Readers Question: my question is whether economic instability means high and fluctuated inflation, employment and unsustainable growth or has other definition?

Economic instability can take various forms. In recent years, we have witnessed a few examples of this. The main types of instability are:

- Inflation – The cost-push inflation of the 1970s. In extreme cases, hyperinflation, e.g. Zimbabwe 2008

- Credit crunch – When the financial sector becomes short of liquidity causing a fall in bank lending, e.g. 2008/09

- Asset bubbles/bust – When asset prices rise rapidly due to irrational exuberance – but then fall.

- Economic growth/recession

- Balance of payments crisis – Countries reliant on a commodity like oil, can be adversely affected by fall in price – leading to capital outflows, e.g. Venezuela, Russia (2016)

- Bond crisis – Eurozone crisis of 2012 saw a rapid rise in bond yields due to high debt and a shortage of liquidity.

More detail on Types of Economic Instability

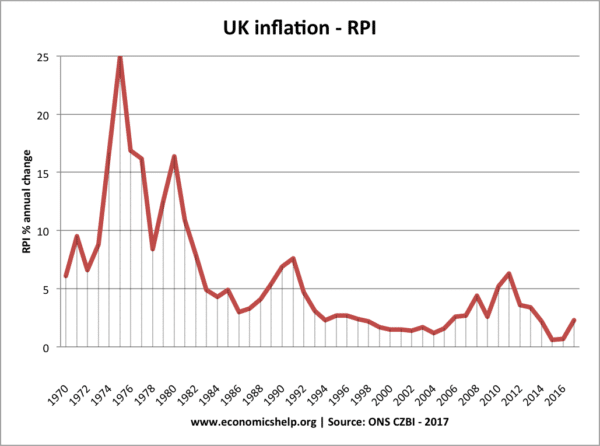

Inflation

In the 1970s, the UK (along with other Western Economies saw inflation above 20%). This was due to higher oil prices, rising wages and inflation expectations. The high inflation created uncertainty because

When prices are rising rapidly, firms and consumers become uncertain about future costs, prices and profitability – this uncertainty tends to reduce their willingness to invest. When inflation is very high and when inflation is above interest rates, the real value of money can decline quickly causing savings to fall in value. In the 1970s, many investors who bought government bonds saw the real value of their savings decline.

Further reading – costs of inflation

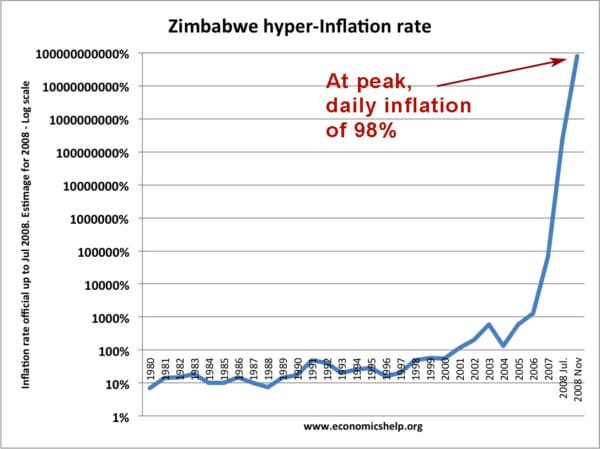

Hyperinflation

In extreme cases, inflation can get out of hand and make ordinary economic transactions difficult. For example, in Zimbabwe, the government responded to a declining economy by printing money, but this caused money to rapidly lose its value.

When money loses value, economies can become very unstable as consumers have to resort to a barter economy. For example, the hyperinflation of Zimbabwe created great economic misery and a collapse in living standards. At its peak, Zimbabwe had a daily inflation rate of 98% – making ordinary transactions difficult as people lost confidence in money.

Further reading – hyperinflation

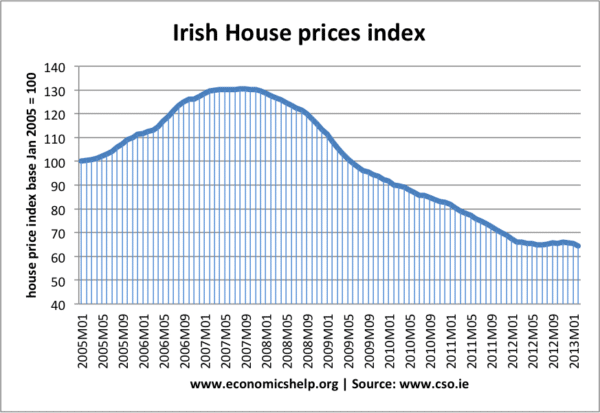

Asset Bubbles

In the early 2000s, there was a global boom in housing. Countries like US, Spain and Ireland saw rising house prices – which encouraged a boom in building. However, the asset bubble proved unsustainable and when the market turned, house prices fell. A volatile housing market affects the reset of the economy. Rising asset prices (especially housing) encourage spending as people remortgage their house. But, a fall in house prices causes this wealth effect to evaporate and people become cautious over spending. The fall in house prices in US and Europe was a significant factor behind the recession of 2009.

Bond crisis

In 2011 and 2012, the Eurozone saw a shortage of liquidity in the bond market. This caused bond yields to rise as markets were less willing to buy government bonds. This led to pressure for fiscal austerity – which in turn led to lower economic growth.

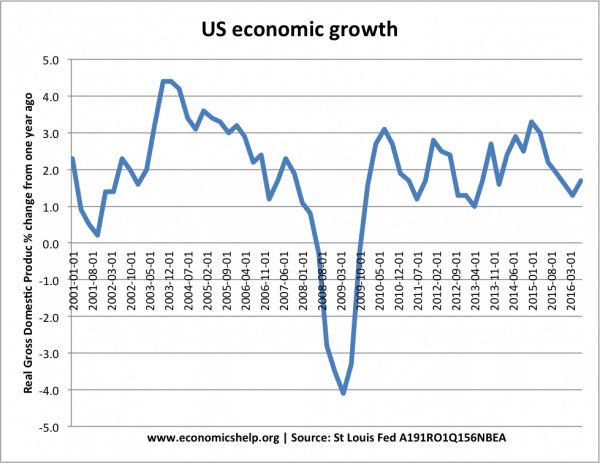

Economic growth/recession

Volatile rates of economic growth have important implications on economic stability. In a recession, with falling output, there is a rise in unemployment, poverty, fall in confidence and a rise in government borrowing. Recessions can cause firms to go out of business so they become more risk averse about investing.

Central banks endeavour to keep economic growth stable and avoid ‘boom and bust‘ cycles – where growth is rapid causing inflation, but followed by an economic downturn.

Balance of payments crisis

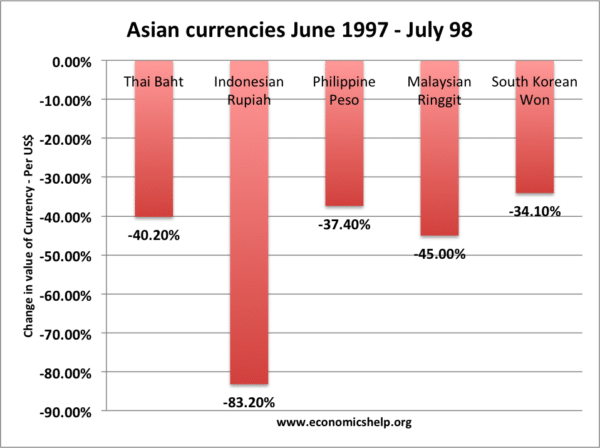

A balance of payments crisis occurs when a country struggles to meet foreign repayments. For example, if export revenues fall (due to falling in oil prices), there will be a rapid deterioration the current account balance of payments. This will cause a depreciation in the exchange rate. If the depreciation is rapid, it can cause individuals to try and put their money in foreign currency to protect its value. This leads to capital flight and can put further pressure on the currency. As the currency devalues, it causes inflation and increases the cost of foreign debt repayments.

The South East Asian crisis of 1997 occurred when foreign investors lost confidence in these emerging economies and sought to withdraw funds. It led to rapid depreciation and further falls in confidence.

Further reading – Asian financial crisis of 1997

Other types of economic instability

Confidence. Economic instability is linked to confidence. When the economy shows signs of instability, consumers and firms become risk-averse. Typically, when people worry about the future, they save a higher % of their income. This higher saving rate can cause a larger fall in output and more instability. It is known as the paradox of thrift.

Labour Unrest. Large-scale strikes can cause lost output and a shortage of key public services. (e.g. The Winter of discontent in the 1970s)

Banking system. When banking system ran out of credit and there was a fall in interbank lending, many realised how reliant on the banking sector the economy was.

In my country, Nigeria, some of the causes of economic instability are more than the above. They include, unemployment of the youth graduates, lack of peace because of constant kipnapping of foreign nationales and killings of security personnel, high degree of corruption, poor transportation, communication, banking and insurances policies, lack of increase in agricultural activities, poor electricity supply and host of other related factors. Thus if you can supornsor me, I would conduct a research on the topic: NIGERIA’S ECONOMIC INSTABILITY CAUSES.’

But wat can be d main reason for instability of price in Nigeria