Imagine an economy with high wages, low debt, public services which work, a short working week and free university tuition. It’s kind of the opposite to the UK, which has seen wage stagnation, growing debt, unaffordable housing and long waiting lists.

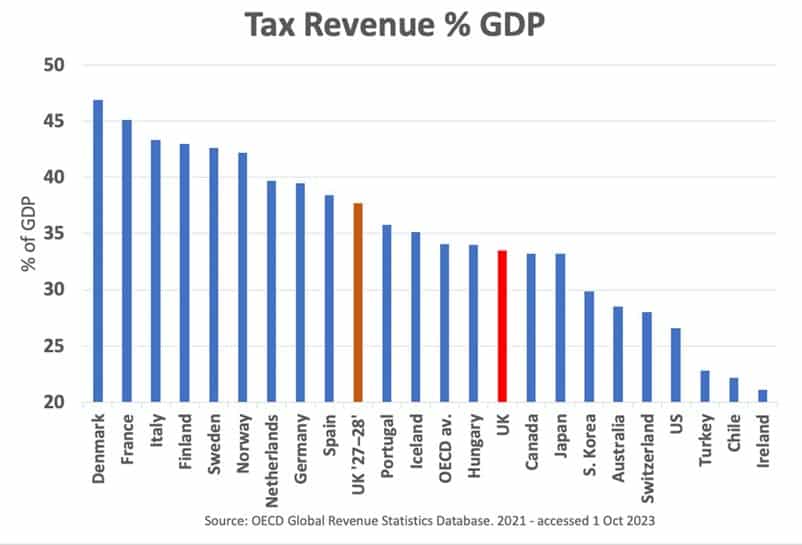

This model economy does actually exist – It’s Denmark, which can claim to be the 2nd happiest country in the world, one of the highest levels of trust and the lowest levels of corruption in the world. However, there is a catch to this model economy. It also happens to have the highest tax rates in the world. In Denmark, nearly 46% of GDP is collected in tax. In 1993, the UK tax share was just 29%, but recently has increased to over 37%. But, even this increase in the tax rate has not been enough to meet the growing demand for public services. Should the UK try and follow the Scandanavian model of higher taxes, or would it simply not work in the UK?

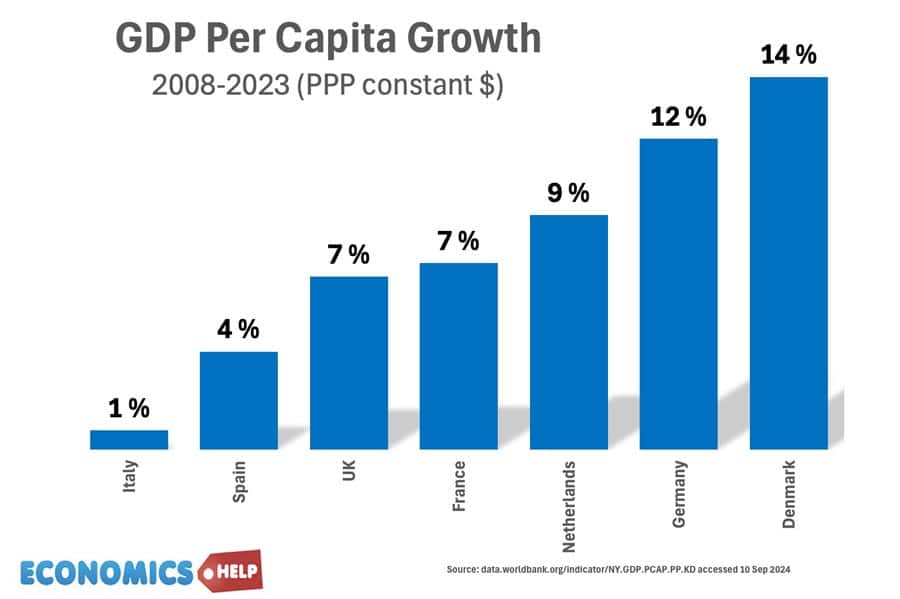

Since 2008, the whole of Western Europe has struggled. GDP per capita growth has been the worst in the post-war period. But one of the better performers has been Denmark, beaten only by Ireland which is distorted by the impact of tax avoiding inward investment. That’s another story. But, the important thing is Denmark shows that high tax is not a barrier to economic growth, investment and innovation. Whilst taxes are high, it is not a socialist economy, the private sector is not managed by the government, but firms are given considerable freedom to invest. Private firms also benefit from a relatively strong public sector. Infrastructure which works, investment in education, good health system all complement private business, reducing business costs and encouraging investment.

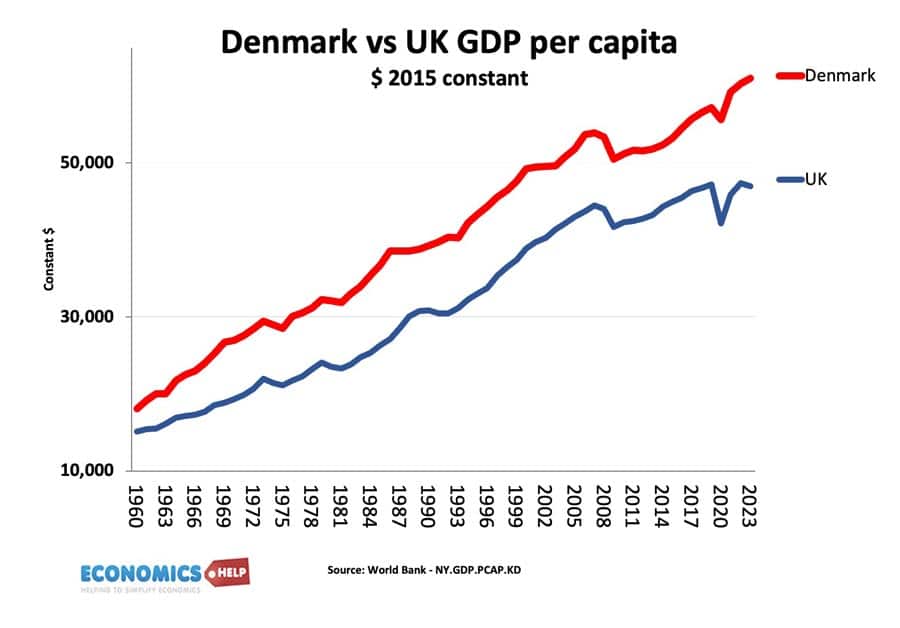

GDP per capita in Denmark is relatively high compared the UK, and if anything the gap has increased in recent decades. Whilst it is true the cost of living is higher in Denmark because of higher taxes, consumption levels are still amongst the highest in Europe. And if having higher wages wasn’t enough, it is achieved through fewer hours worked. The secret is higher labour productivity.

Strong Danish Economy

The other impressive thing about the Danish economy is that it is not artificially inflated by oil or attracting tax avoidance wealth. If you ignore oil rich states and tax havens, Denmark is 2nd only to the United States. The Danish economy is relatively diverse, taking advantage of highly skilled workforce and business friendly environment. It ranks highly in the ease of doing business index. One of the real success stories of the Danish economy is the pharmaceutical industry. Novo Nordisk hit gold with Ozempic the new wonder weight loss drug. It’s success even has people fearing it could be like Finland relying on Nokia then suffering after its decline post Apple iPhone.

Housing Relatively Cheaper

There are many contrasts between the two economies. Despite reputation for high living costs, as a share of income, housing is relatively cheaper in Denmark – though still very expensive.. House price to income ratios are lower too. The UK’s housing crisis has led to one of highest rates of homelessness in the world, much higher than Denmark. In Denmark, domestic residents do not pay tuition fees. In England students are leaving university with an average of over £40,000 debt. No wonder, young people are pessimistic about their fortunes. But, how do Denmark pay for things like free tuition fees and good health care?

Tax differences

In Denmark, consumption taxes are 25%. In the UK VAT is 20%. This is the big difference. It makes goods more expensive but raises substantial amount of revenue. In Denmark, capital gains tax is higher. Up to 42%, compared to the UK top rate of 28%. The highest rate of income tax is 52% in Denmark compared 45% in the UK. Corporation tax is actually higher in the UK. But, overall Denmark raises more revenue. There is also a big difference in government debt levels. UK debt has risen from 40% to 100% in the past two decades. Denmark debt is much lower, giving government much more room for manoeuvre in any future crisis. During the energy price shock, Danish prices rose only 14% compared to 22% in the UK.

Denmark had two advantages in the energy price shock. Firstly, investment in more modern housing means insulation is much better. Only 1.2 degree heat loss compared to the UK at 3 degrees. Denmark has also been more ambitious in phasing out fossil fuels, than the UK. In Denmark 43% of primary energy share comes from renwables, nearly double that of the UK. And Denmark is aiming to decarbonise electricity generation by 2035. Denmark has also almost double the rate of cycling rates than the UK, without the same tendency towards culture wars, that can occur here.

Equality

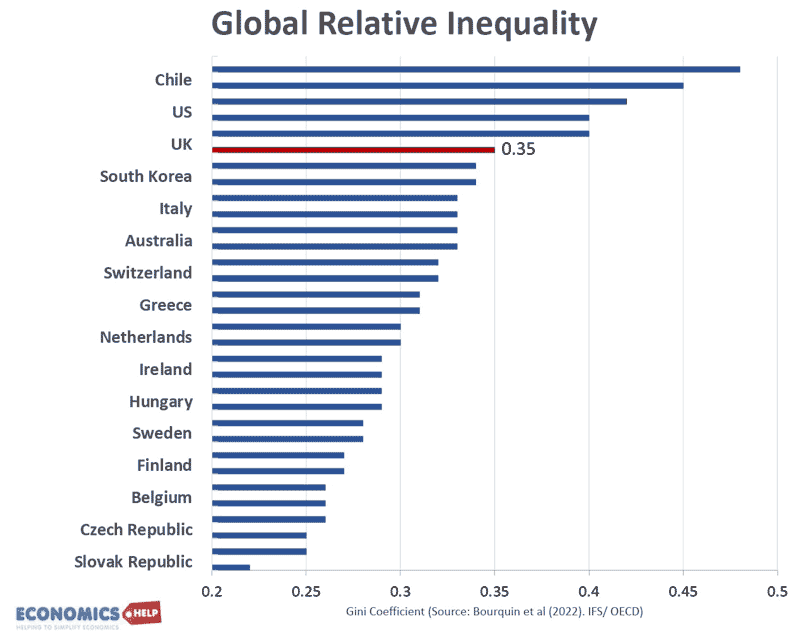

Denmark 0.28

Another comparison is that Denmark has much greater levels of equality. This is partly due tax and benefit system, but the main factor is greater degree of social cohesion and more of a classless society. In the UK, the unwritten class system is still important, with parental wealth playing a role in influencing homeownership rates, education and ultinmately income levels. The greater degree of social cohesion are also important for the wide acceptance of higher tax rates.

Similarities

There are some similarities between the two countries, Denmark avoided joining the Euro, and keeps its own currency. Both countries have experienced concerns over high levels of immigration in the past decade. In both countries, housing is expensive and real wage growth has suffered in past decade.

Would Higher Taxes Solve UK Economic Problems?

But, the big question is – if the UK increased taxes significantly, would it solve the UK’s economic and social problems? Firstly, the Denmark wasn’t always a high tax economy, it was in the late 1960s and early 70s, that the welfare state and tax was significantly increased. This was a boom period when real wages were rising significantly, it’s much easier politically to increase tax rates when wages are rising.

- Lower disposable income

This is a problem the UK would face, with average disposable incomes increasing only slowly, it would be a brave government who would massively increase taxes. The benefits of improved public services would be there in the long-term, but in the short-term, households would face lower disposable income, and higher taxes could be a constraint to growth. In fact, because of stagnant wages, the UK tax burden has increased despite austerity in government spending.

2. Does spending more help?

Secondly, there is no guarantee that higher taxes translate directly into better health outcomes. In recent years, UK public sector productivity has been vepoor. Compared to Denmark, the NHS is still behind in areas like digitalisation and management. If you look at health spending as a share of GDP, the two countries are actually very close.

3. Political differences

Thirdly, the main UK political parties feel obliged to go into elections promising not to increase any major taxes. There isn’t the same culture of support for higher taxes and a more extensive government in the UK. Even if opinion polls say people would support higher taxes for more NHS spending, when it comes to elections, the threat of tax rises is often pivotal. Even 30 years later, you wonder if the Labour party are maybe burned by the 1992 election, where they unexpectedly lost after the threat of higher taxes.

Related

Why Denmark is rich despite high taxes?