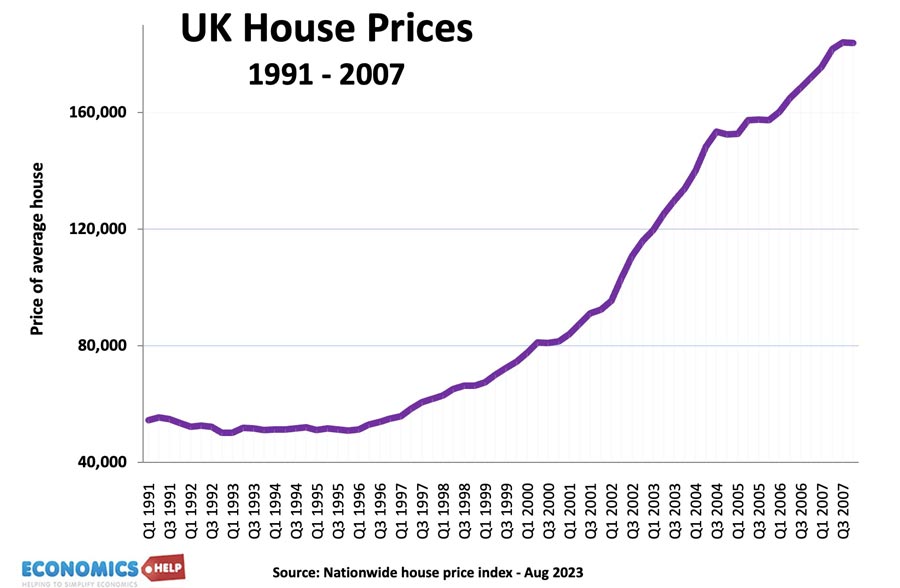

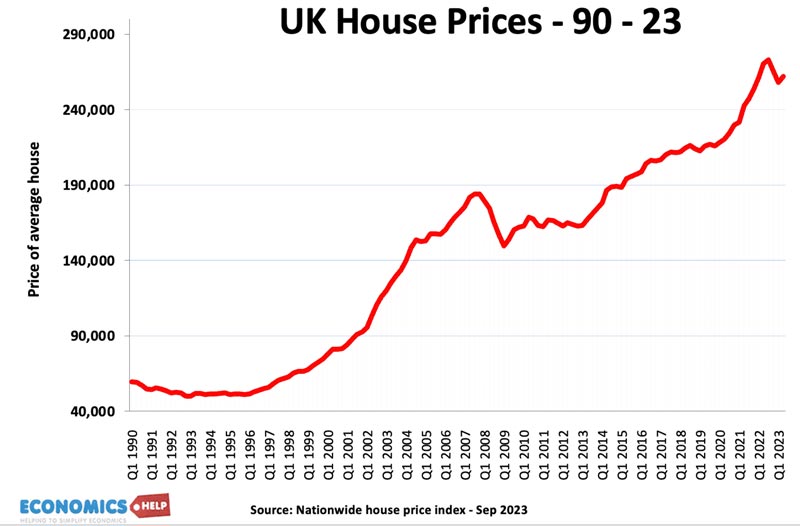

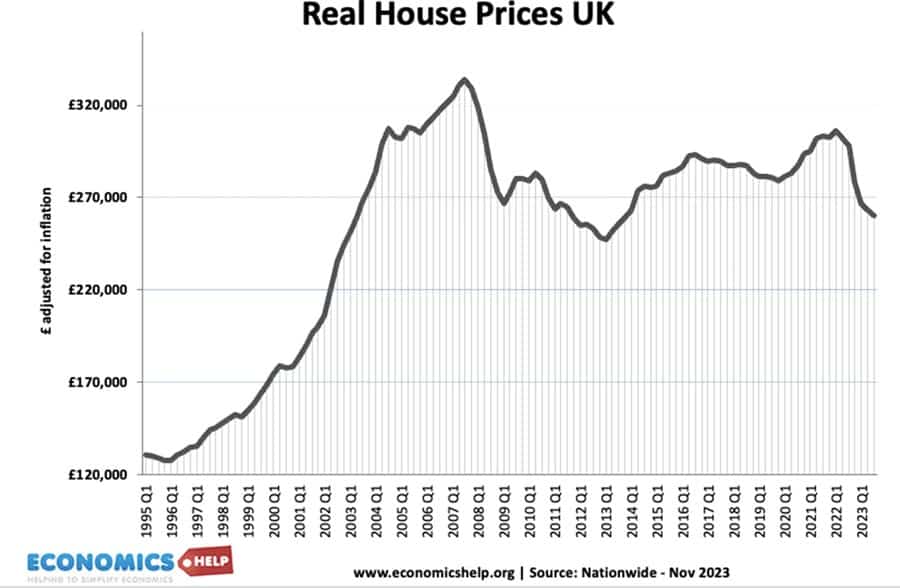

If you had bought a house in 1996, in just eleven years it would have increased 258% £51,367 to £184,131 (258%). After the credit crunch, there was widespread pessimism and stagnant wages, but it didn’t stop house prices rising 83% from 149,709 to 273,000.

In the past 50 years, UK house prices have risen almost 3,000%. If you’re going on past trends, British house prices seem a one-way bet. Even when interest rates went through the roof in 2023, the housing correction was less than expected. It seems average house prices defied gravity and maintained their value. But, given affordability is genuinely stretched and beyond the reach of many, how is it possible that house prices keep rising?

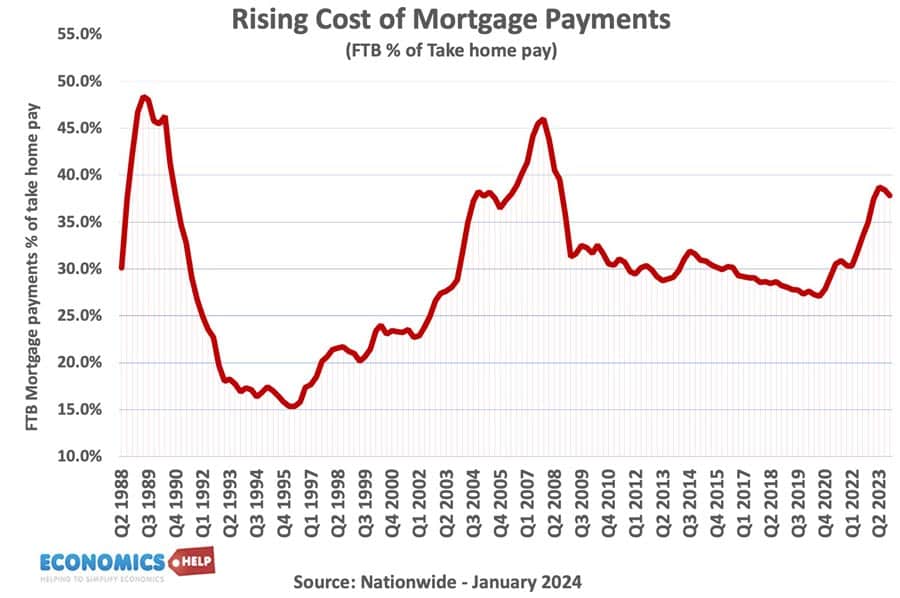

The recent rise in interest rates, made mortgage repayments much more expensive. First time buyers have a twin problem. High deposits and and high monthly repayments. It’s the worst of both worlds and levels of repayment reminiscent of the past crashes. Yet, give or take a few percent, average house prices have maintained there value.

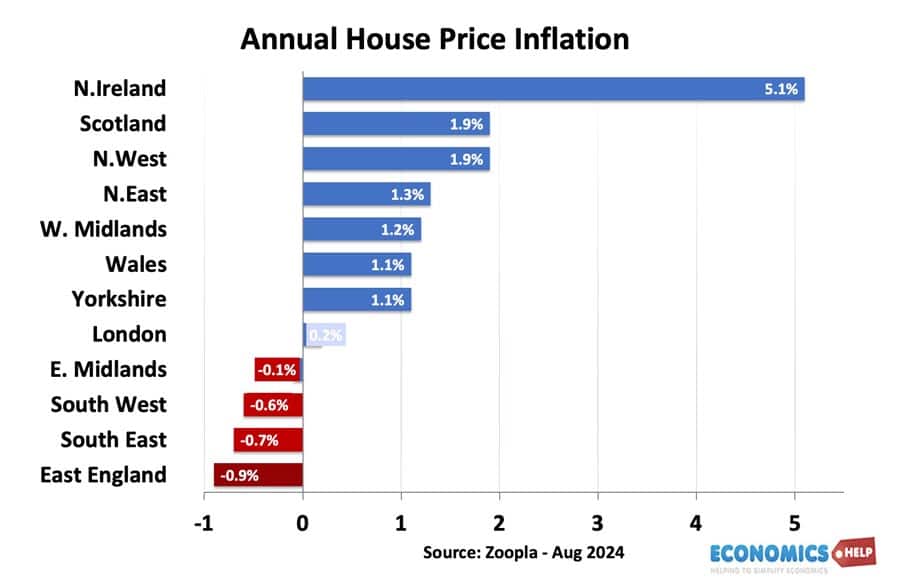

It is true there is a regional effect with prices in London marginally down and Scotland and N.Ireland rising at a faster rate. This reflects how interest rates rises have more effect in expensive areas.

But, when explaining recent house price trends it is important to look at the role of wealth. In recent years, there has been a significant increase in the amount of parental wealth entering the market. Last year, the Bank of Mum and Dad gave a record £9.4 bn. More than double five year ago. 57% entering the property market do so with help from their parents.

The interesting thing is that as housing affordability has worsened and housing more expensive some wealthy homeowners have responded by giving more to their children to get a deposit. The Bank of Mum and Dad is a really big player. It’s almost like parents think what do I need to do to help my children to buy? Why are parents giving so much help to their children?

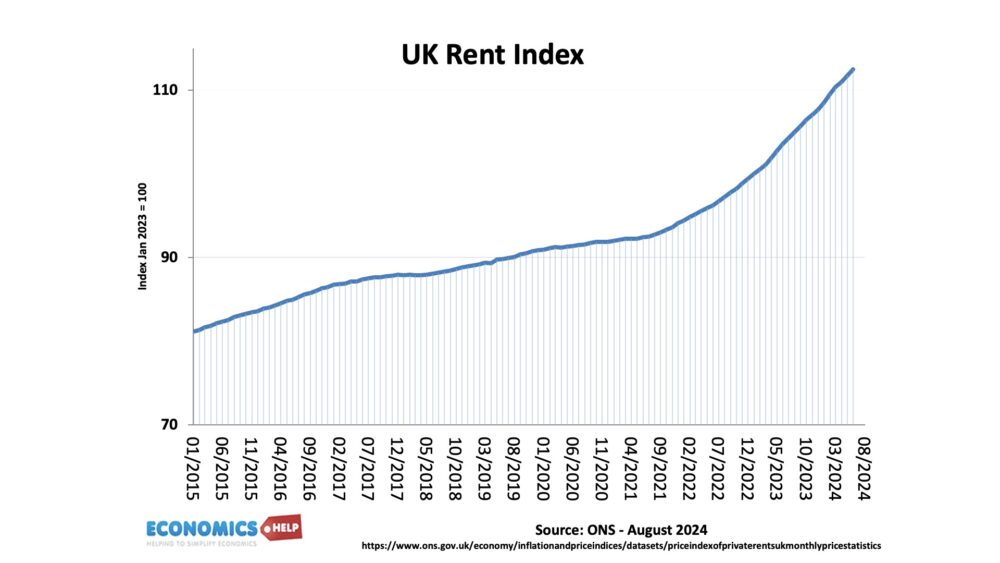

Firstly, the only thing to rise faster than house prices in recent years is rent. This is causing record numbers of young people to either struggle financially or end up living with their parents. Maybe some parents think help with a deposit is a price worth paying to get rid of their troublesome children. It’s not all altruism. But, the broken nature of the rented sector is a factor in encouraging people to try and pay ever higher income multiples.

Wealth Propping up Prices

This is the irony of the market. As household wealth increases, this wealth is then used to inflate the housing market. It’s not a good situation. The UK has seen wealth grow faster than income in recent years. 50% of UK wealth is tied up in property, unlike the US where it is 24%.

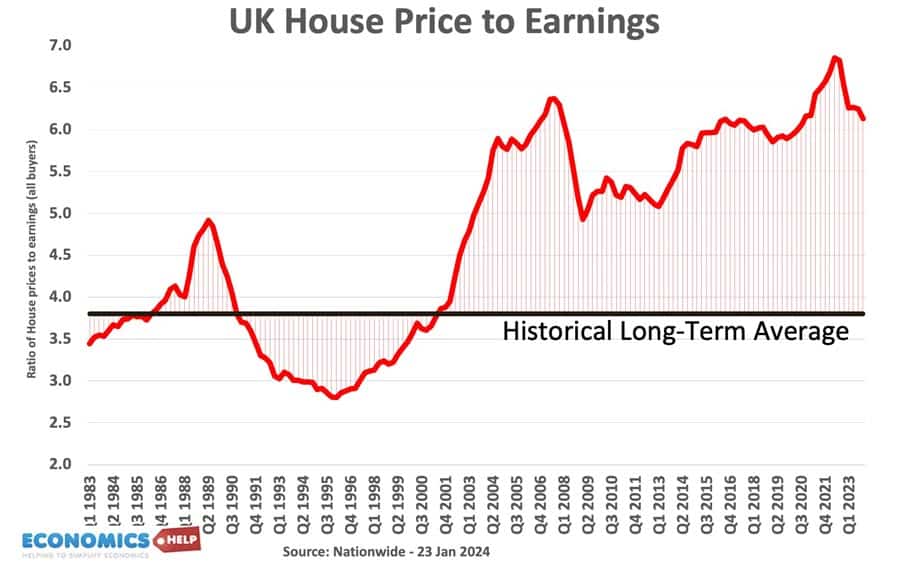

The situation also creates inequality, but it is very significant for explaining the ever-increasing ratio of house price to incomes. Higher interest rates have led to lower mortgage lending, but have not deterred family help. This explains why house price-to-income ratios are still significantly above historical averages. It’s not all about mortgage affordability.

Reasons for Falling Prices?

However, could parents become reluctant to prop up house prices? Not everyone can access family wealth and if you have median income, student debt and are paying market rents, it’s very hard to save for a deposit. The withdrawal of help to buy is another factor reducing demand. There are still good metrics which suggest house prices are overvalued. There may not be a dramatic crash, but there are very real constraints to future booms. Buy to let investment looks less attractive in an era of greater regulation and less prospect of capital gains. But, perhaps the most important factor is that real wage growth has fallen dramatically in the past 14 years. If this continues, it will be important for limiting price growth. Real wages are the biggest factor affecting long-term house prices.

Real House Prices

Also, when we talk about the boom of the past 14 years, it is also a little misleading. Certainly house prices rose faster than wages post 2009. But, if we take into account inflation, the real value of housing looks less impressive. Real house prices are actually still lower than in 2007. They are 12% down on 2022. The interesting thing about UK house prices is that the period 1960 to 2007 was an anamoly in terms of rising real house prices. In the future it’s very hard to see continued increases in real house prices, even accounting for the role of wealth, 50% of the population still rely on borrowing and affordability requirements.

Falling Interest Rates

In the short-term, there is some modest good news for homebuyers. Inflation has been falling and even stubborn core inflation has been falling too. This enables the prospect of future interest rate cuts. At the moment, predictions are fairly modest, with interest rates estimated to stabilise around 4%. But, even a modest cut would encourage more people back into the housing market. So far in 2024, Zoopla report a 14% increase in the stock properties for sale, but demand has rebounded from the stagnation of 2023.

So far 2024 has seen a 23% rise in housing sales. It’s not a boom, but it’s a welcome break from the ultra low transactions of last year.

House Price Predictions

What do experts predict for future house prices. The Office for Budget Responsibility (OBR) predicts a property price increase of 4% in the coming years. Though last year they predicted a 10% fall, which has not materialised. Savills forecast house prices will rise 21% by 2028. This is a real house price increase of 2% a year, suggesting no improvement in affordability.

What about the case for significant house price falls? Last year, there appeared to be good reasons to suggest this could happen. Interest rates soared from a low of 0.5% to 5.25%. At one point with inflation exceeding expectations, mortgage rates rose to over 6%. Combined with record housing unaffordability and weak economy. It seemed the perfect recipe for house prices to fall. It is also worth bearing in mind, that historically, there is a significant time lag between rising interest rates and falling prices. In the nineties, prices fell two years after interest rates started to increase. In the 2009 crash, house prices fell two years after rates started rising. This year, homeowners on fixed rate mortgages are still remortgaging to higher rates. The effective rate on outstanding mortgages has risen from 2.5% to 3.7% and will continue to rise as homeowners remortgage. However, given the performance of the housing market this year, and combined with better news on inflation and interest rates, it is hard to see any imminent crash. New mortgage lending rules brought in post-credit crunch means fewer households are exposed by the rising rates. For all the weakness of the UK economy, unemployment is low, and we’ve even started to see some green shoots of growth.

Black Swan Event

A housing crash would need some new black swan event such as a new inflation shock like 2022 or financial market turmoil like we saw in 2008. Now given geo-political uncertainty this definitely remains a realistic possibility. Also, turmoil in stock markets and financial markets could definitely spill over into the housing market like it did in 2008.

Will Building Homes Reduce Prices

Will building more homes make a difference? The government plan to build 1.5 million homes – will this alter prices? A little bit but not much. As a rough rule of thumb a 1% increase in supply may reduce prices 1% than otherwise. If you build 1.5 million homes in the next 5 years, it would help moderate price rises, but like many housing targets it may prove very difficult to achieve anyway. It’s not just about planning, house builders are reporting falling profit margins and difficulties in employing skilled labour. The effect of building could be greater if houses are built in areas of high demand and limited supply like London. In fact, an interesting development of this year is that the fastest house price growth has come from cheaper areas in the north and Wales. A continued trend to working from home, could rebalance house prices geographically. Though, 1/3 of all graduate jobs are still in London.

Immigration House Prices

How much is immigration affecting house prices? Again there is some upward pressure from the rising population, but it’s not a fundamental factor influencing house prices. Certainly, very high levels of migration of past two years, have put upward pressure on rents and this has spillover effects to house prices. Recent migrants are more likely to be in the private rented sector than owner occupier or council housing. Also, predictions of a booming population are exaggerated, the UK has falling fertility, in the long-term, the population may rise less than the ONS forecast. It is worth bearing in mind the case of Japan, where house prices are still below their 1980s peak, at least partly due to demographic factors.

Buy or Rent?

Should the future of house prices affect whether I buy or rent? There is a general rule to buy a house if you can afford repayments, and not worry about the trajectory of house prices. For investors, buying on an interest only mortgage is less attractive. Since 2000, most investor profits came from capital gains, but it is hard to see any real house price gains in the coming decade.