Collusion occurs when rival firms agree to work together – e.g. setting higher prices in order to make greater profits. Collusion is a way for firms to make higher profits at the expense of consumers and reduces the competitiveness of the market.

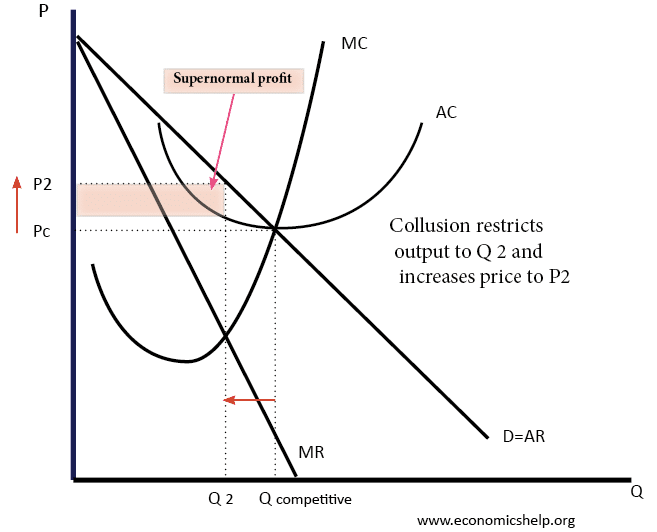

In the above example, a competitive industry will have price P1 and Q competitive. If firms collude, they can restrict output to Q2 and increase the price to P2.

Collusion usually involves some form of agreement to seek higher prices. This may involve:

- Agreeing to increase prices faced by consumers.

- Deals between suppliers and retailers. For example, vertical price-fixing e.g. retail price maintenance. (For example, Fixed Book Price (FBP) set the price a book is sold to the public.

- Monopsony pricing – where retailers collude to reduce the amount paid to suppliers. For example, a retailer with great buying power (Walmart, Amazon) can offer very small profit margins to suppliers as they have little alternative.

- Collusion between existing firms in an industry to exclude new firms from deals to prevent the market from becoming more competitive.

- Sticking to output quotas and higher prices.

- Collusive tendering. For example, ‘cover prices’ for competitive tendering in bidding for public construction contracts. This is when a rival firm agrees to set artificially high price to allow the firm of choice to win with a relatively high contract offer.

Types of collusion

- Formal collusion – when firms make formal agreement to stick to high prices. This can involve the creation of a cartel. The most famous cartel is OPEC – an organisation concerned with setting prices for oil.

- Tacit collusion – where firms make informal agreements or collude without actually speaking to their rivals. This may be to avoid detection by government regulators.

- Price leadership. It is possible firms may try to unofficially collude by following the prices set by a market leader. This enables them to keep prices high, without ever meeting with rival firms. This kind of collusion is hard to prove whether it is unfair competition or just the natural operation of markets.

Problems of collusion

Collusion is seen as bad for consumers and economic welfare, and therefore collusion is mostly regulated by governments. Collusion can lead to:

- High prices for consumers. This leads to a decline in consumer surplus and allocative inefficiency (Price pushed up above marginal cost)

- New firms can be discouraged from entering the market by types of collusion which act as a barrier to entry.

- Easy profits from collusion can make firms lazy and avoid innovation and efforts to increase productivity.

- Industry gets the disadvantages of monopoly (higher price) but less of the advantages (e.g. economies of scale)

Justification for collusion

- In times of unprofitable business conditions, collusion may be a way to try and save the industry and prevent firms from going out of business, which wouldn’t be in the long-term consumer interest. Dairy suppliers tried to use this justification in 2002/03 after problems from foot and mouth disease led to a decline in farm incomes.

- Research and development. Profits from collusion could, in theory, be used to invest in research and development.

Examples of collusion

Milk price by supermarkets 2002-03

After a period of low milk, butter and cheese prices, supermarkets such as Asda and Sainsbury’s colluded with Dairy suppliers, Dairy Crest and Wiseman Dairies to increase the price of milk, cheese and other dairy products in supermarkets. After an OFT investigation, supermarkets and suppliers were fined a total of £116m.

The OFT found prices set by supermarkets went up by three pence per pint of milk, but the income received by farmers did not go up. Milk collusion at BBC

Bank loans collusion – RBS and Barclays 2008-2010

In 2010 the OFT found RBS and Barclays guilty of collusion in sharing price arrangements for loans to professionals, such as lawyers and accountants. Sharing price information is a way to avoid price competition and keep prices high. RBS was fined £28.59m. (Independent)

Recruitment agencies forum cartel 2004-06

Between 2004 and 2006 six recruitment companies formed a cartel called the “Construction Recruitment Forum” which met to fix prices for supplying labour to intermediaries and construction companies. They also excluded a new firm Parc from any dealings. Hays was fined £30.4 million for a ‘Serious breach of competition law.’ BBC link

Collusion in the construction industry – collusion on tender price

In bidding for public sector construction work, construction firms would collude in setting artificially high prices. Firms would decide which contracts they wanted, and rivals would bid purposefully high price. This is a practice known as “Cover pricing”. Successful companies would often reward rivals with a secret payment for avoiding competition.

During the investigation, the OFT found 199 offences where the 103 companies artificially inflated £200m worth of work. Companies were fined a total of £129.5m by the OFT. Guardian link.

Price fixing in air travel – British Airways and Virgin 2004-06

In 2007, British Airways was fined £270m for illegal price-fixing arrangements with Virgin on long haul flights. The two companies met to agree and collude on the extra price of fuel surcharges in response to rising oil prices. Between 2004 and 2006, surcharges on air tickets rose from £5 to £60 per ticket. The £270m fine compares to an annual profit of £611m for BA. BBC link on collusion.

Collusion over hiring practises.

In 2015, Apple and Google were investigated for an agreement between the two companies where they agreed not to hire staff from the other company. This was an attempt to prevent wage spirals due to workers moving between the companies. The companies agreed to make a settlement rather than take it to court.

Regulation for collusion

In the UK, the Competition Act of 1998, states the OFT has the power to impose penalties on companies of up to 10 per cent of their worldwide turnover for breaches of competition law.

Firms which act as whistleblowers can gain immunity from penalties. Therefore, if two firms are colluding there is an incentive to be the first to blow the whistle and give information to the OFT.

Game theory and collusion

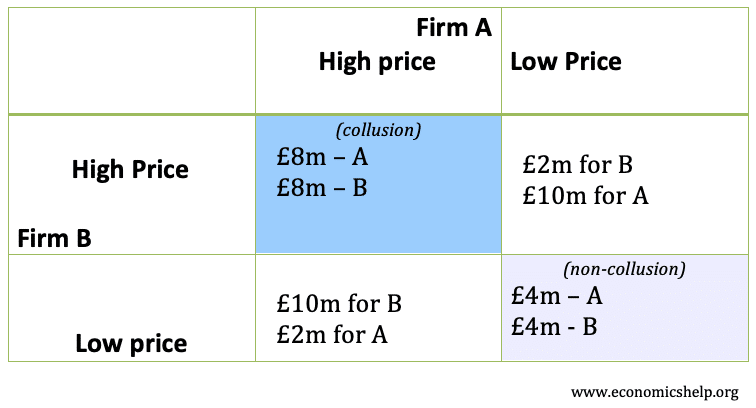

- If firms are competitive and they set low price -they will both make £4m.

- If they collude and set high price, then they will both double their profits and make £8m.

- However, if during collusion, firm A undercuts the collusive price and sets a low price – it is able to sell more. In this case, firm A benefits from the best of both worlds. Prices are high because firm B is setting high price, but firm A is also selling large quantity because it is undercutting its rival. In this case, firm A makes £10m and firm B only makes £2m.

- Therefore, firm B is unlikely to keep prices high and the market reverts to both setting low prices.

The optimal outcome for the firms is to collude (high price, high price) However, whether this occurs depends on whether there are incentives to keep colluding

- For example, legal restrictions on collusion can make it unstable. If a firm reports the collusion to the regulator, then the firm is immune from being fined; it is the other firm which will suffer. Therefore, in collusion, there is a strong incentive to be first to confess. It is a very risky strategy to continue with the collusion, hoping the other firm won’t run to the regulator.

- This is why the law is designed as it is – with a strong incentive to be the one to confess. The downside is that firms who collude for a long-time can be immune from prosecution and being fined.

(Thanks to Shaurya Tomar and Aryan Virdi for suggestions for this webpage.)

Related

Its a great offer from to make sure that the people gets information. I really appreciate to get myself on information.

I am person who like to read know the world so now.

I am great fully for information.

Jah it does give out the information that we need but we need more e.g characteristics of collusion ect

hie guys would appreciate if anyone tells me how to solve a BOP disequilibrium??

Devaluation , depreciation, export promotion , import substitution are the adjustment mechanism for BOP disequilibrium.

What is collusive oligopoly a short defination near about 1 or 2marks….???

Well its easy if you think about it. If you have 1 tomato, 1 tomato = 60 dolarrs , ok? tomato = valuable because it is unique and high price, but if many people have tomato tomato = nonvaluable so it goes down, thats the prism of the stock market conferation ( read in 2006)

What can government do to reduce collusion

This information was very helpful to me in completing my economics assignment and i’m really grateful.

Very highly appreciated.

There is another sort of collusion that is not discussed. It is carried on by product manufacturers. Automobile manufacturers are an extreme example.

A section 1 violation of the Sherman act can be proven by the presents of “Plus Factors.” One of the most significant Plus Factors is the absence of a plausible, legitimate business rationale for conduct .

One example (amongst hundreds is the automobile horn. What plausible, “legitimate” business rationale is there for the use of at least 85 different horns by Ford Motor Company during the 13 years 2008 through 2020? The entire industry engages in similar conduct – with one very important exception, specifically Tesla.

Hi

I wish to say this,as a British National,resident living here,it is my belief that the uk energy industry is in”Collusion” Fixing how energy prices are given and set out to the uk energy consumer’s to basically improve and increase general overall profits made over and above good fair customer service,and pretend that its not them doing it,arranging it,making up the rules,saying its just down to changes made in communication technology.

What they say is total Rubbish,and is why there are more unhappy people today than ever before fighting for justice against unfair and criminal industry practices.

what are the characteristics of collusion?

I am interested in COLLUSION between closed shop labor unions and monopoly investor owed energy utility. The Unions and the investor owned utility control the political structures by being the major contributors to elected officials governing the provision of franchises for operation of the energy utility in a region. Specifically, San Diego Gas and Electric company, a subsidiary of SEMPRA, charges the highest rates in the USA nation . The labor contracts require that ist primary union – International Brotherhood of Electrical Worker, support this monopoly arrangement. Both utility and union are the major funders of political candidates