UK Billionaire Jim Radcliffe recently complained London streets were not safe and it is true, in recent years, knife crime has increased and the justice system remains underfunded, overcrowded with a backlog of cases. But can we actually afford better public services?

Despite stagnant incomes, billionaire wealth has increased from $3 tn to over £12 trillion in 2022. Since the start of Covid, the number of billionaires in the UK has increased by 20%. But, many of these billionaires are paying less tax than you might imagine. 10% of millionaires pay an effective tax rate of 11%, a lower rate than a worker on £15,000 In 2020. But, the bigger issue is not tax rates but tax avoidance. 4 years ago Jim Radcliffe announced he was moving to the tax haven of Monaco to save an estimated £4bn in tax. No wonder, he can afford to invest in a struggling football club.

Tax Rates Post-war

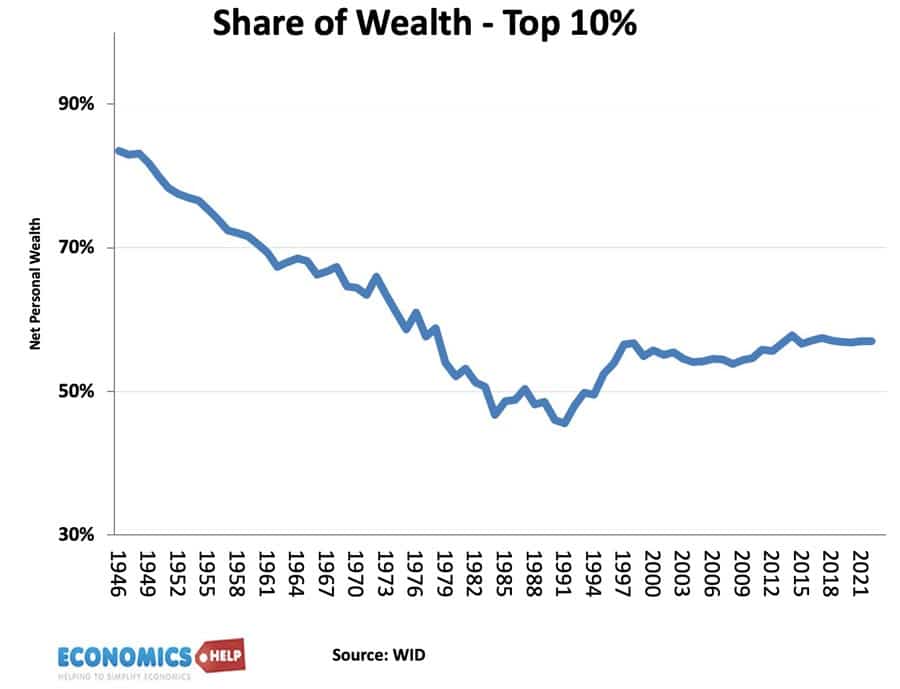

It wasn’t always like this after the Second World War, the sense of national crisis engendered a sense of unity which created a very progressive tax system across the world. Throughout the 50s and 60s, the top rate of income tax averaged 90%, and a purchase tax was limited to luxury items. This tax system far from crushing the economy coincided with the post-war economic boom, the UK experienced its highest rate of economic growth on record, and this was a growth that was broad-based, everyone benefitted from rising incomes. In fact, income inequality declined considerably.

Even more dramatic was the decline in wealth inequality. A combination of high inheritance tax and social changes such as a decline of the aristocratic class. But, the interesting thing is that these trends of relatively progressive tax system were in vogue across the Western world.

Growth of Tax Havens

However, by the 1970s, the rise in cheap global air travel, started the growth of a new phenomenon – the tax haven. Small countries and principalities, suddenly started to see huge influxes of money and wealth as citizens escaped high tax rates elsewhere. The likes of Bermuda, Monaco, and Cayman Islands, could gain high revenues by charging very low tax rates or even non at all. The IMF estimated tax havens cost global governments around $550 billion a year – from lost corporation tax. For example, Amazon Luxembourg handles sales for the UK, France, and 6 other European countries. In 2020, it shifted £8.2bn of UK sales to Luxembourg. In Luxembourg it has an impressive $8 million of sales per employer. For example, in 2020, Despite a Covid surge in income of €44bn, It ended up paying no corporation tax. It does pay VAT in all countries of sales.

Individual Tax Avoidance

And it’s not just companies, individuals have made use of tax havens, with the total amount estimated at between $8 trillion up to $36 trillion. That is another $200 billion tax revenues lost a year lost.

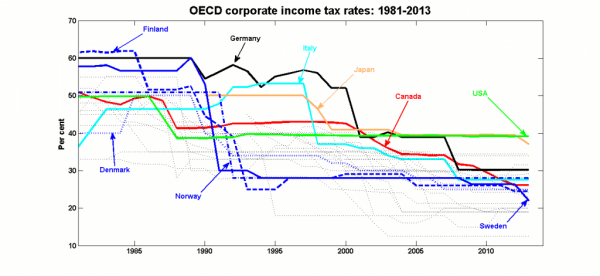

The existence of tax havens, partly explains the ever-increasing global tax competition, which has seen corporation tax rates fall across the world. Free market think tanks are always keen to say you should cut corporation tax rates to attract investment. And the wealthy are able to say, if we don’t have low tax rates, we will simply move. But, it’s become a zero-sum game. If all countries cut corporation tax, it doesn’t create any particular advantage. What is desperately needed – is not beggar thy neighbour policies but global cooperation on minimum tax rates. There is hope that a UN tax convention could play a role in preventing tax abuses. Without it, countries could lose around $4.8 trillion in the coming decade. The OECD have proposed a minimum corporation tax rate of 15%. It is another starting point, though it currently has so many loopholes, it will raise less than hoped.

Different tax rates

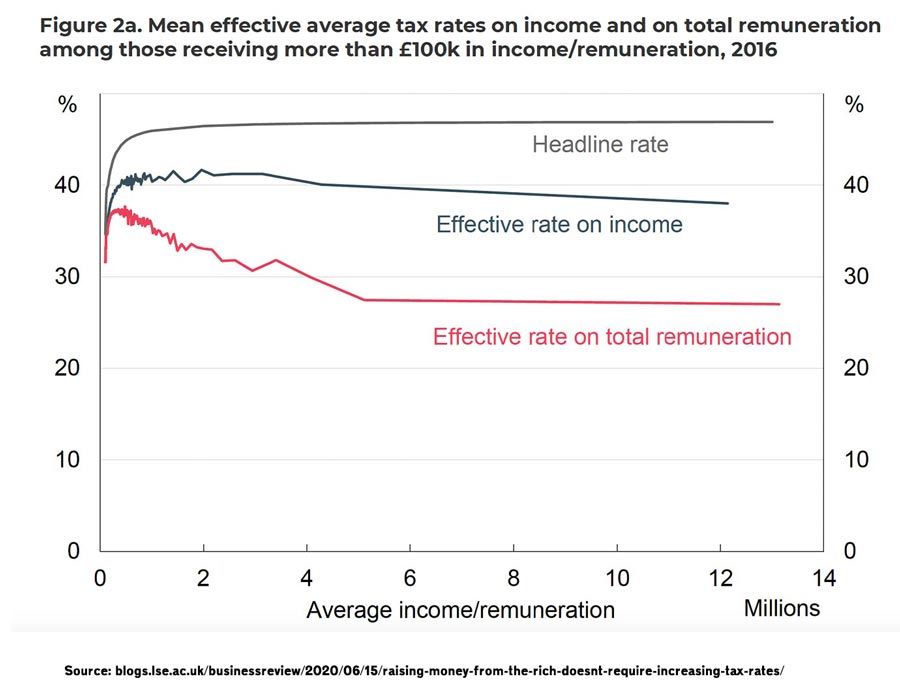

But, what about the UK how can some of rich pay lower tax rates than an average worker? For example, Rishi Sunak paid an effective tax rate of 23% on £2.2m income last year. This is because income came from salaries, US investment income and capital gains. Income from a job is taxed at 47% (45% + 2% NI). Dividends from a personal service company are taxed at 38%. But, if receiving money in the form of capital gains it is taxed at 10 or 20%. In other words, the tax rates the wealthy pay vary. The effective rate is less than the headline rate. Having said this, it is true that the top 1% of income taxpayers are paying a record 30% of all income tax. This is the highest share for the past twenty years. A reflection of faster income growth for the top 1%. But it means 30% of government income tax revenue is paid by just over 300,000 individuals. However, employment income is only one source of revenue for the wealth. An LSE study suggests a flat 35% rate on taxable income and gains for all those with over £100,000 per year, could raise £11 billion per year.

Wealth tax

If each of the five wealthiest people in the world spent a million US dollars every day, it would take them 476 years to exhaust their combined wealth. Another source of tax revenue, the UK is relatively reluctant to use is a wealth tax. An LSE study found that a one-off wealth tax on millionaire couples paid at one per cent a year for five years, would raise £260 billion over five years. However, taxing wealth is not easy. How do you define wealth, how do you document and how would you collect? Taxing income from wealth is generally easier to achieve.

Veil of Ignorance

Neverthless as a thought experiment, the philosopher John Rawls said when choosing laws and tax rates for society, you should choose without the knowledge of where you were born, i.e. with a veil of ignorance of who you were. If we did, we may well prefer to have higher tax on income from wealth and inheritance.. Jim Radcliffe may have saved £4 billion in tax, he is privately rich, but publically poor. He is fearful of wearing a Rolex watch in London, because the government has insufficient funds. This is the tragedy of tax havens, $4 trillion sitting on off-shore accounts, whilst social problems get worse.

The real question with regard to taxing wealth or income from wealth – is how much avoidance will there be? Will millionaires flee to the Bahamas and Monaco. If an America wanted to live in Monaco as a tax exile, they have to relinquish American citizenship – a step few are willing to take. The UK is different, you can become a tax exile, but retain UK citizenship. Also, since taper relief was introduced on capital cain, the 10% rate is seen as an acceptable burden.

Sources