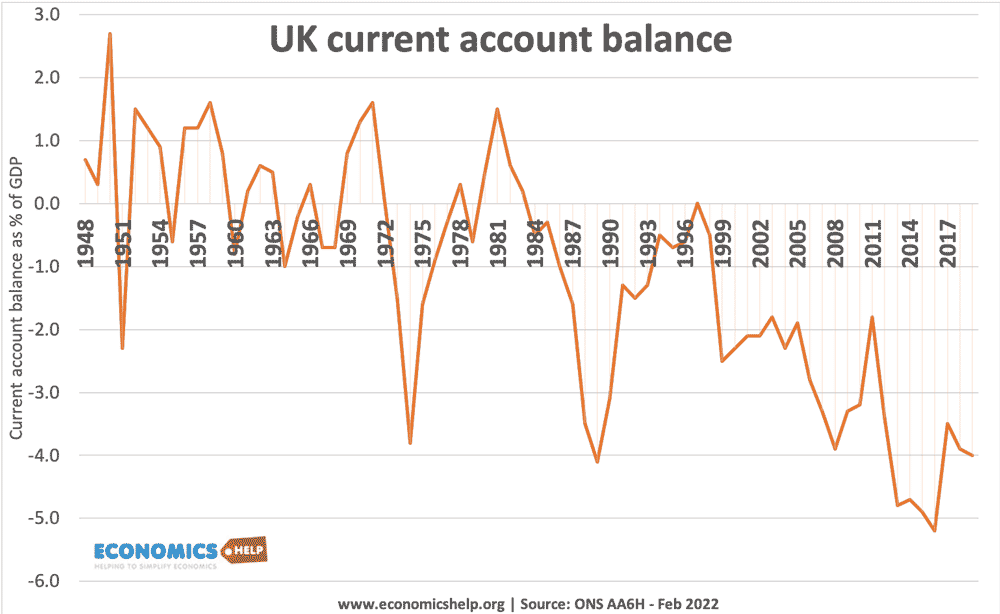

However, most concerningly is the growth in the trade deficit, which is forecast to worsen this winter because of rising energy prices.

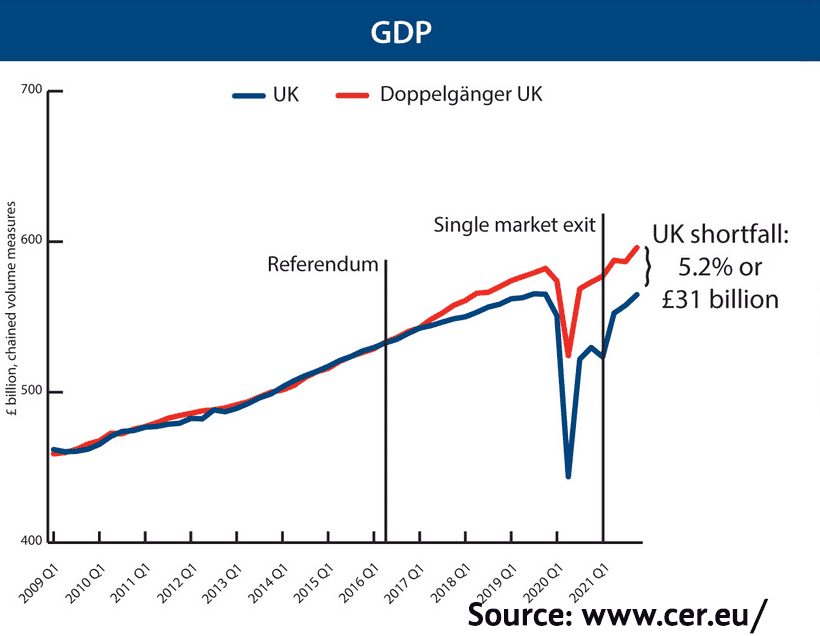

Cost in terms of GDP

Brexit has put downward pressure on UK economic growth for a few reasons.

- Firstly, increase in trade friction with our main trading partner EU.

- Outside the Single Market, the UK is less attractive to foreign investment. UK firms have begun relocating to Europe. (Some 43% of financial firms plan to move some jobs to Europe.

- The loss of free movement of labour has exacerbated labour shortages in certain industries.

Impact of lower growth due to Brexit

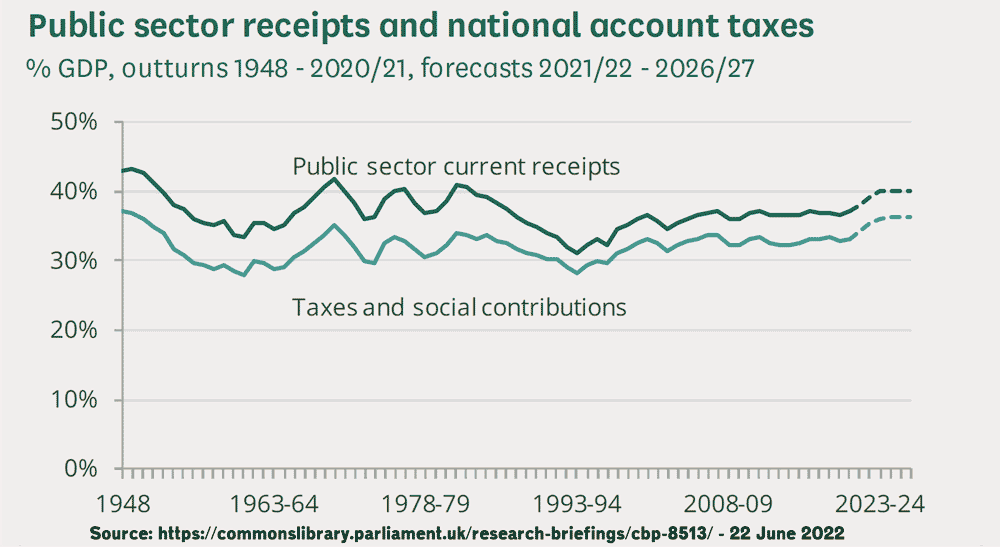

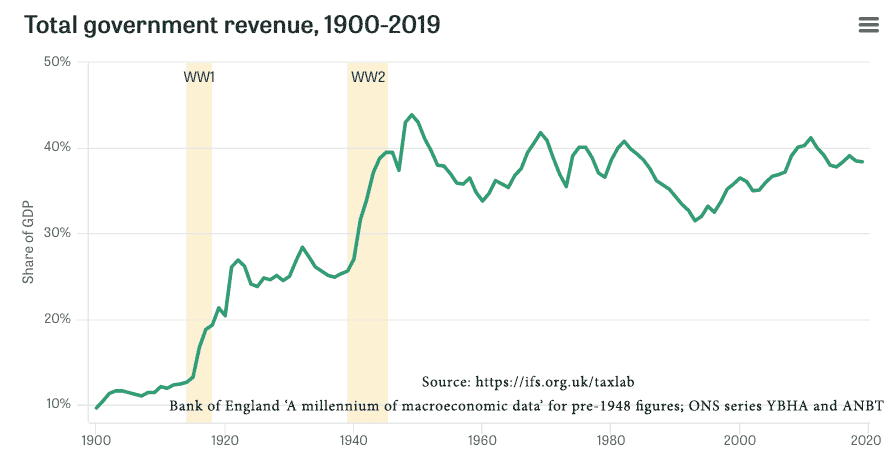

This loss of GDP places any chancellor in a difficult position – putting pressure on a government for higher taxes and/or spending cuts. Of course, with the recent unfunded tax cuts (partially reversed) it puts even more pressure on government spending at a time of poor demographics (ageing population, putting pressure on health care and pensions) It is one reason why taxes are rising to their highest level as a share of GDP for many years.

Source: Parliament UK

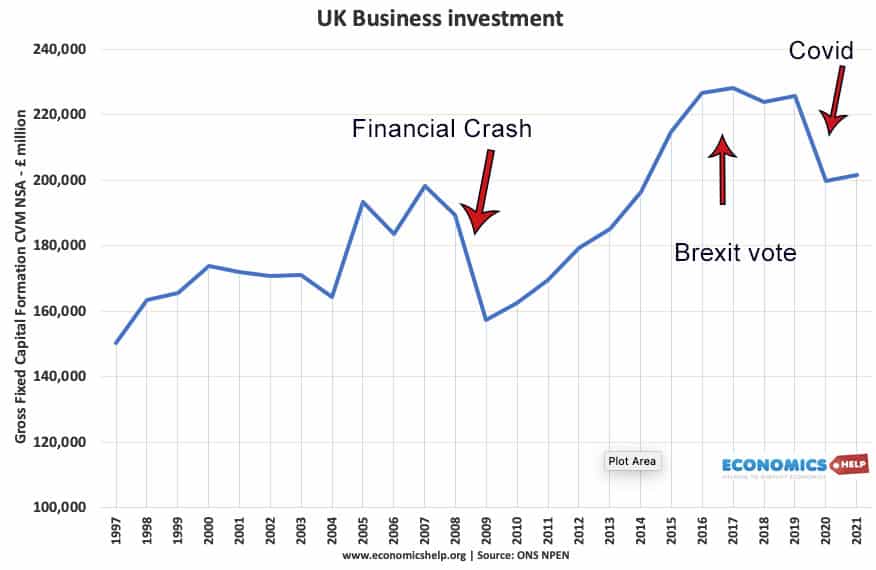

Loss of Investment

Outside the Single Market, the UK is less attractive for multinationals. If possible firms want to avoid the extra regulations, red tape, custom forms, tariffs and uncertainty of Brexit UK.

Source: ONS NPEN

Investment is 13.7 per cent lower. In a group of 22 advanced economies, only Japan has a worse performance than the UK.

What damage has Brexit caused?

- Trade barriers outside the single market. Exporting goods to EU used to be frictionless with a zero-tariffs, now there is more paperwork and customs duties. UK exporters have to prove they are meeting EU regulations. The UK is treated like a ‘third country such as Brazil or US. This has led to 14% fall in exports to EU.

- Importing goods from EU now requires customs declaration and more paperwork. 2021 saw a record rise in customs duties “Between July 2020 and June 2021 the total raised from tax duty was £3.4 billion, but from July 2021 to June 2022, it increased to £5.1 billion.” (link)

- This is partly due to rising prices, but also the effect of Brexit. ” tariff on goods imported from EU, by originating from non-EU countries.

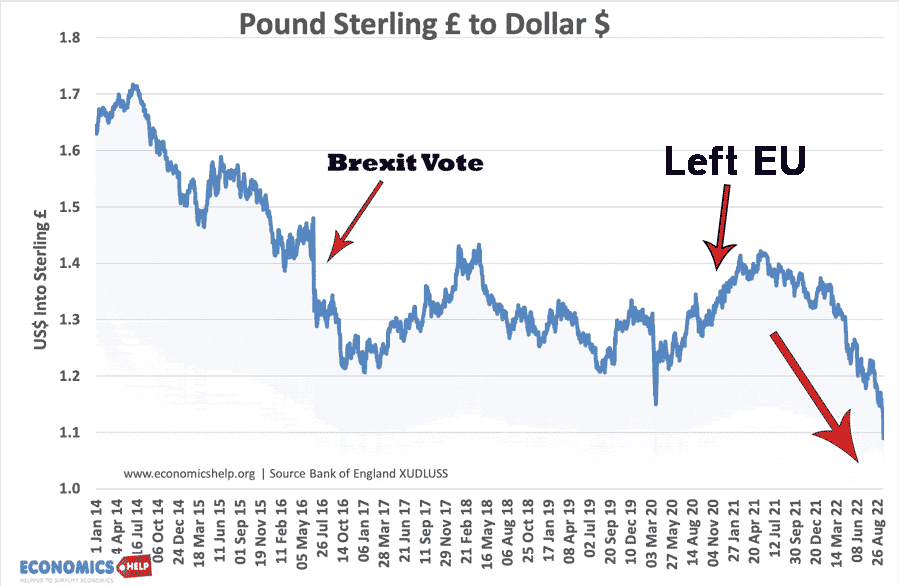

- Higher import prices from the devaluation of the Sterling.

See more on falling Pound Sterling

- Passport checks at the border have caused queues for lorries and passengers travelling to the continent. With passengers needing their passports stamped, it has added an extra 15 seconds per passenger. As a result, Eurostar has cut services from London by a third. The reduced supply of trains has pushed up prices. See: Post-Brexit checks for Eurostar

- Exacerbated labour shortages. Labour shortages have been a global issue with early retirement, a rise in long-term sickness, but, especially for some industries, such as agriculture and hospitality, Brexit has made it harder to fill vacancies. (link)

Brexit and mini-budget

The impact of Brexit can be seen in the recent disastrous mini-budget which included £43bn of unfunded tax cuts in an attempt to boost economic growth, but this ended in a humiliating u-turn as markets knew that tax cuts would not reverse the recent decline in the UK economy. The problem is that with UK debt forecast to rise, the costs of Brexit are particular bad timing.

Further reading

Some helpful figures here. My understanding is that Johnathan Portes agrees that Brexit has had a negative impact on the U.K. economy and trade (hardly a surprise) but has attacked Mark Carney’s comparison between the U.K. and Germany since 2016 based on PPP. I’ve always found the issue of how best to compare countries (nominal GDP v PPP for example) quite difficult to understand. I believe China may be bigger than the US on a PPP basis (well, at least pre covid), though most economists think this is misleading (?) Would you be able to clarify this in a future posting, in particular what you think about the Portes and Carney disagreement. Many thanks.

I agree Mark Carney’s comparison on $US is a misleading stat, and better to use PPP.

Thanks. I note the added text on US dollars and I now get that point… As I say, it would be good if you could do a blog on PPP and how best to compare economies at some point in the future (perhaps already done?) as I think there is a quite a lot of confusion about this. I thought there was currently scepticism among many economists as to whether China would surpass the US any time soon (perhaps ever), though on a PPP basis it may already have done so (?) Thanks again.

Trust an economist to use GDP rather than GDP per capita or GDP PPP per capita to bias a report.

Also the use of Germany as a comparison is highly biased. France, Italy and Spain should have been included.

Lastly the total misunderstanding that Brexit was about economics is profoundly shocking. The MPs who caused the Referendum were deeply concerned about the fact that the EU Constitution of 2004 was built into the 2009 Lisbon Treaty. France and the Netherlands rejected the Constitution in referendums in 2005 because it contained the mechanism for entirely removing national sovereignty in the coming decades (yes, it was a Constitution).

Remain and the corporate media did an excellent job of diverting the attention of the population to economics rather that the constitution.