Since 2019, The German economy has gone into an unexpected decline, posting the 2nd worst performance in Europe. GDP is stagnant, the car industry in decline, real wages falling and discontent rising. For many decades, Germany was the powerhouse of the European economy with rapid growth transforming living standards, but this has come to a faltering halt.

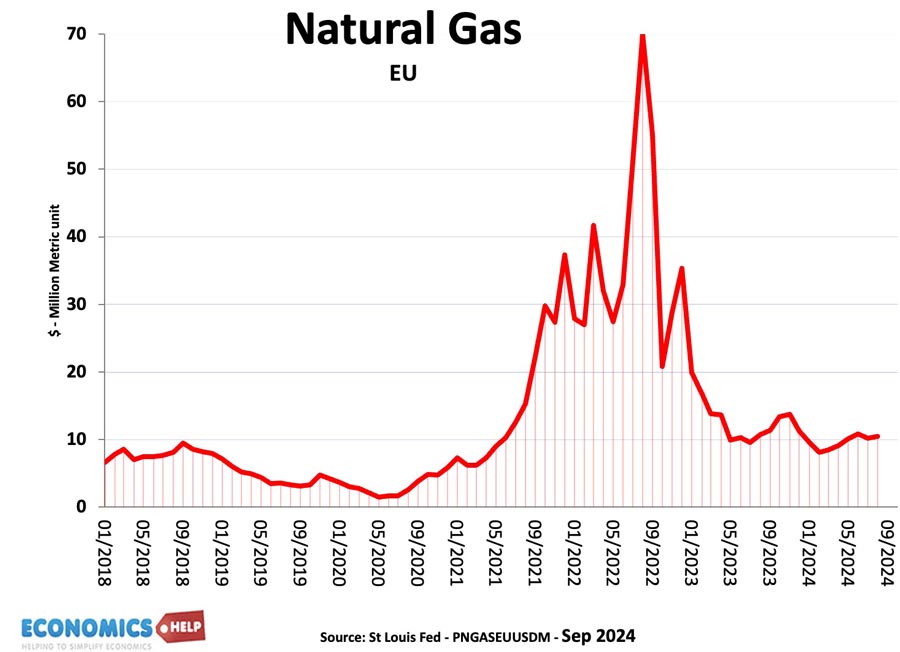

There’s no doubt that the Ukraine War hit the German economy. Disruptions to gas supply saw gas prices soar and although they have come down, they still remain elevated. This is a big deal for an economy which relies heavily on industrial production.

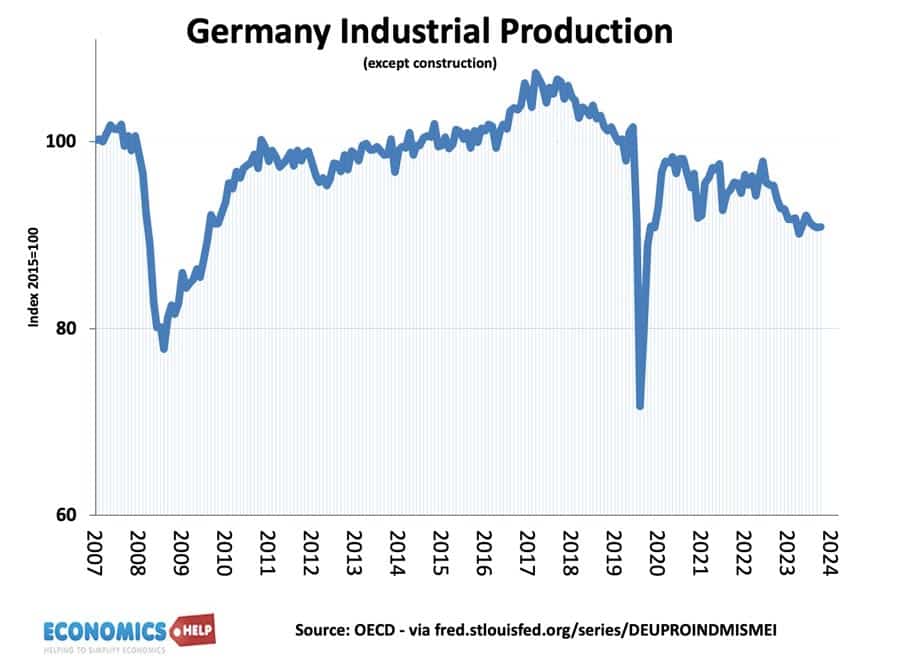

Even the recent fall in gas prices has done little to halt the decline in Germany industrial production, which is now 15% lower than 2016 peak and 25% below pre-trend level. Covid and the Ukraine War can be considered bad luck, but it also highlighted the disastrous decision to close nuclear power stations without reliable alternatives. Although Germany has tried to invest in renewables, it has had to re-open coal powered energy plants to get through winter.

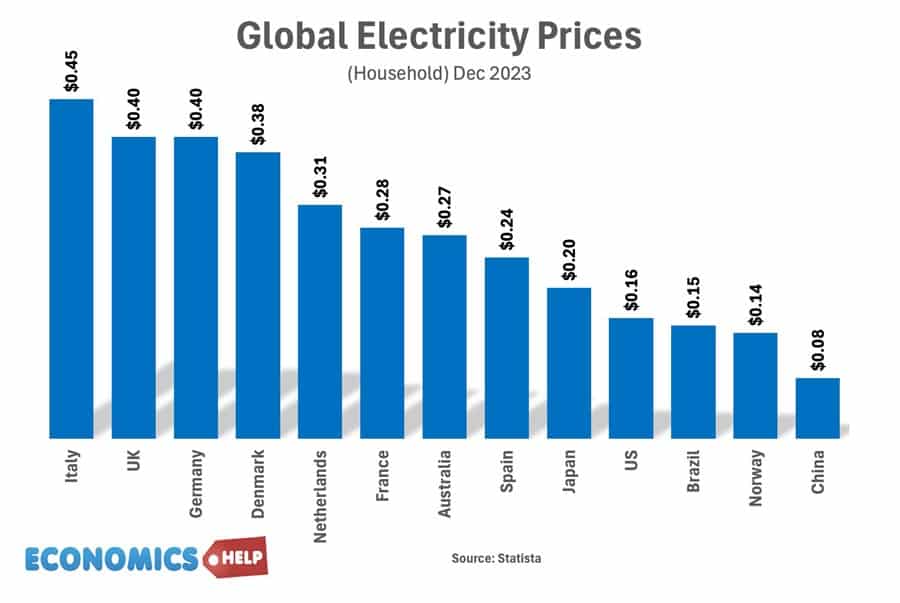

The rise in energy costs has been devastating for German industry. The price of electricity in Germany is more double that of the United States ($0.16 vs $0.40 per KwH), no wonder German industry is losing competitiveness.

The energy crisis definitely hurt the German economy, but this is only part of the story. To understand the troubles of the German economy the once might car industry is revealing. For the first time in 87 years Volkswagen is planning to shut factories in Germany, citing concerns about falling profitability and competitiveness.

China Problem

Exports to China have fallen due to weak Chinese demand – a reflection of China’s own crisis, but more concerning is the fact domestic Chinese firms have been able to undercut German car producers. The real strength of the German economy lay in high tech mechanical engineering, where it was often a pioneer. The first diesel engine was invented in Germany in 1893. Ferdinand Porshe of Germany developed the first electric hybrid car all the way back in the 1900s. For over a century German car brands were the envy of the world. But, whilst Germany is a leader in producing combustion engines this comparative advantage is much less relevant in the new era of battery and electric vehicles. VW invested heaving in promting EV, but jave struggled to make an impact. As the economist notes, it’s foray into software was a disaster and the return on investment very poor. The kind of management failure not typical of post-war Germany

In 2023, the average price of an electric vehicle in Europe was €46,000, by contrast a Chinese import such as a A BYD Dolphin, costs around €30,00. Domestically, Chinese car firms are producing electric vehicles for close to $10,000.

The problem for Germany and European producers is that Chinese competitiveness is only part of the story, massive Chinese state aid is propping up loss making firms. This graph from the Economist shows the number of loss making firms in China. State subsides amount to at least 200 bn Yuan, and this is before hidden subsidies such as subsidies energy. It’s an unfair playing field, and its hurting the German economy.

Poor Management

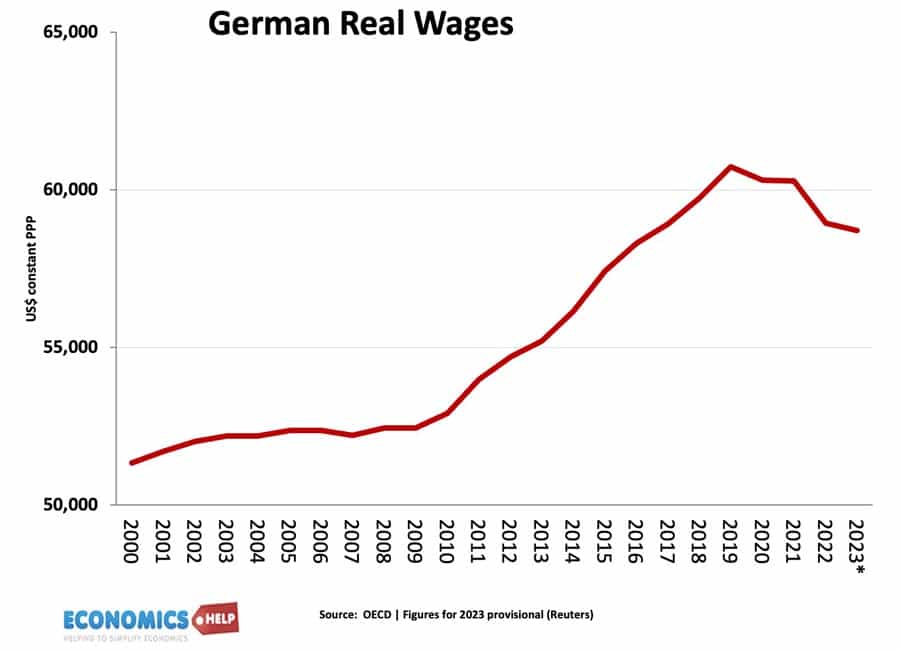

But, it would still be a mistake to blame everything on Chinese subsidies, there is more going on. The industry is still reeling from poor management, exemplified by the diesel emissions scandal. In the US, Volkswagen paid $15 billion in compensation. In Germany Martin Winterkorn, the former boss, known for his authoritarian style is heading to trial. In the post-war period, rising living standards helped cement strong relations between business and workers. The German model of tripartite co-operation was held up as an example, compared to say the UK which suffered from strikes and poor productivity. But, in recent years, inflation and falling real wages have broken that relationship. Strikes are on the rise, the highest rate for 25 years. With Der Spiegel asking if Germany has become a strike nation. The Kiel Institute estimated that the train conductors’ strikes cost the German economy about 100 million euros per day. There was a time when German trains were known for their punctuality, but years of under-investment have created cracks in basic infrastructure.

The fundamental problem is that the recent economic stagnation has caused real wages to fall – something Germany has not seen since the second world war, and this is often hitting low income workers in manufacturing the most. Unemployment is also still high at over 6%

Lack of Investment

Given weakness of economy, you might expect the powerful German state to do more to provide economic stimulus and investment. The government did susbidise energy prices to prevent the worst of the inflation shock, but spending has been constrained by the debt brake rule, brought in after German re-unification after 1990. Last November a court rejected the government’s spending plans for exceeding the country’s debt brake rule – it forced the government to impose severe budget cuts, hitting social spending and investment at exactly the time the economy needs more to compensate for the fall in private consumption.

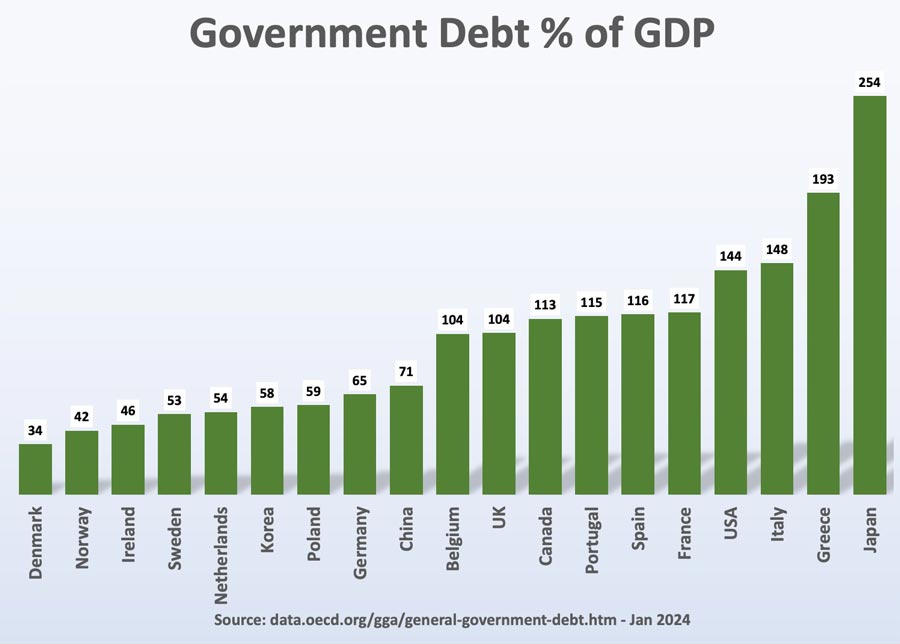

Germany debt as a share of GDP, is actually low by international standards, borrowing costs are very low, and there is a very strong economic argument to prioritise higher growth, but the government is hampered by the interpretation of the constitutional rule and a strong social aversion to debt. There is widespread economic agreement, that the debt rule is damaging, but to change the constitution would take a 66% majority, impossible in the politically fractured times.

There is no shortage of projects Germany needs. Investment in renewable energy, road, investment, but the conservative approach to borrowing has left Germany with one of lowest rates of public sector investment in the developed world. It ranks 23rd for public investment. It has led to higher costs for business as the once reliable train network is now reliably late. Even when there are funds for investment, at a local level investment is often blocked by innumerable rules and regulations which allow legal challenges from vested interests. Construction permits take 50% longer than the OECD average. A mountain of red-tape, means that Germany has slipped down the league table of business attractiveness. The decline in attractiveness has been greater even than Brexit Britain.

Another problem facing the economy is a slow uptake of digitisation. Government bureaucracy is still often using analogue methods leading to higher costs and slower responses. Whilst the US has powered ahead with IT giants like Google, Microsoft and Apple, Europe and Germany has nothing similar. The GDPR law was supposed to rein in big multinationals, but if anything increased costs for small business.

Poland’s Rise

Another aspect of the past German economic model was outsourcing labour intensive production to lower cost neighbours. But, whilst Germany struggles eastern Europe, especially Poland and Czech are booming with rapid growth in real wages. Poland is now attracting investment as an alternative to Germany.

More Optimism

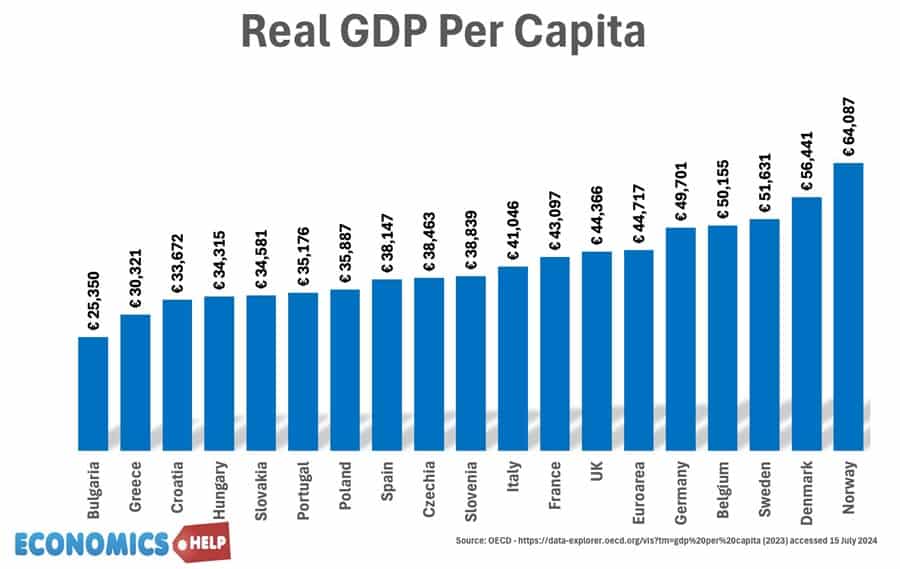

Despite all this gloom, there are reasons to be more positive about the German economy. GDP per capita is still impressive, real wages are high by international standards. In fact, a big problem Germany faces is an unwillingness of households to spend. The net saving rate is significantly higehr in Germany than other countries such as US and UK. Germany excels in running a current account surplus – exporting more than it imports, but in a period of stagnant growth, the economy would benefit from higher spending and a loosening of purse strings from both households and governments. This may give business more confidence to invest. At the moment, the German model of high savings, is contributing to imbalances in the European economy.

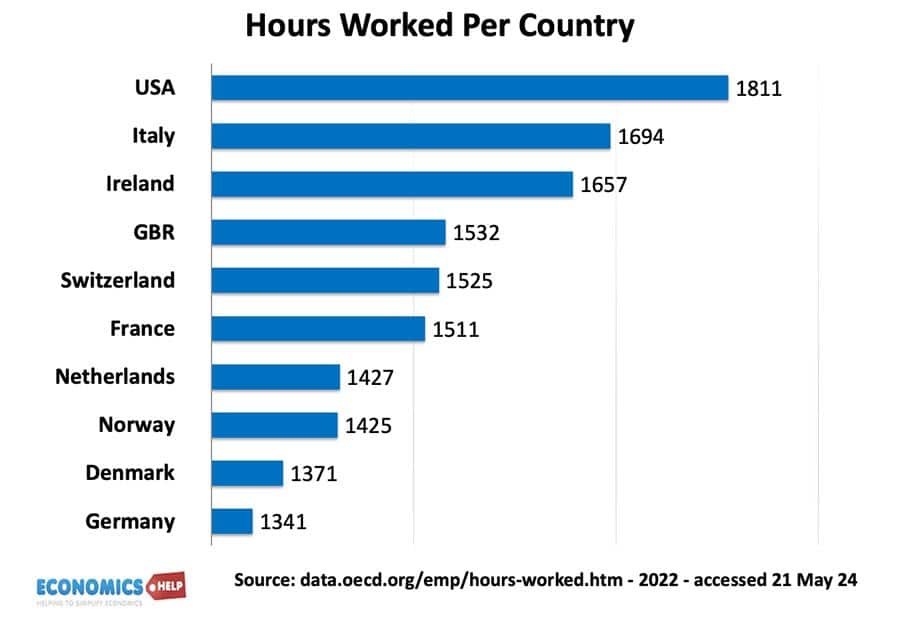

Another interesting factor about the German economy is that workers have one of lowest hours of work per year. In times of growth, this could be used as evidence of high German productivity enabling more leisure time, but now industry bosses complain workers are too keen on ideas of 4-day weeks and not working hard enough.

The German economy is facing an unexpected crisis which has lasted longer than expected. Yet, we need to keep things in perspective, Germany is the third largest economy in the world, with lots of potential. It is not bankrupt or anywhere near, one of the solutions is a willingness to tackle public sector investment, in particular dealing with its long-term energy needs. The German economy has stagnated, but it is not alone. Since 2008, it is underperformed the US, but compared to the rest of western Europe, it is nothing unusual. Germany also has many strengths such as highly educated and skilled workforce. It’s population is ageing, but it is not as chronic as southern Europe. Germany only pays 10% of GDP on pensions compared to 16% in Italy. High levels of immigration have brought considerable concerns, given stagnant wages, but it has gone some way to maintaining the level of the working age population compared to say Japan.

In fact the story of Japan holds potential lessons for Germany. Japan was once the world’s economic powerhouse, but its spectacular fall from boom to bust still lingers. There is a real concern that Germany could see worrying parallels to Japan.

https://worldpopulationreview.com/country-rankings/cost-of-electricity-by-country

https://www.wipo.int/gii-ranking/en/germany

Germany

Private consumption ceic

Real wage growth

Industrial production

G7 working age population oecd

Car production ceic

Productivity growth vs us

Car production innovation diesel – hybrid car Semper Vivus,, self driving car

Digital government index oecd