Is the UK housing market fundamentally overvalued?

Recently, I came across an interesting video which likened the UK housing market to a giant ponzi scheme. But is UK housing like a pack of cards waiting to tumble or are the outrageous prices a reflection of market forces?

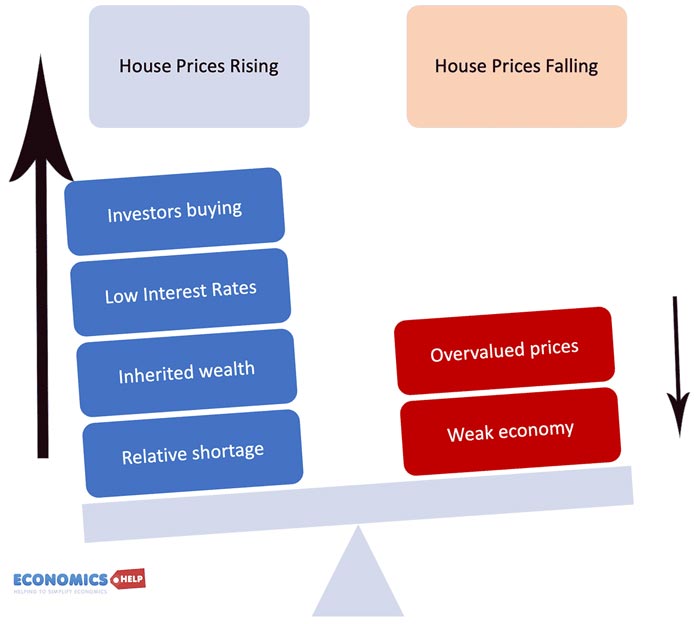

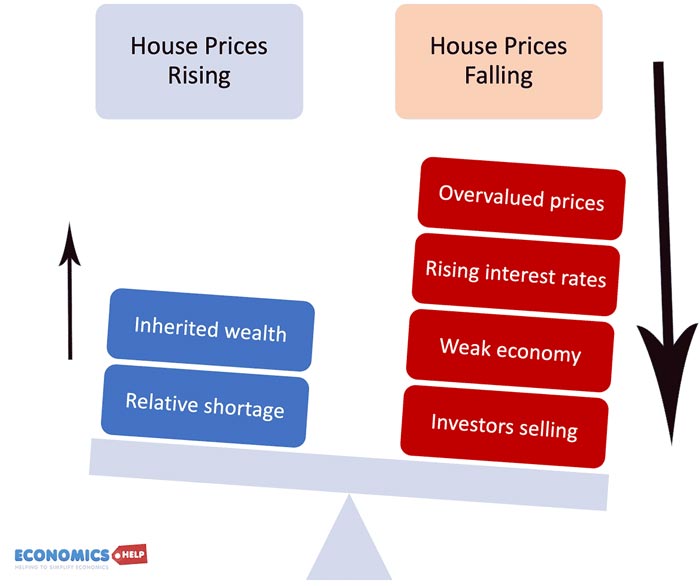

We can think of the housing market like a see-saw. Pre 2022, there were more factors pushing up prices, but recently the balance has decisively shifted with more factors on the side of falling prices.

Let’s explain.

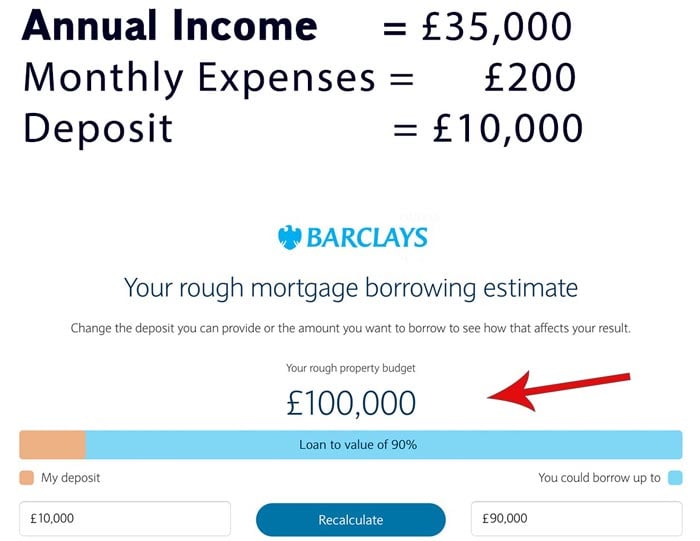

In one of the cheapest areas in Oxford, but a 3 bed semi can easily fetch £350,000. At least 10 times the average Oxford salary of £35,000. According to this mortgage calculator an average salary of £35,000, would only be enough for a £100,000 mortgage, which in Oxford would struggle to get you a garage.

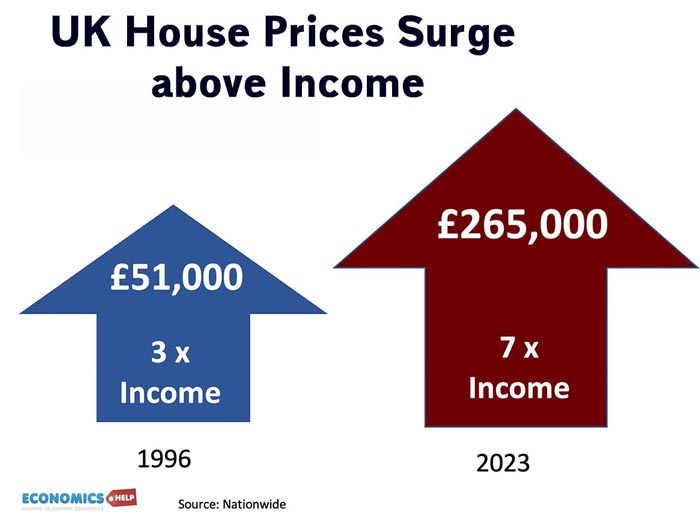

27 years, average UK house prices were £51,000, 3 times average salary. Today they are £265,000, and crucially 7.0 times average salary. If you prefer the ONS Calculation, the ratio is nine times.

In most of the post-war period, house prices were 3-4 times income, which is conveniently similar to the average mortgage lending multiple of banks. But, in recent years, this has been broken. The question is why and can it be sustainable?

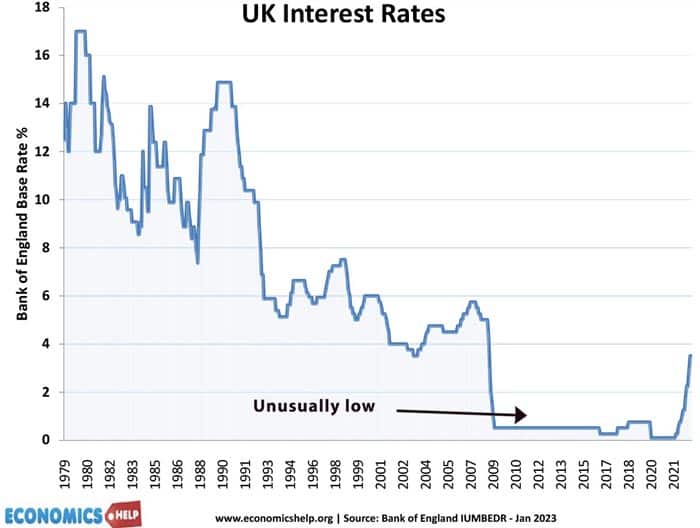

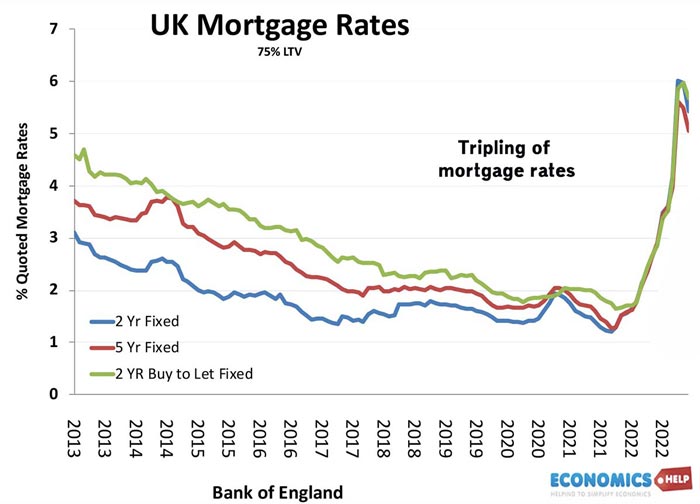

Firstly, low-interest rates have led to historically low mortgage rates, meaning, investors have a logic to buy housing, rather than say bonds, In the past 20 years, rising prices and low interest rates have encouraged a ‘ponzi’ style reinvestment. Investors rely on rising house prices to make profit, encouraging them to buy new properties. Rising prices fuel more speculative buying and a further push to prices.

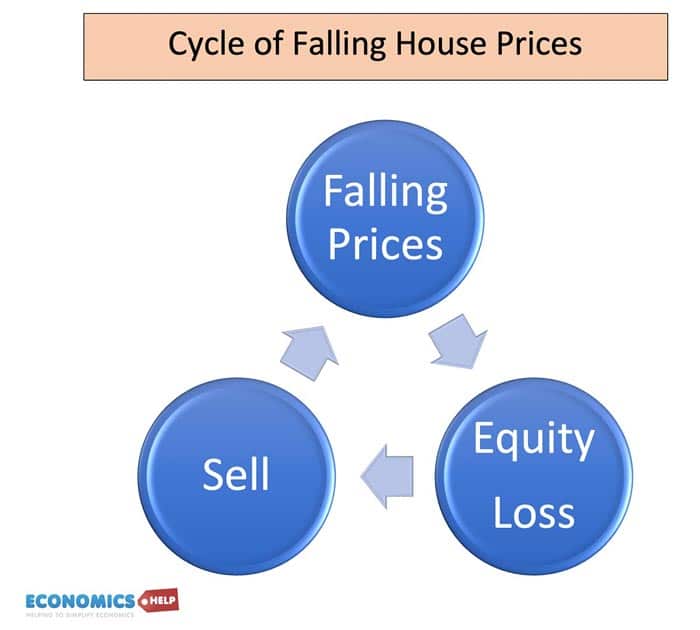

But the problem is – this can easily go into reverse if two things happen – higher interest rates and falling house prices. If interest rates on a £300,000 mortgage rise from 2 to 6%, landlords may struggle to break even – even with very high rents. The recent rise in mortgage rates is crucial for pushing us to a point last seen in 1991 and 2007.

And for those who say interest rates are low by 1990s standards, the difference is we have much more mortgage debt because of the very high prices.

Secondly, if prices fall, who wants to buy to let and be left with negative equity? If investors stop buying and even sell existing properties, it adds to the negative cycle. We only have to look at many recent examples of significant house price falls 1991, 2008. Or further afield, Canada, and New Zealand are all seeing 20% falls in house prices.

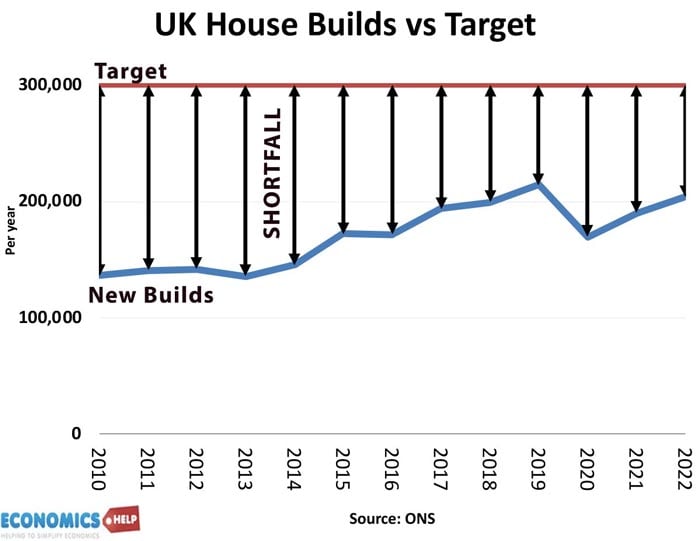

But the story doesn’t stop there. Firstly, as we are often told, the UK has an acute shortage of housing relative to the growing population. The government target of 300,000 new homes a year, fails to be met. So this shortage would help keep prices high.

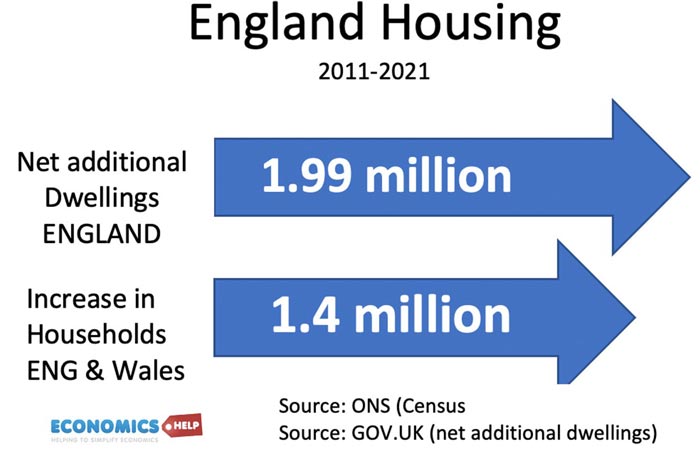

However, is it that simple? This is perhaps controversial, but is the UK’s housing shortage really so acute? Between 2011 and 2021, the number of households in England and Wales rose 6% or 1.4 million, but the net number of dwellings in England alone rose by nearly 2 million. This means supply rose faster than demand. Now, there are housing shortages in some areas, and there is a very real shortage of privately rented accommodation. But, the overall shortage is often exaggerated and if UK house prices are not being propped up by a shortage of supply. It means prices are more vulnerable to rising interest rates.

So, if there is no acute shortage, how come people are able to keep paying ever higher income multiples?

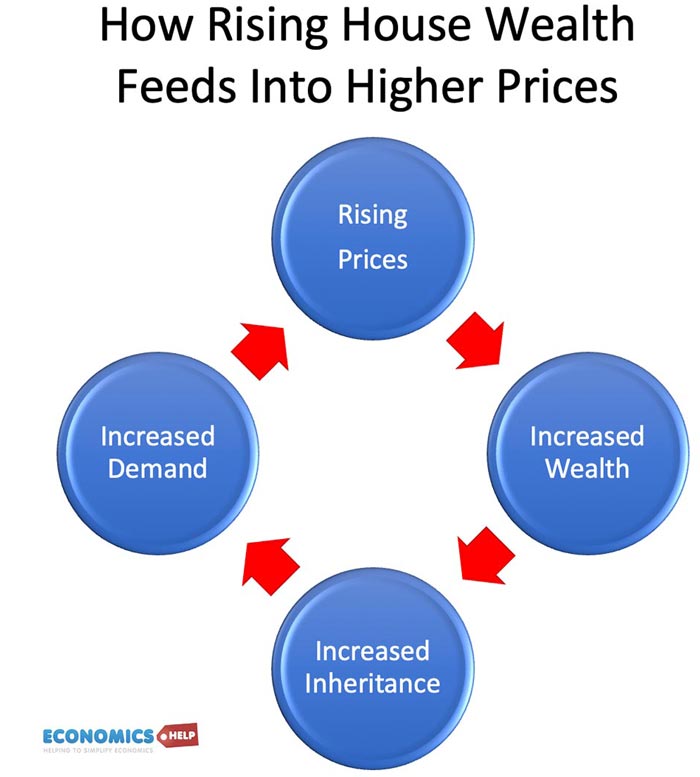

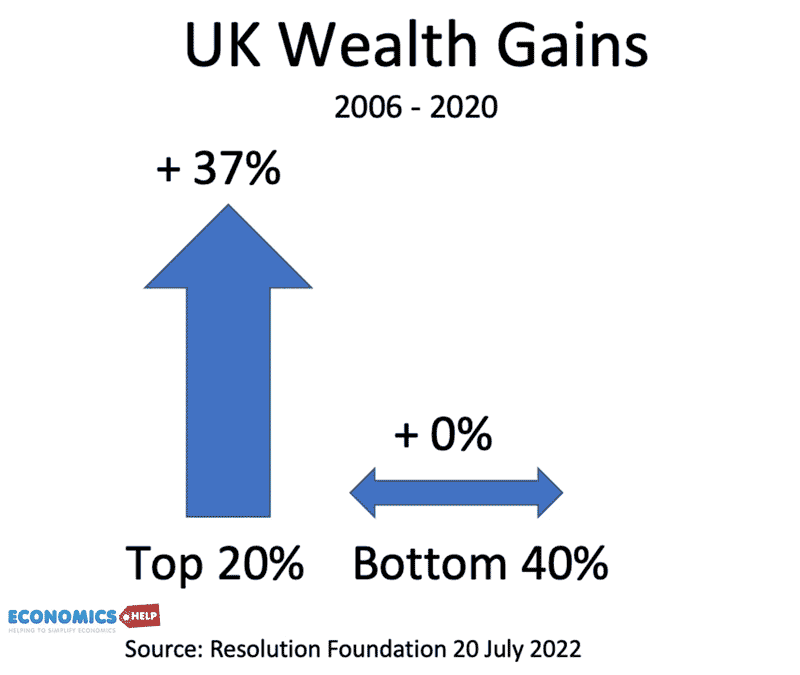

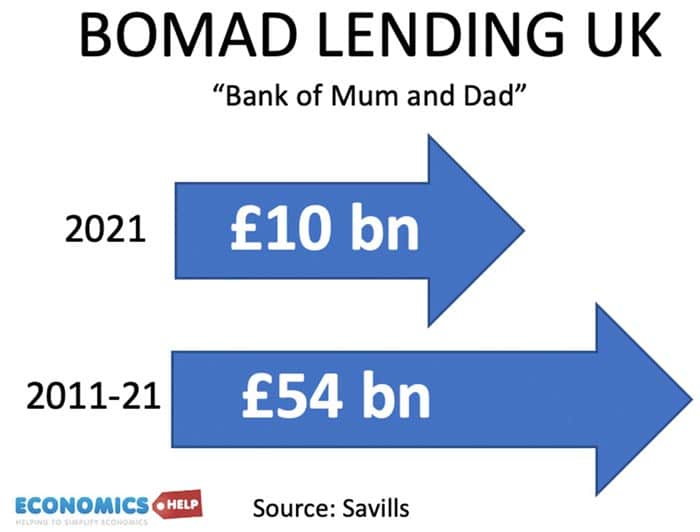

In the past few years, there has been a significant rise in wealth, especially for the top 20%. Rising house prices are a primary cause of this surging wealth gap. In recent years, the UK has become better at increasing wealth rather than income, and it tends to be older people who have benefited most from rising house prices, with young people squeezed out of the market. However, there is another element to consider. As Chris Giles in the FT recently points out, the older baby boomer generation are not frittering this away on luxury holidays and car, but are giving a large proportion to their children. In 2021, the Bank of Mum and Dad contributed a total of £10bn towards first-time buyers. In the past 10 years, a staggering £54bn has been given or loaned to first-time buyers. To put it in context, it contributes around 26% of funds to the UK housing market

If you ever wondered how the average UK deposit for first-time buyers manages to be £60,000, the reason is help from parents to buy. This is important as it creates an almost reverse Ponzi effect. Rising house prices mean rising wealth, which enables parents to gift through inheritance more wealth to their children who can then buy at the higher prices.

Of course, it means a great disparity between those whose parents who own and those who don’t. If your parents can’t help, the chances of getting on the property ladder are slim. But as far as house prices, it explains at least in part, the rise in house prices to incomes.

Another aspect of the housing market is that in the post-war period, we had a long stretch of steadily rising real incomes. Growth averaging 2.5%. However, since 2007, that has gone into reverse, with productivity and growth sharply slowing down. The UK still hasn’t recovered its pre-covid GDP peak and the IMF predict the UK economy will do worse than Russia. Actual unemployment is low, but this won’t save the housing market. For the majority of workers, there is a prolonged cost of living squeeze. Nobody knows yet, if the post-war growth period is over or whether we will have a return to normal growth. But, it is important for the housing market, stagnating incomes will reduce buying power and reduce prices. The market cannot be sustained by inherited wealth alone. The only thing is very weak economic growth will probably mean lower interest rates as inflation falls quicker than expected.

So is the UK housing market a ponzi scheme? No. But, it has does have serious problems. Selling off social housing without replacing it, has contributed to a shortage of private renting. Without generous lending from parents, housing is unaffordable, but this reliance on inheritance is only exacerbating inequality.

Further reading